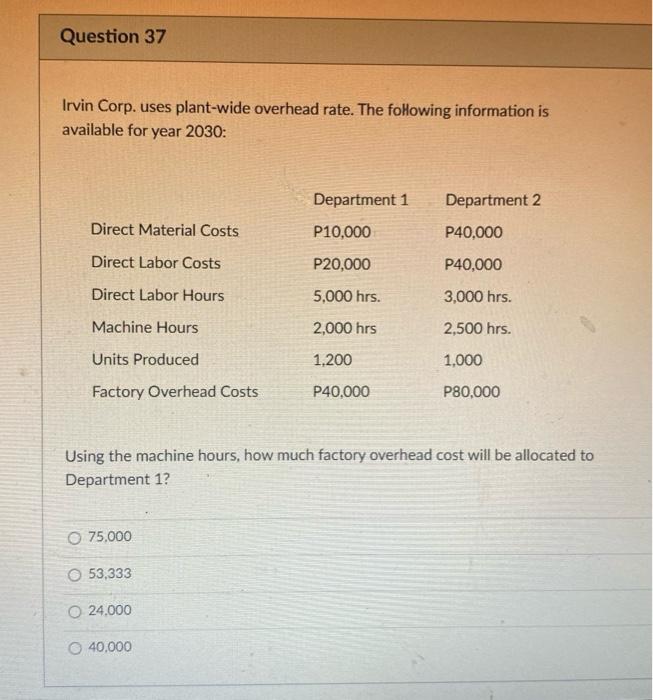

Question 37 Irvin Corp. uses plant-wide overhead rate. The following information is available for year 2030: Department 1 Department 2 Direct Material Costs P10,000

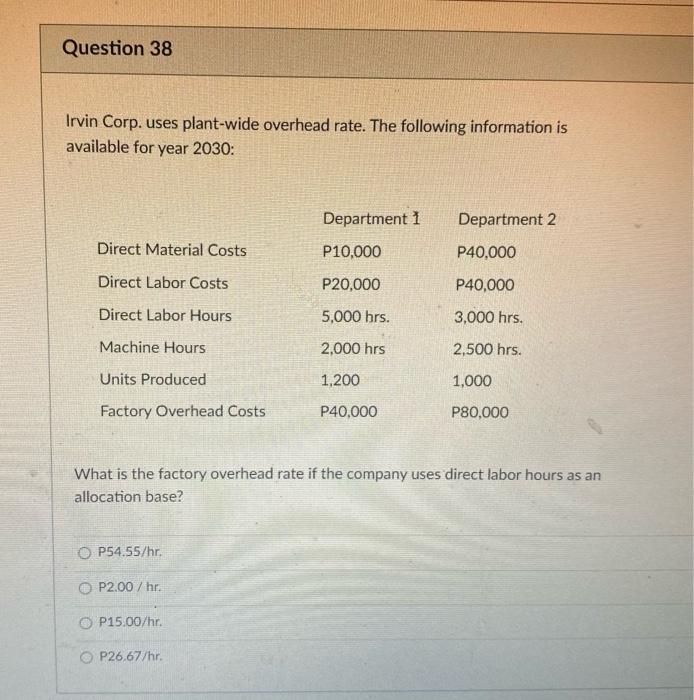

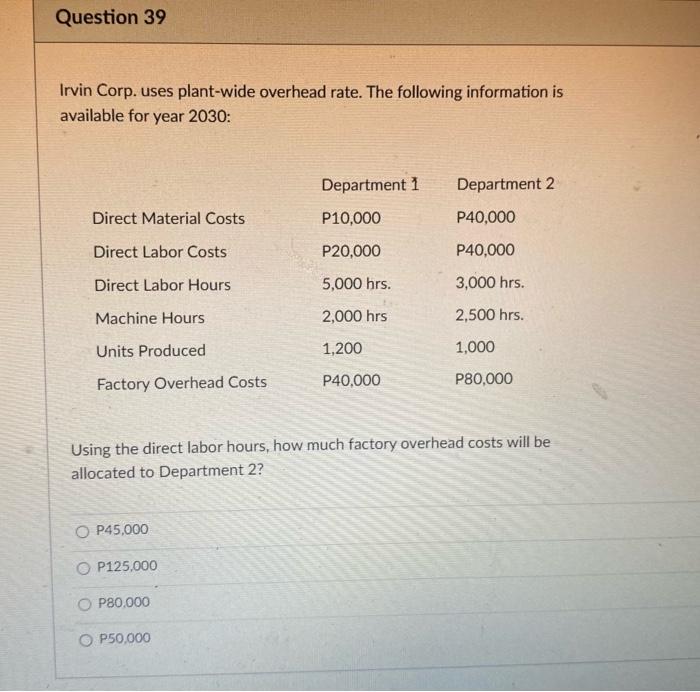

Question 37 Irvin Corp. uses plant-wide overhead rate. The following information is available for year 2030: Department 1 Department 2 Direct Material Costs P10,000 P40,000 Direct Labor Costs P20,000 P40,000 Direct Labor Hours 5,000 hrs. 3,000 hrs. Machine Hours 2,000 hrs 2,500 hrs. Units Produced 1,200 1,000 Factory Overhead Costs P40,000 P80,000 Using the machine hours, how much factory overhead cost will be allocated to Department 1? O75,000 53,333 O 24,000 O 40,000 Question 38 Irvin Corp. uses plant-wide overhead rate. The following information is available for year 2030: Department 1 Department 2 Direct Material Costs P10,000 P40,000 Direct Labor Costs P20,000 P40,000 Direct Labor Hours 5,000 hrs. 3,000 hrs. Machine Hours 2,000 hrs 2,500 hrs. Units Produced 1,200 1,000 Factory Overhead Costs P40,000 P80,000 What is the factory overhead rate if the company uses direct labor hours as an allocation base? P54.55/hr. OP2.00/hr. OP15.00/hr. OP26.67/hr. Question 39 Irvin Corp. uses plant-wide overhead rate. The following information is available for year 2030: Department 1 Department 2 Direct Material Costs P10,000 P40,000 Direct Labor Costs P20,000 P40,000 Direct Labor Hours 5,000 hrs. 3,000 hrs. Machine Hours 2,000 hrs 2,500 hrs. Units Produced 1,200 1,000 Factory Overhead Costs P40,000 P80,000 Using the direct labor hours, how much factory overhead costs will be allocated to Department 2? O P45,000 OP125,000 OP80,000 0 950,000

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Lets break down and solve each question stepbystep Question 37 Using Machine Hours to allocate overh...

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started