.

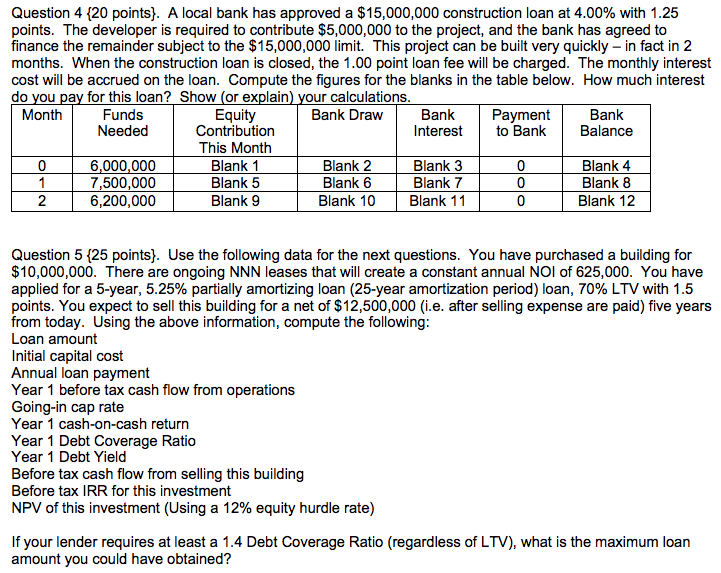

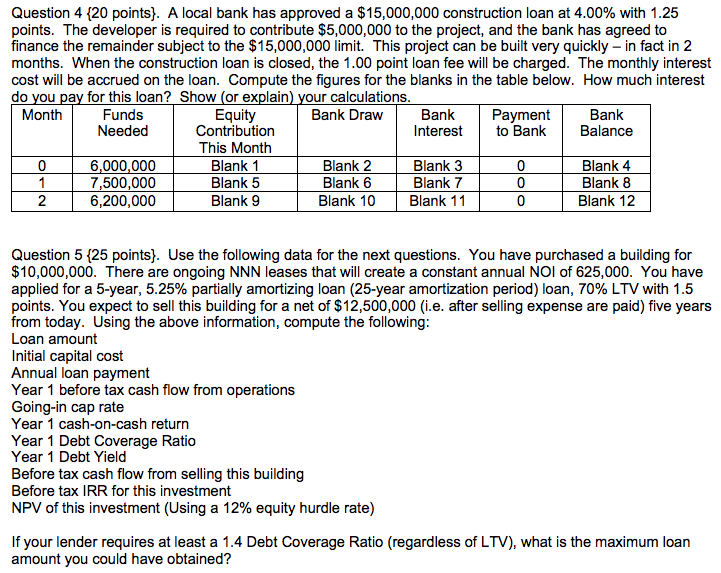

Question 4 20 points). A local bank has approved a $15,000,000 construction loan at 4.00% with 1.25 points. The developer is required to contribute $5,000,000 to the project, and the bank has agreed to finance the remainder subject to the $15,000,000 limit. This project can be built very quickly - in fact in 2 months. When the construction loan is closed, the 1.00 point loan fee will be charged. The monthly interest cost will be accrued on the loan. Compute the figures for the blanks in the table below. How much interest do you pay for this loan? Show (or explain) your calculations. Month Funds Equity Bank Draw Bank Bank Needed Contribution Interest to Bank Balance This Month 6,000,000 Blank 1 Blank 2 Blank 3 Blank 4 1 7,500,000 Blank 5 Blank 6 Blank 7 0 Blank 8 2 6 ,200,000 Blank 9 Blank 10 Blank 11 0 Blank 12 O Question 5 (25 points). Use the following data for the next questions. You have purchased a building for $10,000,000. There are ongoing NNN leases that will create a constant annual NOI of 625,000. You have applied for a 5-year, 5.25% partially amortizing loan (25-year amortization period) loan, 70% LTV with 1.5 points. You expect to sell this building for a net of $12,500,000 (i.e. after selling expense are paid) five years from today. Using the above information, compute the following: Loan amount Initial capital cost Annual loan payment Year 1 before tax cash flow from operations Going-in cap rate Year 1 cash-on-cash return Year 1 Debt Coverage Ratio Year 1 Debt Yield Before tax cash flow from selling this building Before tax IRR for this investment NPV of this investment (Using a 12% equity hurdle rate) If your lender requires at least a 1.4 Debt Coverage Ratio (regardless of LTV), what is the maximum loan amount you could have obtained? Question 4 20 points). A local bank has approved a $15,000,000 construction loan at 4.00% with 1.25 points. The developer is required to contribute $5,000,000 to the project, and the bank has agreed to finance the remainder subject to the $15,000,000 limit. This project can be built very quickly - in fact in 2 months. When the construction loan is closed, the 1.00 point loan fee will be charged. The monthly interest cost will be accrued on the loan. Compute the figures for the blanks in the table below. How much interest do you pay for this loan? Show (or explain) your calculations. Month Funds Equity Bank Draw Bank Bank Needed Contribution Interest to Bank Balance This Month 6,000,000 Blank 1 Blank 2 Blank 3 Blank 4 1 7,500,000 Blank 5 Blank 6 Blank 7 0 Blank 8 2 6 ,200,000 Blank 9 Blank 10 Blank 11 0 Blank 12 O Question 5 (25 points). Use the following data for the next questions. You have purchased a building for $10,000,000. There are ongoing NNN leases that will create a constant annual NOI of 625,000. You have applied for a 5-year, 5.25% partially amortizing loan (25-year amortization period) loan, 70% LTV with 1.5 points. You expect to sell this building for a net of $12,500,000 (i.e. after selling expense are paid) five years from today. Using the above information, compute the following: Loan amount Initial capital cost Annual loan payment Year 1 before tax cash flow from operations Going-in cap rate Year 1 cash-on-cash return Year 1 Debt Coverage Ratio Year 1 Debt Yield Before tax cash flow from selling this building Before tax IRR for this investment NPV of this investment (Using a 12% equity hurdle rate) If your lender requires at least a 1.4 Debt Coverage Ratio (regardless of LTV), what is the maximum loan amount you could have obtained