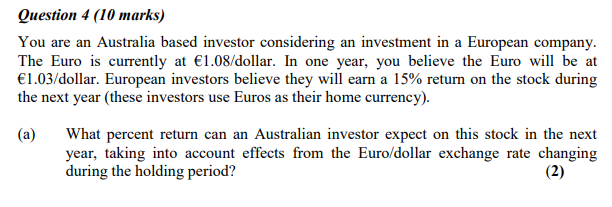

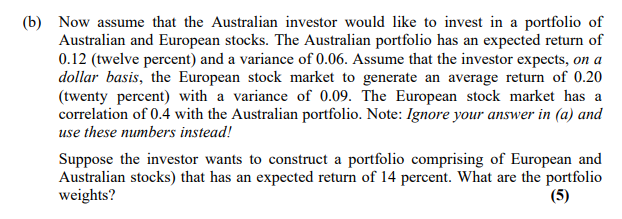

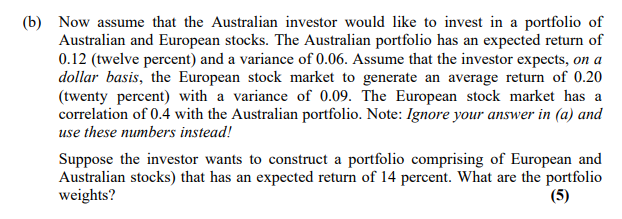

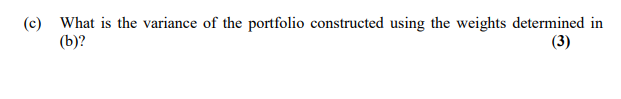

Question 4 (10 marks) You are an Australia based investor considering an investment in a European company. The Euro is currently at 1.08/dollar. In one year, you believe the Euro will be at 1.03/dollar. European investors believe they will earn a 15% return on the stock during the next year these investors use Euros as their home currency). (a) What percent return can an Australian investor expect on this stock in the next year, taking into account effects from the Euro/dollar exchange rate changing during the holding period? (2) (b) Now assume that the Australian investor would like to invest in a portfolio of Australian and European stocks. The Australian portfolio has an expected return of 0.12 (twelve percent) and a variance of 0.06. Assume that the investor expects, on a dollar basis, the European stock market to generate an average return of 0.20 (twenty percent) with a variance of 0.09. The European stock market has a correlation of 0.4 with the Australian portfolio. Note: Ignore your answer in (a) and use these numbers instead! Suppose the investor wants to construct a portfolio comprising of European and Australian stocks) that has an expected return of 14 percent. What are the portfolio weights? (5) (c) What is the variance of the portfolio constructed using the weights determined in (b)? (3) Question 4 (10 marks) You are an Australia based investor considering an investment in a European company. The Euro is currently at 1.08/dollar. In one year, you believe the Euro will be at 1.03/dollar. European investors believe they will earn a 15% return on the stock during the next year these investors use Euros as their home currency). (a) What percent return can an Australian investor expect on this stock in the next year, taking into account effects from the Euro/dollar exchange rate changing during the holding period? (2) (b) Now assume that the Australian investor would like to invest in a portfolio of Australian and European stocks. The Australian portfolio has an expected return of 0.12 (twelve percent) and a variance of 0.06. Assume that the investor expects, on a dollar basis, the European stock market to generate an average return of 0.20 (twenty percent) with a variance of 0.09. The European stock market has a correlation of 0.4 with the Australian portfolio. Note: Ignore your answer in (a) and use these numbers instead! Suppose the investor wants to construct a portfolio comprising of European and Australian stocks) that has an expected return of 14 percent. What are the portfolio weights? (5) (c) What is the variance of the portfolio constructed using the weights determined in (b)? (3)