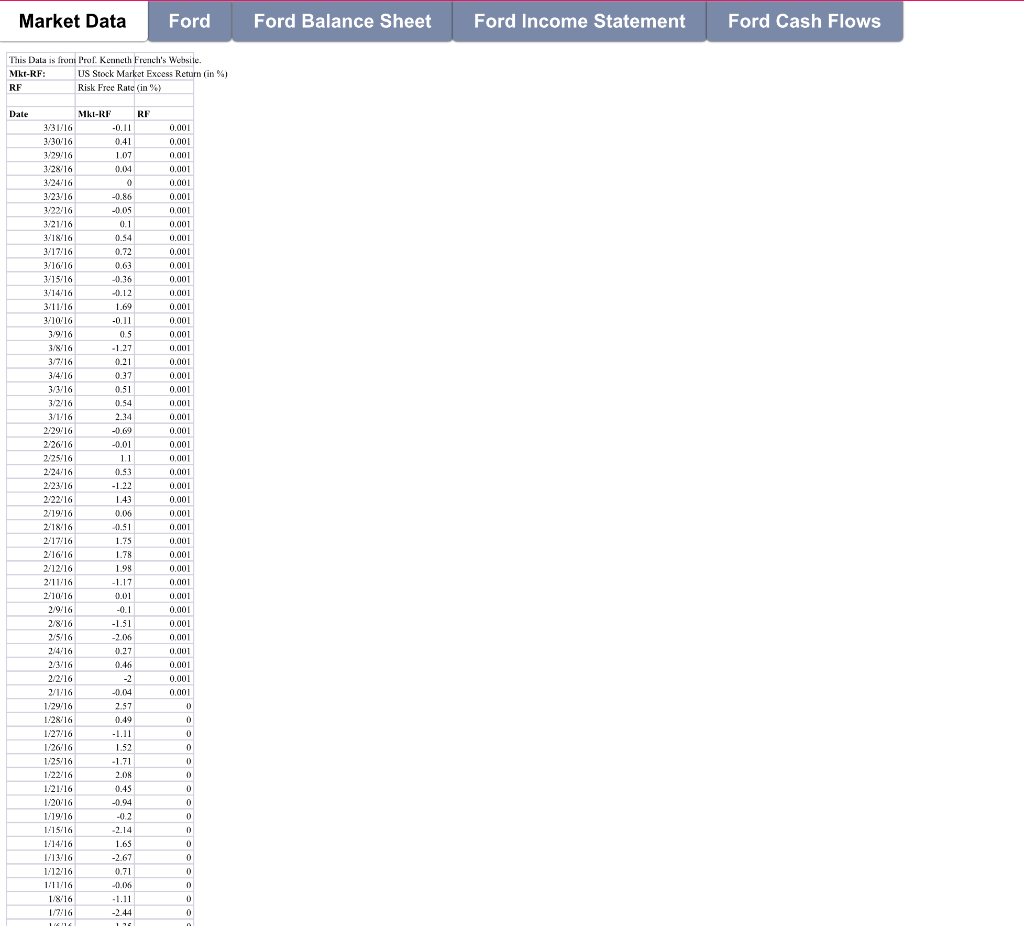

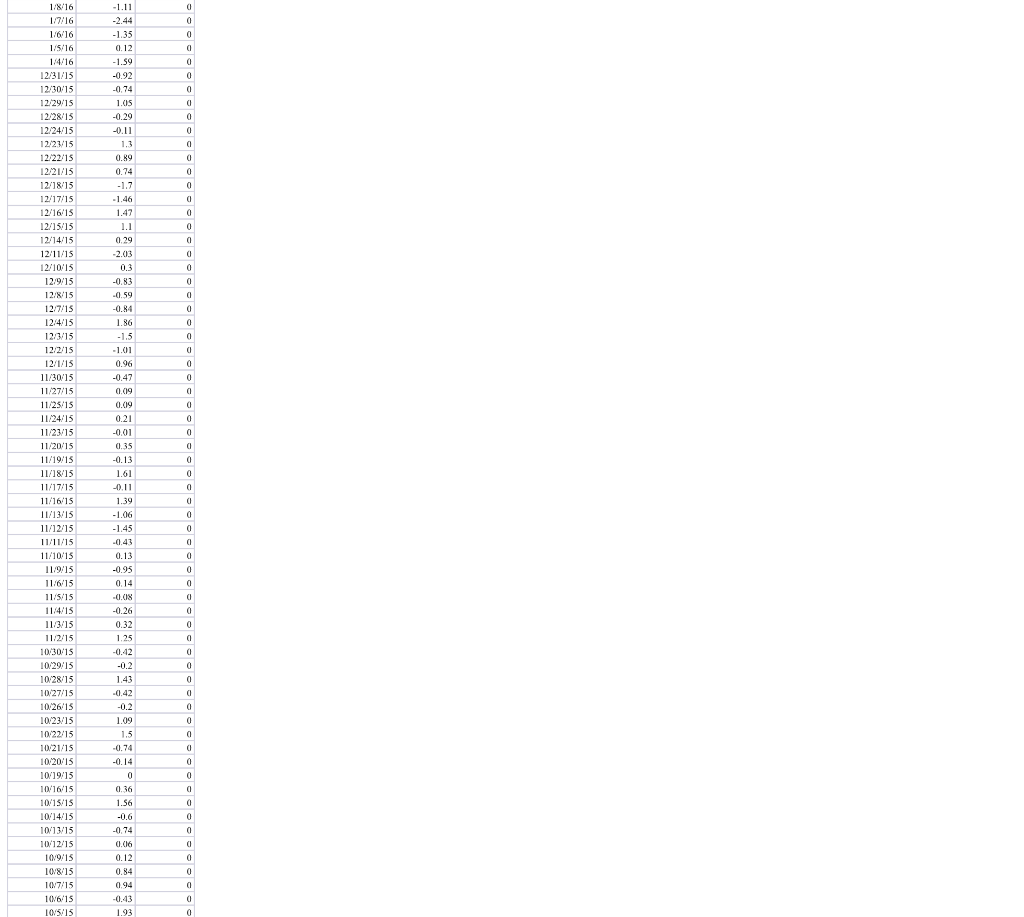

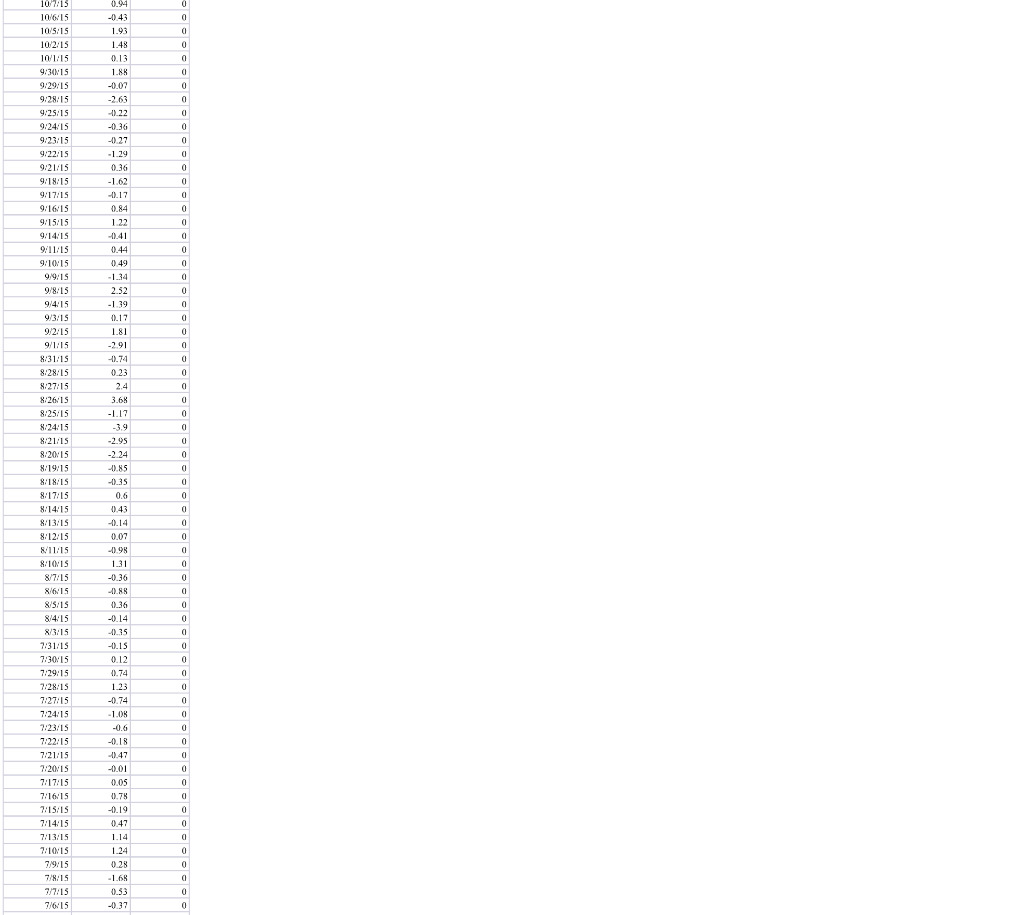

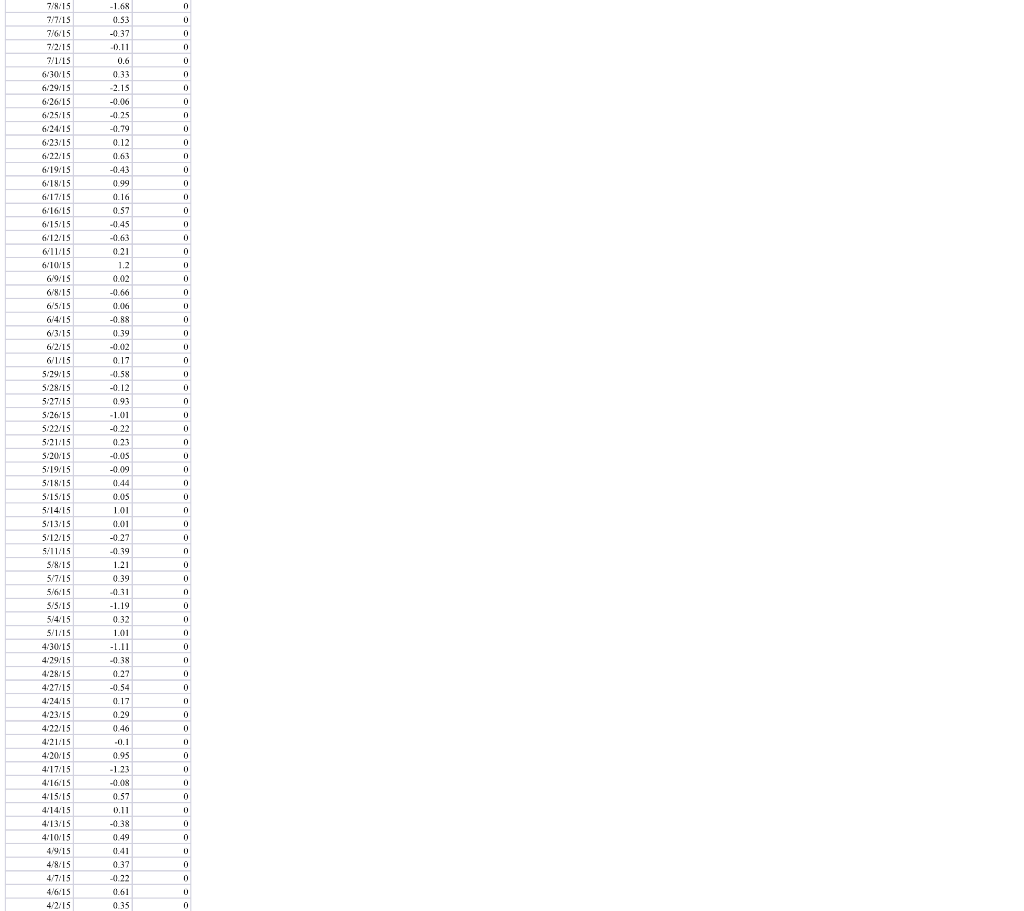

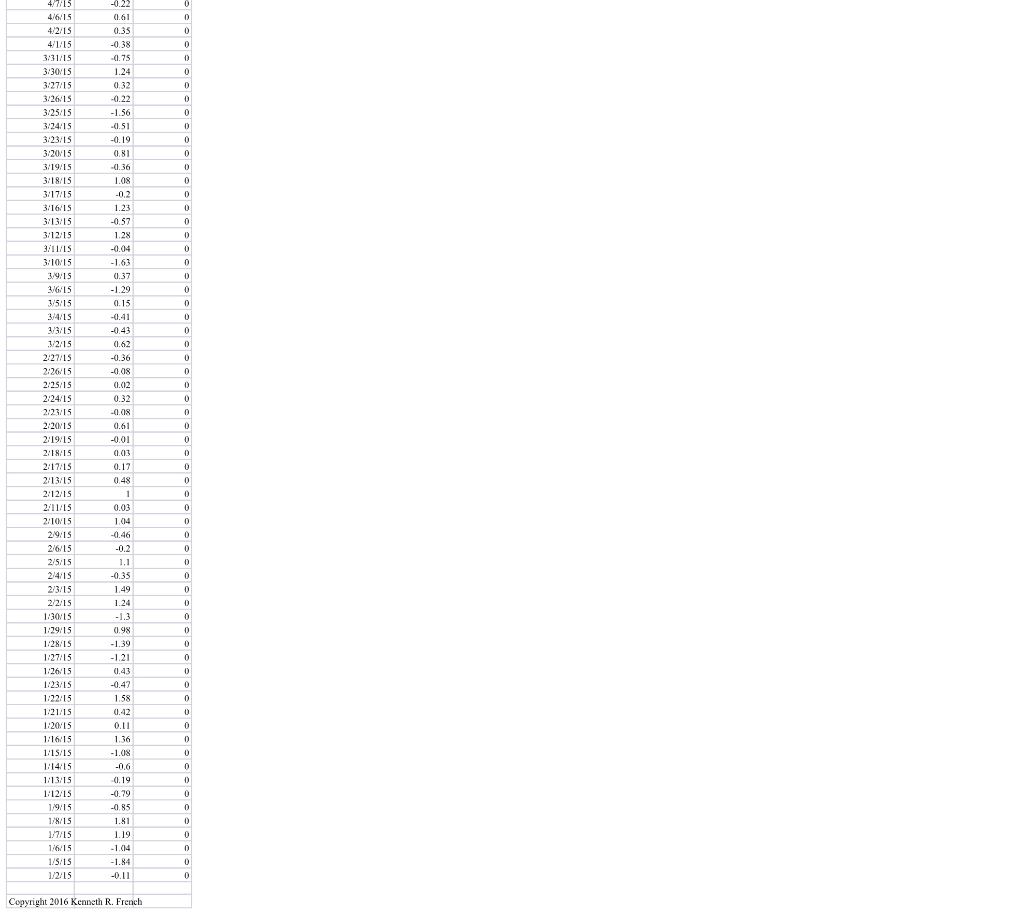

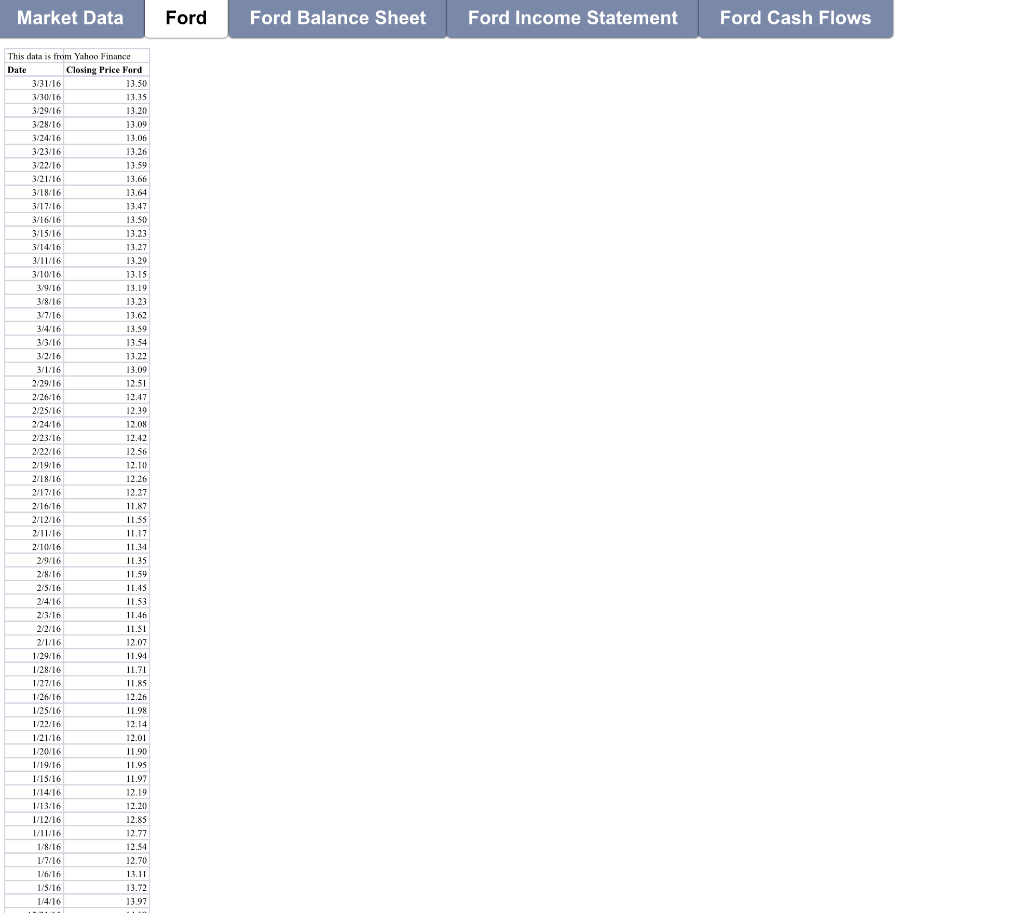

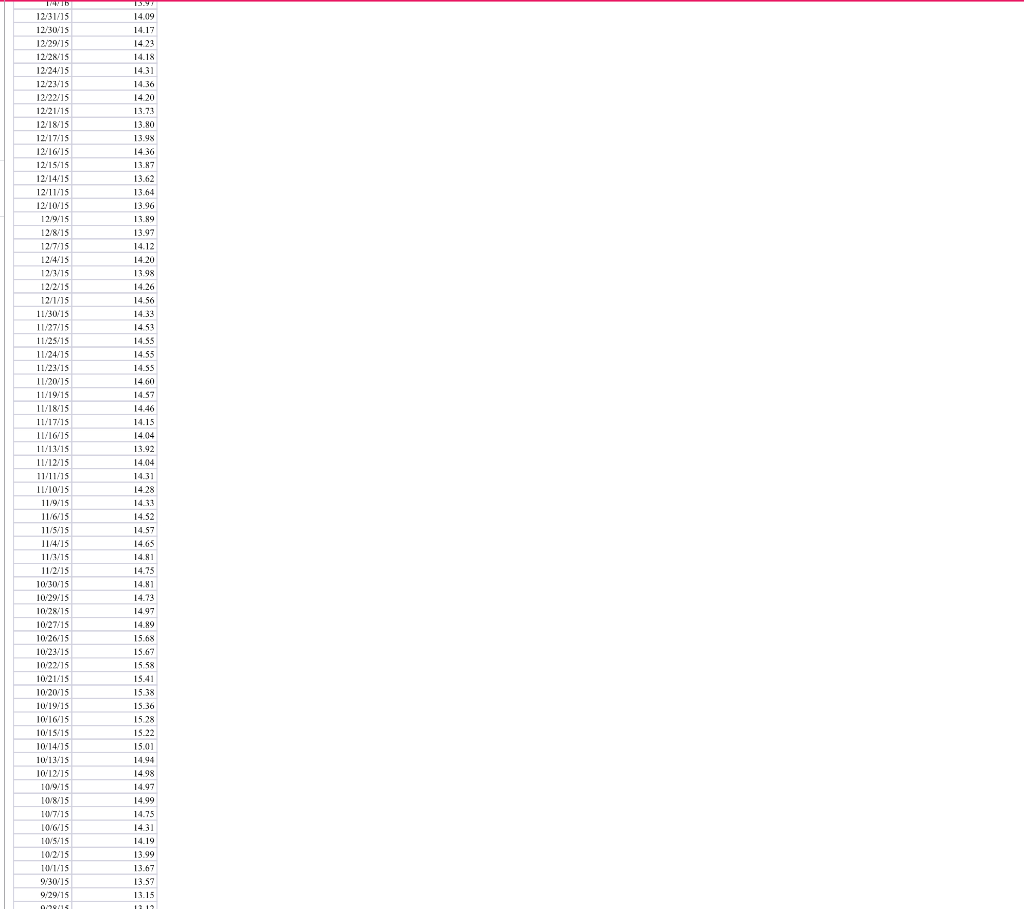

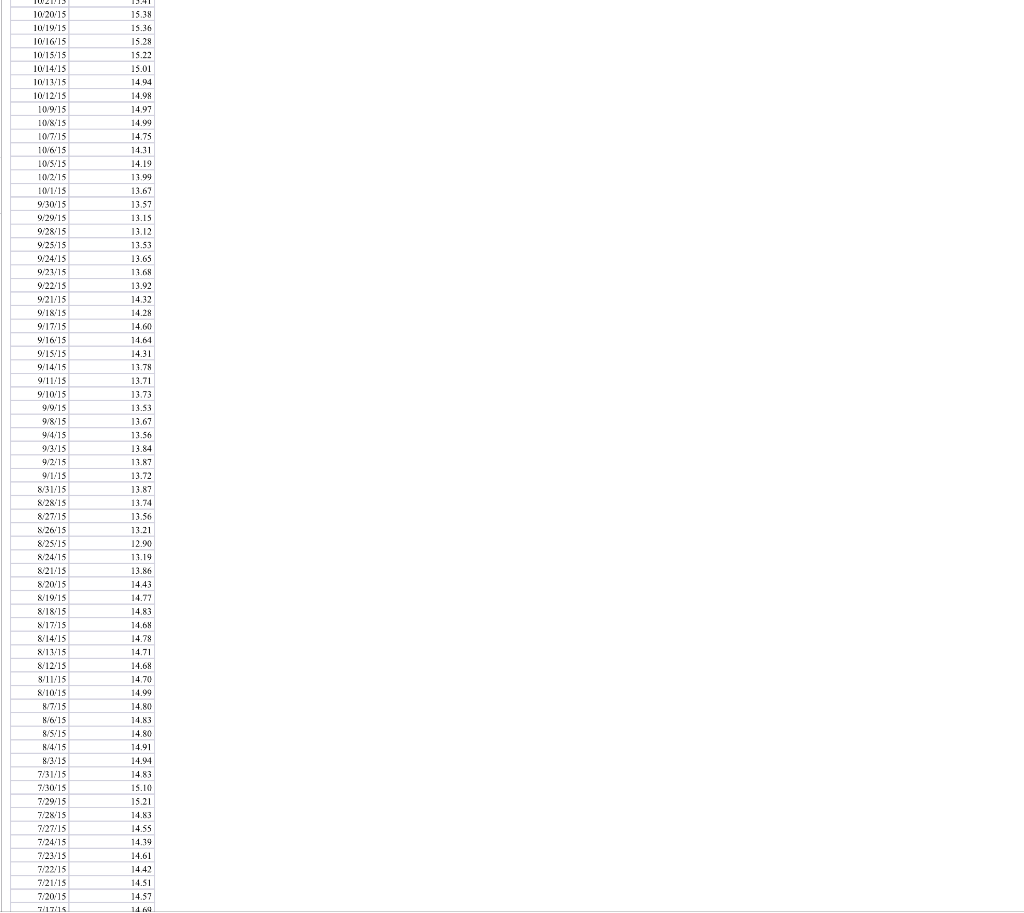

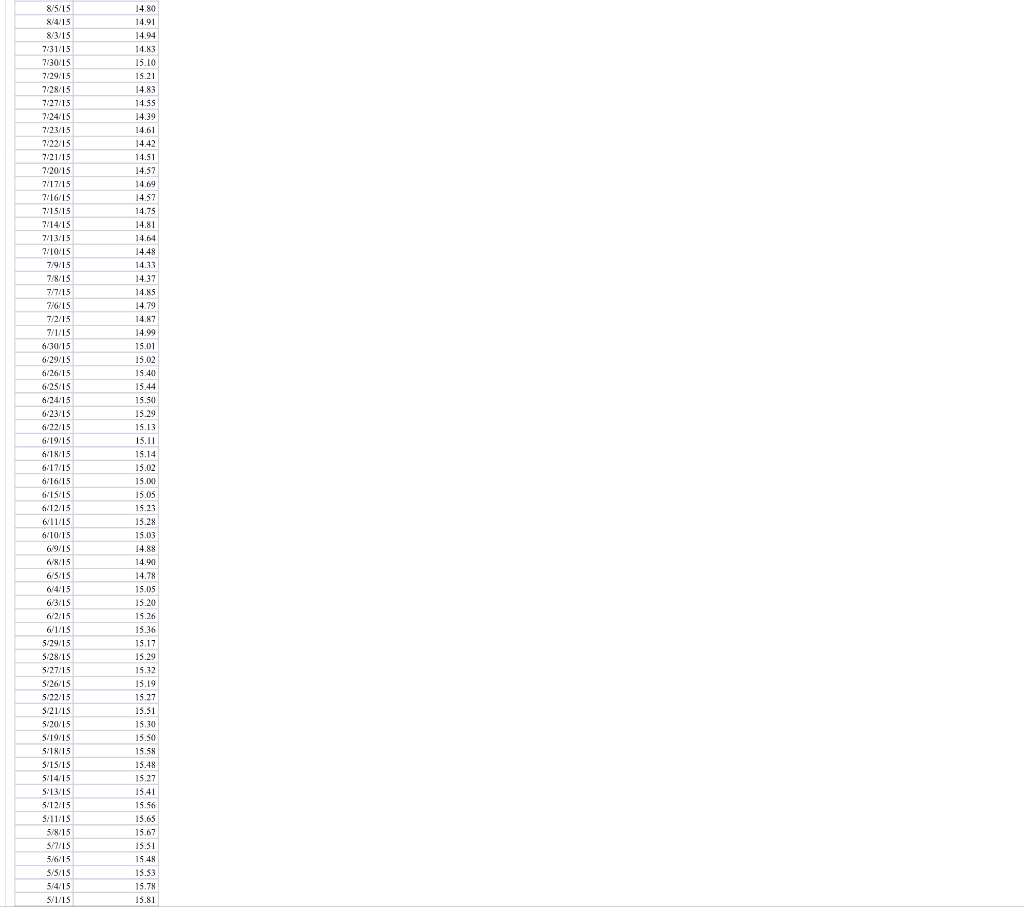

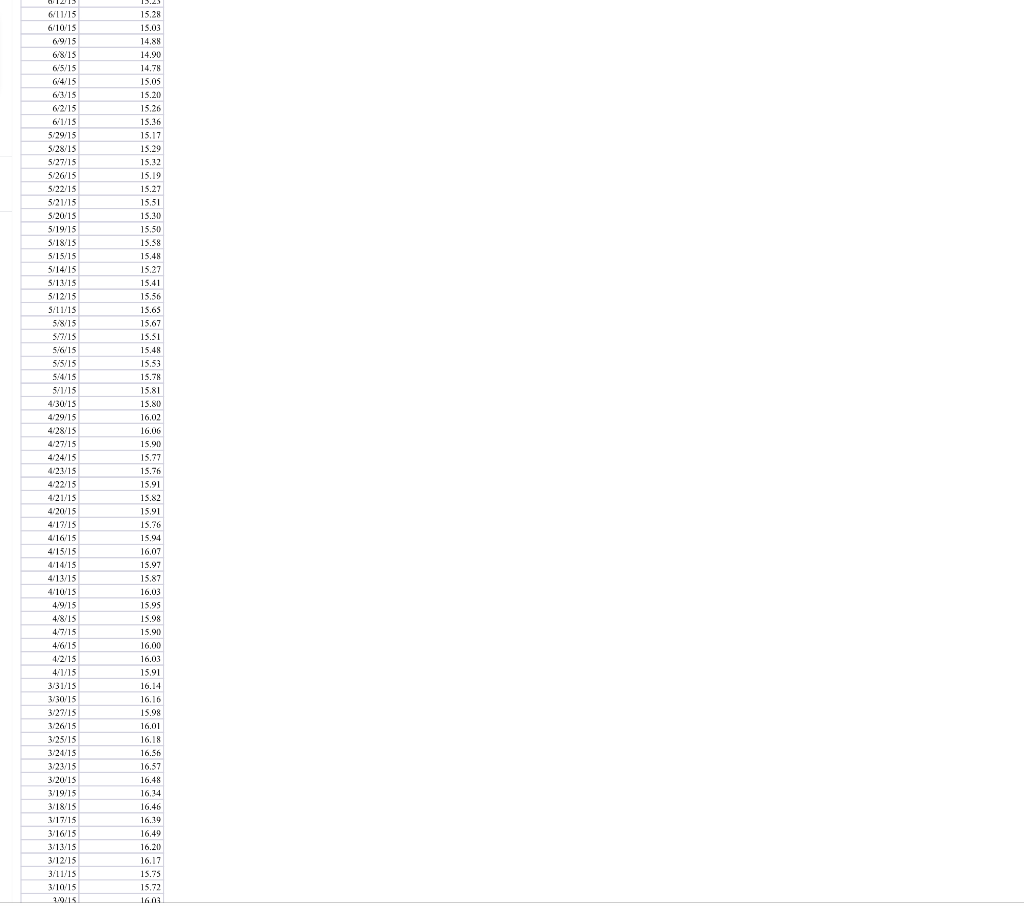

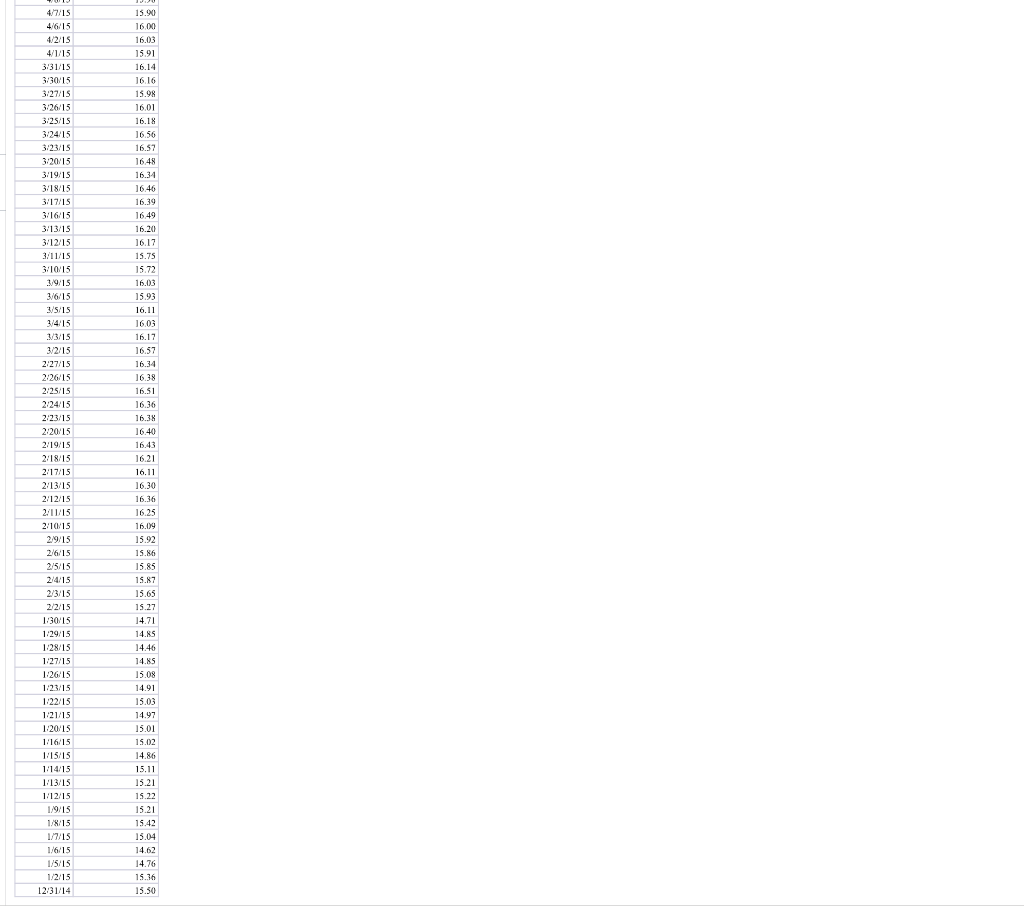

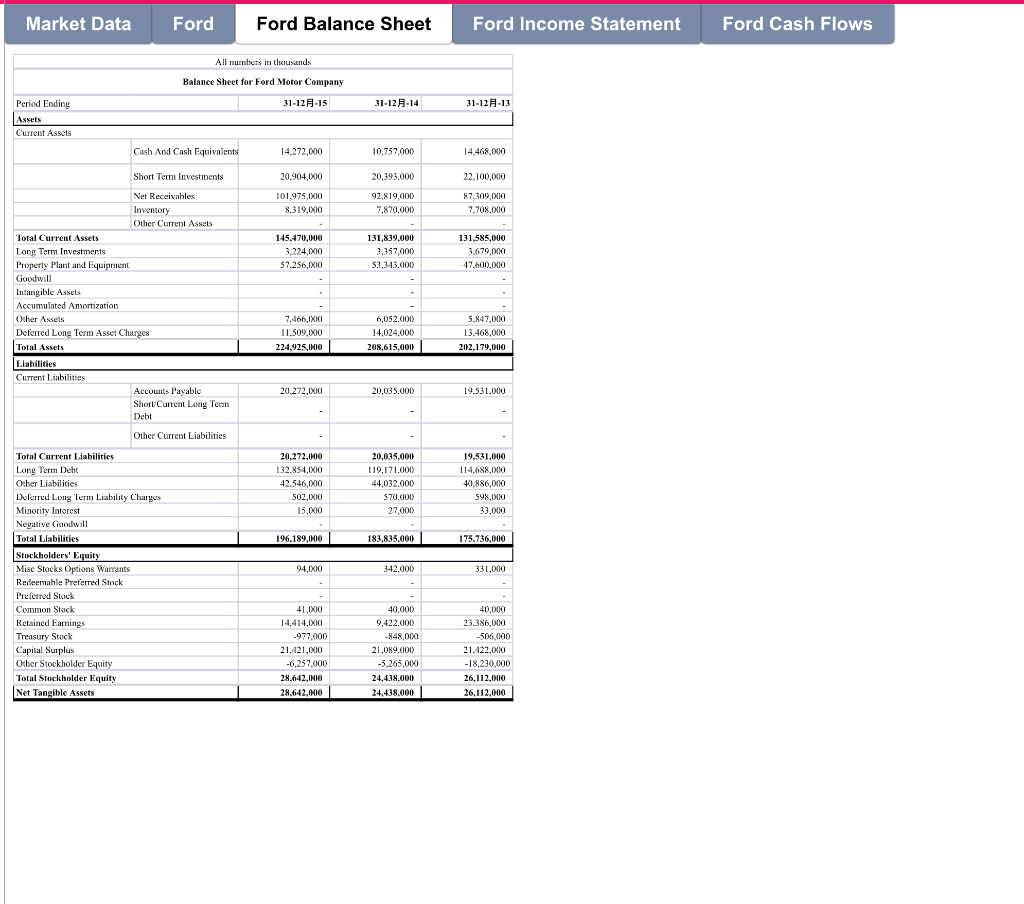

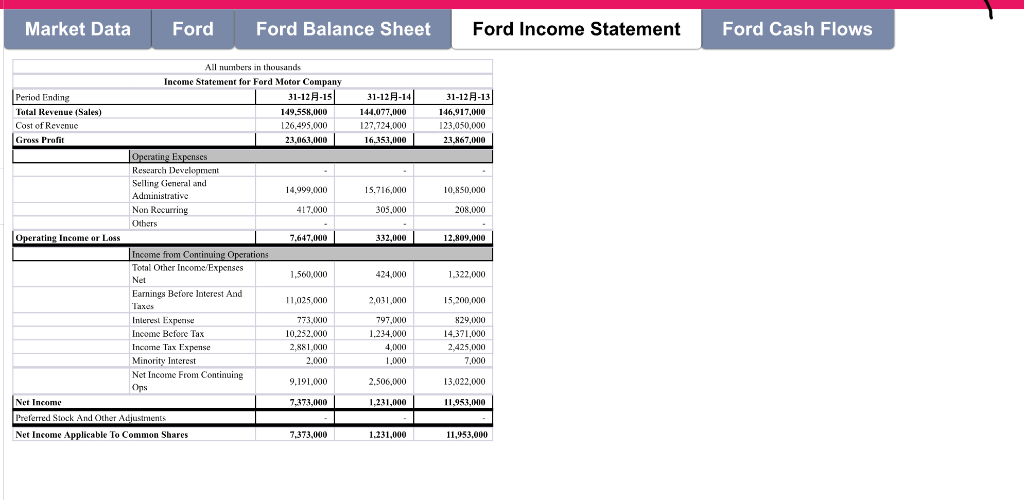

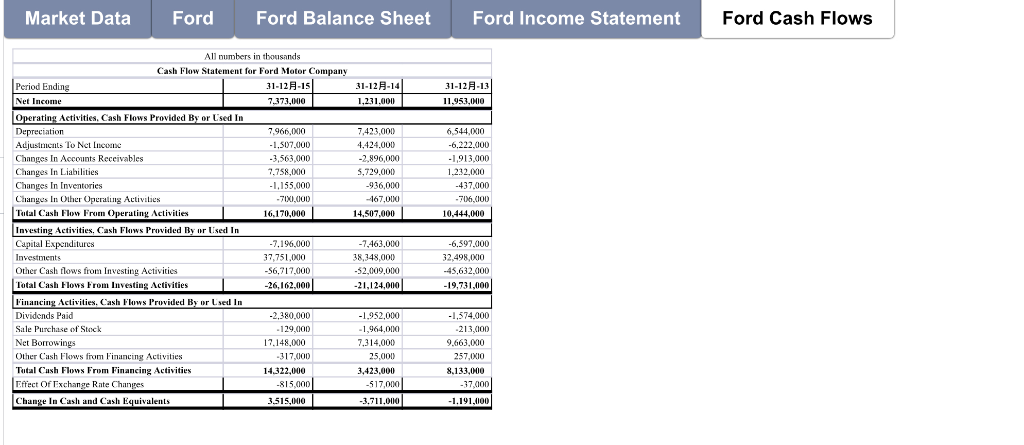

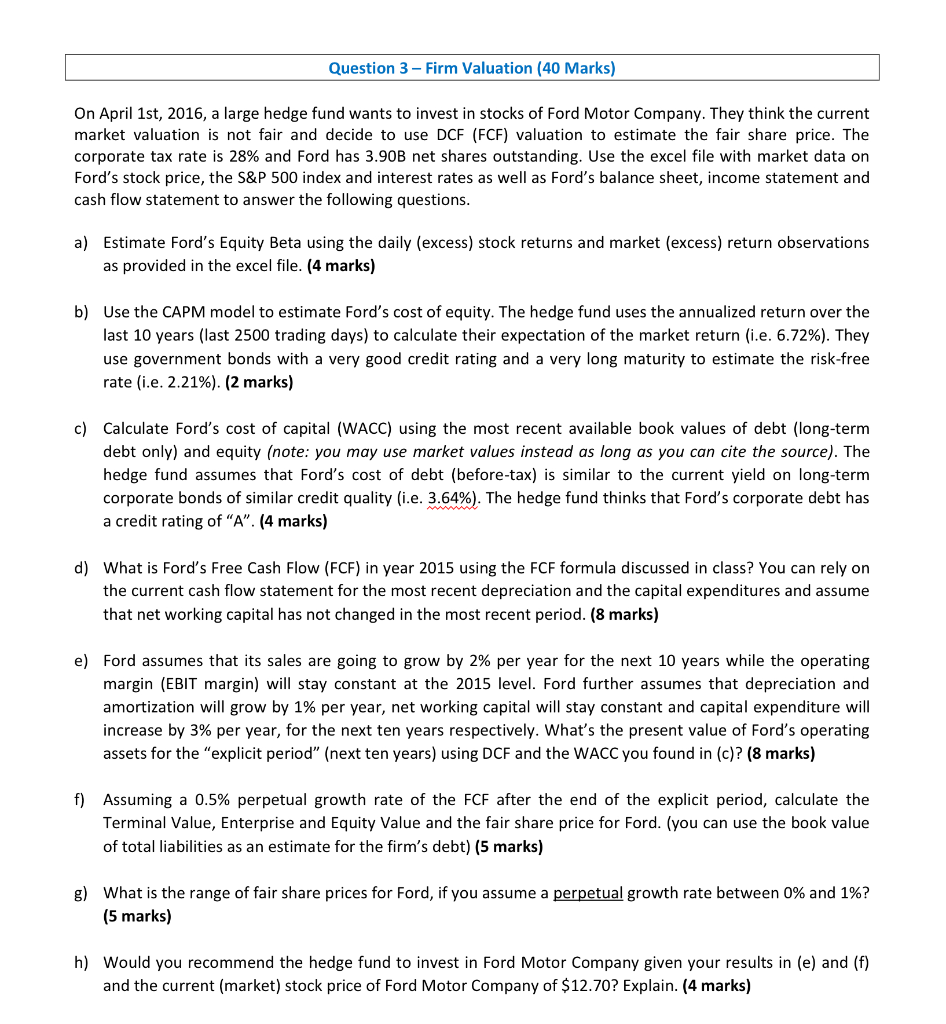

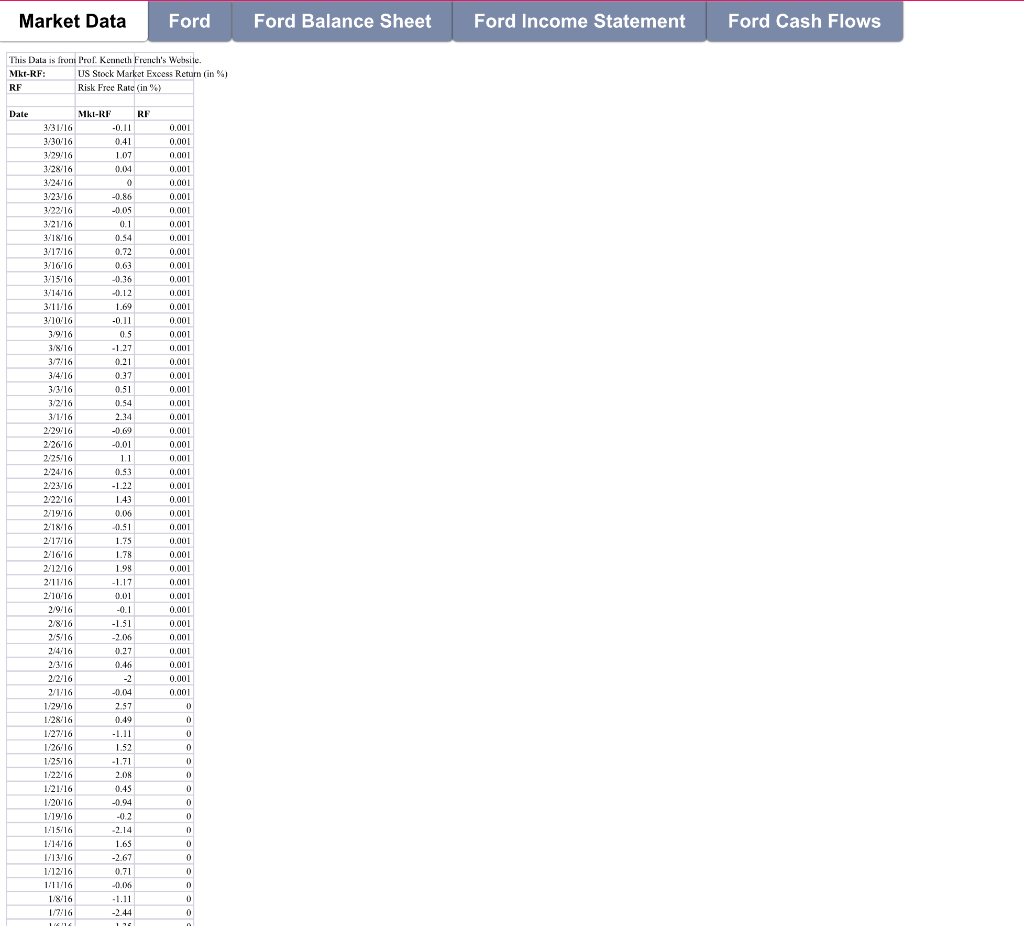

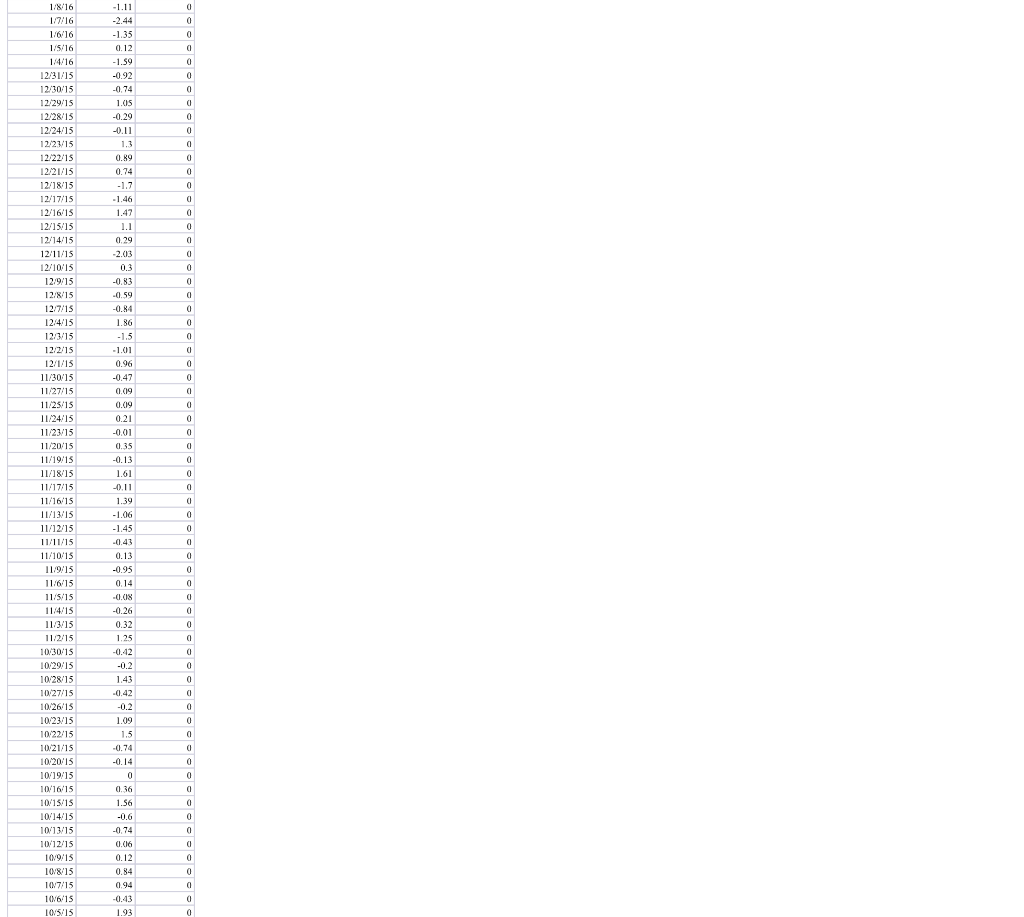

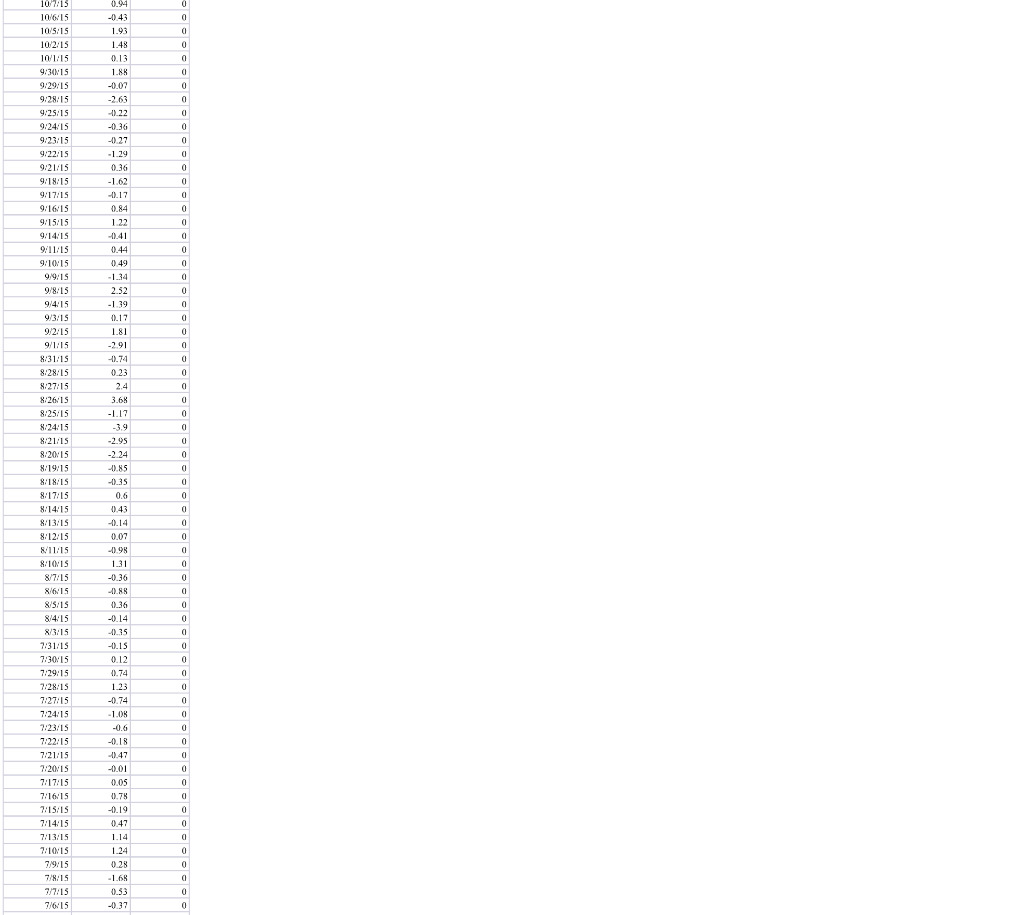

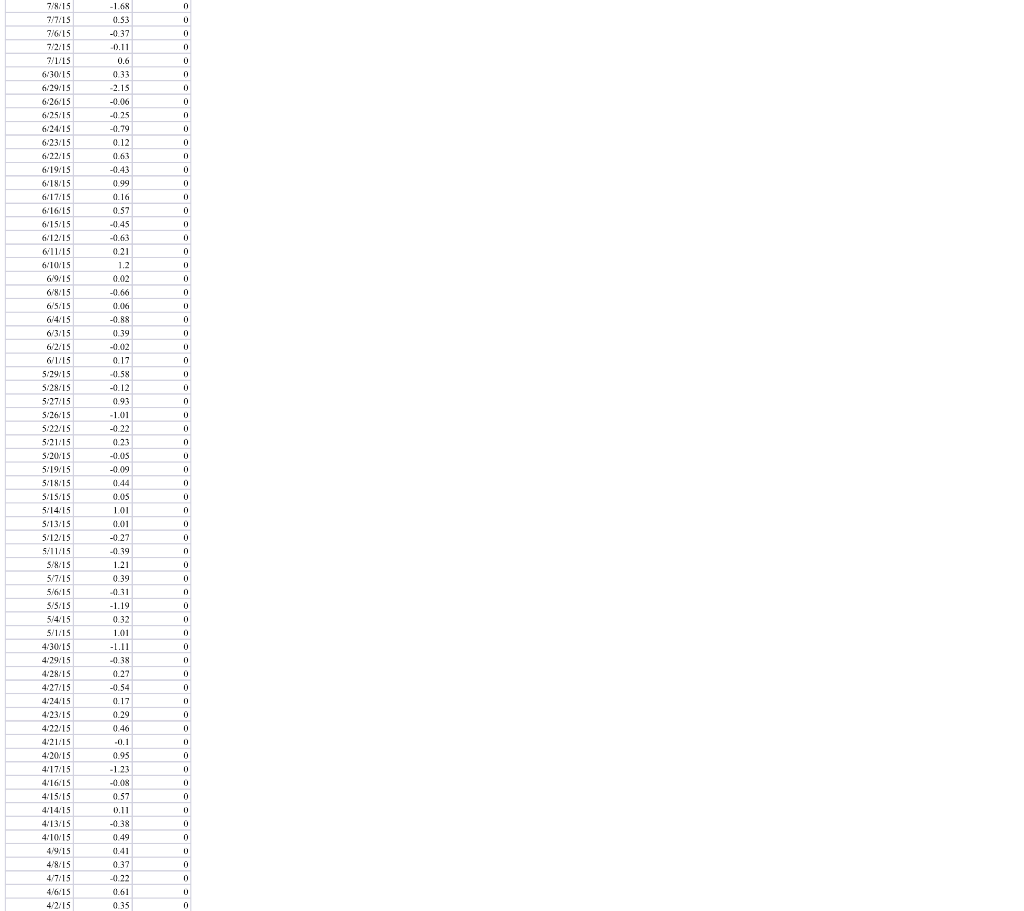

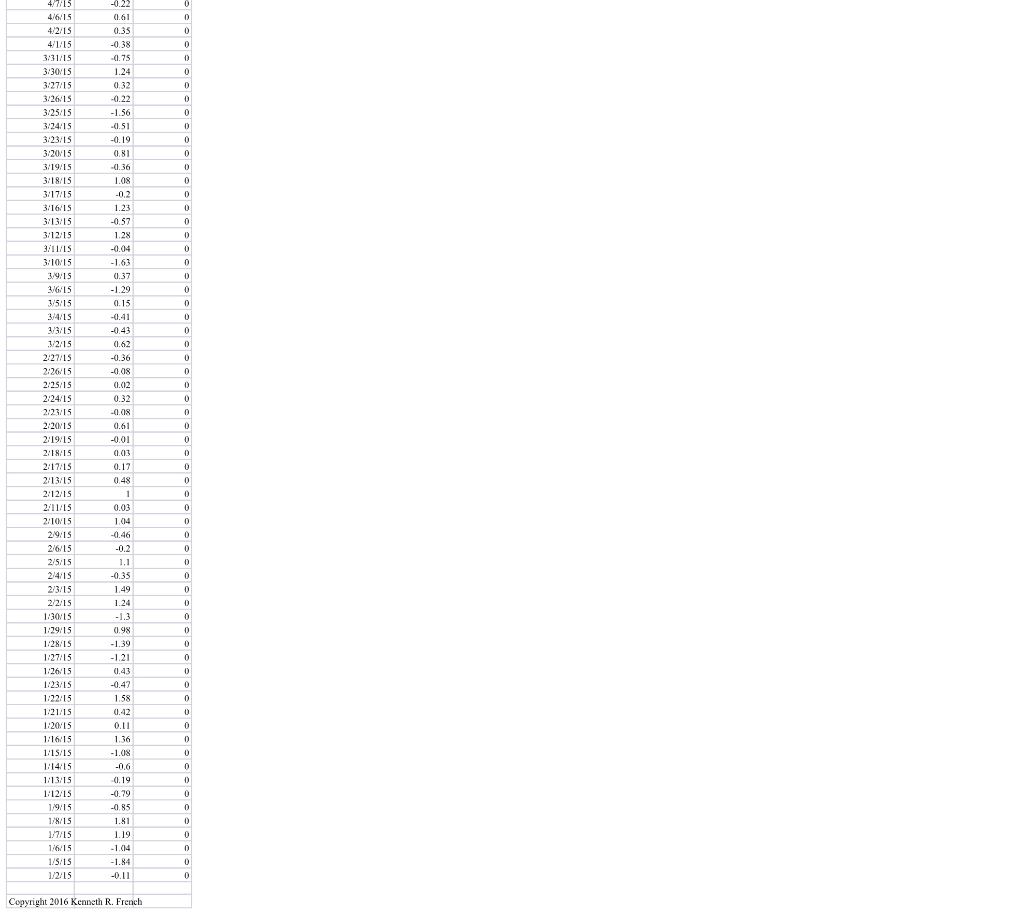

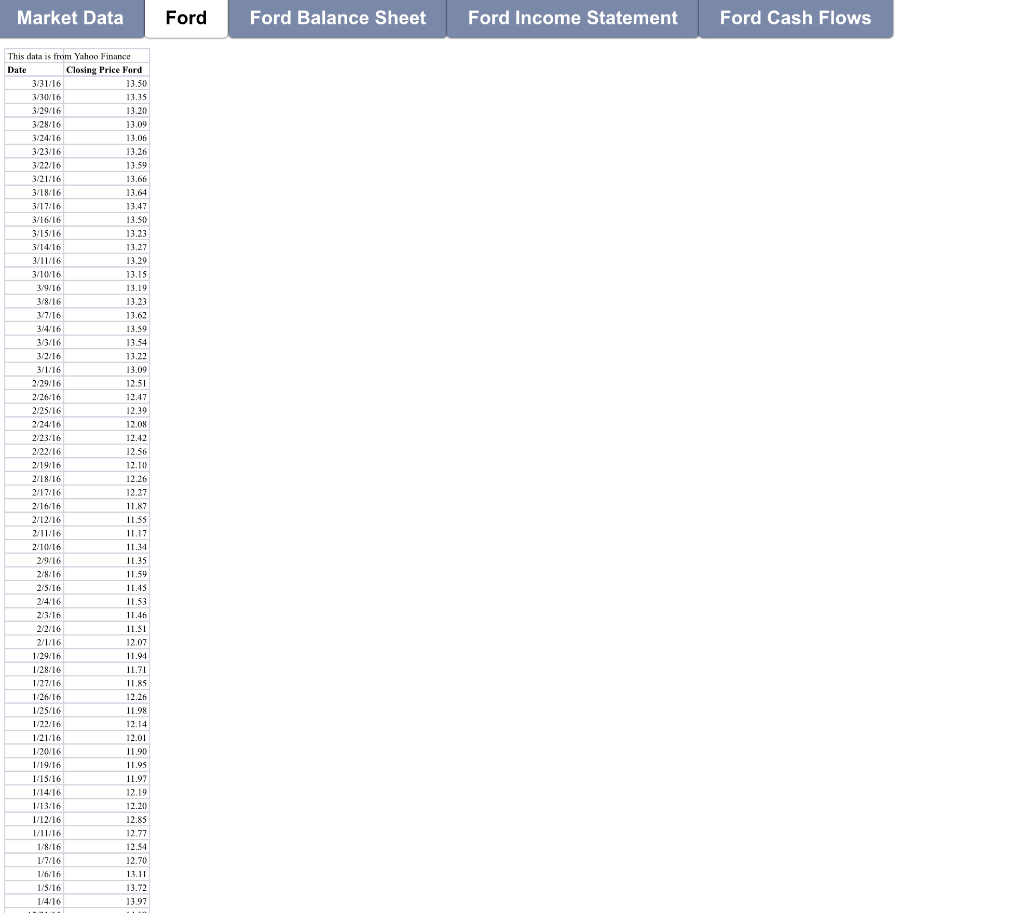

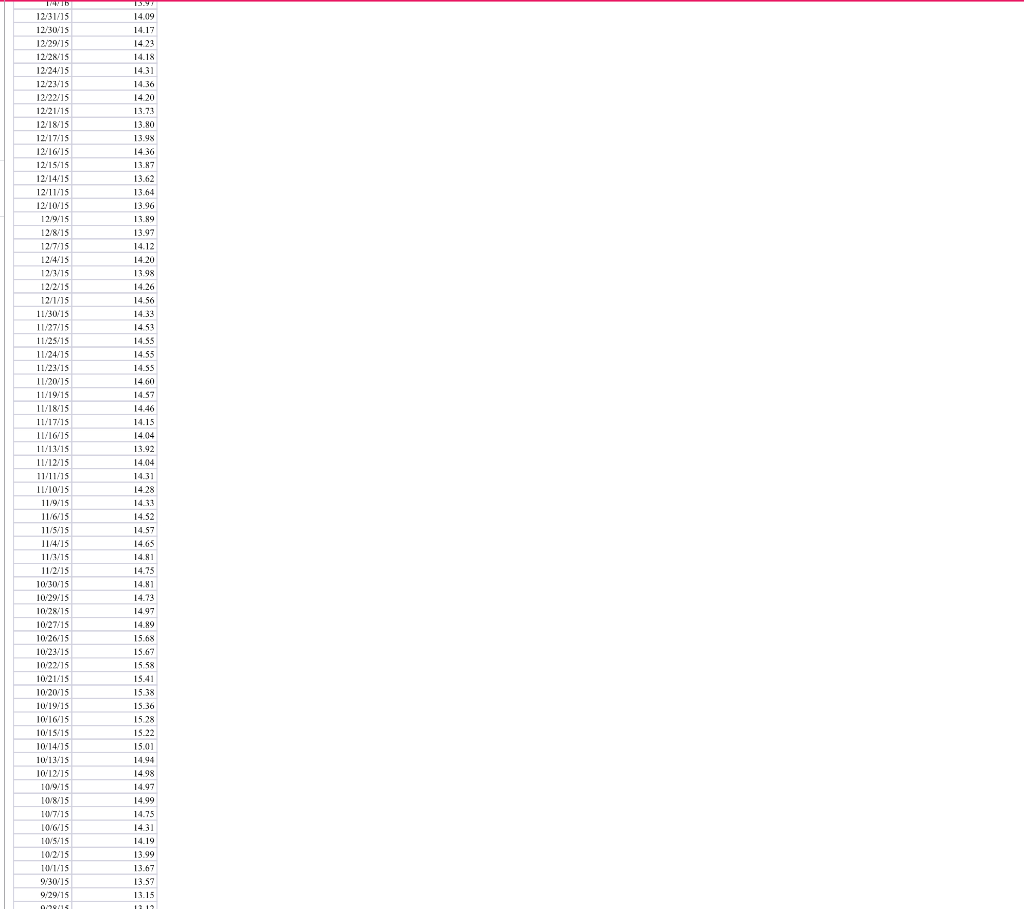

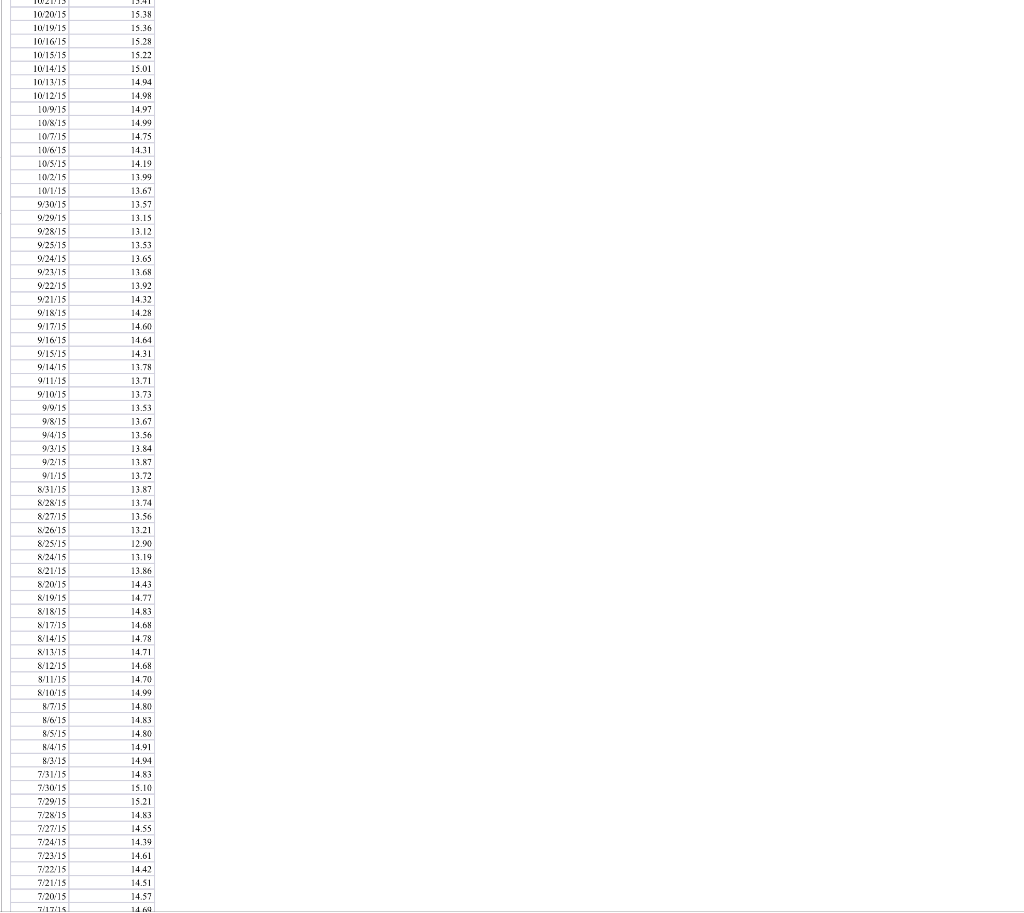

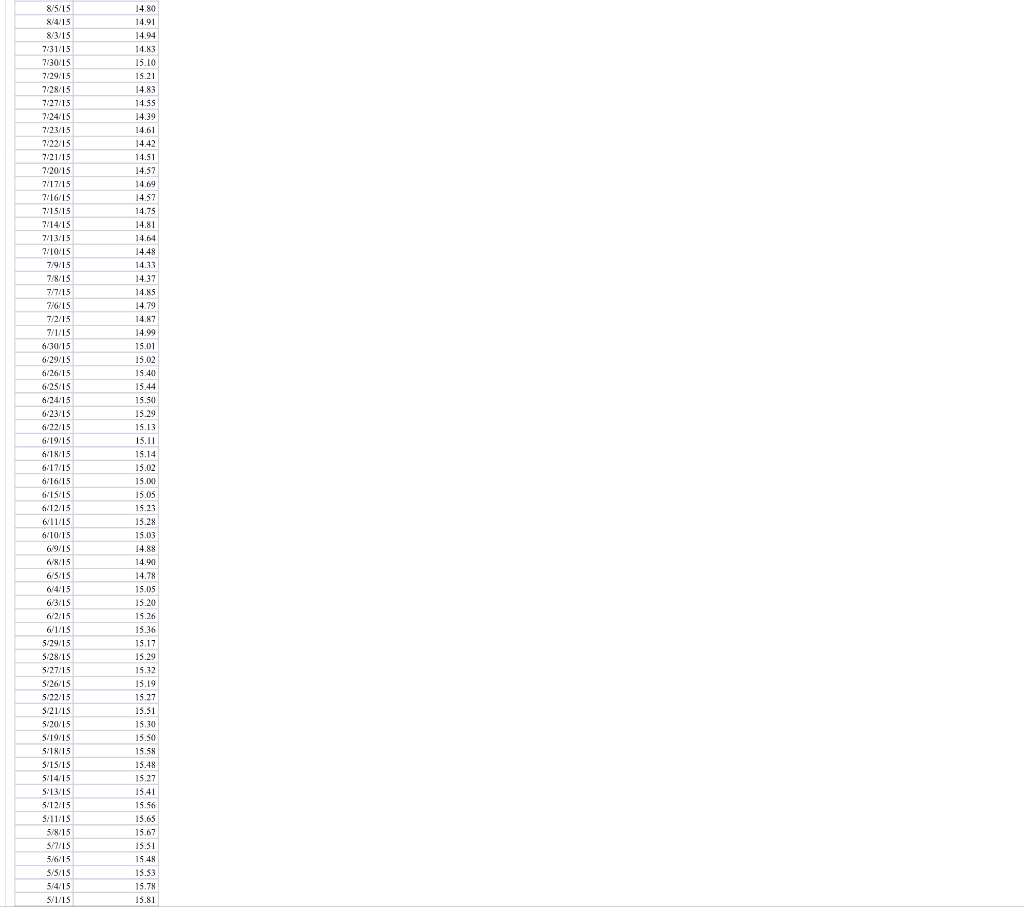

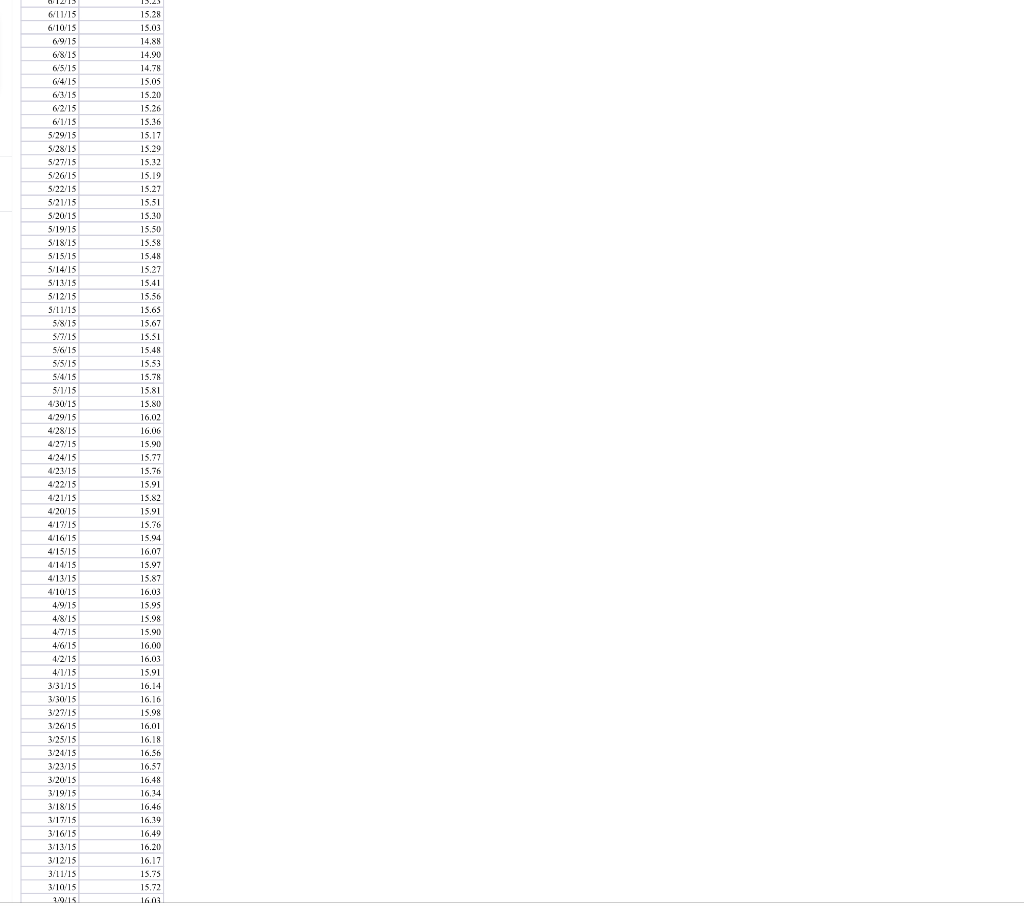

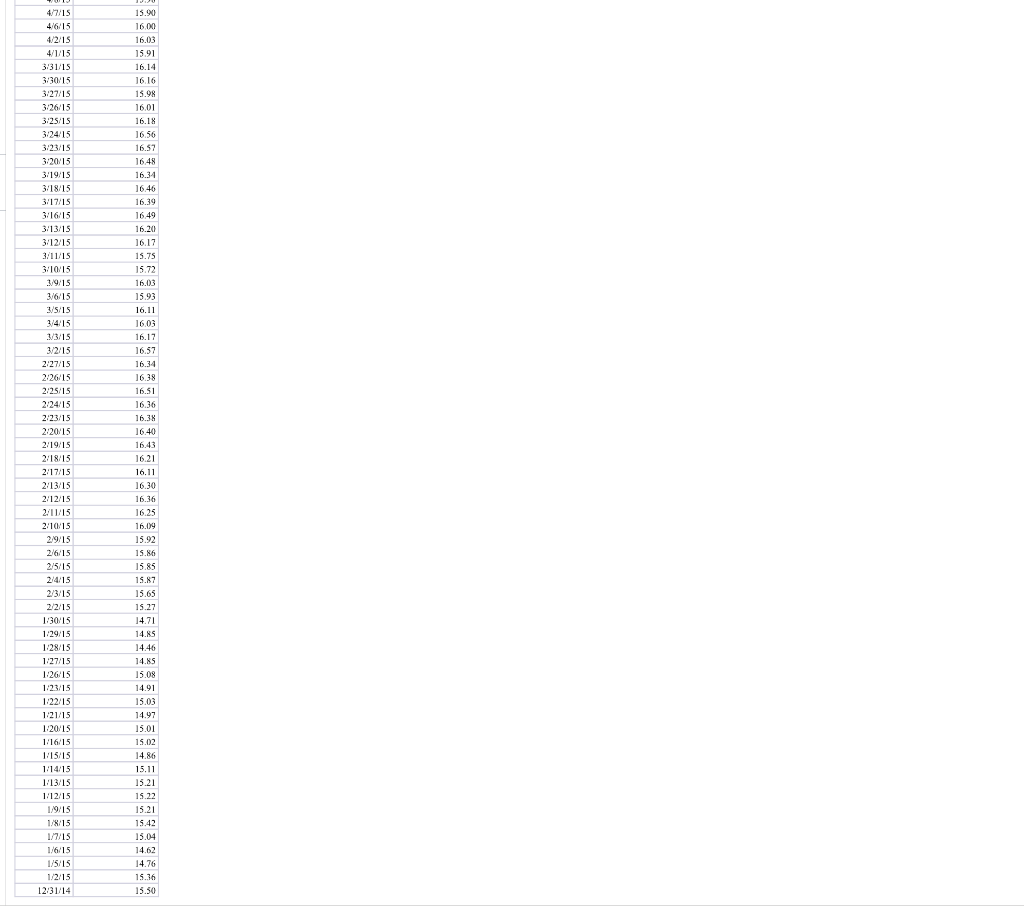

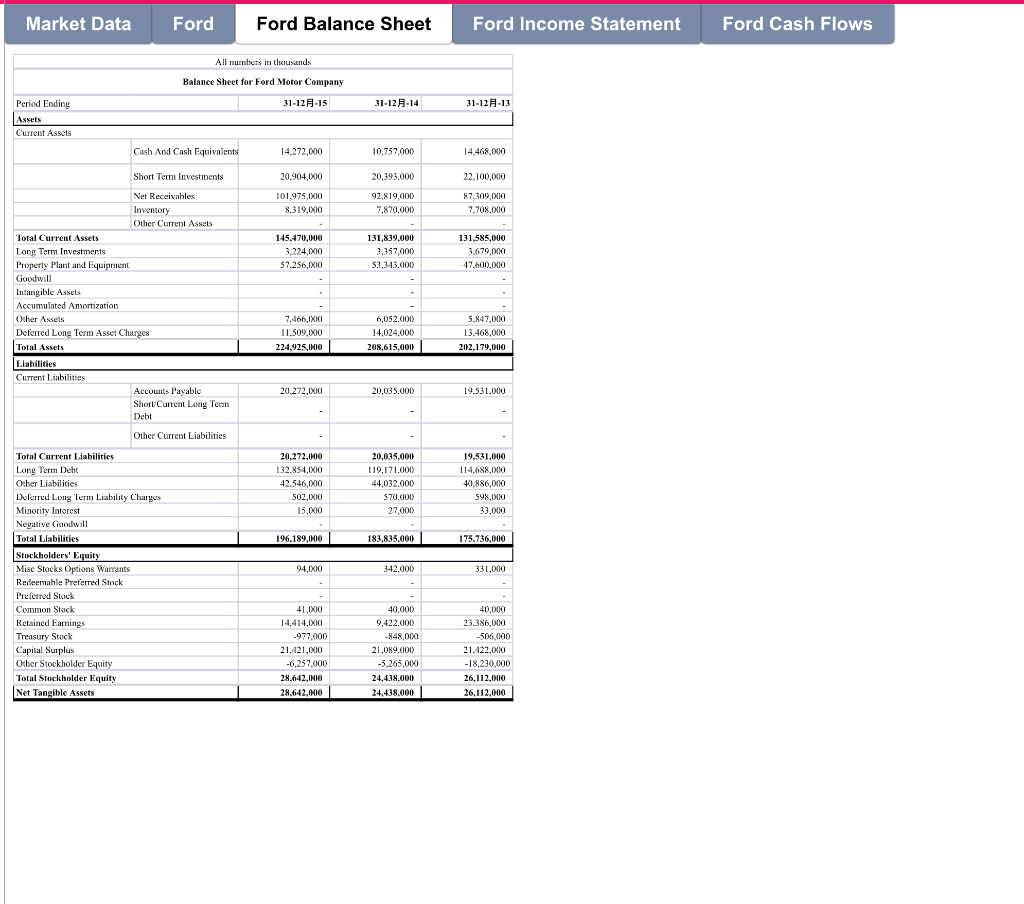

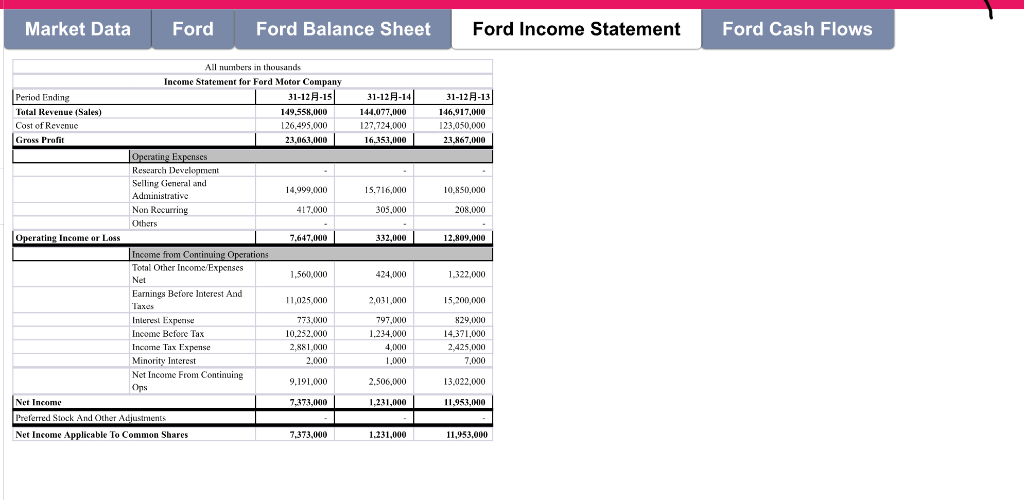

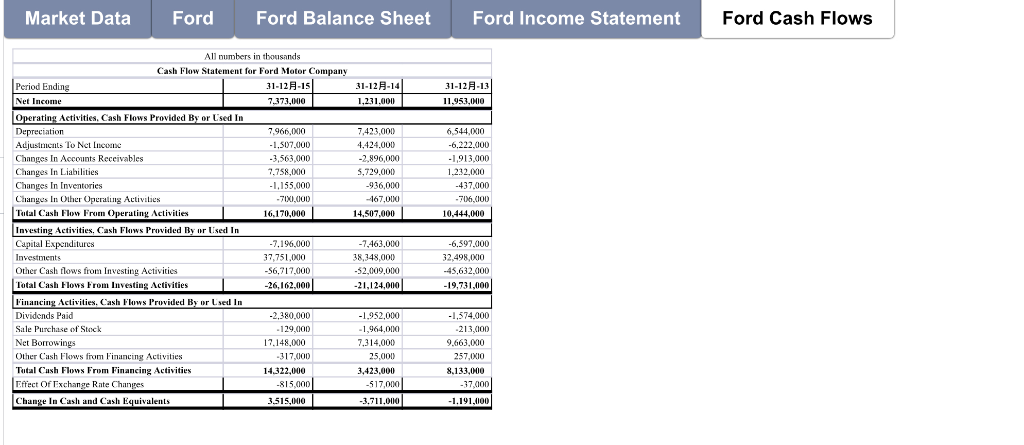

Question 3-Firm Valuation (40 Marks) On April 1st, 2016, a large hedge fund wants to invest in stocks of Ford Motor Company. They think the current market valuation is not fair and decide to use DCF (FCF) valuation to estimate the fair share price. The corporate tax rate is 28% and Ford has 3.90B net shares outstanding. Use the excel file with market data on Ford's stock price, the S&P 500 index and interest rates as well as Ford's balance sheet, income statement and cash flow statement to answer the following questions. a) Estimate Ford's Equity Beta using the daily (excess) stock returns and market (excess) return observations as provided in the excel file. (4 marks) b) Use the CAPM model to estimate Ford's cost of equity. The hedge fund uses the annualized return over the last 10 years (last 2500 trading days) to calculate their expectation of the market return (i.e. 6.72%). They use government bonds with a very good credit rating and a very long maturity to estimate the risk-free rate (i.e. 2.21%). (2 marks) c) Calculate Ford's cost of capital (WACC) using the most recent available book values of debt (long-term debt only) and equity (note: you may use market values instead as long as you can cite the source). The hedge fund assumes that Ford's cost of debt (before-tax) is similar to the current yield on long-term corporate bonds of similar credit quality (i.e. 3.64%). The hedge fund thinks that Ford's corporate debt has a credit rating of "A". (4 marks) d) What is Ford's Free Cash Flow (FCF) in year 2015 using the FCF formula discussed in class? You can rely on the current cash flow statement for the most recent depreciation and the capital expenditures and assume that net working capital has not changed in the most recent period. (8 marks) e) Ford assumes that its sales are going to grow by 2% per year for the next 10 years while the operating margin (EBIT margin) will stay constant at the 2015 level. Ford further assumes that depreciation and amortization will grow by 1% per year, net working capital will stay constant and capital expenditure will increase by 3% per year, for the next ten years respectively. What's the present value of Ford's operating assets for the "explicit period" (next ten years) using DCF and the WACC you found in (c)? (8 marks) f) Assuming a 0.5% perpetual growth rate of the FCF after the end of the explicit period, calculate the Terminal Value, Enterprise and Equity Value and the fair