Answered step by step

Verified Expert Solution

Question

1 Approved Answer

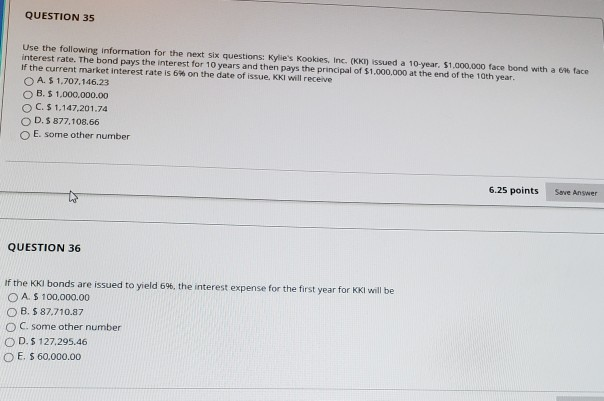

QUESTION 35 Use the following information for the next six questions: Kylie's Kookies, Inc. (KKN) issued a 10-year. 51.000.000 face bond with a 6 face

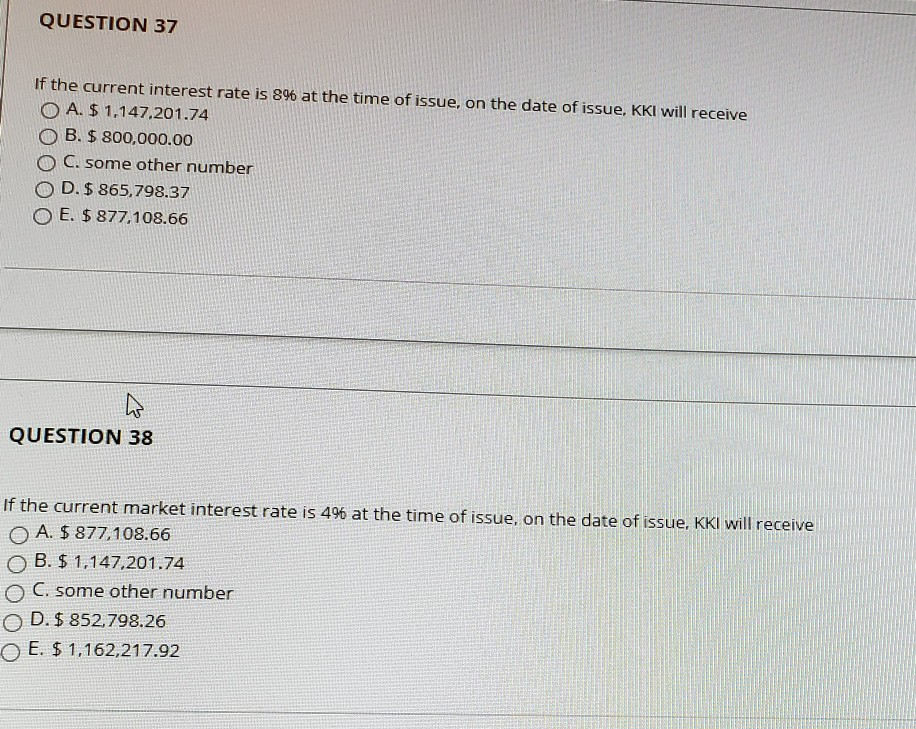

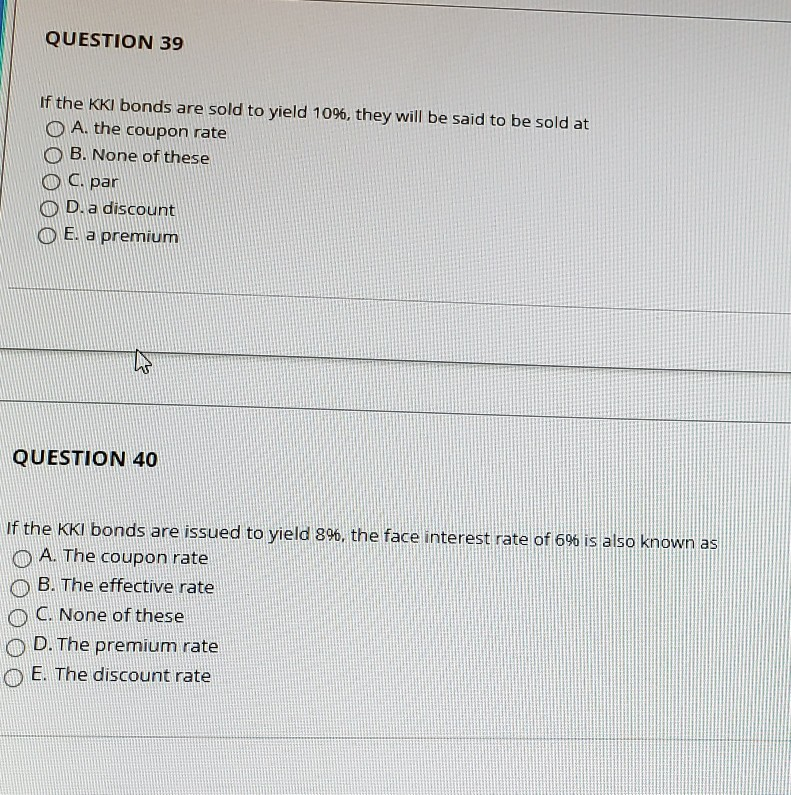

QUESTION 35 Use the following information for the next six questions: Kylie's Kookies, Inc. (KKN) issued a 10-year. 51.000.000 face bond with a 6 face interest rate. The bond pays the interest for 10 years and then pays the principal of $1,000,000 at the end of the 10th year. If the current market interest rate is on the date of issue. I will receive A. S1.707.146.23 OB. $ 1.000.000.00 OC. $ 1.147.201.74 D. $ 877,108.66 E some other number 6.25 points Save Answer QUESTION 36 If the KKI bonds are issued to yield 6%, the interest expense for the first year for KKI will be O A $100,000.00 OB. $ 87.710.87 O C. some other number OD. 127.295.46 O E. $ 60,000.00 QUESTION 37 If the current interest rate is 896 at the time of issue, on the date of issue, KKI will receive O A. $ 1,147,201.74 B. $ 800,000.00 C. some other number OD. $ 865,798.37 E. $ 877,108.66 QUESTION 38 If the current market interest rate is 496 at the time of issue, on the date of issue, KKI will receive A. $ 877,108.66 B. $ 1,147,201.74 O C. some other number D. $ 852.798.26 O E. $1,162,217.92 QUESTION 39 If the KKI bonds are sold to yield 1096, they will be said to be sold at O A. the coupon rate O B. None of these O C. par D. a discount O E. a premium QUESTION 40 If the KKI bonds are issued to yield 89, the face interest rate of 6% is also known as O A. The coupon rate B. The effective rate O C. None of these o D. The premium rate E. The discount rate

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started