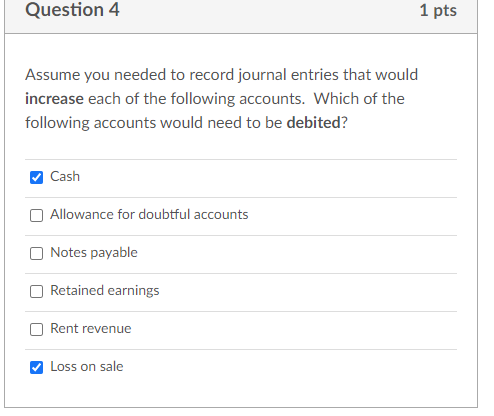

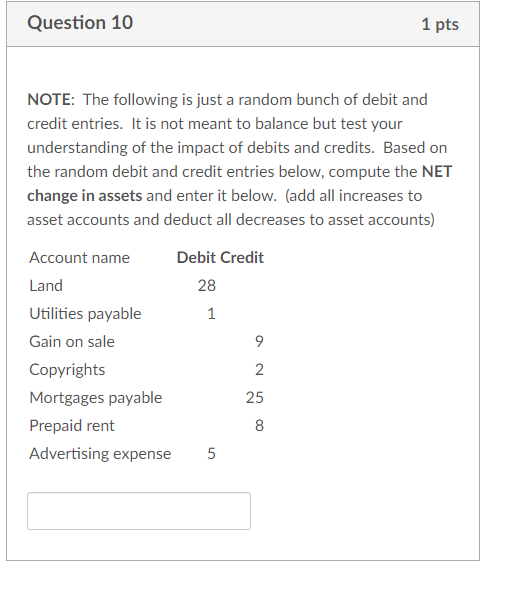

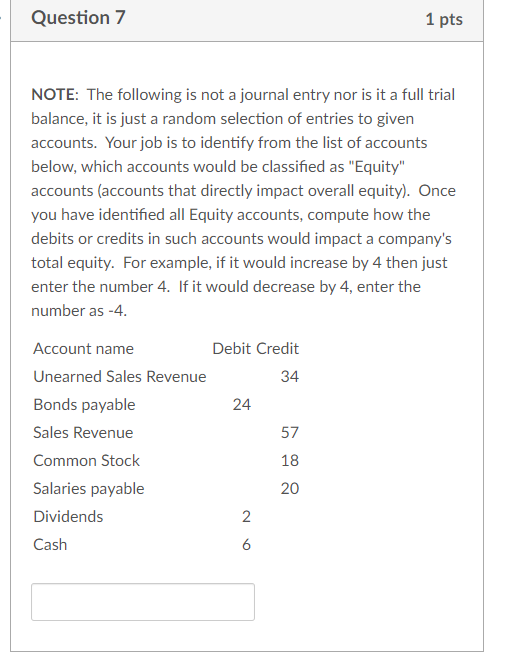

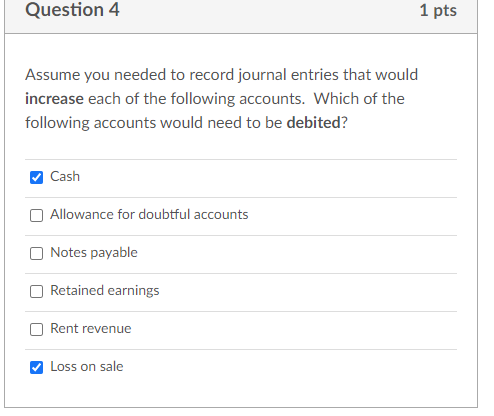

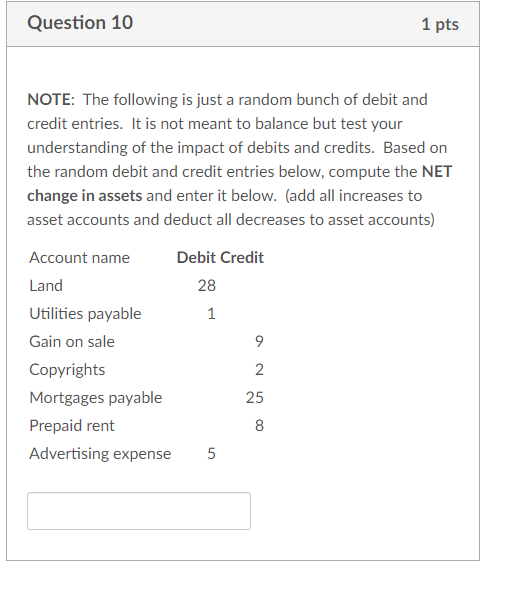

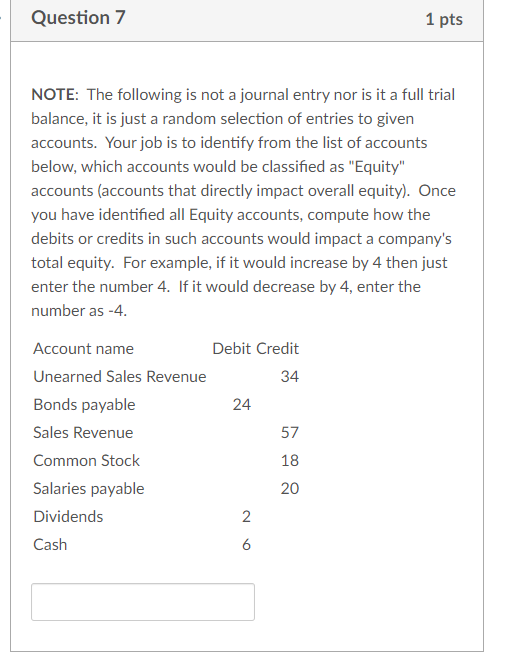

Question 4 1 pts Assume you needed to record journal entries that would increase each of the following accounts. Which of the following accounts would need to be debited? Cash Allowance for doubtful accounts U Notes payable Retained earnings Rent revenue Loss on sale Question 10 1 pts NOTE: The following is just a random bunch of debit and credit entries. It is not meant to balance but test your understanding of the impact of debits and credits. Based on the random debit and credit entries below, compute the NET change in assets and enter it below. (add all increases to asset accounts and deduct all decreases to asset accounts) Account name Debit Credit Land 28 Utilities payable 1 Gain on sale 9 Copyrights 2 Mortgages payable 25 Prepaid rent 8 Advertising expense 5 Question 7 1 pts NOTE: The following is not a journal entry nor is it a full trial balance, it is just a random selection of entries to given accounts. Your job is to identify from the list of accounts below, which accounts would be classified as "Equity" accounts (accounts that directly impact overall equity). Once you have identified all Equity accounts, compute how the debits or credits in such accounts would impact a company's total equity. For example, if it would increase by 4 then just enter the number 4. If it would decrease by 4, enter the number as -4. Account name