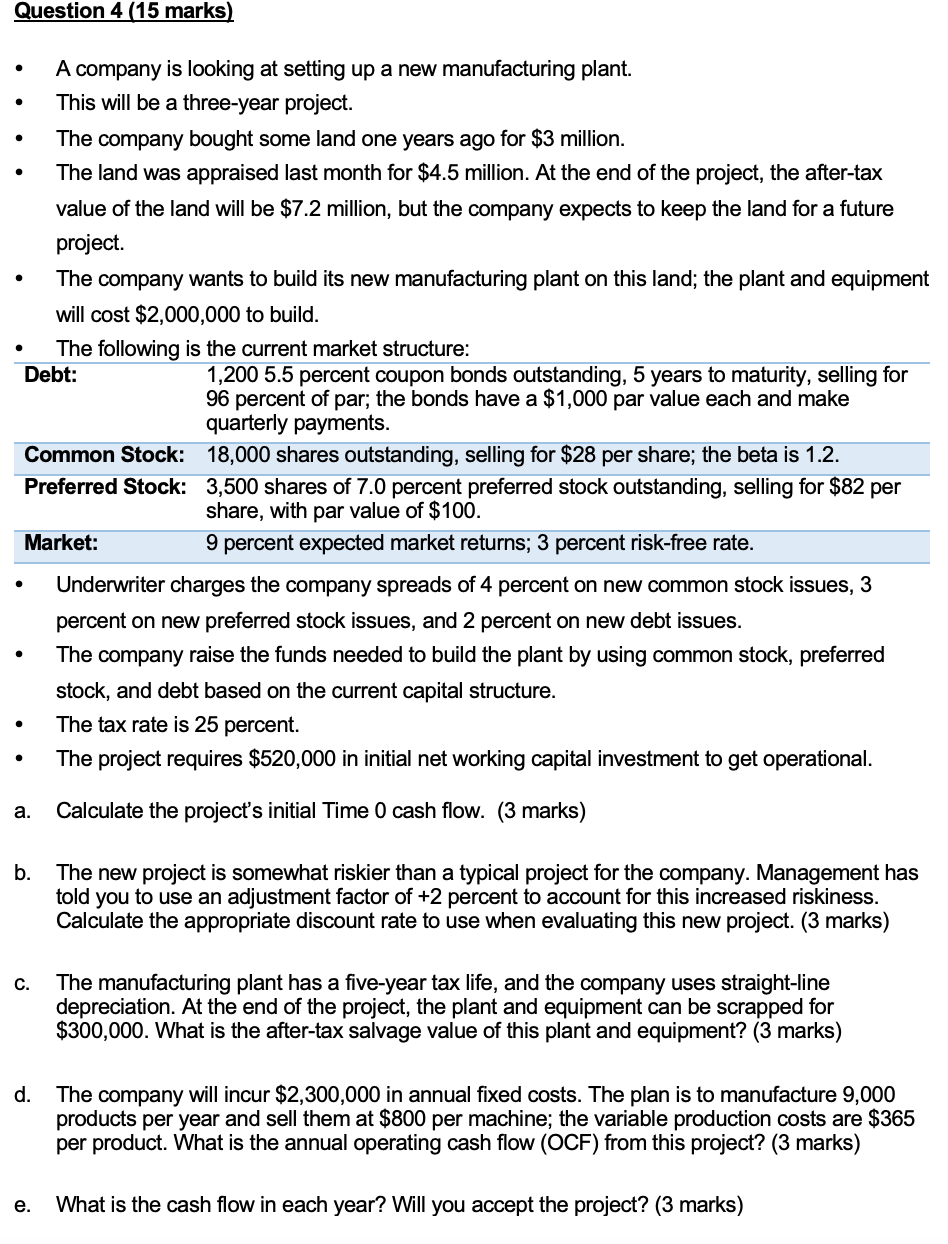

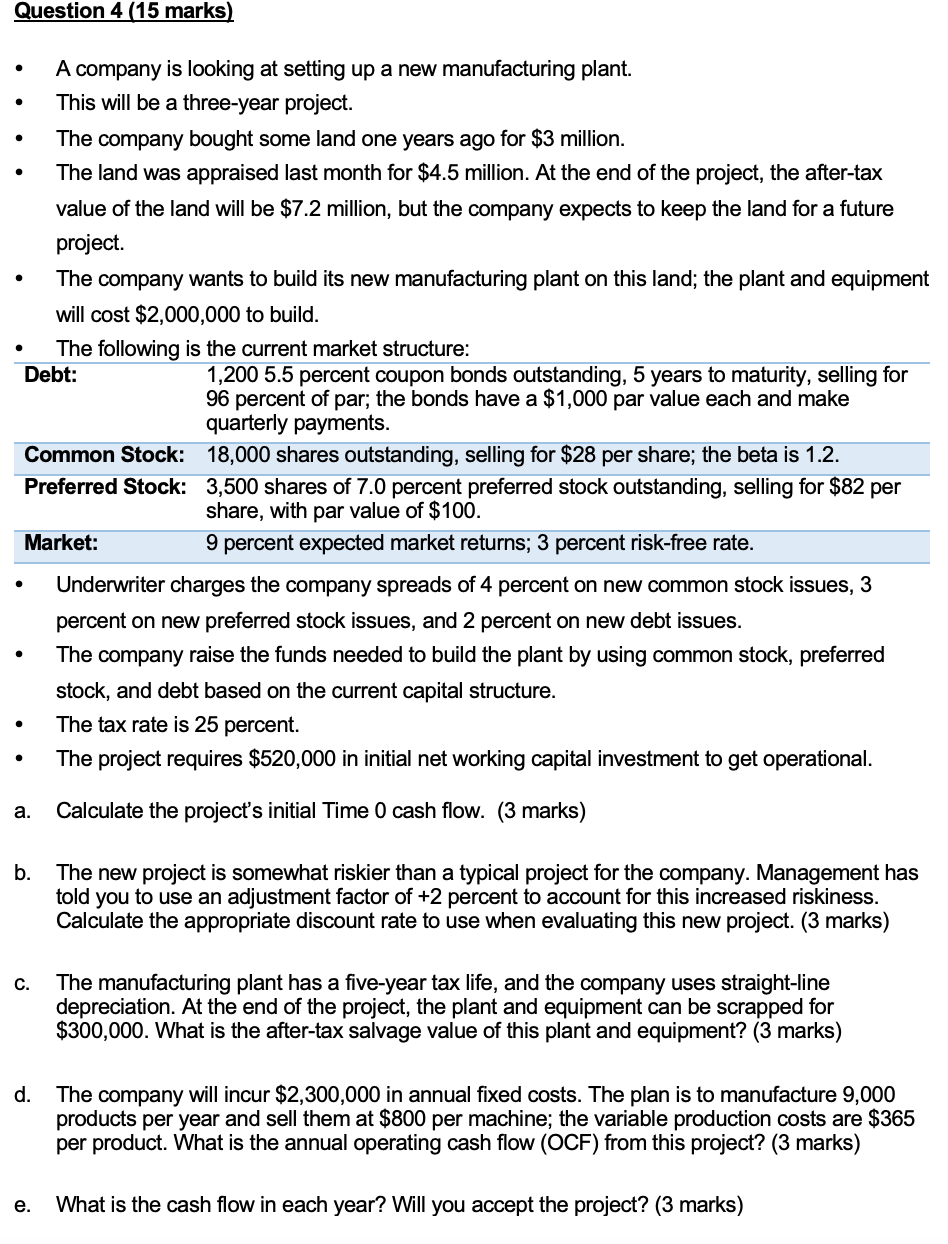

Question 4 (15 marks) The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $2,000,000 to build. The following is the current market structure: Debt: A company is looking at setting up a new manufacturing plant. This will be a three-year project. Common Stock: Preferred Stock: The company bought some land one years ago for $3 million. The land was appraised last month for $4.5 million. At the end of the project, the after-tax value of the land will be $7.2 million, but the company expects to keep the land for a future project. a. Market: 1,200 5.5 percent coupon bonds outstanding, 5 years to maturity, selling for 96 percent of par; the bonds have a $1,000 par value each and make quarterly payments. e. 18,000 shares outstanding, selling for $28 per share; the beta is 1.2. 3,500 shares of 7.0 percent preferred stock outstanding, selling for $82 per share, with par value of $100. 9 percent expected market returns; 3 percent risk-free rate. Underwriter charges the company spreads of 4 percent on new common stock issues, 3 percent on new preferred stock issues, and 2 percent on new debt issues. The company raise the funds needed to build the plant by using common stock, preferred stock, and debt based on the current capital structure. The tax rate is 25 percent. The project requires $520,000 in initial net working capital investment to get operational. Calculate the project's initial Time 0 cash flow. (3 marks) b. The new project is somewhat riskier than a typical project for the company. Ma gement has told you to use an adjustment factor of +2 percent to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating this new project. (3 marks) C. The manufacturing plant has a five-year tax life, and the company uses straight-line depreciation. At the end of the project, the plant and equipment can be scrapped for $300,000. What is the after-tax salvage value of this plant and equipment? (3 marks) d. The company will incur $2,300,000 in annual fixed costs. The plan is to manufacture 9,000 products per year and sell them at $800 per machine; the variable production costs are $365 per product. What is the annual operating cash flow (OCF) from this project? (3 marks) What is the cash flow in each year? Will you accept the project? (3 