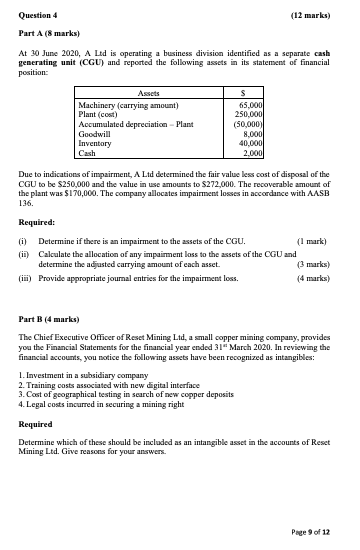

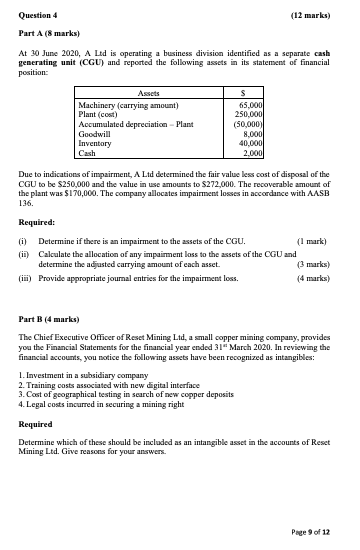

Question 4 (12 marks) Part A (8 marks) At 30 June 2020, A Ltd is operating a business division identified as a separate cash generating unit (CGU) and reported the following assets in its statement of financial position: Assets Machinery (carrying amount) Plant (cost) Accumulated depreciation - Plant Goodwill Inventory s 65.000 250.000 (50,000) 8.000 40,000 2.000 Due to indications of impairment, A Ltd determined the fair value less cost of disposal of the CGU to be $250,000 and the value in use amounts to $272,000. The recoverable amount of the plant was $170,000. The company allocates impairment losses in accordance with ASB 136. Required: (i) Determine if there is an impairment to the assets of the CGU. (1 mark) (ii) Calculate the allocation of any impairment loss to the assets of the CGU and determine the adjusted carrying amount of each asset. (3 marks) (in) Provide appropriate journal entries for the impairment loss. (4 marks) Part B (4 marks) The Chief Executive Officer of Reset Mining Ltd, a small copper mining company provides you the Financial Statements for the financial year ended 31 March 2020. In reviewing the financial accounts, you notice the following assets have been recognized as intangibles: 1. Investment in a subsidiary company 2. Training costs associated with new digital interface 3. Cost of geographical testing in search of new copper deposits 4. Legal costs incurred in securing a mining right Required Determine which of these should be included as an intangible asset in the accounts of Reset Mining Ltd. Give reasons for your answers. Page 9 of 12 Question 4 (12 marks) Part A (8 marks) At 30 June 2020, A Ltd is operating a business division identified as a separate cash generating unit (CGU) and reported the following assets in its statement of financial position: Assets Machinery (carrying amount) Plant (cost) Accumulated depreciation - Plant Goodwill Inventory s 65.000 250.000 (50,000) 8.000 40,000 2.000 Due to indications of impairment, A Ltd determined the fair value less cost of disposal of the CGU to be $250,000 and the value in use amounts to $272,000. The recoverable amount of the plant was $170,000. The company allocates impairment losses in accordance with ASB 136. Required: (i) Determine if there is an impairment to the assets of the CGU. (1 mark) (ii) Calculate the allocation of any impairment loss to the assets of the CGU and determine the adjusted carrying amount of each asset. (3 marks) (in) Provide appropriate journal entries for the impairment loss. (4 marks) Part B (4 marks) The Chief Executive Officer of Reset Mining Ltd, a small copper mining company provides you the Financial Statements for the financial year ended 31 March 2020. In reviewing the financial accounts, you notice the following assets have been recognized as intangibles: 1. Investment in a subsidiary company 2. Training costs associated with new digital interface 3. Cost of geographical testing in search of new copper deposits 4. Legal costs incurred in securing a mining right Required Determine which of these should be included as an intangible asset in the accounts of Reset Mining Ltd. Give reasons for your answers. Page 9 of 12