share price for Ford. (you can use the book value of total liabilities as an estimate for the firm's debt) (5 marks) g) What is the range of fair share prices for Ford, if you assume a perpetual growth rate between 0% and 1%? (5 marks) h) Would you recommend the hedge fund to invest in Ford Motor Company given your results in (e) and (f) and the current (market) stock price of Ford Motor Company of $12.70? Explain. (4 marks) Market Data Ford Ford Balance Sheet Ford Income Statement Ford Cash Flows This Dala is from Prof Kenneth French's Websile. Mkt-RF: US Stock Market Excess Returm (in % ) Risk Free Rate (in %) RE Mkt-RE .. 3/31/16 Date R 0 1 0.00 3/30/16 0.4 0.001 3/29/16 1.07 0.001 3/28/16 004 0.001 0 001 3/24/16 3/23/16 0.84 0,00 3/18/16 0,001 0.72 3/17/16 0.001 0.63 3/16/16 0,001 0.g01 3/15/16 )36 3/14/16 0.12 0,001 3/11/16 1.6 0.001 o 001 0 ' 3/9/16 1 27 3/16/ 0.001 3/7/16 3/4/16 0 21 0,001 0 001 0.3 3/3/16 0.51 0001 3/2/16 0,o 2/29/16 o 001 0 69 2/26/16 0.01 0.001 2/25/16 1.1 0.g01 224/16 043 0,001 2/23/16 1.22 0001 2/22/16 143 0.001 2/19/16 0.06 0.001 0.5 218/16 0.00 2/16/16 78 0001 2/12/16 95 000 1.17 0.001 o 001 211/16 2/10/16 0.0 2/9/16 0 0.00 2/8/16 1.5 0.001 o 001 7/4/16 17 2/3/16 46 0,001 2/2/16 -2 0001 0. 04 2/1/16 0.001 7 57 1/29/16 1/28/16 0.4 L26/16 1 7 1/25/16 2 08 122/16 0 121/16 041 L20/16 094 1/19/16 -0.2 13/16 2.67 0 /12/16 0.71 1/11/16 ) 06 1/8/16 1.11 1/16 2.44 0 18/16 -1.11 1/7/16 -2.44 1 SS 1:4/16 12/31/15 0.92 0 0 74 12/30/15 0 12/29/15 10 12/28/15 0.29 0 0.1 Sli+771 12/22/15 0 89 12/21/15 0,74 0 12/18/15 0 1 46 12/17/15 12/16/15 1.47 0 12/15/15 12/11/15 203 12/10/15 0.3 0 0 82 12/9/15 0 12/8/15 0 5 C 0.8 12/7/15 124/15 1.8 12/2/15 1.01 12/1/15 0.90 0 11/30/15 041 0 11/27/15 009 11/25/15 0,09 1/24/15 0.21 11/20/15 0.35 11/19/15 0.13 0 1/18/15 161 0 0.11 11/17/15 0 1 3s 11/16/15 W13/15 L0c 11/12/15 1.4: 0 119/15 095 116/15 0.14 0 11/5/15 11/4/15 0,26 113/15 0.32 0 10/29/15 -02 0 10/28/15 1.43 0 0 47 10/27/15 10/26/15 10/23/15 1.09 0 10/22/15 0 14 10/20/15 0 10/19/15 0 10/16/15 36 1 56 10/15/15 10/14/15 0 109/15 0.12 10/8/15 0.84 0 0 94 10/7/15 0 0 43 106/15 0. 10/5/15 1.93 10/7/15 0.94 1 93 10/5:15 10/2:15 1.48 0 .13 10/1:15 0 1 88 9:3015 9:2915 -0,07 9:28:15 -2.63 36 9:2415 923/15 027 0 9/22/15 1.29 36 9:21/15 0 91815 -1.62 917/15 .I 915/15 9:14:15 41 0 91115 0 44 0 9:1015 0 9/915 -1.34 9/315 017 181 9/2/15 0 9/115 -2.91 0 8:3115 0.74 8:28/15 0.23 8:25:15 -L.17 8:24:15 3.5 0 8/21/15 295 8:2015 -2.24 0 8:19:15 8/18/15 0.35 8:17:15 0.0 8:13/15 14 0.07 812/15 0 0.98 8/11/15 0 1 31 8:10:15 0 8/7:15 -0.36 8/6/15 .88 8/415 14 .35 8/3:15 0 7:3115 0 7:3015 o12 0 7:2915 ).74 0 2613 23 7/24:15 1 08 7:23/15 -0 6 0 7:22:15 018 0 7/21/15 ) 47 0.01 7:20/15 0.02 7:1515 019 7:14:15 47 0 I14 7:13/15 0 1 24 710:15 0 7/915 0.28 7/715 037 7/615 0 7/8:15 -1.68 7/7/15 .53 0 11 7/215 7/1/15 06 133 63015 6/29/15 15 626/15 6/25/15 25 623/15 12 063 6/22/15 6/19/15 043 6:18/15 0 16 6/1715 1613 6/12/15 063 021 6/11/15 6/1015 1.2 691S 0.07 6/8/15 0.66 GA15 6/3/15 39 6/2/15 6/1/15 017 0 S:29/15 58 5:28/15 ,12 S:26/15 5:22/15 22 1.23 5:21/15 5:20/15 5:1915 0.09 5:1815 44 5:15/15 S13/15 512/15 22 5/11/15 39 1 21 5/8/15 5/715 0 39 5/615 0.31 5/4:15 5/1/1' L01 4:3015 4:29/15 35 4:28/15 0 27 42715 .54 4:23/15 29 4:22/15 146 0.1 421/15 4:2015 095 0 1 21 4:17:15 11 4:1415 4:13/15 38 4:1015 4/9/15 41 4/8/15 0 3: 4/2/15 35 4/2/15 0 3 4/1/15 38 0 7 331/15 0 1 24 3/30/15 0 32 3/27/15 3/26/15 l.22 3/24/15 05 3:23/15 0 3/20/15 0.8 0 3:19/15 136 3:18/15 1.08 0 57 3:13/15 0 3/12/15 1.28 3/11/15 0 04 3/10/15 1.63 0 3/9/15 (.37 1/5/15 12 3/4/15 041 3/315 043 0 3/2/15 0 62 0 36 227/15 226/15 0.08 2:2415 0 37 o 2/23/15 0 08 0 2:20/15 