Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Tes.Co is a wholesaler who buys and sells product EXE. The demand for product EXE is 24,000 units each year Tes.CO sells product EXE

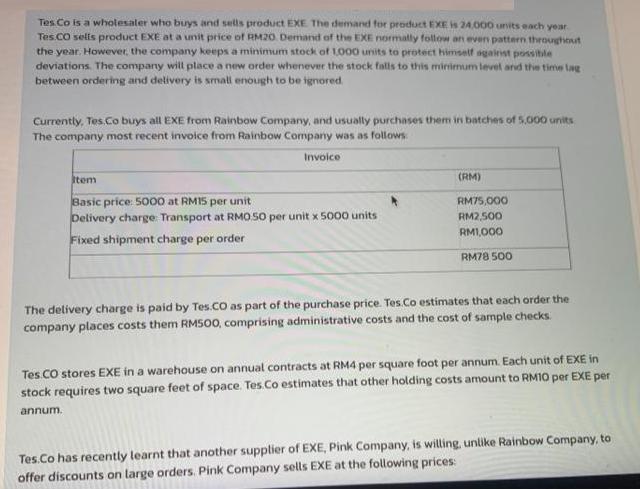

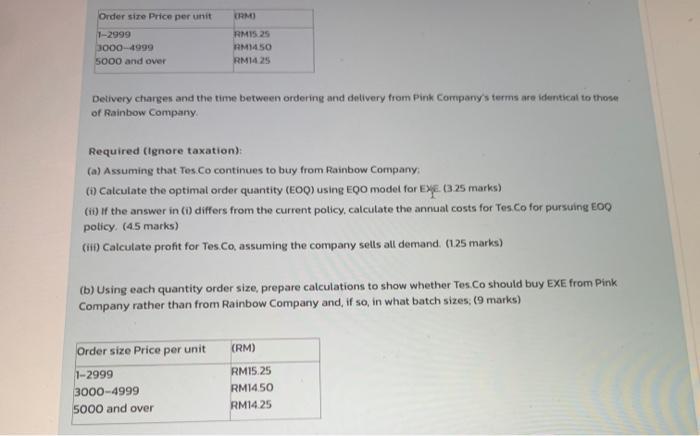

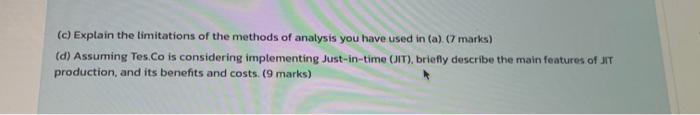

Tes.Co is a wholesaler who buys and sells product EXE. The demand for product EXE is 24,000 units each year Tes.CO sells product EXE at a unit price of RM20. Demand of the EXE normally follow an even pattern throughout the year. However, the company keeps a minimum stock of 1,000 units to protect himself against possible deviations. The company will place a new order whenever the stock falls to this minimum level and the time lag between ordering and delivery is small enough to be ignored. Currently, Tes.Co buys all EXE from Rainbow Company, and usually purchases them in batches of 5,000 units The company most recent invoice from Rainbow Company was as follows Invoice Item Basic price: 5000 at RM15 per unit Delivery charge: Transport at RM0.50 per unit x 5000 units Fixed shipment charge per order (RM) RM75,000 RM2,500 RM1,000 RM78 500 The delivery charge is paid by Tes.CO as part of the purchase price. Tes.Co estimates that each order the company places costs them RM500, comprising administrative costs and the cost of sample checks. Tes.CO stores EXE in a warehouse on annual contracts at RM4 per square foot per annum. Each unit of EXE in stock requires two square feet of space. Tes.Co estimates that other holding costs amount to RM10 per EXE per annum. Tes.Co has recently learnt that another supplier of EXE, Pink Company, is willing, unlike Rainbow Company, to offer discounts on large orders. Pink Company sells EXE at the following prices: Order size Price per unit 1-2999 3000-4999 5000 and over (RM) RAM 50 RMI 2. Delivery charges and the time between ordering and delivery from Pink Company's terms are identical to those of Rainbow Company. Required (Ignore taxation): (a) Assuming that Tes.Co continues to buy from Rainbow Company; (i) Calculate the optimal order quantity (EOQ) using EQO model for EXE. (3.25 marks) (ii) If the answer in (i) differs from the current policy, calculate the annual costs for Tes.Co for pursuing EOQ policy. (4.5 marks) (iii) Calculate profit for Tes.Co, assuming the company sells all demand. (1.25 marks) Order size Price per unit 1-2999 3000-4999 5000 and over (b) Using each quantity order size, prepare calculations to show whether Tes.Co should buy EXE from Pink Company rather than from Rainbow Company and, if so, in what batch sizes: (9 marks) (RM) RMIS 25 RMM50. RMM.25 (c) Explain the limitations of the methods of analysis you have used in (a). (7 marks) (d) Assuming Tes.Co is considering implementing Just-in-time (JIT), briefly describe the main features of JIT production, and its benefits and costs. (9 marks)

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

a 1 The optimal order quantity EOQ using the EOQ model for EXE is 5000 units ii The annual costs for ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started