Answered step by step

Verified Expert Solution

Question

1 Approved Answer

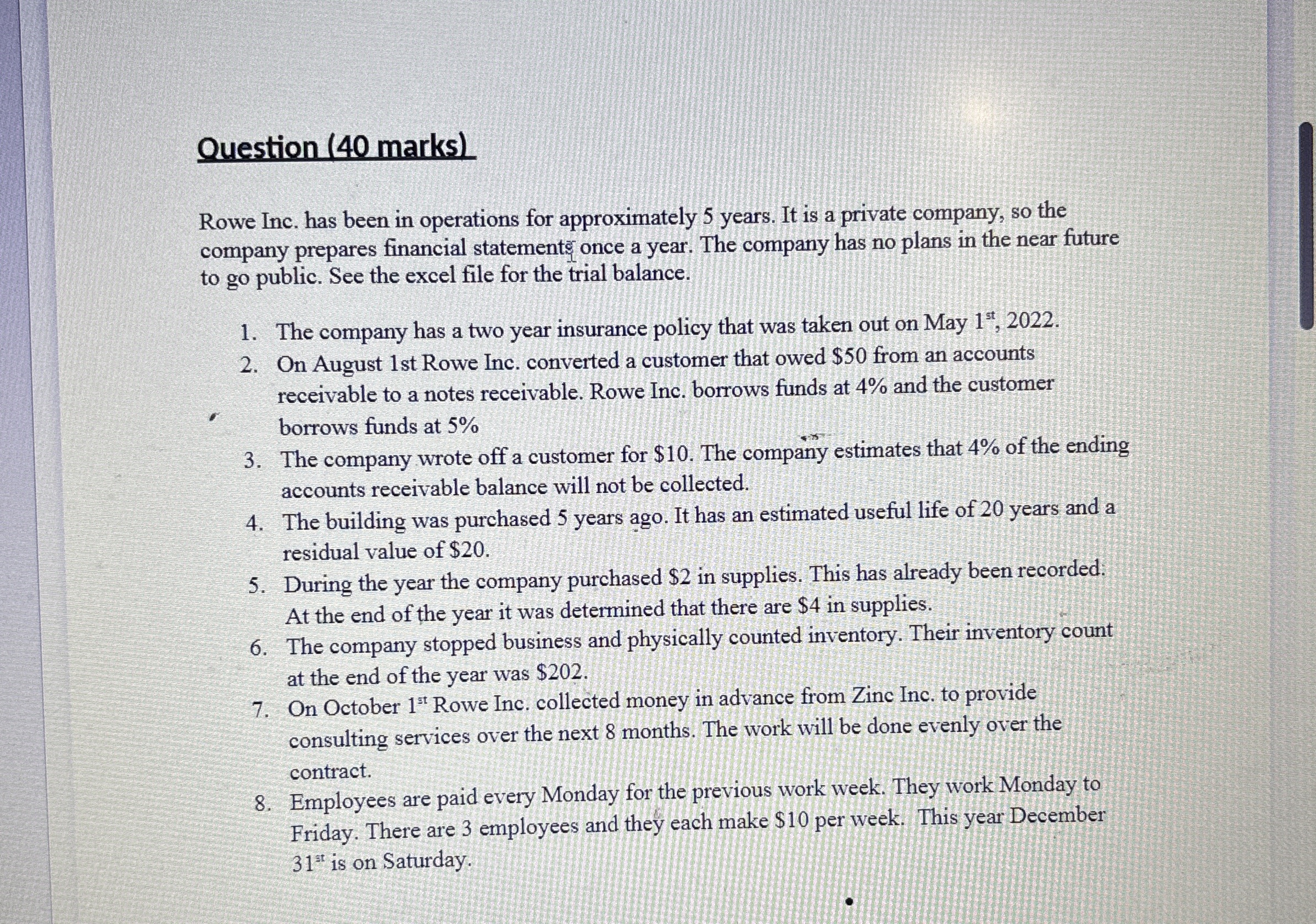

Question ( 4 0 marks ) Rowe Inc. has been in operations for approximately 5 years. It is a private company, so the company prepares

Question marks

Rowe Inc. has been in operations for approximately years. It is a private company, so the company prepares financial statements once a year. The company has no plans in the near future to go public. See the excel file for the trial balance.

The company has a two year insurance policy that was taken out on May

On August st Rowe Inc. converted a customer that owed $ from an accounts receivable to a notes receivable. Rowe Inc. borrows funds at and the customer borrows funds at

The company wrote off a customer for $ The company estimates that of the ending accounts receivable balance will not be collected.

The building was purchased years ago. It has an estimated useful life of years and a residual value of $

During the year the company purchased $ in supplies. This has already been recorded. At the end of the year it was determined that there are $ in supplies.

The company stopped business and physically counted inventory. Their inventory count at the end of the year was $

On October Rowe Inc. collected money in advance from Zinc Inc. to provide consulting services over the next months. The work will be done evenly over the contract.

Employees are paid every Monday for the previous work week. They work Monday to Friday. There are employees and they each make $ per week. This year December is on Saturday.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started