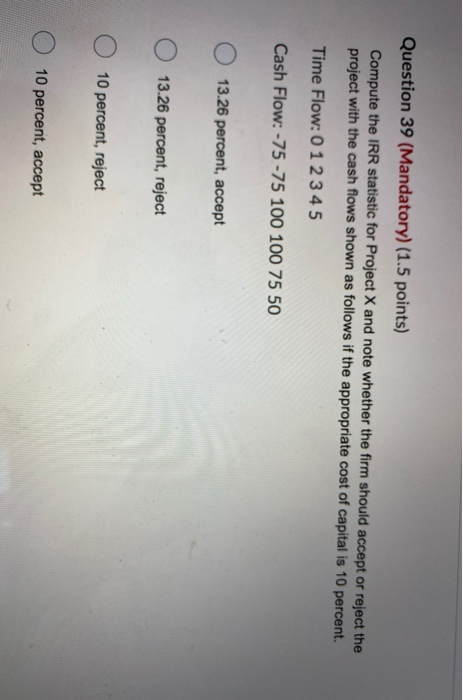

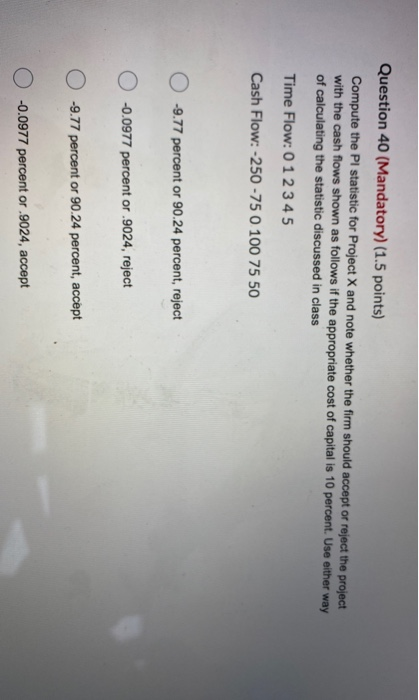

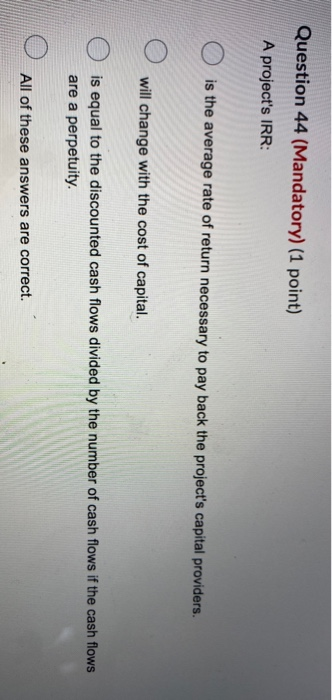

Question 39 (Mandatory) (1.5 points) Compute the IRR statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent. Time Flow: 0 1 2 3 4 5 Cash Flow: -75-75 100 100 75 50 O 13.26 percent, accept 0 13.26 percent, reject O 10 percent, reject O 10 percent, accept Question 40 (Mandatory) (1.5 points) Compute the Pl statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent. Use either way of calculating the statistic discussed in class Time Flow: 0 1 2 3 4 5 Cash Flow: -250-75 0 100 75 50 0 -9.77 percent or 90.24 percent, reject 0 -0.0977 percent or.9024, reject 0 -9.77 percent or 90.24 percent, accept 0 -0.0977 percent or 9024, accept Question 44 (Mandatory) (1 point) A project's IRR: O is the average rate of return necessary to pay back the project's capital providers. will change with the cost of capital. is equal to the discounted cash flows divided by the number of cash flows if the cash flows are a perpetuity. All of these answers are correct. Question 39 (Mandatory) (1.5 points) Compute the IRR statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent. Time Flow: 0 1 2 3 4 5 Cash Flow: -75-75 100 100 75 50 O 13.26 percent, accept 0 13.26 percent, reject O 10 percent, reject O 10 percent, accept Question 40 (Mandatory) (1.5 points) Compute the Pl statistic for Project X and note whether the firm should accept or reject the project with the cash flows shown as follows if the appropriate cost of capital is 10 percent. Use either way of calculating the statistic discussed in class Time Flow: 0 1 2 3 4 5 Cash Flow: -250-75 0 100 75 50 0 -9.77 percent or 90.24 percent, reject 0 -0.0977 percent or.9024, reject 0 -9.77 percent or 90.24 percent, accept 0 -0.0977 percent or 9024, accept Question 44 (Mandatory) (1 point) A project's IRR: O is the average rate of return necessary to pay back the project's capital providers. will change with the cost of capital. is equal to the discounted cash flows divided by the number of cash flows if the cash flows are a perpetuity. All of these answers are correct