0 61 2'1915 001 0 2:18/15 0.01 217/15 0,17 213/15 48 0 03 1 (04 21015 29/15 .46 0 2/6/15 0.2 0 2/5/15 1.1 0 35 2/4/15 2/2/15 24 3015 0 1:2915 1.98 1:28/15 0 1:2715 1.2 0 126/15 ().43 1:22/15 I58 0 ) 47 1:21/15 011 12015 0 1:16/15 36 1 08 1/15/15 12/15 1915 0.85 0 1 81 1/8/15 0 1/7/15 1/6/15 1.04 0 1/24 Copyright 2016 Kenneth R. French 12/31/15 14(09 12/30/15 14.17 12/29/15 14.23 12/28/15 14.18 1224/15 14.31 12/23/15 14.36 1701 13 73 12/18/15 13.80 13.98 12/17/15 12/16/15 14.36 12/15/15 13.87 12/14/15 12/10/15 13.96 13.89 12/9/15 12/8/15 13 97 12/7/15 14.12 12/4/15 14.20 12/2/15 14.26 12/1/15 14.56 11/30/15 14.33 11/27/15 14.53 11/25/15 14.55 215 1/20/15 14 60 11/19/15 14.57 11/18/15 14.46 11/17/15 14.15 1/16/15 14.04 1/12/15 14.04 1/10/15 14.28 14.33 11/9/15 11/6/15 14.52 14.57 11/5/15 1/4/15 14.65 11/2/15 1475 10/30/15 14.8 10/29/15 14.73 10/28/15 14.97 10/27/15 14.89 IS67 15.58 10/22/15 10/21/15 15.41 10/20/15 15.38 10/19/15 15.36 10/16/15 15.28 10/14/15 15.01 10/13/15 14.94 10/12/15 14.98 10/9/15 14.97 0/8/15 14.99 1431 15/15 14.19 10/2/15 13.99 1/15 13.67 9/30/15 13.57 9/29/15 13.15 10/20/15 15.38 10/19/15 15.36 10/16/15 15.28 10/15/15 15.22 10/14/15 15.01 14 08 14.97 10/9/15 18/15 14.99 14.75 L0/7/15 106/15 14.31 0/5/15 14.19 10/1/15 13.67 13.57 9/30/15 9/29/15 13.15 9/28/15 13.12 13.53 9/25/15 13.03 2/15 13.92 9/22/15 14.32 9/21/15 9/18/15 14.28 9/17/15 14.60 14.64 9/16/15 13 7 9/14/15 9/11/15 13.71 13.73 9/10/15 9/9/15 13.53 9/8/15 13.67 9/415 13.56 13.87 9/2/15 13.87 8/31/15 15'28 13.74 13.56 8/27/15 8/26/15 13.21 8/25/15 12.90 821/15 13.86 14.43 8/20/15 8/19/15 14.77 8/18/15 14.83 8/17/15 14.68 4. 8/12/15 14.68 14.70 8/1/15 8/10/15 14.99 8/7/15 14.80 8/6/15 14.83 1491 R/4/15 8/3/15 14.94 7/31/15 14.83 7/30/15 15.10 7/29/15 15.21 12 S 14.83 14 39 7/24/15 7/23/15 14.61 7/22/15 14.42 14.51 7/21/15 7/20/15 14.57 T/17/15. 14 6 8/5/15 14.80 8/4/15 14.91 8/3/15 14.94 7/30/15 15.10 7:29/15 15.21 7/28/15 14.83 7/27/15 14.55 724/15 14.39 2/2245 7/21/15 14.51 720/15 14 57 7/17/15 14.69 716/15 14.57 14.75 713/15 14.64 710/15 14.48 7/9/15 14.33 7/8/15 14.37 7/7/15 14.85 7/2/15 14 93 7/1/15 14.99 6/3015 15.01 6/29/15 15.02 6/26/15 15.40 15 5/ 623/15 15.29 6/22/15 15.13 619/15 15.11 6/18/15 15.14 617/15 15.02 6/16/15 15.00 6/11/15 15.28 15.03 6/10/15 6/9/15 14.88 14.90 6/8/15 6/5/15 14.78 6/3/15 15 20 6/2/15 15.26 6/1/15 15.36 5:29/15 15.17 5/28/1S 15.29 S3615 15 19 5/22/15 15.27 521/15 15.51 5/20/15 15.30 519/15 15.50 5:18/15 . 5/14/15 15.27 513/15 15.4 5/12/15 15.56 /11/15 15.65 15.67 5/8/15 5/6/15 15 18 5/5/15 15.53 5/4/15 15.78 5/1/15 15.81 611/15 15.28 6/10/15 15.03 69/15 14.88 68/15 14.90 6/5/15 14.78 15 20 63/15 6/2/15 15.26 61/15 15.36 5/29/15 15.17 5/28/15 15.29 5/26/15 5/22/15 15.27 5/21/15 15.51 5/20/15 15.30 5/19/15 15.50 15/16 514/15 15.27 5/13/15 15.41 512/15 15.56 S/11/15 15.65 515/ 15.67 5/6/15 15 48 5/5/15 15.53 5/4/15 15.78 5/1/15 15.8 4/30/15 15.80 428/15 15.90 4/27/15 4/24/15 15.77 4/23/15 5.76 4/22/15 15.91 4/21/15 15.82 4/20/15 15.9 4/16/15 15 94 4/15/15 16.07 4/14/15 15.97 4/13/15 15.87 4/10/15 16.03 48/15 5.09 47/15 15.90 4/6/15 16.00 4/2/15 16.03 4/1/15 15.9 3/30/15 ... 