Answered step by step

Verified Expert Solution

Question

1 Approved Answer

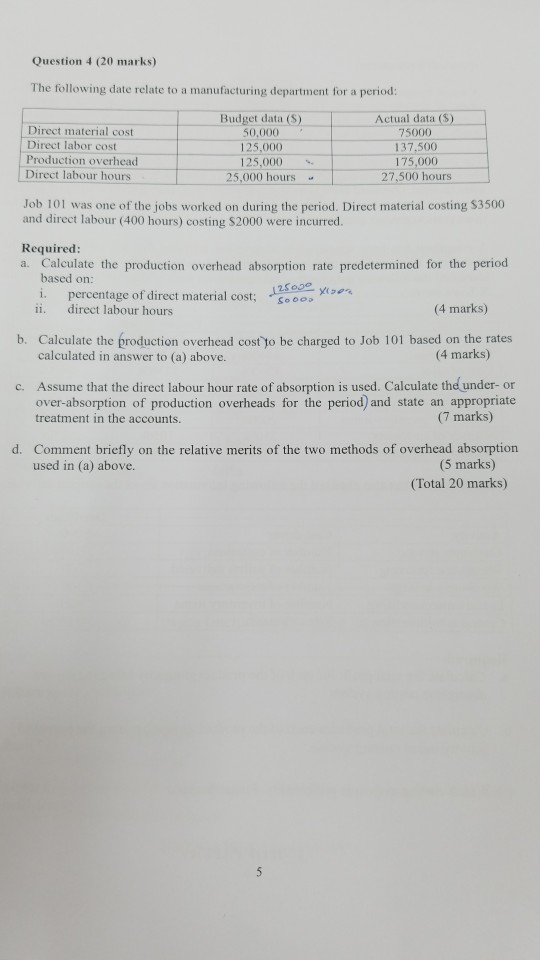

Question 4 (20 marks) The following date relate to a manufacturing department for a period: Direct material cost Direct labor cost Production overhead Direct labour

Question 4 (20 marks) The following date relate to a manufacturing department for a period: Direct material cost Direct labor cost Production overhead Direct labour hours Budget data (S) 50,000 125,000 125.000 25,000 hours Actual data (S) 75000 137,500 175,000 27.500 hours 125000 SODO Job 101 was one of the jobs worked on during the period. Direct material costing S3500 and direct labour (400 hours) costing S2000 were incurred. Required: a. Calculate the production overhead absorption rate predetermined for the period based on: i. percentage of direct material cost; direct labour hours (4 marks) b. Calculate the production overhead cost to be charged to Job 101 based on the rates calculated in answer to (a) above. (4 marks) C. Assume that the direct labour hour rate of absorption is used. Calculate the under-or over-absorption of production overheads for the period) and state an appropriate treatment in the accounts. (7 marks) d. Comment briefly on the relative merits of the two methods of overhead absorption used in (a) above. (5 marks) (Total 20 marks) 5

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started