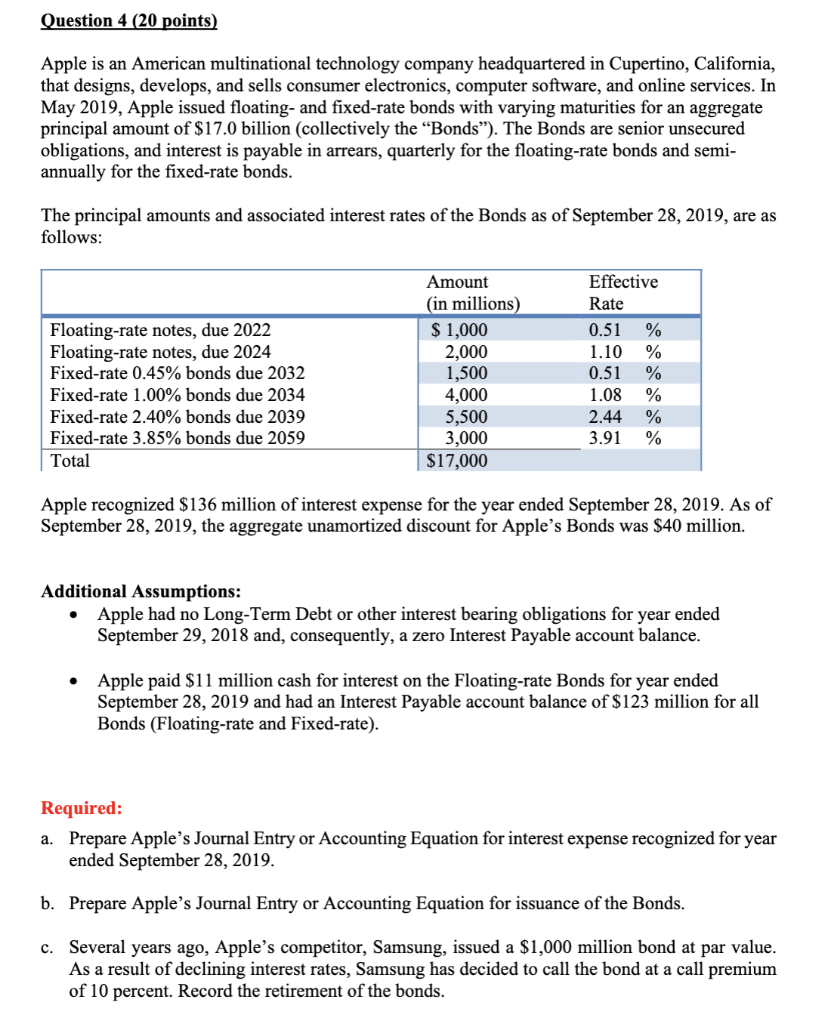

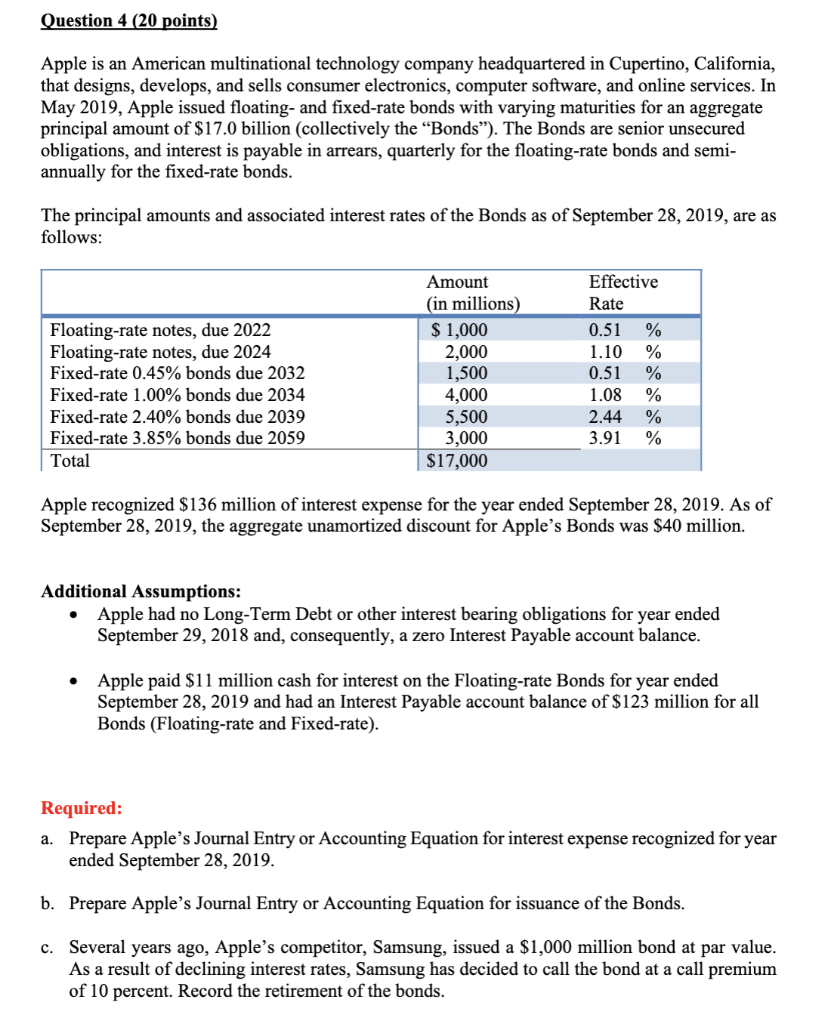

Question 4 (20 points) Apple is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. In May 2019, Apple issued floating- and fixed-rate bonds with varying maturities for an aggregate principal amount of $17.0 billion (collectively the Bonds). The Bonds are senior unsecured obligations, and interest is payable in arrears, quarterly for the floating-rate bonds and semi- annually for the fixed-rate bonds. The principal amounts and associated interest rates of the Bonds as of September 28, 2019, are as follows: Effective Rate Floating-rate notes, due 2022 Floating-rate notes, due 2024 Fixed-rate 0.45% bonds due 2032 Fixed-rate 1.00% bonds due 2034 Fixed-rate 2.40% bonds due 2039 Fixed-rate 3.85% bonds due 2059 Total Amount (in millions) $ 1,000 2,000 1,500 4,000 5,500 3,000 $17,000 0.51 1.10 0.51 1.08 2.44 3.91 % % % % % % Apple recognized $136 million of interest expense for the year ended September 28, 2019. As of September 28, 2019, the aggregate unamortized discount for Apples Bonds was $40 million. Additional Assumptions: Apple had no Long-Term Debt or other interest bearing obligations for year ended September 29, 2018 and, consequently, a zero Interest Payable account balance. Apple paid $11 million cash for interest on the Floating-rate Bonds for year ended September 28, 2019 and had an Interest Payable account balance of $123 million for all Bonds (Floating-rate and Fixed-rate). Required: a. Prepare Apple's Journal Entry or Accounting Equation for interest expense recognized for year ended September 28, 2019. b. Prepare Apple's Journal Entry or Accounting Equation for issuance of the Bonds. c. Several years ago, Apple's competitor, Samsung, issued a $1,000 million bond at par value. As a result of declining interest rates, Samsung has decided to call the bond at a call premium of 10 percent. Record the retirement of the bonds. Question 4 (20 