Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Benny, a British temporarily residing in Hong Kong, acquired a factory unit from Good Property Developing Company Limited, the developer of the factory building,

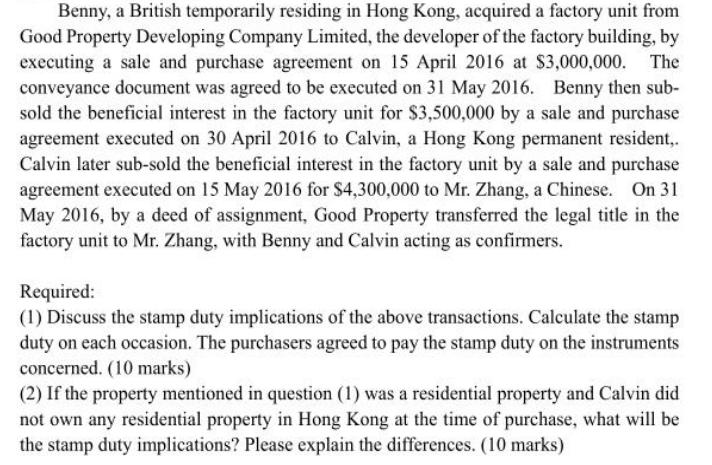

Benny, a British temporarily residing in Hong Kong, acquired a factory unit from Good Property Developing Company Limited, the developer of the factory building, by executing a sale and purchase agreement on 15 April 2016 at $3,000,000. conveyance document was agreed to be executed on 31 May 2016. Benny then sub- sold the beneficial interest in the factory unit for $3,500,000 by a sale and purchase agreement executed on 30 April 2016 to Calvin, a Hong Kong permanent resident,. Calvin later sub-sold the beneficial interest in the factory unit by a sale and purchase agreement executed on 15 May 2016 for $4,300,000 to Mr. Zhang, a Chinese. On 31 May 2016, by a deed of assignment, Good Property transferred the legal title in the factory unit to Mr. Zhang, with Benny and Calvin acting as confirmers. Required: (1) Discuss the stamp duty implications of the above transactions. Calculate the stamp duty on each occasion. The purchasers agreed to pay the stamp duty on the instruments concerned. (10 marks) (2) If the property mentioned in question (1) was a residential property and Calvin did not own any residential property in Hong Kong at the time of purchase, what will be the stamp duty implications? Please explain the differences. (10 marks)

Step by Step Solution

★★★★★

3.50 Rating (153 Votes )

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started