3/27/15 15.98 3/26/15 16.01 3/25/15 1618 3/24/15 16,56 3/19/15 16.14 3/18/15 6 46 3/17/15 16 39 3/16/15 16.49 16.2 3/11/15 15.75 3/10/15 15.72 3015 1603 4/7/15 15.90 4/6/15 16.00 4/2/15 16.03 4/1/15 15.91 16.14 327/15 15.98 16.01 3/26/15 3:25/15 16.18 3/24/15 16.56 3/23/15 16.57 3/19/15 16.34 3/18/15 1646 16.39 3/17/15 3/16/15 1649 16.20 3:13/15 3/10/15 15.72 3/9/15 16.03 3/6/15 15.93 3/5/15 16.11 16.03 3/4/15 3/2/15 16.57 16.34 227/15 2/26/15 16.38 2/25/15 16.51 2/24/15 16.36 2015 16.43 2/19/15 218/15 16.21 217/15 16.11 2/13/15 16.30 16.36 2/12/15 2/11/15 16.25 2 16 03 2/6/15 15.86 2/5/15 15.85 2/4/15 15.87 2/3/15 15.65 15.27 2/2/13 1/29/15 14.85 1:28/15 14.46 127/15 14.85 126/15 15.08 14.9 1:23/15 1/21/15 14 47 1-20/15 15.01 15.02 16/15 15/15 14 86 1:14/15 15.11 1/9/15 15.21 1/8/15 15.42 1/7/15 15.04 1/6/15 14.62 1/5/15 14.76 12/31/14 15.50 Ford Income Statement Ford Cash Flows Market Data Ford Ford Balance Sheet All numbers in thousands Balance Sheet for Ford Motor Company 31-12-15 31-12 A-14 31-12 A-13 Period Ending Assets Current Assets Cash And Cash Equivalents 14,272,000 10,757,000 14,468,000 Short Term Investments 22.100,000 20.393,000 20,904,000 Net Receivahles. 101,975,000 92,819,000 87.309.000 8.319,000 7,870.000 7,708,000 Other Current Assets 131,585,000 131,839,000 Total Current Assets 145.470,000 Long Term Investments 3,224,000 3,357,000 3679.000 Property Plant and Equipment 47,600,000 57,256,000 5 343 000 Goodwill Intangible Assets . Amortization 7,466.000 Otber Assets 6,052.000) 5.847,000 Deferred Long Term Asset Charges Total Assets 11.509,000 14.024,000 13.468,000 224.925.JM00 208.615.000 202.179.000 Liabilities Current Liabilities Accounts Payable 20.272.000 20,035.000 19.531,000 Current Long Term Other Current Liabilities Total Current Liabilities 20,272,000 20,035,000 19,531,000 Long Term Debt 132.854.000 119.171 000 114 688 000 4 546 000 Other Liabilities 44,032,000 40,886,000 Deferred Long Term Liability Charges s711 101 502.000 598,000 Minority Interest 15,000 27,000 33.000 Total Liabilities 196.189.000 183.835.000 175.736.000 Stockholders' Equity 04 000 Mise Stocks Options Warrants 342.000 331,000 Redeemahle Preferred Stock Preferred Stock 40 000 41.000 Common Stock 40.000 Retained Eamings 9,6 14 240017 00 21.421,000 21.422.000 Capital Suplus 21.089,000 Otber Stockholder Equity -6.257.000 -5,265,000 -18.230,000 Total Stockholder Equity 28.642.000 24,438.000 26.112.000 Net Tangible Assets 24.438.000 28.642.000 26.112.000 Ford Balance Sheet Market Data Ford Ford Income Statement Ford Cash Flows All numbers in thousands Income Statement for Ford Mote tor Company Period Ending 31-12A-14 31-12A-13 Tatal Revenue (Sales) 149.558.000 144,077,000 146.917.000 126.495.000 Cost of Revenue 127,724,000 123.050.000 Gross Profit 23.063.000 16.353.000 23.867.000 Operating Expenses Research Development Selling ieneral and 14,999.000 15.716,000 10,850,000 Administrative ecurring 417,000 305.000 208.000 Others 33 000 Operating Income or Loss 7.647,000 12.809.000 Income from Continuing Operations Total Other Income/Expenses 1.560.000 424.000 1,322,000 Net Earnings Before Interest And 11.025.000 2031 000 15,200,000 es 829,000 Exnense 773,000 797I0 Income Before Tax 10.252.000 1.234.000 14.371,000 2.425.000 2,881,00 Incame Tax Expense 4 000 Minority Interest 2.000 L000 7,000 Net Income From Continuing 9,191.000 2.506.000 13,022,000 Ons Net Income 7.373-000 1,231,000 11,953,000 Preferred Stock And Other Adjustrments Net Income Applicable 7,373.000 Common Shares 1231,000 11,953,000 Ford Ford Income Statement Ford Cash Flows Market Data Ford Balance Sheet 1 numbers in thousands Cash Flow Statement for Ford Motor Company 31-12-14 31-12-13 u953000 31-12-15 Period Endine Net Income 7.373.0MI9 1.231.000 Operating Activities, Cash Flows Provided By or Used In Depreciation 7,966,000 7,423,000 6,544,010 ncoe Chanres In Accounts Receivables 3.563.000 2896.000 -1913,000 Changes In Liabilities 7,758.000 5,729,000 1.232.000 Changes In Inventories 1.155.000 936,000 -437,000 Changes In Other Operaling Activities 7I) 00D 467,000 -706.000 Total Cash Flow From Operuting Activities 16.170,000 14.507.000 10.444.000 Investing Activities, Cash Flows Provided By or Used In Capital Expenditures 7,196,000 -7463,000 -6.397.000 52 Other Cash lows from Investing Activities 56.717.000 52 009 000 45.632.000 Total Cash Flows From Investing Activities 26.162.000 -21,124,000 -19,731,000 Financing Activities, Cash Flows Provided By or LsedUr Dividends Paid -2.380,000 -1,952,000 1 964 000 -1,574,000 Sale Purchase of Stock 129.000 -213.000 Net Borrowings 17.148,000 7,314,000 9.663.000 Other Cash Flows from Financing Activities -317,000 25,000 257,000 14. 