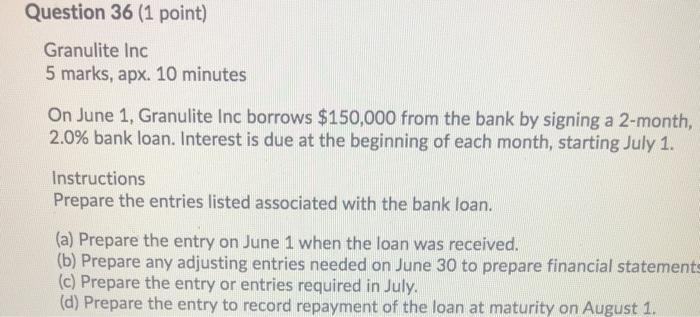

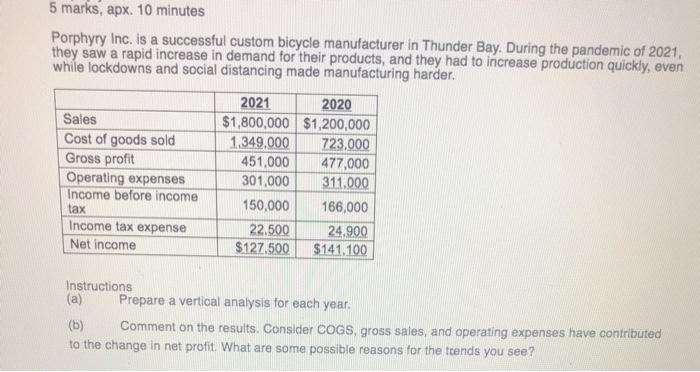

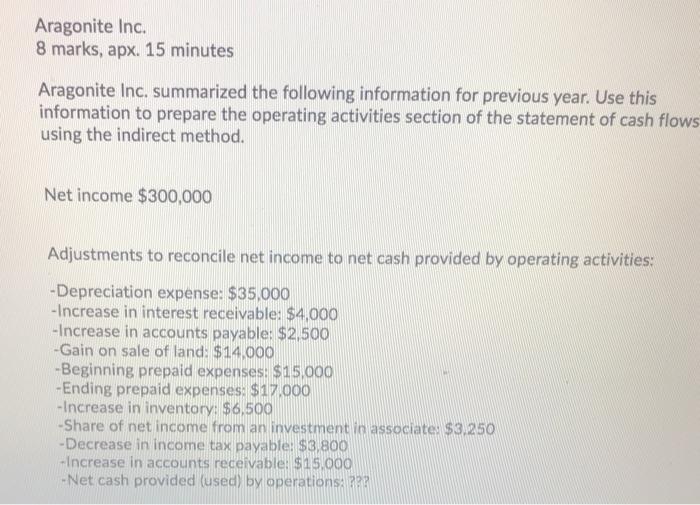

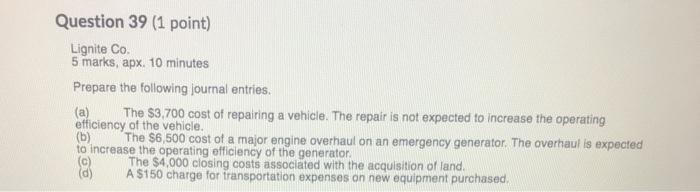

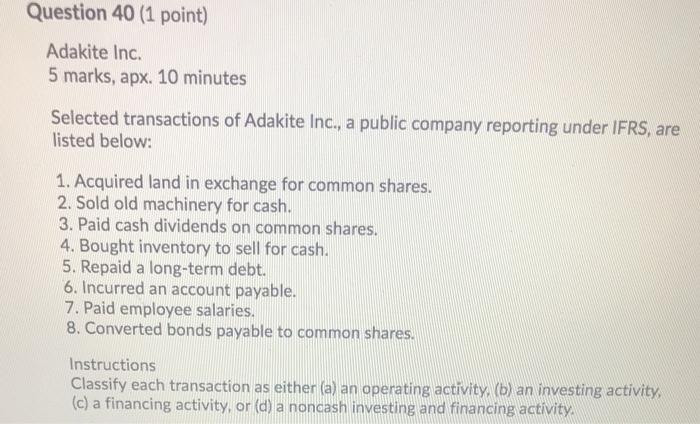

Question 36 (1 point) Granulite Inc 5 marks, apx. 10 minutes On June 1, Granulite Inc borrows $150,000 from the bank by signing a 2-month, 2.0% bank loan. Interest is due at the beginning of each month, starting July 1. Instructions Prepare the entries listed associated with the bank loan. (a) Prepare the entry on June 1 when the loan was received. (b) Prepare any adjusting entries needed on June 30 to prepare financial statements (c) Prepare the entry or entries required in July. (d) Prepare the entry to record repayment of the loan at maturity on August 1. 5 marks, apx. 10 minutes Porphyry Inc. is a successful custom bicycle manufacturer in Thunder Bay. During the pandemic of 2021, they saw a rapid increase in demand for their products, and they had to increase production quickly, even while lockdowns and social distancing made manufacturing harder. Sales Cost of goods sold Gross profit Operating expenses Income before income tax Income tax expense Net income 2021 2020 $1,800,000 $1,200,000 1.349.000 723,000 451,000 477,000 301,000 311,000 150,000 166,000 22.500 24.900 $127.500 $141.100 Instructions (a) Prepare a vertical analysis for each year. (6) Comment on the results. Consider COGS, gross sales, and operating expenses have contributed to the change in net profit. What are some possible reasons for the trends you see? Aragonite Inc. 8 marks, apx. 15 minutes Aragonite Inc. summarized the following information for previous year. Use this information to prepare the operating activities section of the statement of cash flows using the indirect method. Net income $300,000 Adjustments to reconcile net income to net cash provided by operating activities: -Depreciation expense: $35,000 -Increase in interest receivable: $4,000 -Increase in accounts payable: $2,500 -Gain on sale of land: $14,000 -Beginning prepaid expenses: $15,000 -Ending prepaid expenses: $17.000 - Increase in inventory: $6,500 -Share of net income from an investment in associate: $3,250 -Decrease in income tax payable: $3,800 -Increase in accounts receivable: $15.000 -Net cash provided (used) by operations Question 39 (1 point) Lignite Co. 5 marks, apx. 10 minutes Prepare the following journal entries. The $3,700 cost of repairing a vehicle. The repair is not expected to increase the operating efficiency of the vehicle. (b) The $6,500 cost of a major engine overhaul on an emergency generator. The overhaul is expected to increase the operating officiency of the generator (c) The $4.000 closing costs associated with the acquisition of land. (d) A $150 charge for transportation expenses on new equipment purchased (a) Question 40 (1 point) Adakite Inc. 5 marks, apx. 10 minutes Selected transactions of Adakite Inc., a public company reporting under IFRS, are listed below: 1. Acquired land in exchange for common shares. 2. Sold old machinery for cash. 3. Paid cash dividends on common shares. 4. Bought inventory to sell for cash. 5. Repaid a long-term debt. 6. Incurred an account payable. 7. Paid employee salaries. 8. Converted bonds payable to common shares. Instructions Classify each transaction as either (a) an operating activity. (b) an investing activity, (c) a financing activity, or (d) a noncash investing and financing activity