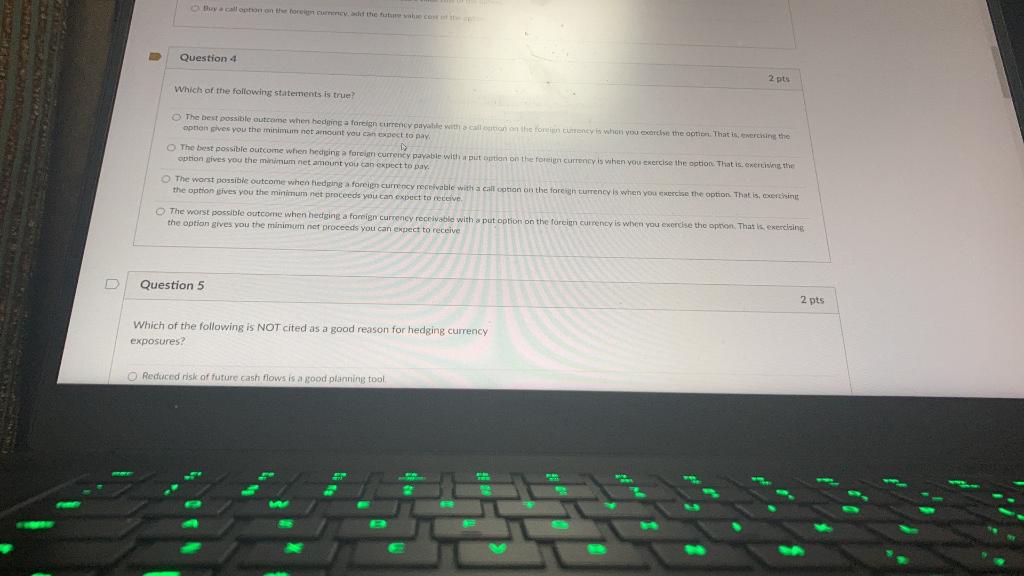

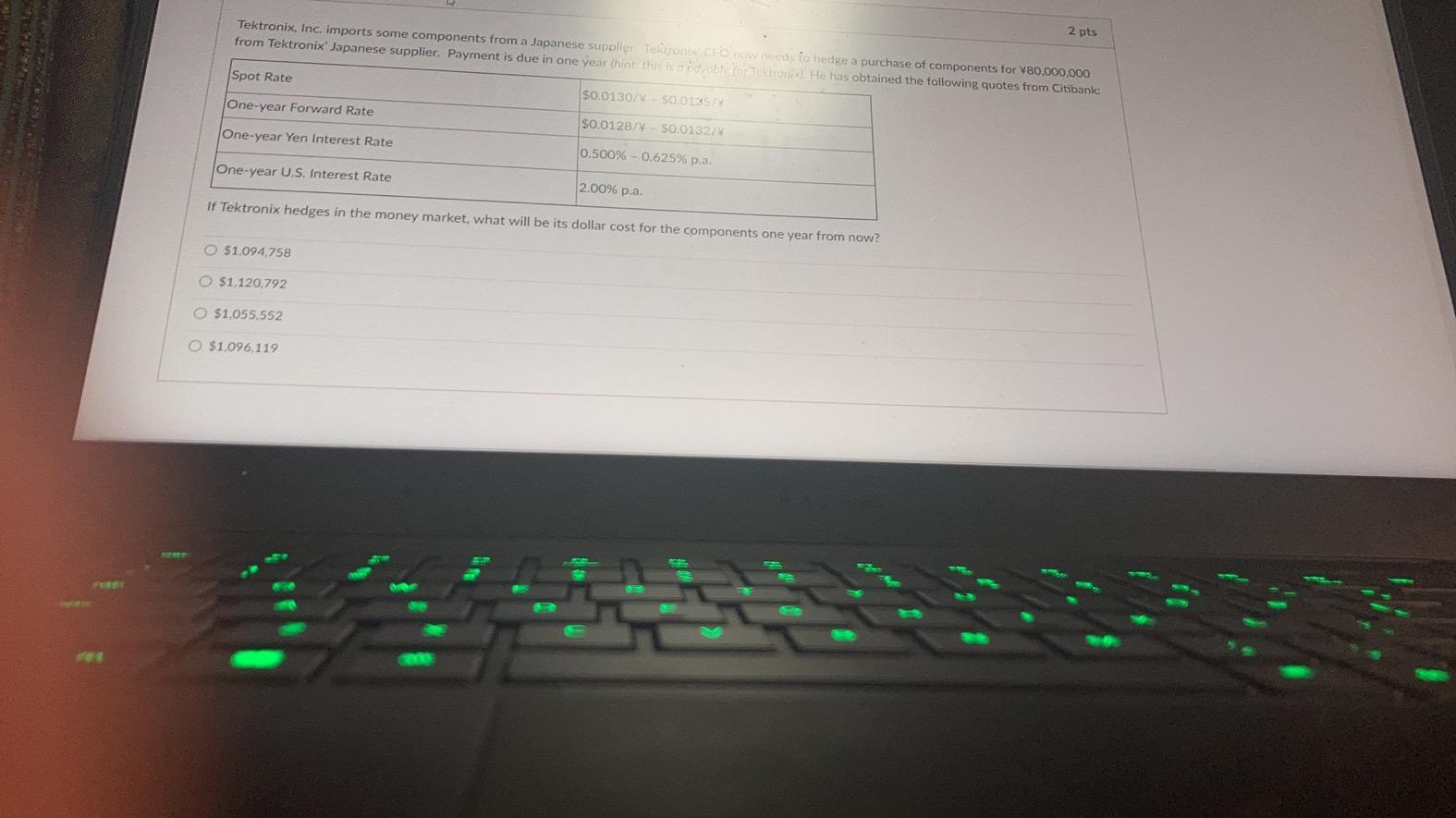

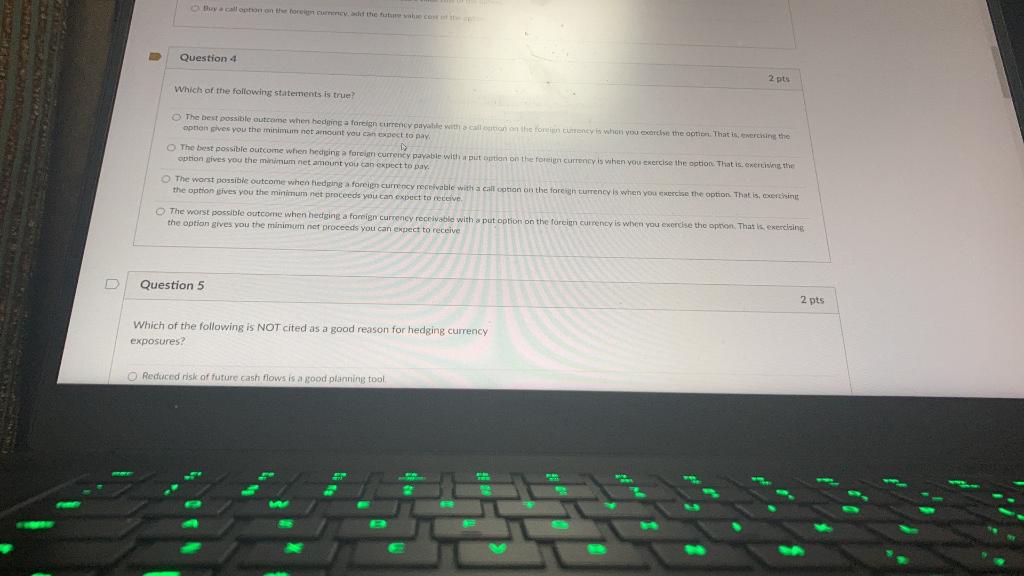

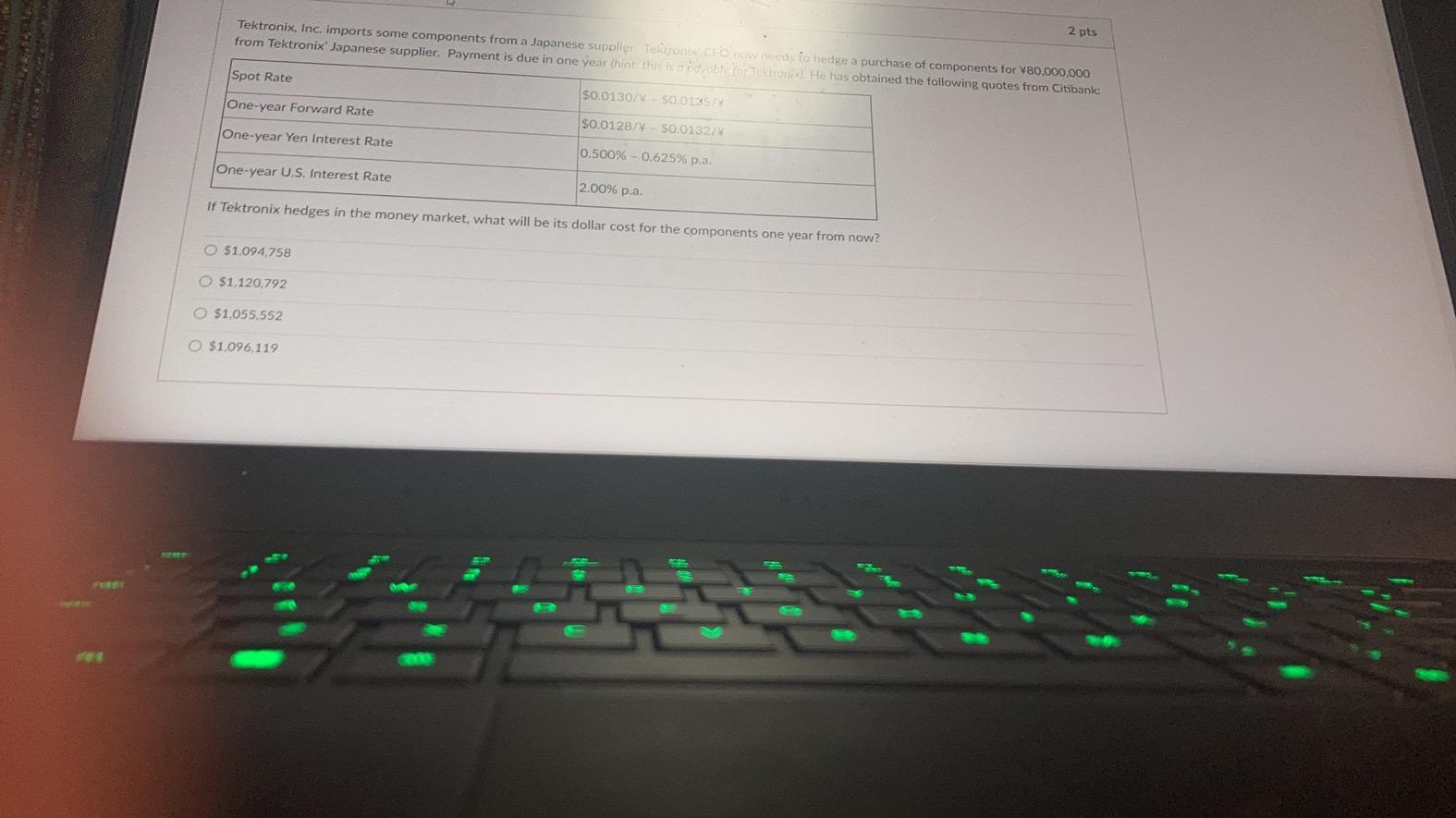

Question 4 2 pts Which of the following statements is true? The best possible outcome when hedging a foreign currency payable with cleation on the roman currency is when you the the option. That is, twin the option gives you the minimum net amount you can expect to pay The best possible outcome when hedging foreign currency payable with a putution on the foreign currency is when you exercise the option. That is exercising the option gives you the minimum net amount you can expect to pay The worst possible outcome when hedging a foreign currency receivable with a call option on the foreign currency is when you exercise the option. That is thing the option gives you the minimum net proceeds you can expect to receive The worst possible outcome when hedging a foreign currency receivable with a put option on the foreign currency is when you exerdse the option. That is exercising the option gives you the minimum net proceeds you can expect to receive Question 5 2 pts Which of the following is NOT cited as a good reason for