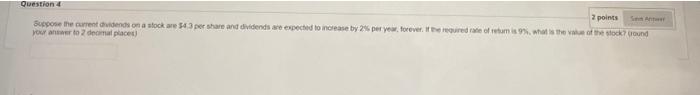

Question: Question 4 2 points Suppose the current dividends on a stock are $4.3 per share and dividends are expected to increase by 2% per year,

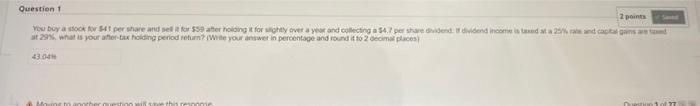

Question 4 2 points Suppose the current dividends on a stock are $4.3 per share and dividends are expected to increase by 2% per year, forever. If the required rate of retum is 9%, what is the value of the stock? (round your answer to 2 decimal places) Question 1 2 points You buy a stock for $41 per share and sell it for $59 atter holding it for slightly over a year and collecting a $4.7 per share dividend. If dividend income is taxed at a 25% rate and capital gains a at 29%, what is your after-tax holding period return? (Write your answer in percentage and round it to 2 decimal places) 43.04 this response

Step by Step Solution

There are 3 Steps involved in it

Get step-by-step solutions from verified subject matter experts