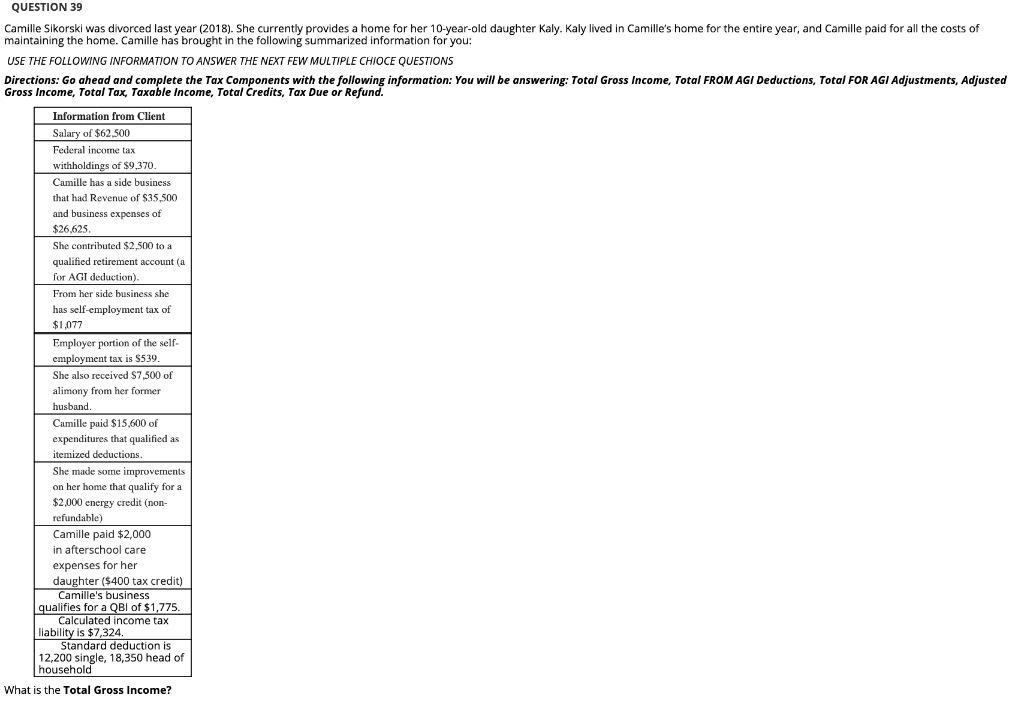

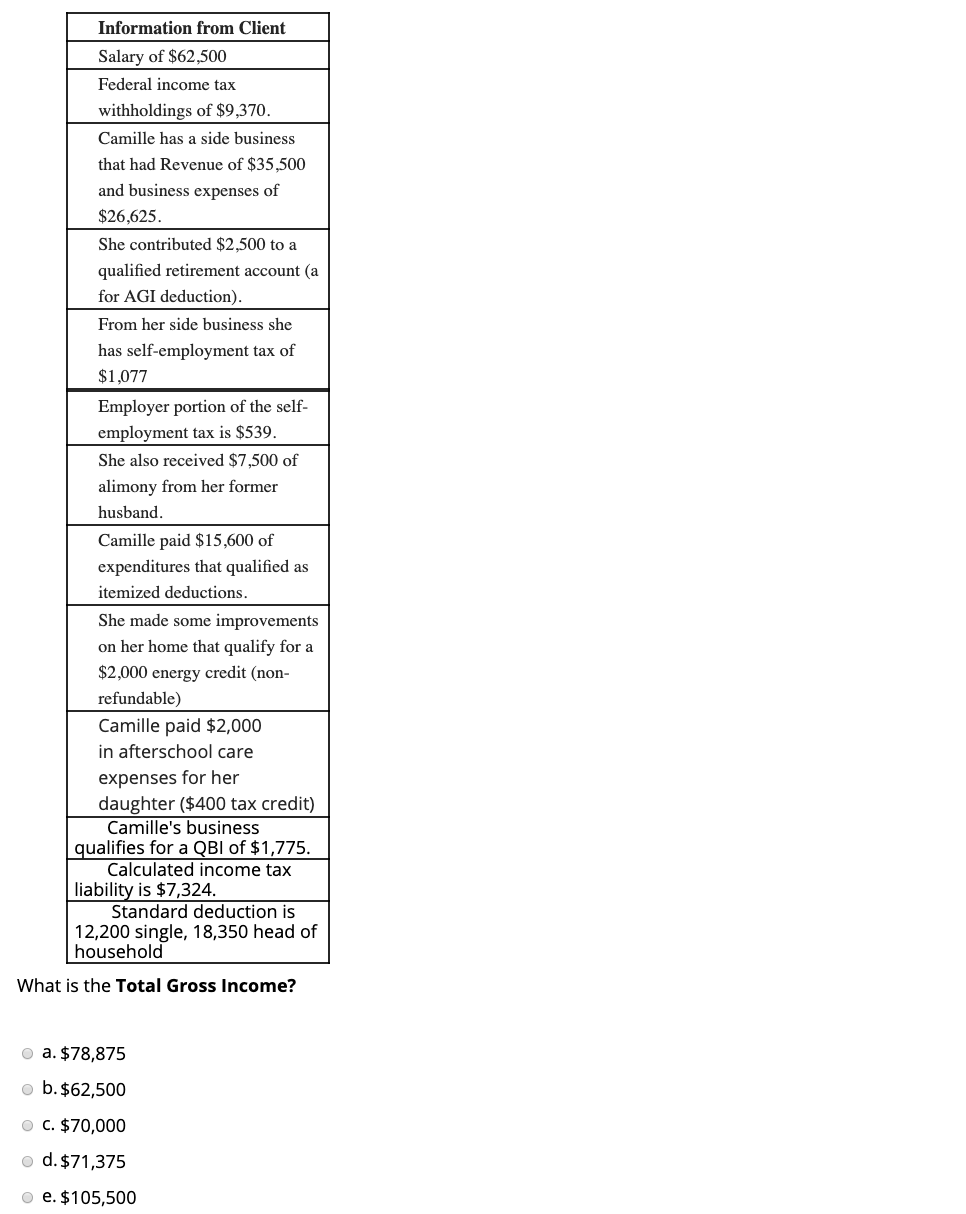

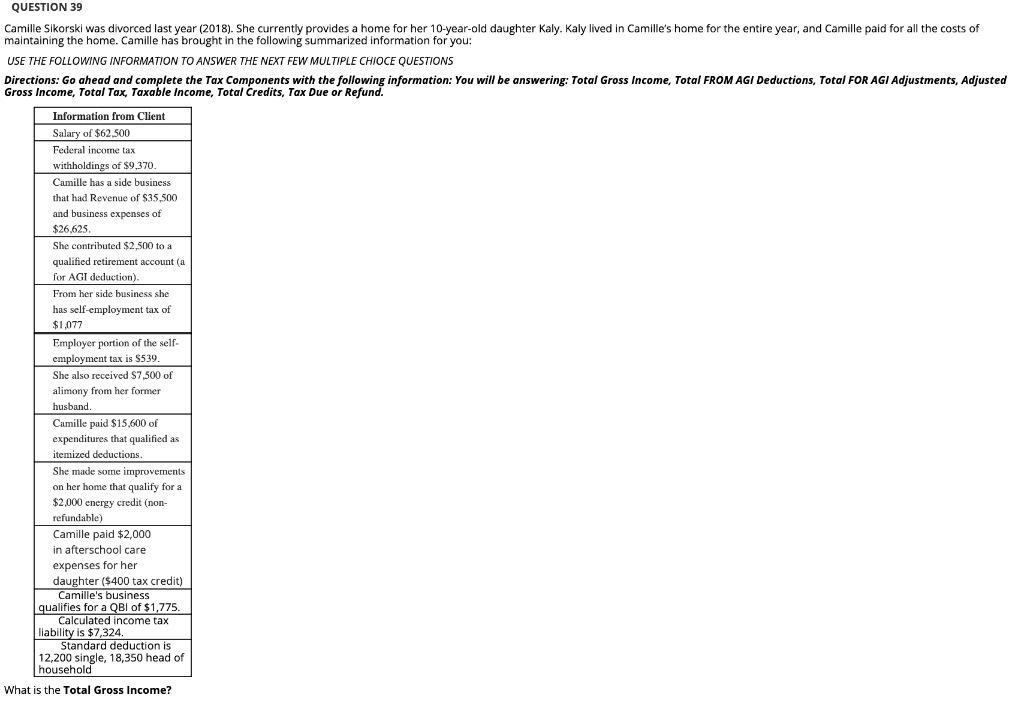

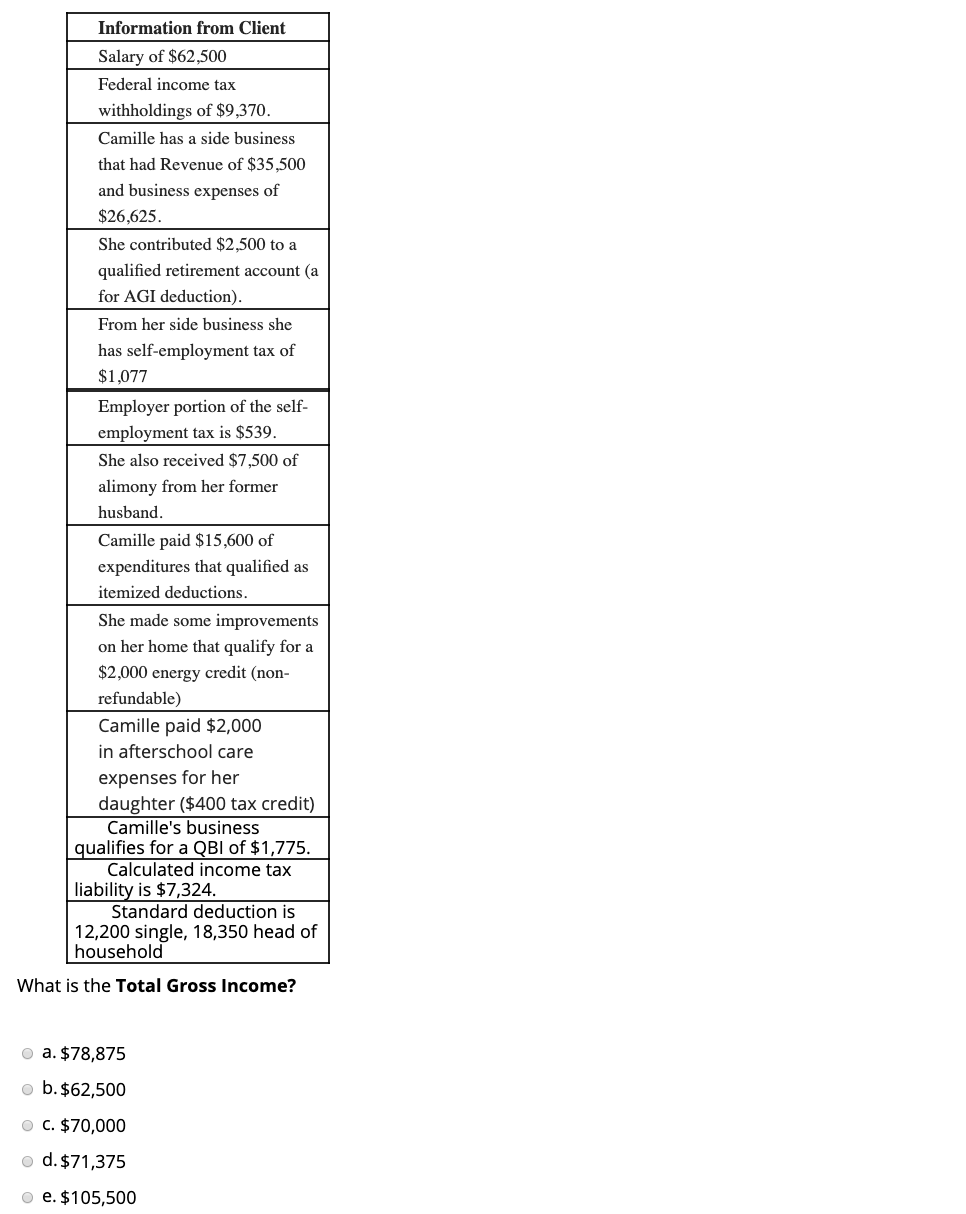

QUESTION 39 Camille Sikorski was divorced last year (2018). She currently provides a home for her 10-year-old daughter Kaly. Kaly lived in Camille's home for the entire year, and Camille paid for all the costs of maintaining the home. Camille has brought in the following summarized information for you: USE THE FOLLOWING INFORMATION TO ANSWER THE NEXT FEW MULTIPLE CHIOCE QUESTIONS Directions: Go ahead and complete the Tax Components with the following information: You will be answering: Total Gross Income, Total FROM AGI Deductions, Total FOR AGI Adjustments, Adjusted Gross Income, Total Tax, Taxable income, Total Credits, Tax Due or Refund. Information from Client Salary of $62,500 Federal income