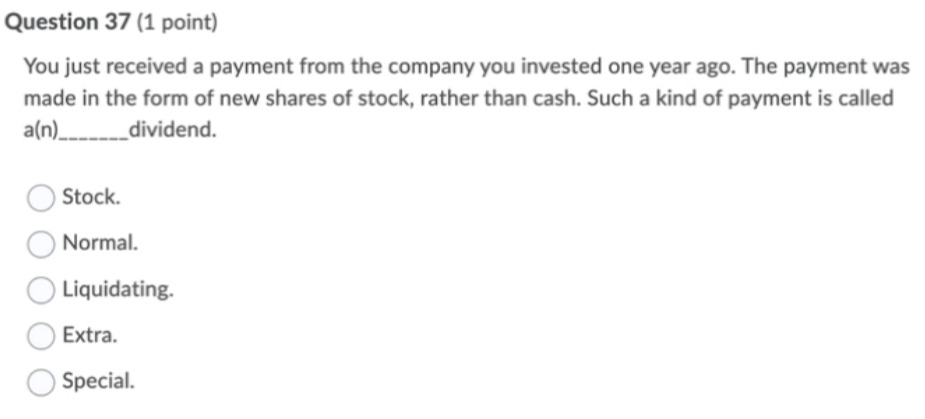

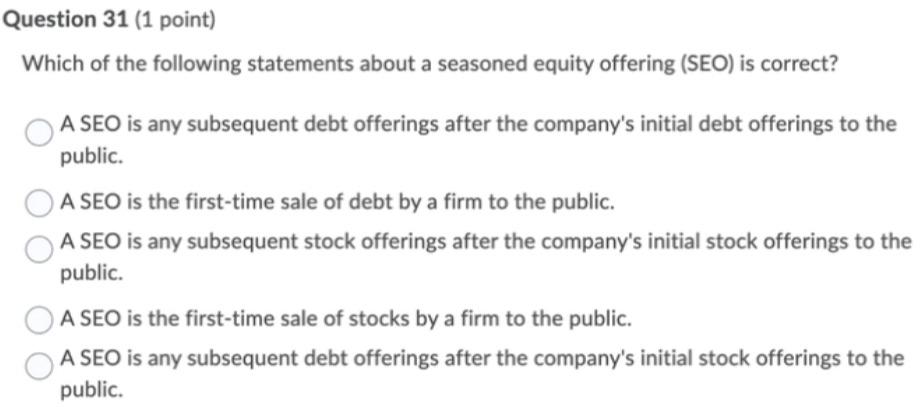

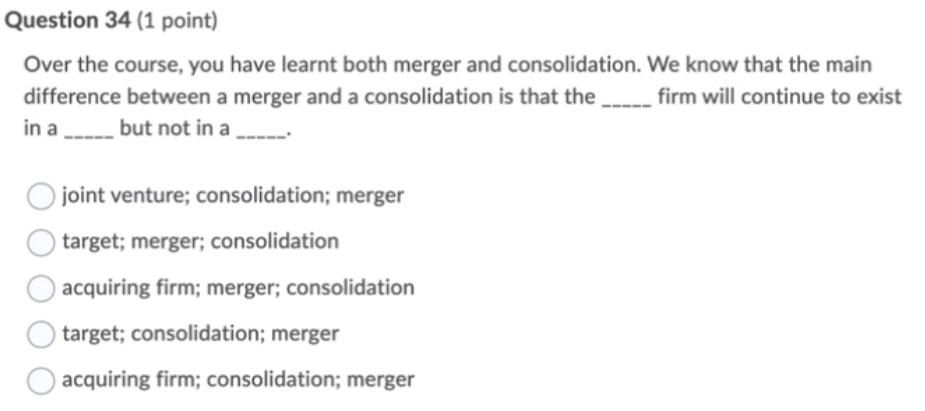

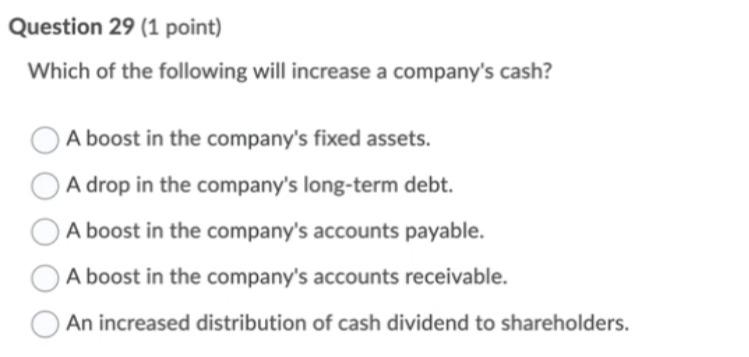

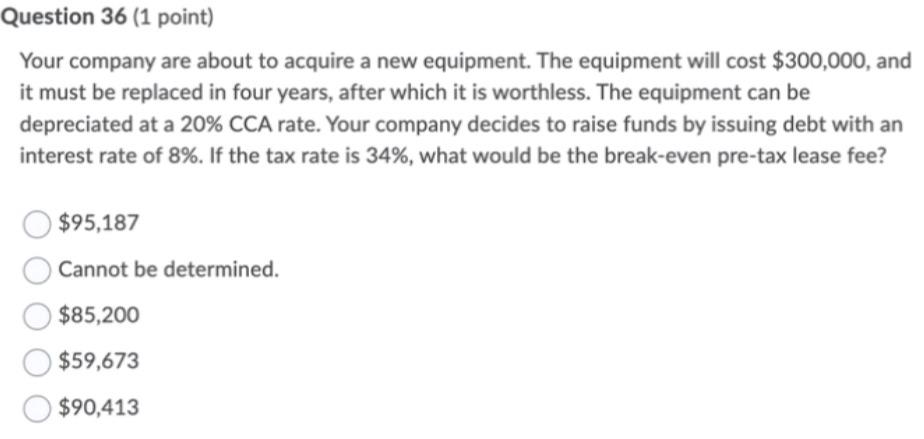

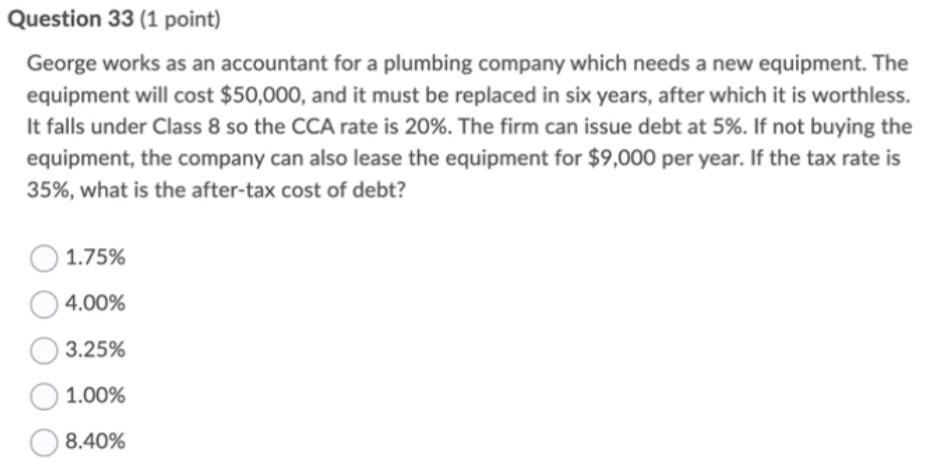

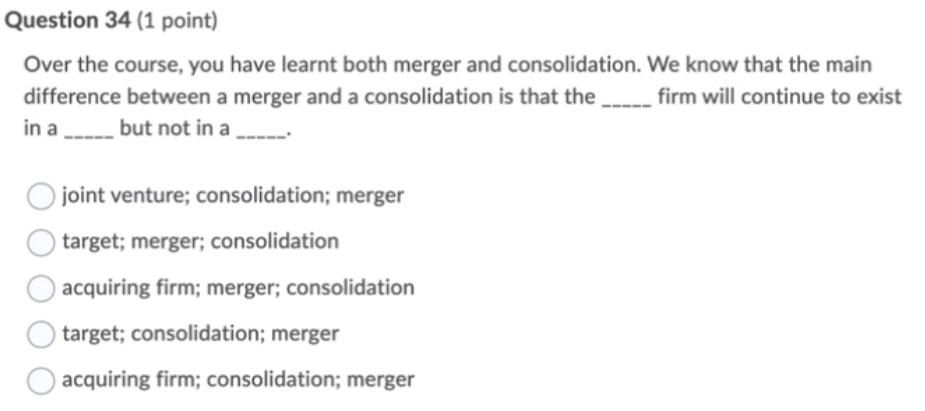

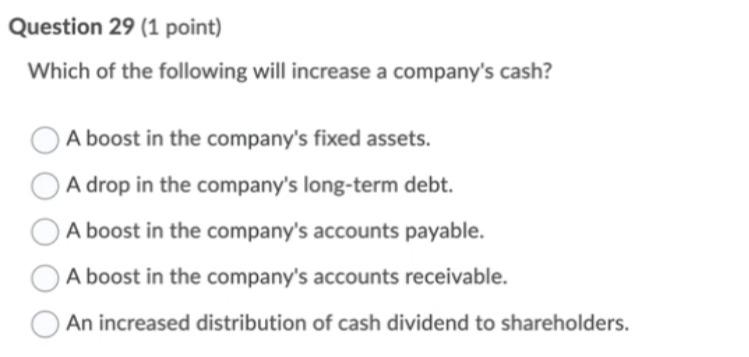

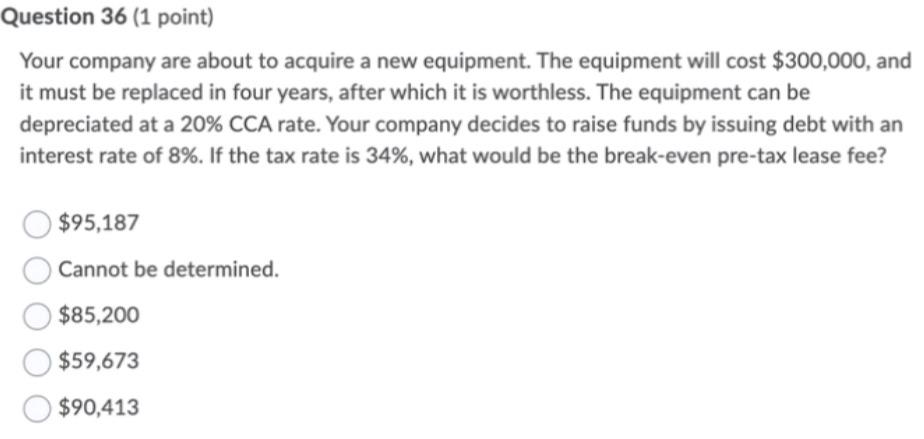

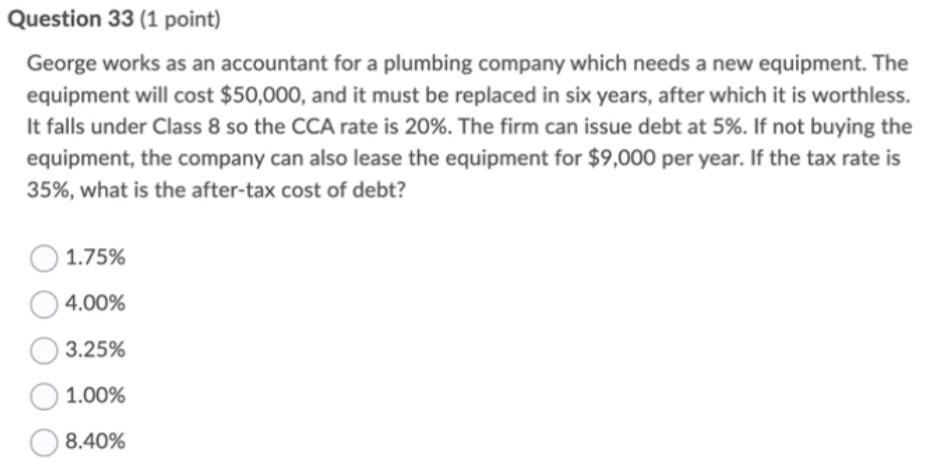

Question 37 (1 point) You just received a payment from the company you invested one year ago. The payment was made in the form of new shares of stock, rather than cash. Such a kind of payment is called a(n) _______dividend. Stock. Normal. Liquidating. Extra. Special. Question 31 (1 point) Which of the following statements about a seasoned equity offering (SEO) is correct? A SEO is any subsequent debt offerings after the company's initial debt offerings to the public. A SEO is the first-time sale of debt by a