Answered step by step

Verified Expert Solution

Question

1 Approved Answer

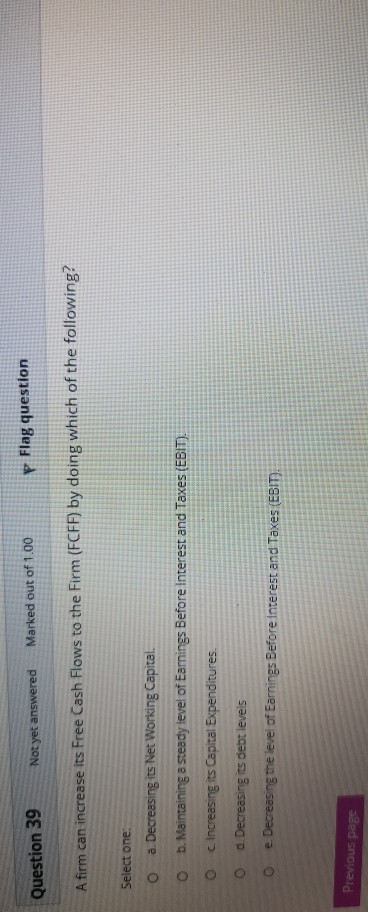

Question 39 Not yet answered Marked out of 1.00 P Flag question A firm can increase its Free Cash Flows to the Firm (FCFF) by

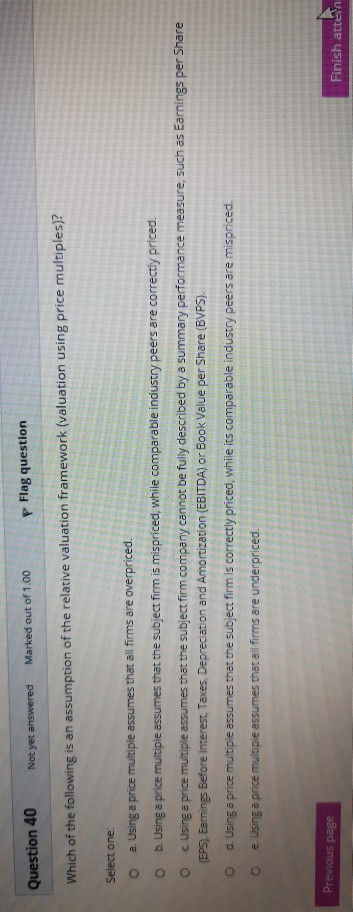

Question 39 Not yet answered Marked out of 1.00 P Flag question A firm can increase its Free Cash Flows to the Firm (FCFF) by doing which of the following? Select one O a. Decreasing its Net Working Capital. o b. Maintaining a steady level of Earnings Before Interest and Taxes (EBIT). Increasing its Capital Expenditures. Od. Decreasing its debt levels o e Decreasing the level of Earnings Before Interest and Taxes (EBIT). Previous page Question 40 Not yet answered Marked out of 1.00 p Flag question Which of the following is an assumption of the relative valuation framework (valuation using price multiples)? Select one: a. Using a price multiple assumes that all firms are overpriced. ob. Using a price multiple assumes that the subject firm is mispriced, while comparable industry peers are correctly priced. o Using a price multiple assumes that the subject firm company cannot be fully described by a summary performance measure, such as Earnings per Share (EPS), Earnings Before Interest, Taxes, Depreciation and Amortization (EBITDA) or Book Value per Share (BVPS). O d. Using a price multiple assumes that the subject firm is correctly priced, while its comparable industry peers are mispriced. e. Using a price multiple assumes that all firms are underpriced. Previous page Finish atten

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started