3,423,000 8.133 Rahcing Activities 15.000 Change In Cash and Cash Equivalents 3,515,000 -3,711.000 1,191,000 Question 3-Firm Valuation (40 Marks) On April 1st, 2016, a large hedge fund wants to invest in stocks of Ford Motor Company. They think the current market valuation is not fair and decide to use DCF (FCF) valuation to estimate the fair share price. The corporate tax rate is 28% and Ford has 3.90B net shares outstanding. Use the excel file with market data on Ford's stock price, the S&P 500 index and interest rates as well as Ford's balance sheet, income statement and cash flow statement to answer the following questions. a) Estimate Ford's Equity Beta using the daily (excess) stock returns and market (excess) return observations as provided in the excel file. (4 marks) b) Use the CAPM model to estimate Ford's cost of equity. The hedge fund uses the annualized return over the last 10 years (last 2500 trading days) to calculate their expectation of the market return (i.e. 6.72%). They use government bonds with a very good credit rating and a very long maturity to estimate the risk-free rate (i.e. 2.21%). (2 marks) c) Calculate Ford's cost of capital (WACC) using the most recent available book values of debt (long-term debt only) and equity (note: you may use market values instead as long as you can cite the source). The hedge fund assumes that Ford's cost of debt (before-tax) is similar to the current yield on long-term corporate bonds of similar credit quality (i.e. 3.64%). The hedge fund thinks that Ford's corporate debt has a credit rating of "A". (4 marks) d) What is Ford's Free Cash Flow (FCF) in year 2015 using the FCF formula discussed in class? You can rely on the current cash flow statement for the most recent depreciation and the capital expenditures and assume that net working capital has not changed in the most recent period. (8 marks) e) Ford assumes that its sales are going to grow by 2% per year for the next 10 years while the operating margin (EBIT margin) will stay constant at the 2015 level. Ford further assumes that depreciation and amortization will grow by 1% per year, net working capital will stay constant and capital expenditure will increase by 3% per year, for the next ten years respectively. What's the present value of Ford's operating assets for the "explicit period" (next ten years) using DCF and the WACC you found in (c)? (8 marks) f) Assuming a 0.5% perpetual growth rate of the FCF after the end of the explicit period, calculate the Terminal Value, Enterprise and Equity Value and the fair share price for Ford. (you can use the book value of total liabilities as an estimate for the firm's debt) (5 marks) g) What is the range of fair share prices for Ford, if you assume a perpetual growth rate between 0% and 1%? (5 marks) h) Would you recommend the hedge fund to invest in Ford Motor Company given your results in (e) and (f) and the current (market) stock price of Ford Motor Company of $12.70? Explain. (4 marks) Market Data Ford Ford Balance Sheet Ford Income Statement Ford Cash Flows This Dala is from Prof Kenneth French's Websile. Mkt-RF: US Stock Market Excess Returm (in % ) Risk Free Rate (in %) RE Mkt-RE .. 