Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 3B) In December 2021, Xintong moved from Toronto Calgary to commence a PhD degree in math (he will be studying hypergeometric resummation and

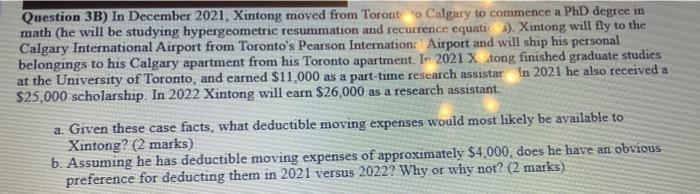

Question 3B) In December 2021, Xintong moved from Toronto Calgary to commence a PhD degree in math (he will be studying hypergeometric resummation and recurrence equatic). Xintong will fly to the Calgary International Airport from Toronto's Pearson Internation: Airport and will ship his personal belongings to his Calgary apartment from his Toronto apartment. In 2021 Xtong finished graduate studies at the University of Toronto, and earned $11,000 as a part-time research assistar In 2021 he also received a $25,000 scholarship. In 2022 Xintong will earn $26,000 as a research assistant. a. Given these case facts, what deductible moving expenses would most likely be available to Xintong? (2 marks) b. Assuming he has deductible moving expenses of approximately $4,000, does he have an obvious preference for deducting them in 2021 versus 2022? Why or why not? (2 marks)

Step by Step Solution

★★★★★

3.47 Rating (160 Votes )

There are 3 Steps involved in it

Step: 1

a Given these case facts what deductible moving expenses would most likely be available to Xin...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started