Debit Credit Unearned Sales Revenue 34 Bonds payable 24 Sales Revenue 57 Common Stock 18 Salaries payable 20 Dividends 2 Cash 6 Question 4 1 pts Assume you needed to record journal entries that would increase each of the following accounts. Which of the following accounts would need to be debited? Cash Allowance for doubtful accounts U Notes payable Retained earnings Rent revenue Loss on sale Question 10 1 pts NOTE: The following is just a random bunch of debit and credit entries. It is not meant to balance but test your understanding of the impact of debits and credits. Based on the random debit and credit entries below, compute the NET change in assets and enter it below. (add all increases to asset accounts and deduct all decreases to asset accounts) Account name Debit Credit Land 28 Utilities payable 1 Gain on sale 9 Copyrights 2 Mortgages payable 25 Prepaid rent 8 Advertising expense 5 Question 7 1 pts NOTE: The following is not a journal entry nor is it a full trial balance, it is just a random selection of entries to given accounts. Your job is to identify from the list of accounts below, which accounts would be classified as "Equity" accounts (accounts that directly impact overall equity). Once you have identified all Equity accounts, compute how the debits or credits in such accounts would impact a company's total equity. For example, if it would increase by 4 then just enter the number 4. If it would decrease by 4, enter the number as -4. Account name Debit Credit Unearned Sales Revenue 34 Bonds payable 24 Sales Revenue 57 Common Stock 18 Salaries payable 20 Dividends 2 Cash 6