3/31/16 Date R 0 1 0.00 3/30/16 0.4 0.001 3/29/16 1.07 0.001 3/28/16 004 0.001 0 001 3/24/16 3/23/16 0.84 0,00 3/18/16 0,001 0.72 3/17/16 0.001 0.63 3/16/16 0,001 0.g01 3/15/16 )36 3/14/16 0.12 0,001 3/11/16 1.6 0.001 o 001 0 ' 3/9/16 1 27 3/16/ 0.001 3/7/16 3/4/16 0 21 0,001 0 001 0.3 3/3/16 0.51 0001 3/2/16 0,o 2/29/16 o 001 0 69 2/26/16 0.01 0.001 2/25/16 1.1 0.g01 224/16 043 0,001 2/23/16 1.22 0001 2/22/16 143 0.001 2/19/16 0.06 0.001 0.5 218/16 0.00 2/16/16 78 0001 2/12/16 95 000 1.17 0.001 o 001 211/16 2/10/16 0.0 2/9/16 0 0.00 2/8/16 1.5 0.001 o 001 7/4/16 17 2/3/16 46 0,001 2/2/16 -2 0001 0. 04 2/1/16 0.001 7 57 1/29/16 1/28/16 0.4 L26/16 1 7 1/25/16 2 08 122/16 0 121/16 041 L20/16 094 1/19/16 -0.2 13/16 2.67 0 /12/16 0.71 1/11/16 ) 06 1/8/16 1.11 1/16 2.44 0 18/16 -1.11 1/7/16 -2.44 1 SS 1:4/16 12/31/15 0.92 0 0 74 12/30/15 0 12/29/15 10 12/28/15 0.29 0 0.1 Sli+771 12/22/15 0 89 12/21/15 0,74 0 12/18/15 0 1 46 12/17/15 12/16/15 1.47 0 12/15/15 12/11/15 203 12/10/15 0.3 0 0 82 12/9/15 0 12/8/15 0 5 C 0.8 12/7/15 124/15 1.8 12/2/15 1.01 12/1/15 0.90 0 11/30/15 041 0 11/27/15 009 11/25/15 0,09 1/24/15 0.21 11/20/15 0.35 11/19/15 0.13 0 1/18/15 161 0 0.11 11/17/15 0 1 3s 11/16/15 W13/15 L0c 11/12/15 1.4: 0 119/15 095 116/15 0.14 0 11/5/15 11/4/15 0,26 113/15 0.32 0 10/29/15 -02 0 10/28/15 1.43 0 0 47 10/27/15 10/26/15 10/23/15 1.09 0 10/22/15 0 14 10/20/15 0 10/19/15 0 10/16/15 36 1 56 10/15/15 10/14/15 0 109/15 0.12 10/8/15 0.84 0 0 94 10/7/15 0 0 43 106/15 0. 10/5/15 1.93 10/7/15 0.94 1 93 10/5:15 10/2:15 1.48 0 .13 10/1:15 0 1 88 9:3015 9:2915 -0,07 9:28:15 -2.63 36 9:2415 923/15 027 0 9/22/15 1.29 36 9:21/15 0 91815 -1.62 917/15 .I 915/15 9:14:15 41 0 91115 0 44 0 9:1015 0 9/915 -1.34 9/315 017 181 9/2/15 0 9/115 -2.91 0 8:3115 0.74 8:28/15 0.23 8:25:15 -L.17 8:24:15 3.5 0 8/21/15 295 8:2015 -2.24 0 8:19:15 8/18/15 0.35 8:17:15 0.0 8:13/15 14 0.07 812/15 0 0.98 8/11/15 0 1 31 8:10:15 0 8/7:15 -0.36 8/6/15 .88 8/415 14 .35 8/3:15 0 7:3115 0 7:3015 o12 0 7:2915 ).74 0 2613 23 7/24:15 1 08 7:23/15 -0 6 0 7:22:15 018 0 7/21/15 ) 47 0.01 7:20/15 0.02 7:1515 019 7:14:15 47 0 I14 7:13/15 0 1 24 710:15 0 7/915 0.28 7/715 037 7/615 0 7/8:15 -1.68 7/7/15 .53 0 11 7/215 7/1/15 06 133 63015 6/29/15 15 626/15 6/25/15 25 623/15 12 063 6/22/15 6/19/15 043 6:18/15 0 16 6/1715 1613 6/12/15 063 021 6/11/15 6/1015 1.2 691S 0.07 6/8/15 0.66 GA15 6/3/15 39 6/2/15 6/1/15 017 0 S:29/15 58 5:28/15 ,12 S:26/15 5:22/15 22 1.23 5:21/15 5:20/15 5:1915 0.09 5:1815 44 5:15/15 S13/15 512/15 22 5/11/15 39 1 21 5/8/15 5/715 0 39 5/615 0.31 5/4:15 5/1/1' L01 4:3015 4:29/15 35 4:28/15 0 27 42715 .54 4:23/15 29 4:22/15 146 0.1 421/15 4:2015 095 0 1 21 4:17:15 11 4:1415 4:13/15 38 4:1015 4/9/15 41 4/8/15 0 3: 4/2/15 35 4/2/15 0 3 4/1/15 38 0 7 331/15 0 1 24 3/30/15 0 32 3/27/15 3/26/15 l.22 3/24/15 05 3:23/15 0 3/20/15 0.8 0 3:19/15 136 3:18/15 1.08 0 57 3:13/15 0 3/12/15 1.28 3/11/15 0 04 3/10/15 1.63 0 3/9/15 (.37 1/5/15 12 3/4/15 041 3/315 043 0 3/2/15 0 62 0 36 227/15 226/15 0.08 2:2415 0 37 o 2/23/15 0 08 0 2:20/15 0 61 2'1915 001 0 2:18/15 0.01 217/15 0,17 213/15 48 0 03 1 (04 21015 29/15 .46 0 2/6/15 0.2 0 2/5/15 1.1 0 35 2/4/15 2/2/15 24 3015 0 1:2915 1.98 1:28/15 0 1:2715 1.2 0 126/15 ().43 1:22/15 I58 0 ) 47 1:21/15 011 12015 0 1:16/15 36 1 08 1/15/15 12/15 1915 0.85 0 1 81 1/8/15 0 1/7/15 1/6/15 1.04 0 1/24 Copyright 2016 Kenneth R. French 12/31/15 14(09 12/30/15 14.17 12/29/15 14.23 12/28/15 14.18 1224/15 14.31 12/23/15 14.36 1701 13 73 12/18/15 13.80 13.98 12/17/15 12/16/15 14.36 12/15/15 13.87 12/14/15 12/10/15 13.96 13.89 12/9/15 12/8/15 13 97 12/7/15 14.12 12/4/15 14.20 12/2/15 14.26 12/1/15 14.56 