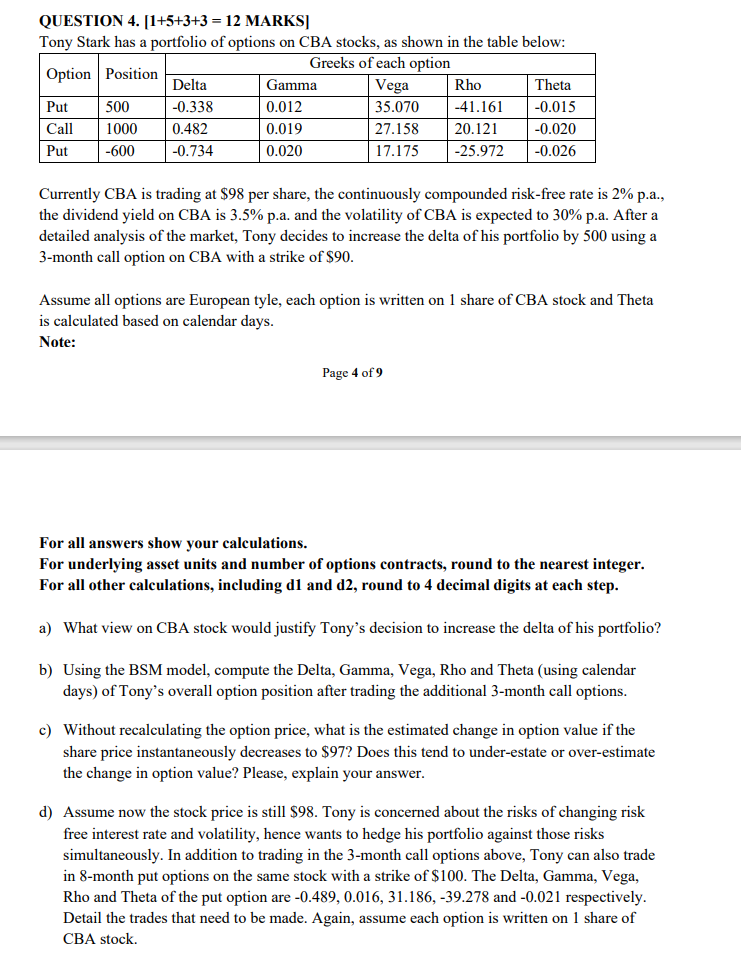

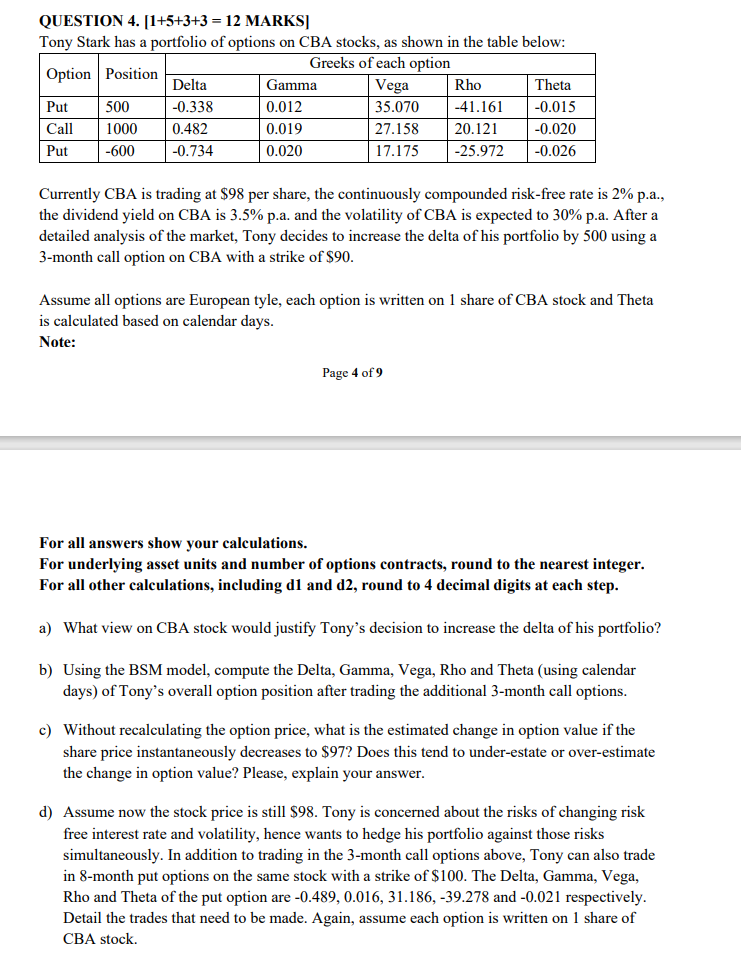

QUESTION 4. [1+5+3+3 = 12 MARKS] Tony Stark has a portfolio of options on CBA stocks, as shown in the table below: Greeks of each option Option Position Delta Gamma Vega Rho Theta Put 500 -0.338 0.012 35.070 -41.161 -0.015 1000 0.019 27.158 20.121 -0.020 Put -600 -0.734 0.020 17.175 -25.972 -0.026 Call 0.482 Currently CBA is trading at $98 per share, the continuously compounded risk-free rate is 2% p.a., the dividend yield on CBA is 3.5% p.a. and the volatility of CBA is expected to 30% p.a. After a detailed analysis of the market, Tony decides to increase the delta of his portfolio by 500 using a 3-month call option on CBA with a strike of $90. Assume all options are European tyle, each option is written on 1 share of CBA stock and Theta is calculated based on calendar days. Note: Page 4 of 9 For all answers show your calculations. For underlying asset units and number of options contracts, round to the nearest integer. For all other calculations, including di and d2, round to 4 decimal digits at each step. a) What view on CBA stock would justify Tony's decision to increase the delta of his portfolio? b) Using the BSM model, compute the Delta, Gamma, Vega, Rho and Theta (using calendar days) of Tony's overall option position after trading the additional 3-month call options. c) Without recalculating the option price, what is the estimated change in option value if the share price instantaneously decreases to $97? Does this tend to under-estate or over-estimate the change in option value? Please, explain your answer. d) Assume now the stock price is still $98. Tony is concerned about the risks of changing risk free interest rate and volatility, hence wants to hedge his portfolio against those risks simultaneously. In addition to trading in the 3-month call options above, Tony can also trade in 8-month put options on the same stock with a strike of $100. The Delta, Gamma, Vega, Rho and Theta of the put option are -0.489, 0.016, 31.186, -39.278 and -0.021 respectively. Detail the trades that need to be made. Again, assume each