marks) Question 4 (15 marks) The company wants to build its new manufacturing plant on this land; the plant and equipment will cost $2,000,000 to build. The following is the current market structure: Debt: A company is looking at setting up a new manufacturing plant. This will be a three-year project. Common Stock: Preferred Stock: The company bought some land one years ago for $3 million. The land was appraised last month for $4.5 million. At the end of the project, the after-tax value of the land will be $7.2 million, but the company expects to keep the land for a future project. a. Market: 1,200 5.5 percent coupon bonds outstanding, 5 years to maturity, selling for 96 percent of par; the bonds have a $1,000 par value each and make quarterly payments. e. 18,000 shares outstanding, selling for $28 per share; the beta is 1.2. 3,500 shares of 7.0 percent preferred stock outstanding, selling for $82 per share, with par value of $100. 9 percent expected market returns; 3 percent risk-free rate. Underwriter charges the company spreads of 4 percent on new common stock issues, 3 percent on new preferred stock issues, and 2 percent on new debt issues. The company raise the funds needed to build the plant by using common stock, preferred stock, and debt based on the current capital structure. The tax rate is 25 percent. The project requires $520,000 in initial net working capital investment to get operational. Calculate the project's initial Time 0 cash flow. (3 marks) b. The new project is somewhat riskier than a typical project for the company. Ma gement has told you to use an adjustment factor of +2 percent to account for this increased riskiness. Calculate the appropriate discount rate to use when evaluating this new project. (3 marks) C. The manufacturing plant has a five-year tax life, and the company uses straight-line depreciation. At the end of the project, the plant and equipment can be scrapped for $300,000. What is the after-tax salvage value of this plant and equipment? (3 marks) d. The company will incur $2,300,000 in annual fixed costs. The plan is to manufacture 9,000 products per year and sell them at $800 per machine; the variable production costs are $365 per product. What is the annual operating cash flow (OCF) from this project? (3 marks) What is the cash flow in each year? Will you accept the project