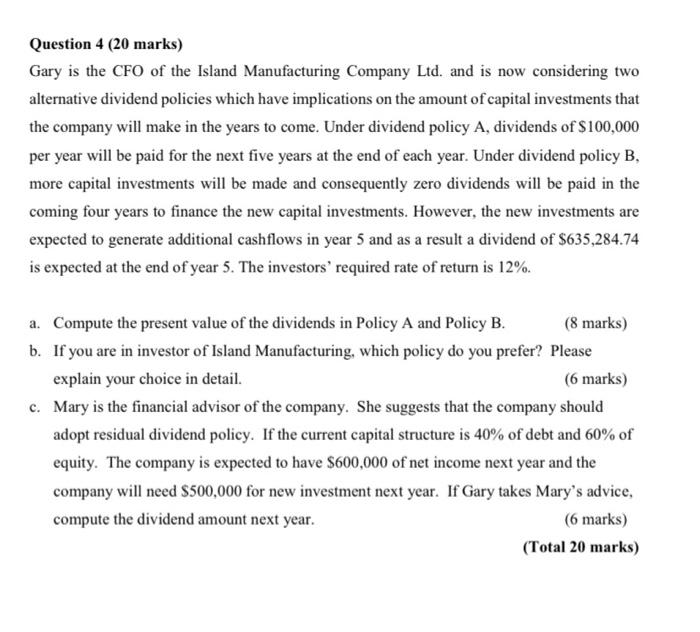

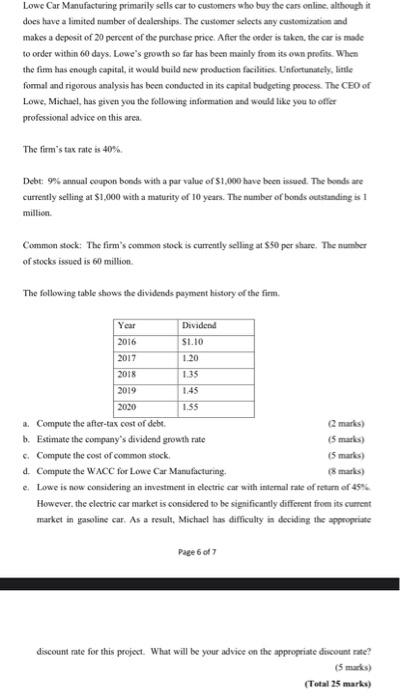

Question 4 (20 marks) Gary is the CFO of the Island Manufacturing Company Ltd. and is now considering two alternative dividend policies which have implications on the amount of capital investments that the company will make in the years to come. Under dividend policy A, dividends of $100,000 per year will be paid for the next five years at the end of each year. Under dividend policy B, more capital investments will be made and consequently zero dividends will be paid in the coming four years to finance the new capital investments. However, the new investments are expected to generate additional cashflows in year 5 and as a result a dividend of $635,284.74 is expected at the end of year 5. The investors' required rate of return is 12%. a. Compute the present value of the dividends in Policy A and Policy B. (8 marks) b. If you are in investor of Island Manufacturing, which policy do you prefer? Please explain your choice in detail. (6 marks) c. Mary is the financial advisor of the company. She suggests that the company should adopt residual dividend policy. If the current capital structure is 40% of debt and 60% of equity. The company is expected to have $600,000 of net income next year and the company will need $500,000 for new investment next year. If Gary takes Mary's advice, compute the dividend amount next year. (6 marks) (Total 20 marks) Lowe Car Manufacturing primarily sells car to customers who buy the cars online, although it does have a limited number of dealerships. The customer selects any customizations and makes a deposit of 20 percent of the purchase price. After the order is taken, the car is made to order within 60 days. Lowe's growth so far has been mainly from its own profits. When the firm has enough capital, it would build new production facilities. Unfortunately, litle formal and rigorous analysis has been conducted in its capital budgeting process. The CEO of Lowe, Michael, has given you the following information and would like you to offer professional advice on this area. The firm's tax rate is 40% Debt: 9% annual coupon bonds with a par value of $1,000 have been issued. The bends are currently selling at $1,000 with a maturity of 10 years. The number of bonds outstanding ist million Common stock: The firm's common stock is currently selling at $50 per share. The number of stocks issued is 60 million The following table shows the dividends payment history of the firm Year Duvidend 2016 S1.10 2017 1.20 2018 1.35 2019 2020 1.55 & Compute the after-tax cost of debt (2 marks) b. Estimate the company's dividend growth rate 6. Compute the cost of common stock 5 marks) & Compute the WACC for Lowe Car Manufacturing e Lowe is now considering an investment in electric car with internal rate of return of 45% However, the electric car market is considered to be significantly different from its current market in gasoline car. As a result, Michael has difficulty in deciding the appropriate Page 6 of 7 discount rate for this project. What will be your advice on the appropriate discount rate? (5 marks) (Total 25 marks)