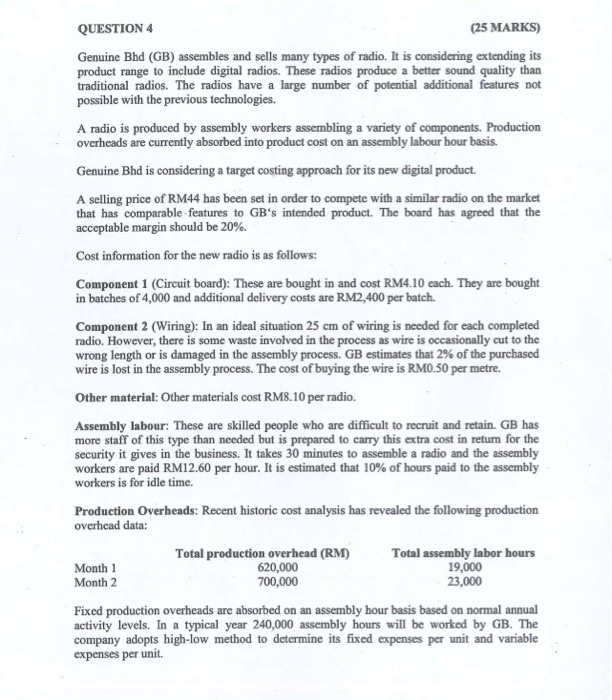

QUESTION 4 (25 MARKS) Genuine Bhd (GB) assembles and sells many types of radio. It is considering extending its product range to include digital radios. These radios produce a better sound quality than traditional radios. The radios have a large number of potential additional features not possible with the previous technologies. A radio is produced by assembly workers assembling a variety of components. Production overheads are currently absorbed into product cost on an assembly labour hour basis. Genuine Bhd is considering a target costing approach for its new digital product. A selling price of RM44 has been set in order to compete with a similar radio on the market that has comparable features to GB's intended product. The board has agreed that the acceptable margin should be 20%. Cost information for the new radio is as follows: Component 1 (Circuit board): These are bought in and cost RM4.10 each. They are bought in batches of 4,000 and additional delivery costs are RM2,400 per batch. Component 2 (Wiring): In an ideal situation 25 cm of wiring is needed for each completed radio. However, there is some waste involved in the process as wire is occasionally cut to the wrong length or is damaged in the assembly process. GB estimates that 2% of the purchased wire is lost in the assembly process. The cost of buying the wire is RM0.50 per metre. Other material: Other materials cost RM8.10 per radio. Assembly labour: These are skilled people who are difficult to recruit and retain. GB has more staff of this type than needed but is prepared to carry this extra cost in return for the security it gives in the business. It takes 30 minutes to assemble a radio and the assembly workers are paid RM12.60 per hour. It is estimated that 10% of hours paid to the assembly workers is for idle time. Production Overheads: Recent historic cost analysis has revealed the following production overhead data: Month 1 Month 2 Total production overhead (RM) 620,000 700,000 Total assembly labor hours 19,000 23,000 Fixed production overheads are absorbed on an assembly hour basis based on normal annual activity levels. In a typical year 240,000 assembly hours will be worked by GB. The company adopts high-low method to determine its fixed expenses per unit and variable expenses per unit. Required: a) Briefly describe the target costing process GB should undertake (4 marks) b) Explain 3 (THREE) benefits to GB of adopting target costing approach at the early stage in product development process. (9 marks) c) Calculate the expected cost per unit for the radio and identify any target cost reduction that might exist (12 marks)