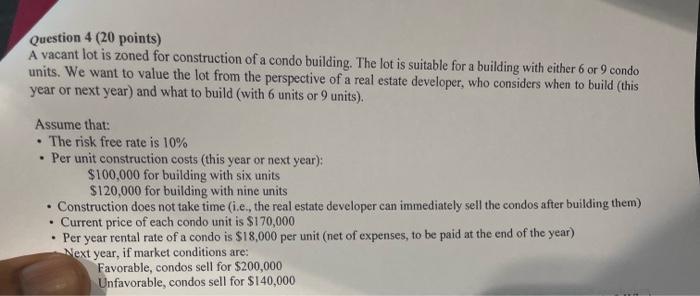

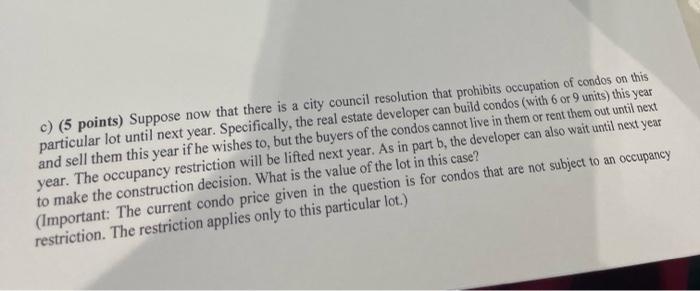

Question 4 (20 points) A vacant lot is zoned for construction of a condo building. The lot is suitable for a building with either 6 or 9 condo units. We want to value the lot from the perspective of a real estate developer, who considers when to build this year or next year) and what to build (with 6 units or 9 units). . Assume that: The risk free rate is 10% Per unit construction costs (this year or next year): $100,000 for building with six units $120,000 for building with nine units . Construction does not take time (i.e., the real estate developer can immediately sell the condos after building them) Current price of each condo unit is $170,000 Per year rental rate of a condo is $18,000 per unit (net of expenses, to be paid at the end of the year) Next year, if market conditions are: Favorable, condos sell for $200,000 Unfavorable, condos sell for $140,000 . c) (5 points) Suppose now that there is a city council resolution that prohibits occupation of condos on this particular lot until next year. Specifically, the real estate developer can build condos (with 6 or 9 units) this year and sell them this year if he wishes to, but the buyers of the condos cannot live in them or rent them out until next year. The occupancy restriction will be lifted next year. As in part b, the developer can also wait until next year to make the construction decision. What is the value of the lot in this case? (Important: The current condo price given in the question is for condos that are not subject to an occupancy restriction. The restriction applies only to this particular lot.) Question 4 (20 points) A vacant lot is zoned for construction of a condo building. The lot is suitable for a building with either 6 or 9 condo units. We want to value the lot from the perspective of a real estate developer, who considers when to build this year or next year) and what to build (with 6 units or 9 units). . Assume that: The risk free rate is 10% Per unit construction costs (this year or next year): $100,000 for building with six units $120,000 for building with nine units . Construction does not take time (i.e., the real estate developer can immediately sell the condos after building them) Current price of each condo unit is $170,000 Per year rental rate of a condo is $18,000 per unit (net of expenses, to be paid at the end of the year) Next year, if market conditions are: Favorable, condos sell for $200,000 Unfavorable, condos sell for $140,000 . c) (5 points) Suppose now that there is a city council resolution that prohibits occupation of condos on this particular lot until next year. Specifically, the real estate developer can build condos (with 6 or 9 units) this year and sell them this year if he wishes to, but the buyers of the condos cannot live in them or rent them out until next year. The occupancy restriction will be lifted next year. As in part b, the developer can also wait until next year to make the construction decision. What is the value of the lot in this case? (Important: The current condo price given in the question is for condos that are not subject to an occupancy restriction. The restriction applies only to this particular lot.)