Answered step by step

Verified Expert Solution

Question

1 Approved Answer

QUESTION 39 Khloe and Kimberly Kardashian each retired this year from Kanye Company and started receiving distributions from their respective retirement plans. Khloe's plan was

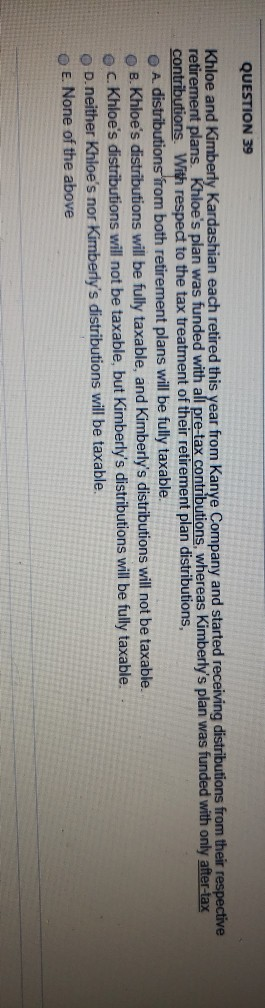

QUESTION 39 Khloe and Kimberly Kardashian each retired this year from Kanye Company and started receiving distributions from their respective retirement plans. Khloe's plan was funded with all pre-tax contributions, whereas Kimberly's plan was funded with only after-tax contributions. With respect to the tax treatment of their retirement plan distributions, A. distributions from both retirement plans will be fully taxable. B. Khloe's distributions will be fully taxable, and Kimberly's distributions will not be taxable. c. Khloe's distributions will not be taxable, but Kimberly's distributions will be fully taxable. D. neither Khloe's nor Kimberly's distributions will be taxable. E. None of the above

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started