Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3-7? 12. Mutual Funds You are investigating mutual funds for the Securities and Exchange Commission. The Tip-Top-Table fund increased its value by $50,000 per

Question 3-7?

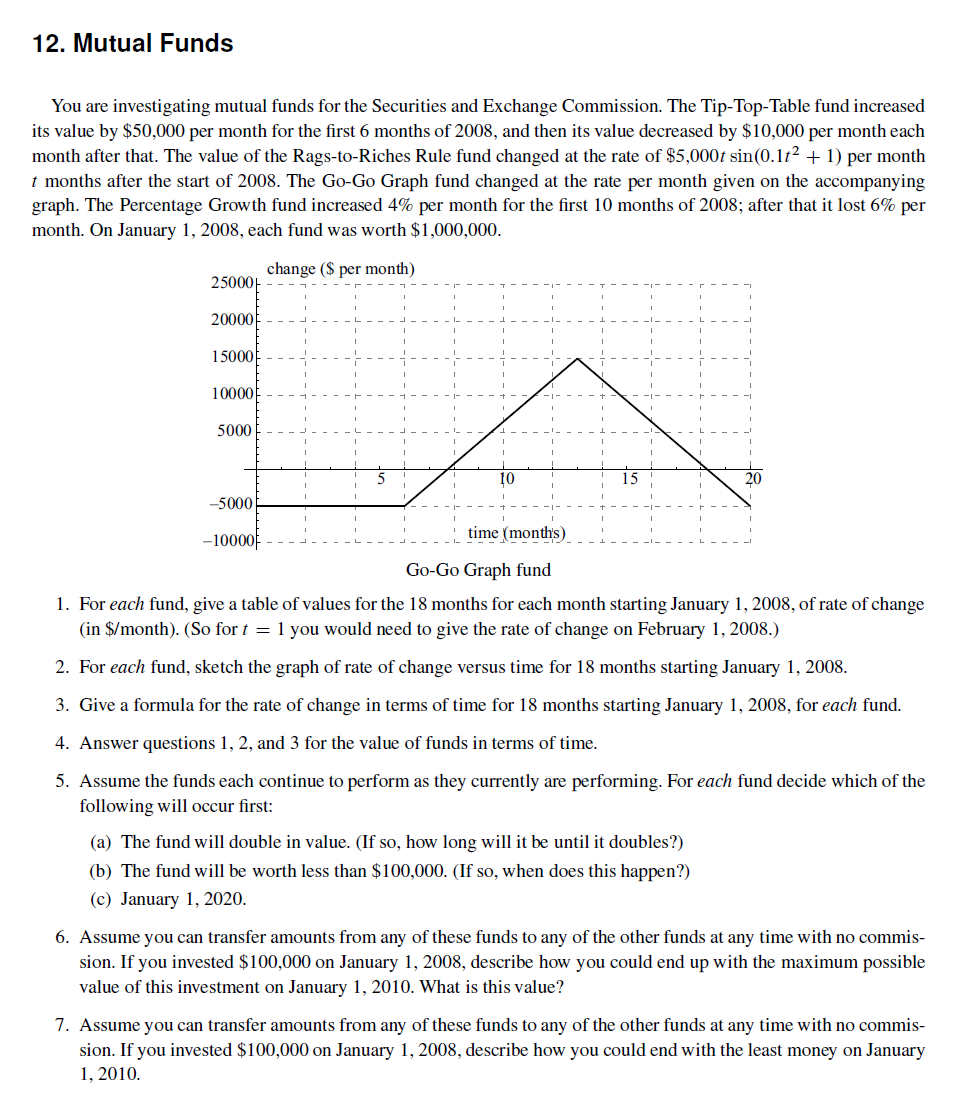

12. Mutual Funds You are investigating mutual funds for the Securities and Exchange Commission. The Tip-Top-Table fund increased its value by $50,000 per month for the first 6 months of 2008, and then its value decreased by $10,000 per month each month after that. The value of the Rags-to-Riches Rule fund changed at the rate of $5,000t sin(0.112 + 1) per month t months after the start of 2008. The Go-Go Graph fund changed at the rate per month given on the accompanying graph. The Percentage Growth fund increased 4% per month for the first 10 months of 2008; after that it lost 6% per month. On January 1, 2008, each fund was worth $1,000,000. change ($ per month 25000 20000! 15000 100001 5000 10 -5000 -10000 time (months) Go-Go Graph fund 1. For each fund, give a table of values for the 18 months for each month starting January 1, 2008, of rate of change (in $/month). (So for t = 1 you would need to give the rate of change on February 1, 2008.) 2. For each fund, sketch the graph of rate of change versus time for 18 months starting January 1, 2008. 3. Give a formula for the rate of change in terms of time for 18 months starting January 1, 2008, for each fund. 4. Answer questions 1, 2, and 3 for the value of funds in terms of time. 5. Assume the funds each continue to perform as they currently are performing. For each fund decide which of the following will occur first: (a) The fund will double in value. (If so, how long will it be until it doubles?) (b) The fund will be worth less than $100,000. (If so, when does this happen?) (c) January 1, 2020. 6. Assume you can transfer amounts from any of these funds to any of the other funds at any time with no commis- sion. If you invested $100,000 on January 1, 2008, describe how you could end up with the maximum possible value of this investment on January 1, 2010. What is this value? 7. Assume you can transfer amounts from any of these funds to any of the other funds at any time with no commis- sion. If you invested $100,000 on January 1, 2008, describe how you could end with the least money on January 1, 2010. 12. Mutual Funds You are investigating mutual funds for the Securities and Exchange Commission. The Tip-Top-Table fund increased its value by $50,000 per month for the first 6 months of 2008, and then its value decreased by $10,000 per month each month after that. The value of the Rags-to-Riches Rule fund changed at the rate of $5,000t sin(0.112 + 1) per month t months after the start of 2008. The Go-Go Graph fund changed at the rate per month given on the accompanying graph. The Percentage Growth fund increased 4% per month for the first 10 months of 2008; after that it lost 6% per month. On January 1, 2008, each fund was worth $1,000,000. change ($ per month 25000 20000! 15000 100001 5000 10 -5000 -10000 time (months) Go-Go Graph fund 1. For each fund, give a table of values for the 18 months for each month starting January 1, 2008, of rate of change (in $/month). (So for t = 1 you would need to give the rate of change on February 1, 2008.) 2. For each fund, sketch the graph of rate of change versus time for 18 months starting January 1, 2008. 3. Give a formula for the rate of change in terms of time for 18 months starting January 1, 2008, for each fund. 4. Answer questions 1, 2, and 3 for the value of funds in terms of time. 5. Assume the funds each continue to perform as they currently are performing. For each fund decide which of the following will occur first: (a) The fund will double in value. (If so, how long will it be until it doubles?) (b) The fund will be worth less than $100,000. (If so, when does this happen?) (c) January 1, 2020. 6. Assume you can transfer amounts from any of these funds to any of the other funds at any time with no commis- sion. If you invested $100,000 on January 1, 2008, describe how you could end up with the maximum possible value of this investment on January 1, 2010. What is this value? 7. Assume you can transfer amounts from any of these funds to any of the other funds at any time with no commis- sion. If you invested $100,000 on January 1, 2008, describe how you could end with the least money on January 1, 2010Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started