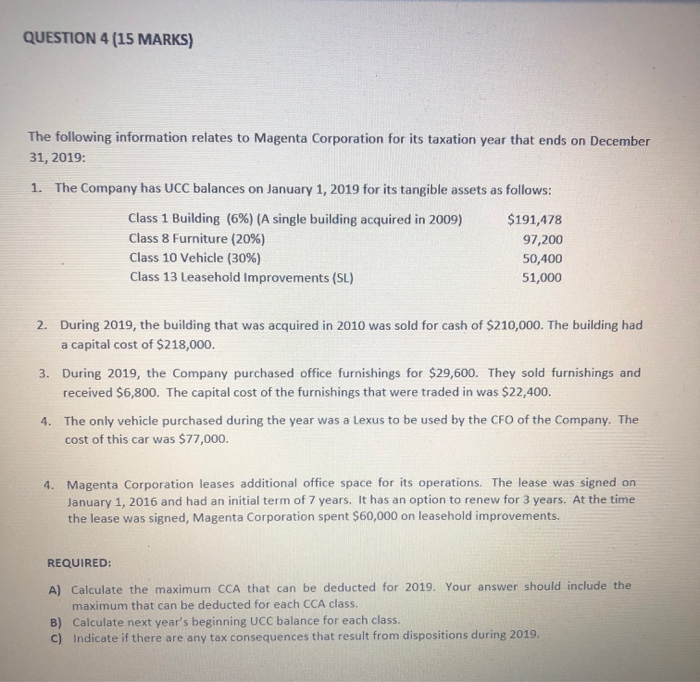

QUESTION 4 (15 MARKS) The following information relates to Magenta Corporation for its taxation year that ends on December 31, 2019: 1. The Company has UCC balances on January 1, 2019 for its tangible assets as follows: Class 1 Building (6%) (A single building acquired in 2009) $191,478 Class 8 Furniture (20%) 97,200 Class 10 Vehicle (30%) 50,400 Class 13 Leasehold Improvements (SL) 51,000 2. During 2019, the building that was acquired in 2010 was sold for cash of $210,000. The building had a capital cost of $218,000. 3. During 2019, the Company purchased office furnishings for $29,600. They sold furnishings and received $6,800. The capital cost of the furnishings that were traded in was $22,400. 4. The only vehicle purchased during the year was a Lexus to be used by the CFO of the Company. The cost of this car was $77,000. 4. Magenta Corporation leases additional office space for its operations. The lease was signed on January 1, 2016 and had an initial term of 7 years. It has an option to renew for 3 years. At the time the lease was signed, Magenta Corporation spent $60,000 on leasehold improvements. REQUIRED: A) Calculate the maximum CCA that can be deducted for 2019. Your answer should include the maximum that can be deducted for each CCA class. B) Calculate next year's beginning UCC balance for each class. c) Indicate if there are any tax consequences that result from dispositions during 2019. QUESTION 4 (15 MARKS) The following information relates to Magenta Corporation for its taxation year that ends on December 31, 2019: 1. The Company has UCC balances on January 1, 2019 for its tangible assets as follows: Class 1 Building (6%) (A single building acquired in 2009) $191,478 Class 8 Furniture (20%) 97,200 Class 10 Vehicle (30%) 50,400 Class 13 Leasehold Improvements (SL) 51,000 2. During 2019, the building that was acquired in 2010 was sold for cash of $210,000. The building had a capital cost of $218,000. 3. During 2019, the Company purchased office furnishings for $29,600. They sold furnishings and received $6,800. The capital cost of the furnishings that were traded in was $22,400. 4. The only vehicle purchased during the year was a Lexus to be used by the CFO of the Company. The cost of this car was $77,000. 4. Magenta Corporation leases additional office space for its operations. The lease was signed on January 1, 2016 and had an initial term of 7 years. It has an option to renew for 3 years. At the time the lease was signed, Magenta Corporation spent $60,000 on leasehold improvements. REQUIRED: A) Calculate the maximum CCA that can be deducted for 2019. Your answer should include the maximum that can be deducted for each CCA class. B) Calculate next year's beginning UCC balance for each class. c) Indicate if there are any tax consequences that result from dispositions during 2019