tax withholdings of $9,370. Camille has a side business that had Revenue of $35,500 and business expenses of $26,625 She contributed $2,500 to a qualified retirement account (a for AGI deduction). From her side business she has self-employment tax of $1,077 Employer portion of the self- employment tax is $539. She also received $7,500 of alimony from her former husband. Camille paid $15,600 of expenditures that qualified as itemized deductions. She made some improvements on her home that qualify for a $2,000 energy credit (non- refundable) Camille paid $2,000 in afterschool care expenses for her daughter ($400 tax credit) Camille's business qualifies for a QBI of $1,775. Calculated income tax liability is $7,324. Standard deduction is 12,200 single, 18,350 head of household What is the Total Gross Income? Information from Client Salary of $62,500 Federal income tax withholdings of $9,370. Camille has a side business that had Revenue of $35,500 and business expenses of $26,625. She contributed $2,500 to a qualified retirement account (a for AGI deduction) From her side business she has self-employment tax of $1,077 Employer portion of the self- employment tax is $539. She also received $7,500 of alimony from her former husband. Camille paid $15,600 of expenditures that qualified as itemized deductions. She made some improvements on her home that qualify for a $2,000 energy credit (non- refundable) Camille paid $2,000 in afterschool care expenses for her daughter ($400 tax credit) Camille's business qualifies for a QBI of $1,775. Calculated income tax liability is $7,324. Standard deduction is 12,200 single, 18,350 head of household What is the Total Gross Income? a. $78,875 b.$62,500 C. $70,000 od. $71,375 e. $105,500