Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (20 marks) Your best friend Trevor has been given a project by his new boss at the Bank. Trevor has never used one

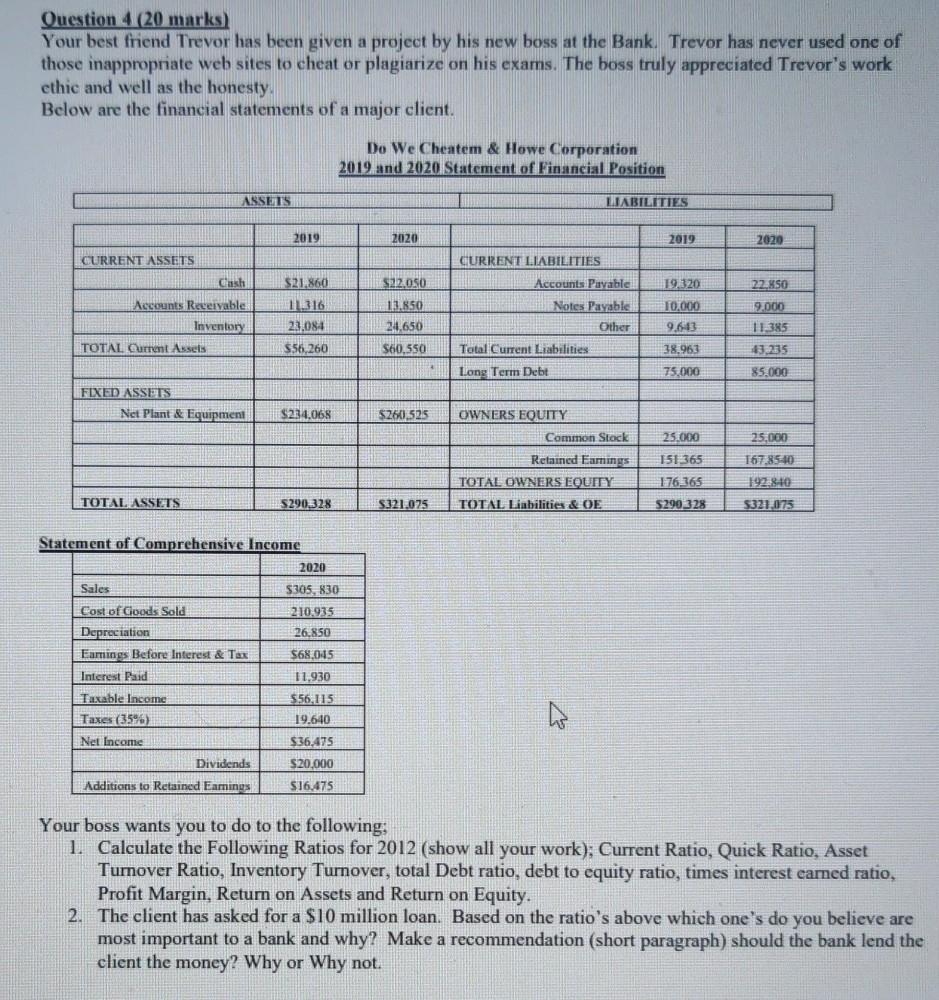

Question 4 (20 marks) Your best friend Trevor has been given a project by his new boss at the Bank. Trevor has never used one of those inappropriate web sites to cheat or plagiarize on his exams. The boss truly appreciated Trevor's work ethic and well as the honesty Below are the financial statements of a major client. Do We Cheatem & Howe Corporation 2019 and 2020 Statement of Financial Position ASSETS LIABILITIES 2019 2020 2019 2020 CURRENT ASSETS CURRENT LIABILITIES $22050 19,320 Cash Accounts Receivable Inventory TOTAL Current Assets $21,860 11316 21.084 12.850 24,650 Accounts Payable Notes Payable Other Total Current Liabilities Long Term Debt 10.000 9.6.13 27450 19.000 11.385 3235 $56,260 $60.550 38,963 75.000 85.000 FIXED ASSETS Net Plant & Equipment $234,068 $260.525 25.000 25,000 OWNERS EQUITY Common Stock Retained Earnings TOTAL OWNERS EQUITY TOTAL Liabilities & OE 151365 176365 167,8540 1922840 TOTAL ASSETS 5290328 $321.075 S290 328 $321,075 Statement of Comprehensive Income 2020 Sales 5305, 830 Cost of Cloods Sold 210,935 Depreciation 26.850 Eamings Before Interest & Tax $68,045 Interest Paid 11,930 Taxable Income $56,115 Taxes (3546) 19.610 Net Income $36,475 Dividends $20,000 Additions to Retained Eamines $16,475 Your boss wants you to do to the following: 1. Calculate the Following Ratios for 2012 (show all your work), Current Ratio, Quick Ratio, Asset Turnover Ratio, Inventory Turnover, total Debt ratio, debt to equity ratio, times interest earned ratio, Profit Margin, Retum on Assets and Return on Equity. 2. The client has asked for a $10 million loan. Based on the ratio's above which one's do you believe are most important to a bank and why? Make a recommendation (short paragraph) should the bank lend the client the money? Why or Why not

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started