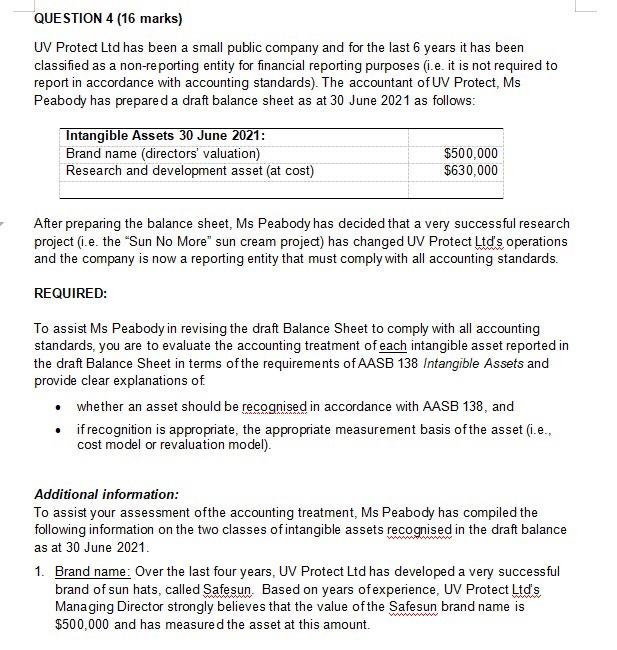

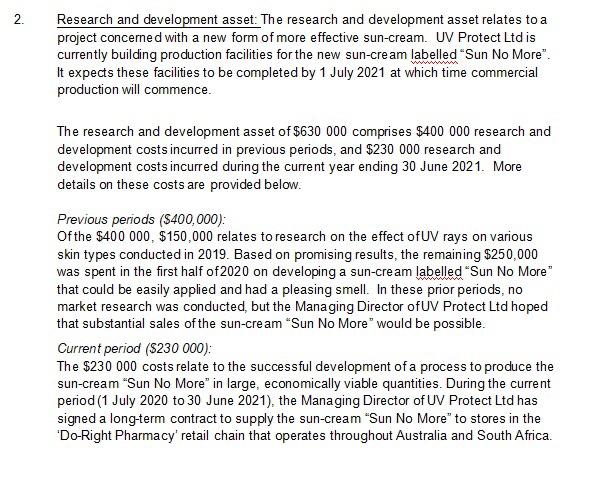

QUESTION 4 (16 marks) UV Protect Ltd has been a small public company and for the last 6 years it has been classified as a non-reporting entity for financial reporting purposes (i.e. it is not required to report in accordance with accounting standards). The accountant of UV Protect, Ms Peabody has prepared a draft balance sheet as at 30 June 2021 as follows: Intangible Assets 30 June 2021: Brand name (directors' valuation) Research and development asset (at cost) $500,000 $630,000 After preparing the balance sheet, Ms Peabody has decided that a very successful research project (i.e. the "Sun No More" sun cream project) has changed UV Protect Ltd's operations and the company is now a reporting entity that must comply with all accounting standards. REQUIRED: To assist Ms Peabody in revising the draft Balance Sheet to comply with all accounting standards, you are to evaluate the accounting treatment of each intangible asset reported in the draft Balance Sheet in terms of the requirements of AASB 138 Intangible Assets and provide clear explanations of whether an asset should be recognised in accordance with AASB 138, and if recognition is appropriate, the appropriate measurement basis of the asset (1.e., cost model or revaluation model). Additional information: To assist your assessment of the accounting treatment, Ms Peabody has compiled the following information on the two classes of intangible assets recognised in the draft balance as at 30 June 2021 1. Brand name: Over the last four years, UV Protect Ltd has developed a very successful brand of sun hats, called Safesun. Based on years of experience, UV Protect Ltd's Managing Director strongly believes that the value of the Safesun brand name is $500,000 and has measured the asset at this amount. 2. Research and development asset: The research and development asset relates to a project concerned with a new form of more effective sun-cream. UV Protect Ltd is currently building production facilities for the new sun-cre am labelled "Sun No More". It expects these facilities to be completed by 1 July 2021 at which time commercial production will commence. The research and development asset of $630 000 comprises $400 000 research and development costs incurred in previous periods, and $230 000 research and development costs incurred during the current year ending 30 June 2021. More details on these costs are provided below. Previous periods ($400,000): Of the $400 000, $150,000 relates to research on the effect of UV rays on various skin types conducted in 2019. Based on promising results, the remaining $250,000 was spent in the first half of 2020 on developing a sun-cre am labelled "Sun No More" that could be easily applied and had a pleasing smell. In these prior periods, no market research was conducted, but the Managing Director of UV Protect Ltd hoped that substantial sales of the sun-cream "Sun No More" would be possible. Current period (5230 000): The $230 000 costs relate to the successful development of a process to produce the sun-cream "Sun No More" in large, economically viable quantities. During the current period (1 July 2020 to 30 June 2021), the Managing Director of UV Protect Ltd has signed a long-term contract to supply the sun-cream "Sun No More" to stores in the 'Do-Right Pharmacy' retail chain that operates throughout Australia and South Africa