Answered step by step

Verified Expert Solution

Question

1 Approved Answer

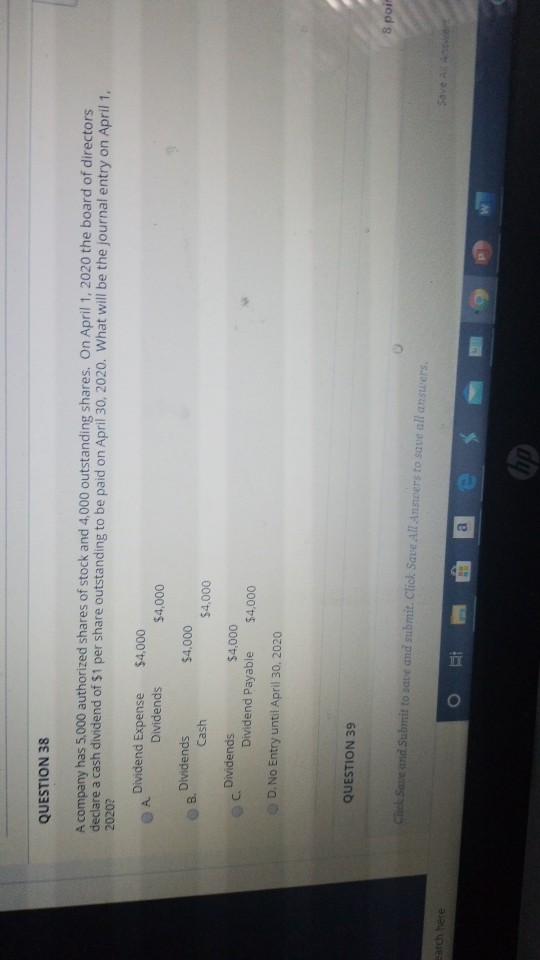

QUESTION 38 A company has 5,000 authorized shares of stock and 4,000 outstanding shares. On April 1, 2020 the board of directors 2020 declare a

