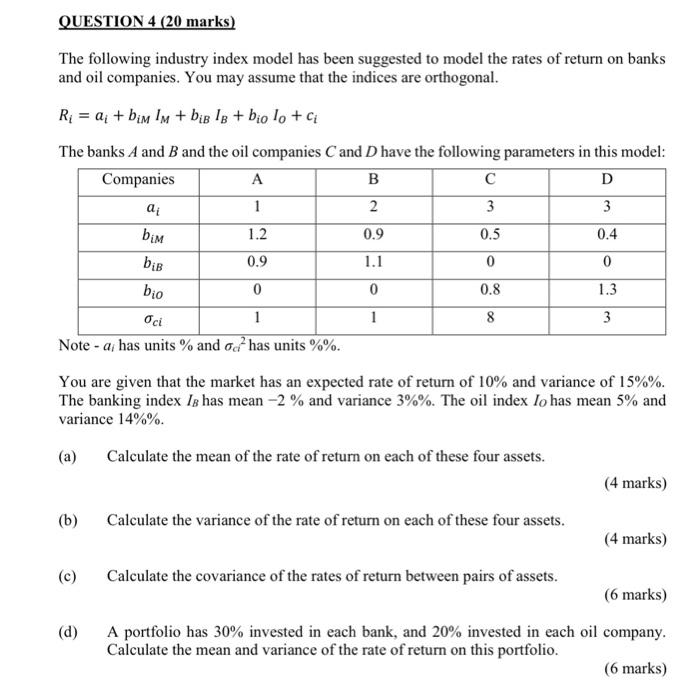

QUESTION 4 (20 marks) The following industry index model has been suggested to model the rates of return on banks and oil companies. You may assume that the indices are orthogonal. R; = ai + bim IM + bis 18 + bio lo + c The banks A and B and the oil companies and Dhave the following parameters in this model: Companies A B D a 1 2 3 3 1.2 0.9 0.5 0.4 biM biB 0.9 1.1 0 0 bio 0 0 0.8 1.3 Oci 1 1 8 3 Note - a; has units % and oc/has units %%. You are given that the market has an expected rate of return of 10% and variance of 15%%. The banking index Ig has mean -2% and variance 3%%. The oil index lo has mean 5% and variance 14%%. (a) (b) Calculate the mean of the rate of return on each of these four assets. (4 marks) Calculate the variance of the rate of return on each of these four assets. (4 marks) Calculate the covariance of the rates of return between pairs of assets. (6 marks) A portfolio has 30% invested in each bank, and 20% invested in each oil company. Calculate the mean and variance of the rate of return on this portfolio. (6 marks) (c) (d) QUESTION 4 (20 marks) The following industry index model has been suggested to model the rates of return on banks and oil companies. You may assume that the indices are orthogonal. R; = ai + bim IM + bis 18 + bio lo + c The banks A and B and the oil companies and Dhave the following parameters in this model: Companies A B D a 1 2 3 3 1.2 0.9 0.5 0.4 biM biB 0.9 1.1 0 0 bio 0 0 0.8 1.3 Oci 1 1 8 3 Note - a; has units % and oc/has units %%. You are given that the market has an expected rate of return of 10% and variance of 15%%. The banking index Ig has mean -2% and variance 3%%. The oil index lo has mean 5% and variance 14%%. (a) (b) Calculate the mean of the rate of return on each of these four assets. (4 marks) Calculate the variance of the rate of return on each of these four assets. (4 marks) Calculate the covariance of the rates of return between pairs of assets. (6 marks) A portfolio has 30% invested in each bank, and 20% invested in each oil company. Calculate the mean and variance of the rate of return on this portfolio. (6 marks) (c) (d)