option is written on 1 share of CBA stock. QUESTION 4. [1+5+3+3 = 12 MARKS] Tony Stark has a portfolio of options on CBA stocks, as shown in the table below: Greeks of each option Option Position Delta Gamma Vega Rho Theta Put 500 -0.338 0.012 35.070 -41.161 -0.015 1000 0.019 27.158 20.121 -0.020 Put -600 -0.734 0.020 17.175 -25.972 -0.026 Call 0.482 Currently CBA is trading at $98 per share, the continuously compounded risk-free rate is 2% p.a., the dividend yield on CBA is 3.5% p.a. and the volatility of CBA is expected to 30% p.a. After a detailed analysis of the market, Tony decides to increase the delta of his portfolio by 500 using a 3-month call option on CBA with a strike of $90. Assume all options are European tyle, each option is written on 1 share of CBA stock and Theta is calculated based on calendar days. Note: Page 4 of 9 For all answers show your calculations. For underlying asset units and number of options contracts, round to the nearest integer. For all other calculations, including di and d2, round to 4 decimal digits at each step. a) What view on CBA stock would justify Tony's decision to increase the delta of his portfolio? b) Using the BSM model, compute the Delta, Gamma, Vega, Rho and Theta (using calendar days) of Tony's overall option position after trading the additional 3-month call options. c) Without recalculating the option price, what is the estimated change in option value if the share price instantaneously decreases to $97? Does this tend to under-estate or over-estimate the change in option value? Please, explain your answer. d) Assume now the stock price is still $98. Tony is concerned about the risks of changing risk free interest rate and volatility, hence wants to hedge his portfolio against those risks simultaneously. In addition to trading in the 3-month call options above, Tony can also trade in 8-month put options on the same stock with a strike of $100. The Delta, Gamma, Vega, Rho and Theta of the put option are -0.489, 0.016, 31.186, -39.278 and -0.021 respectively. Detail the trades that need to be made. Again, assume each option is written on 1 share of CBA stock