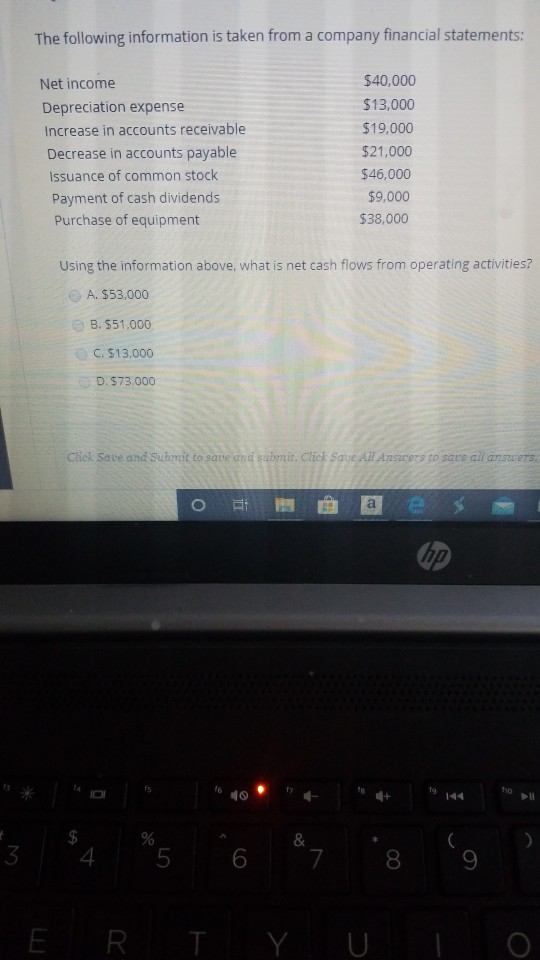

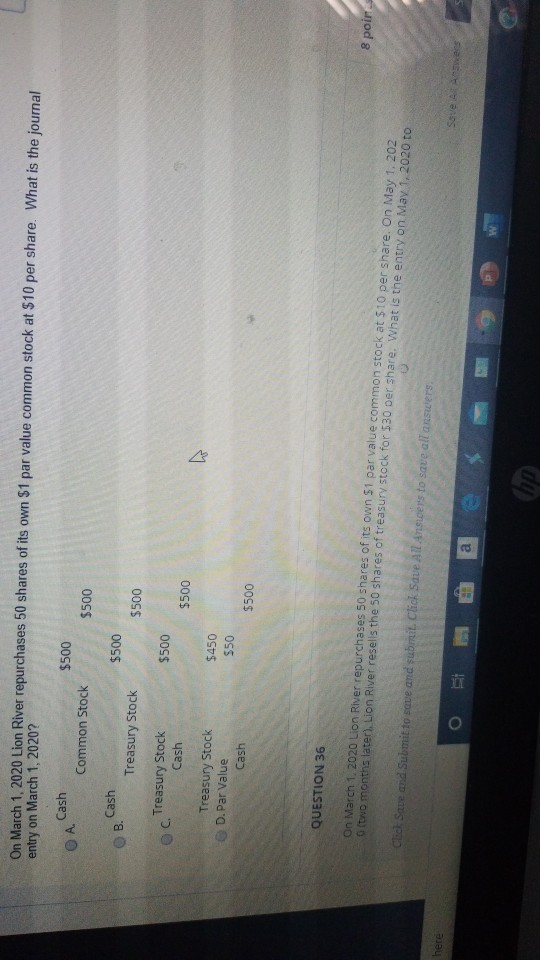

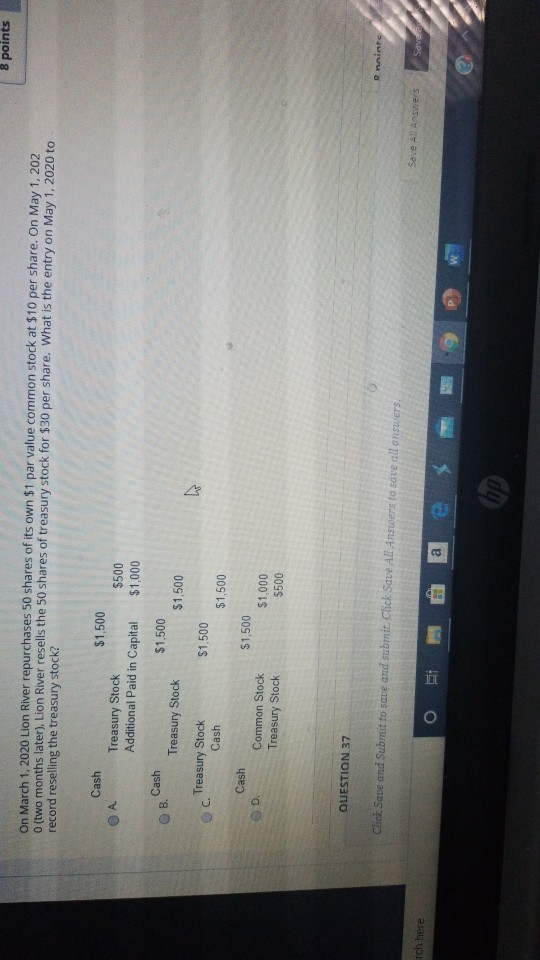

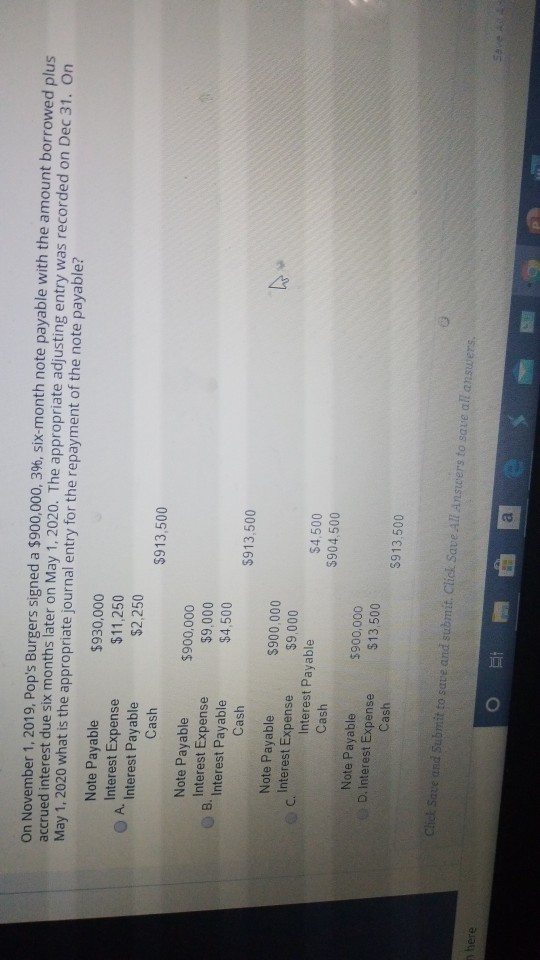

QUESTION 38 A company has 5,000 authorized shares of stock and 4,000 outstanding shares. On April 1, 2020 the board of directors 2020 declare a cash dividend of $1 per share outstanding to be paid on April 30, 2020. What will be the journal entry on April 1. A Dividend Expense Dividends $4,000 $4,000 $4.000 $4,000 B. Dividends Cash Dividends $4,000 C. Dividend Payable $4,000 D.No Entry until April 30, 2020 QUESTION 39 8 poi Click Save and Submit to save and submit. Click Save All Answers to save all answers. earch here a e cho The following information is taken from a company financial statements: Net income Depreciation expense Increase in accounts receivable Decrease in accounts payable Issuance of common stock Payment of cash dividends Purchase of equipment $40,000 $13,000 $19,000 $21,000 $46,000 $9,000 $38,000 Using the information above, what is net cash flows from operating activities? A. $53,000 B. $51,000 C. $13,000 D. $73,000 Click Save and submit to save and submit. Click Save ansers to save all answers. o co hp to & 3 4 6 8 E R T Y U entry on March 1, 2020? On March 1, 2020 Lion River repurchases 50 shares of its own $1 par value common stock at $10 per share. What is the journal Cash . $500 Common Stock $500 Cash B. $500 Treasury Stock $500 oc. Treasury Stock $500 Cash $500 N Treasury Stock D. Par Value Cash $450 $50 $500 QUESTION 36 8 poir On March 1, 2020 Lion River repurchases 50 shares of its own 51 par value common stock at $10 per share. On