hedging currency exposures? Reduced risk of future cash flows is a good planning tool Tektronix. Inc. imports some components from a Japanese supplier Teknoloowhead to hedge a purchase of components for 480,000,000 from Tektronix Japanese supplier. Payment is due in one year (hint this to pay able to sektionis). He has obtained the following quotes from Citibank: 2 pts Spot Rate $0.01307 $0.019574 One-year Forward Rate $0.0128/4 - $0.0132/ One-year Yen Interest Rate 0.500% - 0.625% p.a. One-year U.S. Interest Rate 2.00% p.a. If Tektronix hedges in the money market, what will be its dollar cost for the components one year from now? O $1.094.758 o $1.120.792 $1.055.552 O $1.096,119 Question 4 2 pts Which of the following statements is true? The best possible outcome when hedging a foreign currency payable with cleation on the roman currency is when you the the option. That is, twin the option gives you the minimum net amount you can expect to pay The best possible outcome when hedging foreign currency payable with a putution on the foreign currency is when you exercise the option. That is exercising the option gives you the minimum net amount you can expect to pay The worst possible outcome when hedging a foreign currency receivable with a call option on the foreign currency is when you exercise the option. That is thing the option gives you the minimum net proceeds you can expect to receive The worst possible outcome when hedging a foreign currency receivable with a put option on the foreign currency is when you exerdse the option. That is exercising the option gives you the minimum net proceeds you can expect to receive Question 5 2 pts Which of the following is NOT cited as a good reason for hedging currency exposures? Reduced risk of future cash flows is a good planning tool Tektronix. Inc. imports some components from a Japanese supplier Teknoloowhead to hedge a purchase of components for 480,000,000 from Tektronix Japanese supplier. Payment is due in one year (hint this to pay able to sektionis). He has obtained the following quotes from Citibank: 2 pts Spot Rate $0.01307 $0.019574 One-year Forward Rate $0.0128/4 - $0.0132/ One-year Yen Interest Rate 0.500% - 0.625% p.a. One-year U.S. Interest Rate 2.00% p.a. If Tektronix hedges in the money market, what will be its dollar cost for the components one year from now? O $1.094.758 o $1.120.792 $1.055.552 O $1.096,119