points) Apple is an American multinational technology company headquartered in Cupertino, California, that designs, develops, and sells consumer electronics, computer software, and online services. In May 2019, Apple issued floating- and fixed-rate bonds with varying maturities for an aggregate principal amount of $17.0 billion (collectively the Bonds). The Bonds are senior unsecured obligations, and interest is payable in arrears, quarterly for the floating-rate bonds and semi- annually for the fixed-rate bonds. The principal amounts and associated interest rates of the Bonds as of September 28, 2019, are as follows: Effective Rate Floating-rate notes, due 2022 Floating-rate notes, due 2024 Fixed-rate 0.45% bonds due 2032 Fixed-rate 1.00% bonds due 2034 Fixed-rate 2.40% bonds due 2039 Fixed-rate 3.85% bonds due 2059 Total Amount (in millions) $ 1,000 2,000 1,500 4,000 5,500 3,000 $17,000 0.51 1.10 0.51 1.08 2.44 3.91 % % % % % % Apple recognized $136 million of interest expense for the year ended September 28, 2019. As of September 28, 2019, the aggregate unamortized discount for Apples Bonds was $40 million. Additional Assumptions: Apple had no Long-Term Debt or other interest bearing obligations for year ended September 29, 2018 and, consequently, a zero Interest Payable account balance. Apple paid $11 million cash for interest on the Floating-rate Bonds for year ended September 28, 2019 and had an Interest Payable account balance of $123 million for all Bonds (Floating-rate and Fixed-rate). Required: a. Prepare Apple's Journal Entry or Accounting Equation for interest expense recognized for year ended September 28, 2019. b. Prepare Apple's Journal Entry or Accounting Equation for issuance of the Bonds. c. Several years ago, Apple's competitor, Samsung, issued a $1,000 million bond at par value. As a result of declining interest rates, Samsung has decided to call the bond at a call premium of 10 percent. Record the retirement of the bonds