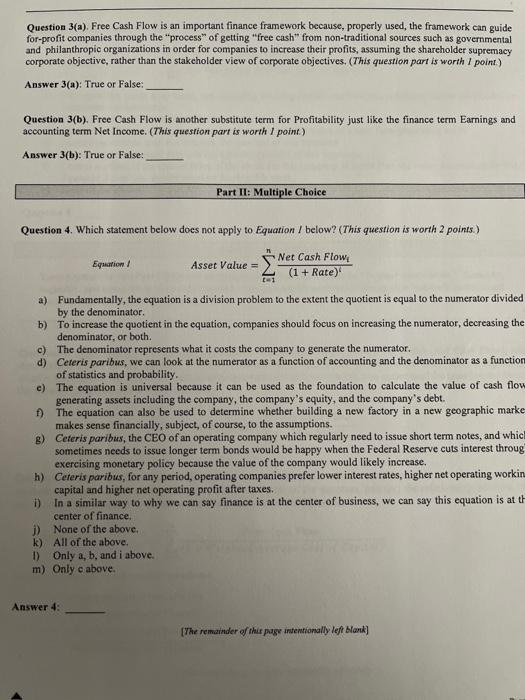

Question 3(a). Free Cash Flow is an important finance framework because, properly used, the framework can guide for-profit companies through the process of getting "free cash from non-traditional sources such as governmental and philanthropic organizations in order for companies to increase their profits, assuming the shareholder supremacy corporate objective, rather than the stakeholder view of corporate objectives. (This question part is worth 1 point) Answer 3(a): True or False: Question 3(b). Free Cash Flow is another substitute term for Profitability just like the finance term Earnings and accounting term Net Income. (This question part is worth 1 point) Answer 3(b): True or False: Part II: Multiple Choice Question 4. Which statement below does not apply to Equation / below? (This question is worth 2 points) R Equation Asset Value = Net Cash Flow, (1 + Rate) a) Fundamentally, the equation is a division problem to the extent the quotient is equal to the numerator divided by the denominator b) To increase the quotient in the equation, companies should focus on increasing the numerator, decreasing the denominator, or both. c) The denominator represents what it costs the company to generate the numerator. d) Ceteris paribus, we can look at the numerator as a function of accounting and the denominator as a function of statistics and probability. c) The equation is universal because it can be used as the foundation to calculate the value of cash flow generating assets including the company, the company's equity, and the company's debt. f) The equation can also be used to determine whether building a new factory in a new geographic marke makes sense financially, subject, of course, to the assumptions. B) Ceteris paribus, the CEO of an operating company which regularly need to issue short term notes, and which sometimes needs to issue longer term bonds would be happy when the Federal Reserve cuts interest throug exercising monetary policy because the value of the company would likely increase. h) Ceteris paribus, for any period, operating companies prefer lower interest rates, higher net operating workin capital and higher net operating profit after taxes. 1) In a similar way to why we can say finance is at the center of business, we can say this equation is att center of finance. i) None of the above. k) All of the above. 1) Only a, b, and i above. m) Only e above. Answer 4: [The remainder of this page intentionally left blank]