11/30/15 14.33 11/27/15 14.53 11/25/15 14.55 215 1/20/15 14 60 11/19/15 14.57 11/18/15 14.46 11/17/15 14.15 1/16/15 14.04 1/12/15 14.04 1/10/15 14.28 14.33 11/9/15 11/6/15 14.52 14.57 11/5/15 1/4/15 14.65 11/2/15 1475 10/30/15 14.8 10/29/15 14.73 10/28/15 14.97 10/27/15 14.89 IS67 15.58 10/22/15 10/21/15 15.41 10/20/15 15.38 10/19/15 15.36 10/16/15 15.28 10/14/15 15.01 10/13/15 14.94 10/12/15 14.98 10/9/15 14.97 0/8/15 14.99 1431 15/15 14.19 10/2/15 13.99 1/15 13.67 9/30/15 13.57 9/29/15 13.15 10/20/15 15.38 10/19/15 15.36 10/16/15 15.28 10/15/15 15.22 10/14/15 15.01 14 08 14.97 10/9/15 18/15 14.99 14.75 L0/7/15 106/15 14.31 0/5/15 14.19 10/1/15 13.67 13.57 9/30/15 9/29/15 13.15 9/28/15 13.12 13.53 9/25/15 13.03 2/15 13.92 9/22/15 14.32 9/21/15 9/18/15 14.28 9/17/15 14.60 14.64 9/16/15 13 7 9/14/15 9/11/15 13.71 13.73 9/10/15 9/9/15 13.53 9/8/15 13.67 9/415 13.56 13.87 9/2/15 13.87 8/31/15 15'28 13.74 13.56 8/27/15 8/26/15 13.21 8/25/15 12.90 821/15 13.86 14.43 8/20/15 8/19/15 14.77 8/18/15 14.83 8/17/15 14.68 4. 8/12/15 14.68 14.70 8/1/15 8/10/15 14.99 8/7/15 14.80 8/6/15 14.83 1491 R/4/15 8/3/15 14.94 7/31/15 14.83 7/30/15 15.10 7/29/15 15.21 12 S 14.83 14 39 7/24/15 7/23/15 14.61 7/22/15 14.42 14.51 7/21/15 7/20/15 14.57 T/17/15. 14 6 8/5/15 14.80 8/4/15 14.91 8/3/15 14.94 7/30/15 15.10 7:29/15 15.21 7/28/15 14.83 7/27/15 14.55 724/15 14.39 2/2245 7/21/15 14.51 720/15 14 57 7/17/15 14.69 716/15 14.57 14.75 713/15 14.64 710/15 14.48 7/9/15 14.33 7/8/15 14.37 7/7/15 14.85 7/2/15 14 93 7/1/15 14.99 6/3015 15.01 6/29/15 15.02 6/26/15 15.40 15 5/ 623/15 15.29 6/22/15 15.13 619/15 15.11 6/18/15 15.14 617/15 15.02 6/16/15 15.00 6/11/15 15.28 15.03 6/10/15 6/9/15 14.88 14.90 6/8/15 6/5/15 14.78 6/3/15 15 20 6/2/15 15.26 6/1/15 15.36 5:29/15 15.17 5/28/1S 15.29 S3615 15 19 5/22/15 15.27 521/15 15.51 5/20/15 15.30 519/15 15.50 5:18/15 . 5/14/15 15.27 513/15 15.4 5/12/15 15.56 /11/15 15.65 15.67 5/8/15 5/6/15 15 18 5/5/15 15.53 5/4/15 15.78 5/1/15 15.81 611/15 15.28 6/10/15 15.03 69/15 14.88 68/15 14.90 6/5/15 14.78 15 20 63/15 6/2/15 15.26 61/15 15.36 5/29/15 15.17 5/28/15 15.29 5/26/15 5/22/15 15.27 5/21/15 15.51 5/20/15 15.30 5/19/15 15.50 15/16 514/15 15.27 5/13/15 15.41 512/15 15.56 S/11/15 15.65 515/ 15.67 5/6/15 15 48 5/5/15 15.53 5/4/15 15.78 5/1/15 15.8 4/30/15 15.80 428/15 15.90 4/27/15 4/24/15 15.77 4/23/15 5.76 4/22/15 15.91 4/21/15 15.82 4/20/15 15.9 4/16/15 15 94 4/15/15 16.07 4/14/15 15.97 4/13/15 15.87 4/10/15 16.03 48/15 5.09 47/15 15.90 4/6/15 16.00 4/2/15 16.03 4/1/15 15.9 3/30/15 ... 3/27/15 15.98 3/26/15 16.01 3/25/15 1618 3/24/15 16,56 3/19/15 16.14 3/18/15 6 46 3/17/15 16 39 3/16/15 16.49 16.2 3/11/15 15.75 3/10/15 15.72 3015 1603 4/7/15 15.90 4/6/15 16.00 4/2/15 16.03 4/1/15 15.91 16.14 327/15 15.98 16.01 3/26/15 3:25/15 16.18 3/24/15 16.56 3/23/15 16.57 3/19/15 16.34 3/18/15 1646 16.39 3/17/15 3/16/15 1649 16.20 3:13/15 3/10/15 15.72 3/9/15 16.03 3/6/15 15.93 3/5/15 16.11 16.03 3/4/15 3/2/15 16.57 16.34 227/15 2/26/15 16.38 2/25/15 16.51 2/24/15 16.36 2015 16.43 2/19/15 218/15 16.21 217/15 16.11 2/13/15 16.30 16.36 2/12/15 2/11/15 16.25 2 16 03 2/6/15 15.86 2/5/15 15.85 2/4/15 15.87 2/3/15 15.65 15.27 2/2/13 1/29/15 14.85 1:28/15 14.46 127/15 14.85 126/15 15.08 14.9 1:23/15 1/21/15 14 47 1-20/15 15.01 15.02 16/15 15/15 14 86 1:14/15 15.11 1/9/15 15.21 1/8/15 15.42 1/7/15 15.04 1/6/15 14.62 1/5/15 14.76 12/31/14 15.50 Ford Income Statement Ford Cash Flows Market Data Ford Ford Balance Sheet All numbers in thousands Balance Sheet for Ford Motor Company 31-12-15 31-12 A-14 31-12 A-13 Period Ending Assets Current Assets Cash And Cash Equivalents 14,272,000 10,757,000 14,468,000 Short Term Investments 22.100,000 20.393,000 20,904,000 Net Receivahles. 