May 1, 202 Otwo months later). Llon River resells the 50 shares of treasury stock for 530 per share. What is the entry on May 1, 2020 to Click Save and Submit to save and submit. Click Save All Answers to save all answers. here Sove AA w 8 points On March 1, 2020 Lion River repurchases 50 shares of its own $1 par value common stock at $10 per share. On May 1, 202 0 (two months later), Lion River resells the 50 shares of treasury stock for $30 per share. What is the entry on May 1, 2020 to record reselling the treasury stock? Cash $1,500 A Treasury Stock $500 Additional Paid in Capital $1,000 Cash $1,500 B. Treasury Stock $1,500 C. Treasury Stock $1,500 Cash $1,500 Cash $1,500 D. Common Stock $1,000 Treasury Stock $500 OUESTION 37 Click Save and Submit to save and submit. Click Save All Answers to save all answers, ich here Save Answers Save a W On November 1, 2019, Pop's Burgers signed a $900,000, 396, six-month note payable with the amount borrowed plus accrued interest due six months later on May 1, 2020. The appropriate adjusting entry was recorded on Dec 31. On May 1, 2020 what is the appropriate journal entry for the repayment of the note payable? Note Payable $930,000 Interest Expense $11,250 Interest Payable $2,250 Cash $913,500 A. Note Payable Interest Expense B. Interest Payable $900,000 $9,000 $4,500 Cash $913,500 Note Payable $900,000 Interest Expense $9,000 Interest Payable Cash Note Payable $900,000 D. Interest Expense $13,500 $4.500 $904,500 Cash $913.500 n here Chel Save and Submit to save and submit. Click Save All Answers to save all answers

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started