Answered step by step

Verified Expert Solution

Question

1 Approved Answer

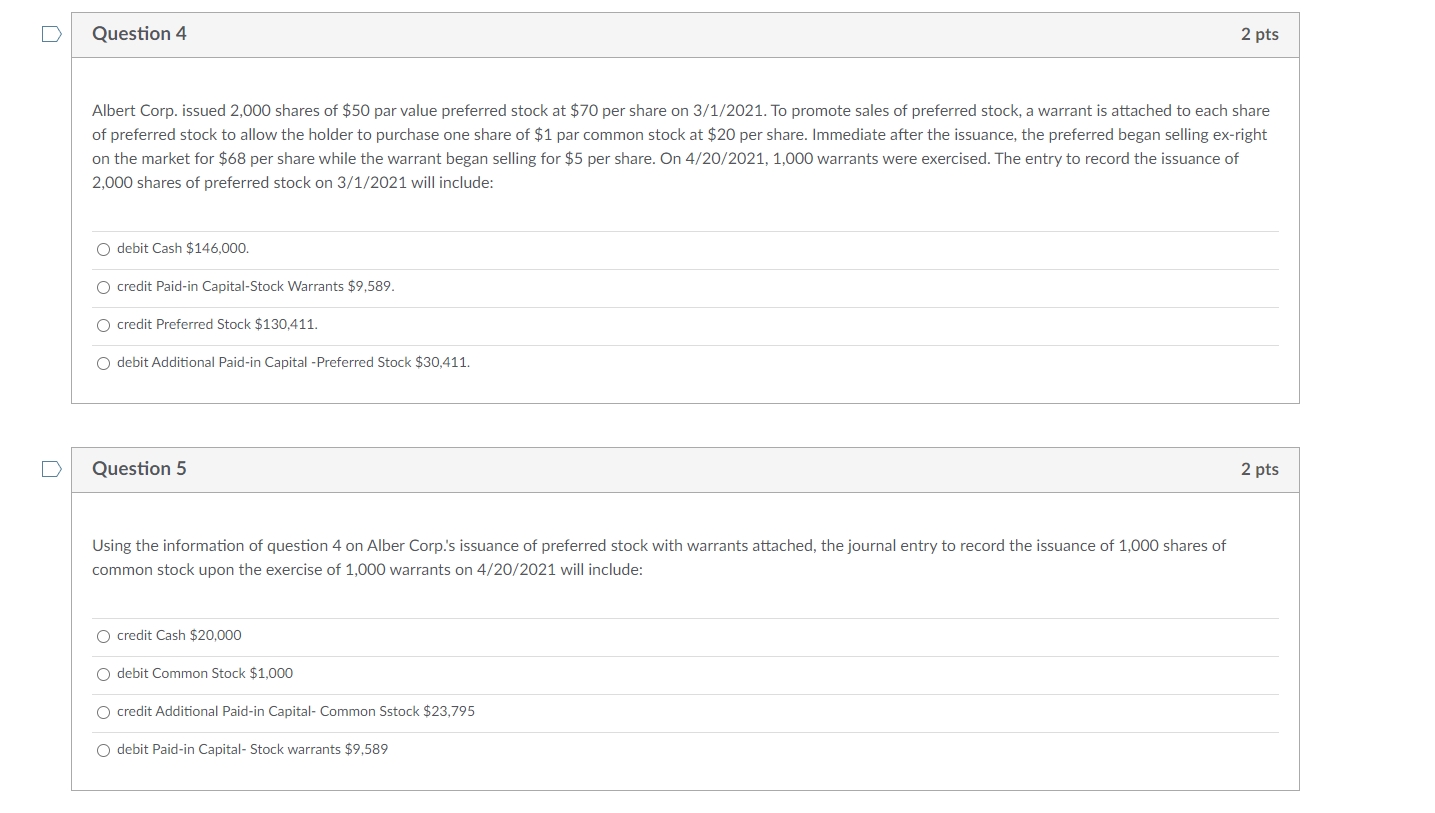

Question 4 2 pts Albert Corp. issued 2,000 shares of $50 par value preferred stock at $70 per share on 3/1/2021. To promote sales

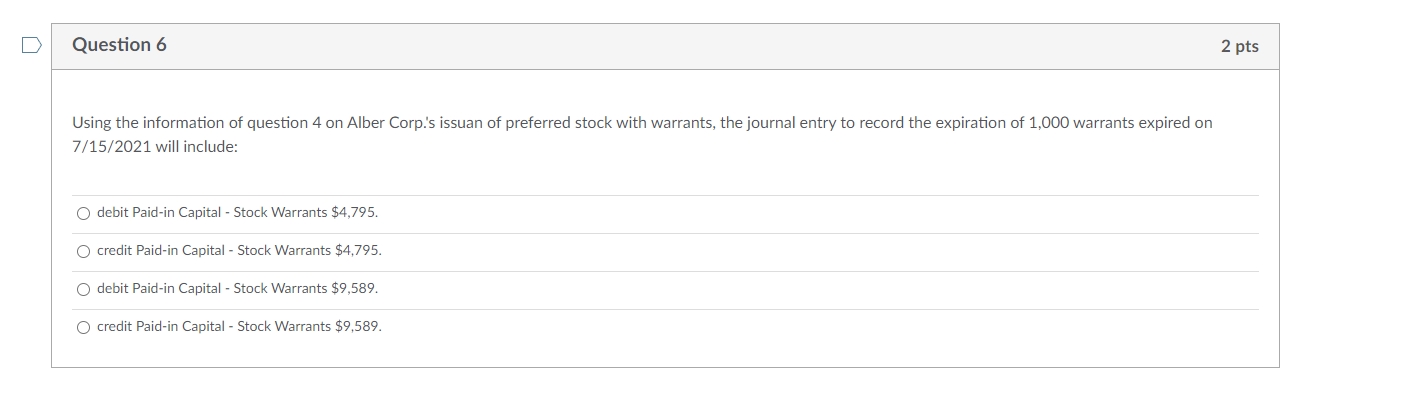

Question 4 2 pts Albert Corp. issued 2,000 shares of $50 par value preferred stock at $70 per share on 3/1/2021. To promote sales of preferred stock, a warrant is attached to each share of preferred stock to allow the holder to purchase one share of $1 par common stock at $20 per share. Immediate after the issuance, the preferred began selling ex-right on the market for $68 per share while the warrant began selling for $5 per share. On 4/20/2021, 1,000 warrants were exercised. The entry to record the issuance of 2,000 shares of preferred stock on 3/1/2021 will include: debit Cash $146,000. credit Paid-in Capital-Stock Warrants $9,589. credit Preferred Stock $130,411. O debit Additional Paid-in Capital -Preferred Stock $30,411. Question 5 Using the information of question 4 on Alber Corp.'s issuance of preferred stock with warrants attached, the journal entry to record the issuance of 1,000 shares of common stock upon the exercise of 1,000 warrants on 4/20/2021 will include: credit Cash $20,000 debit Common Stock $1,000 credit Additional Paid-in Capital- Common Sstock $23,795 debit Paid-in Capital-Stock warrants $9,589 2 pts Question 6 Using the information of question 4 on Alber Corp.'s issuan of preferred stock with warrants, the journal entry to record the expiration of 1,000 warrants expired on 7/15/2021 will include: debit Paid-in Capital - Stock Warrants $4,795. credit Paid-in Capital - Stock Warrants $4,795. debit Paid-in Capital - Stock Warrants $9,589. credit Paid-in Capital - Stock Warrants $9,589. 2 pts

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Answer Question 4 The journal entry to record the issuance of 2000 shares of 50 par value preferred ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started