101,975,000 92,819,000 87.309.000 8.319,000 7,870.000 7,708,000 Other Current Assets 131,585,000 131,839,000 Total Current Assets 145.470,000 Long Term Investments 3,224,000 3,357,000 3679.000 Property Plant and Equipment 47,600,000 57,256,000 5 343 000 Goodwill Intangible Assets . Amortization 7,466.000 Otber Assets 6,052.000) 5.847,000 Deferred Long Term Asset Charges Total Assets 11.509,000 14.024,000 13.468,000 224.925.JM00 208.615.000 202.179.000 Liabilities Current Liabilities Accounts Payable 20.272.000 20,035.000 19.531,000 Current Long Term Other Current Liabilities Total Current Liabilities 20,272,000 20,035,000 19,531,000 Long Term Debt 132.854.000 119.171 000 114 688 000 4 546 000 Other Liabilities 44,032,000 40,886,000 Deferred Long Term Liability Charges s711 101 502.000 598,000 Minority Interest 15,000 27,000 33.000 Total Liabilities 196.189.000 183.835.000 175.736.000 Stockholders' Equity 04 000 Mise Stocks Options Warrants 342.000 331,000 Redeemahle Preferred Stock Preferred Stock 40 000 41.000 Common Stock 40.000 Retained Eamings 9,6 14 240017 00 21.421,000 21.422.000 Capital Suplus 21.089,000 Otber Stockholder Equity -6.257.000 -5,265,000 -18.230,000 Total Stockholder Equity 28.642.000 24,438.000 26.112.000 Net Tangible Assets 24.438.000 28.642.000 26.112.000 Ford Balance Sheet Market Data Ford Ford Income Statement Ford Cash Flows All numbers in thousands Income Statement for Ford Mote tor Company Period Ending 31-12A-14 31-12A-13 Tatal Revenue (Sales) 149.558.000 144,077,000 146.917.000 126.495.000 Cost of Revenue 127,724,000 123.050.000 Gross Profit 23.063.000 16.353.000 23.867.000 Operating Expenses Research Development Selling ieneral and 14,999.000 15.716,000 10,850,000 Administrative ecurring 417,000 305.000 208.000 Others 33 000 Operating Income or Loss 7.647,000 12.809.000 Income from Continuing Operations Total Other Income/Expenses 1.560.000 424.000 1,322,000 Net Earnings Before Interest And 11.025.000 2031 000 15,200,000 es 829,000 Exnense 773,000 797I0 Income Before Tax 10.252.000 1.234.000 14.371,000 2.425.000 2,881,00 Incame Tax Expense 4 000 Minority Interest 2.000 L000 7,000 Net Income From Continuing 9,191.000 2.506.000 13,022,000 Ons Net Income 7.373-000 1,231,000 11,953,000 Preferred Stock And Other Adjustrments Net Income Applicable 7,373.000 Common Shares 1231,000 11,953,000 Ford Ford Income Statement Ford Cash Flows Market Data Ford Balance Sheet 1 numbers in thousands Cash Flow Statement for Ford Motor Company 31-12-14 31-12-13 u953000 31-12-15 Period Endine Net Income 7.373.0MI9 1.231.000 Operating Activities, Cash Flows Provided By or Used In Depreciation 7,966,000 7,423,000 6,544,010 ncoe Chanres In Accounts Receivables 3.563.000 2896.000 -1913,000 Changes In Liabilities 7,758.000 5,729,000 1.232.000 Changes In Inventories 1.155.000 936,000 -437,000 Changes In Other Operaling Activities 7I) 00D 467,000 -706.000 Total Cash Flow From Operuting Activities 16.170,000 14.507.000 10.444.000 Investing Activities, Cash Flows Provided By or Used In Capital Expenditures 7,196,000 -7463,000 -6.397.000 52 Other Cash lows from Investing Activities 56.717.000 52 009 000 45.632.000 Total Cash Flows From Investing Activities 26.162.000 -21,124,000 -19,731,000 Financing Activities, Cash Flows Provided By or LsedUr Dividends Paid -2.380,000 -1,952,000 1 964 000 -1,574,000 Sale Purchase of Stock 129.000 -213.000 Net Borrowings 17.148,000 7,314,000 9.663.000 Other Cash Flows from Financing Activities -317,000 25,000 257,000 14. 3,423,000 8.133 Rahcing Activities 15.000 Change In Cash and Cash Equivalents 3,515,000 -3,711.000 1,191,000