firm to the public. A SEO is any subsequent stock offerings after the company's initial stock offerings to the public. A SEO is the first-time sale of stocks by a firm to the public. A SEO is any subsequent debt offerings after the company's initial stock offerings to the public. Question 34 (1 point) Over the course, you have learnt both merger and consolidation. We know that the main difference between a merger and a consolidation is that the _____ firm will continue to exist in a but not in a joint venture; consolidation; merger target; merger; consolidation acquiring firm; merger; consolidation target; consolidation; merger acquiring firm; consolidation; merger Question 29 (1 point) Which of the following will increase a company's cash? A boost in the company's fixed assets. A drop in the company's long-term debt. A boost in the company's accounts payable. A boost in the company's accounts receivable. An increased distribution of cash dividend to shareholders. Question 36 (1 point) Your company are about to acquire a new equipment. The equipment will cost $300,000, and it must be replaced in four years, after which it is worthless. The equipment can be depreciated at a 20% CCA rate. Your company decides to raise funds by issuing debt with an interest rate of 8%. If the tax rate is 34%, what would be the break-even pre-tax lease fee? $95,187 Cannot be determined. $85,200 $59,673 $90,413 Question 33 (1 point) George works as an accountant for a plumbing company which needs a new equipment. The equipment will cost $50,000, and it must be replaced in six years, after which it is worthless. It falls under Class 8 so the CCA rate is 20%. The firm can issue debt at 5%. If not buying the equipment, the company can also lease the equipment for $9,000 per year. If the tax rate is 35%, what is the after-tax cost of debt? 1.75% 4.00% 3.25% 1.00% 8.40%