Answered step by step

Verified Expert Solution

Question

1 Approved Answer

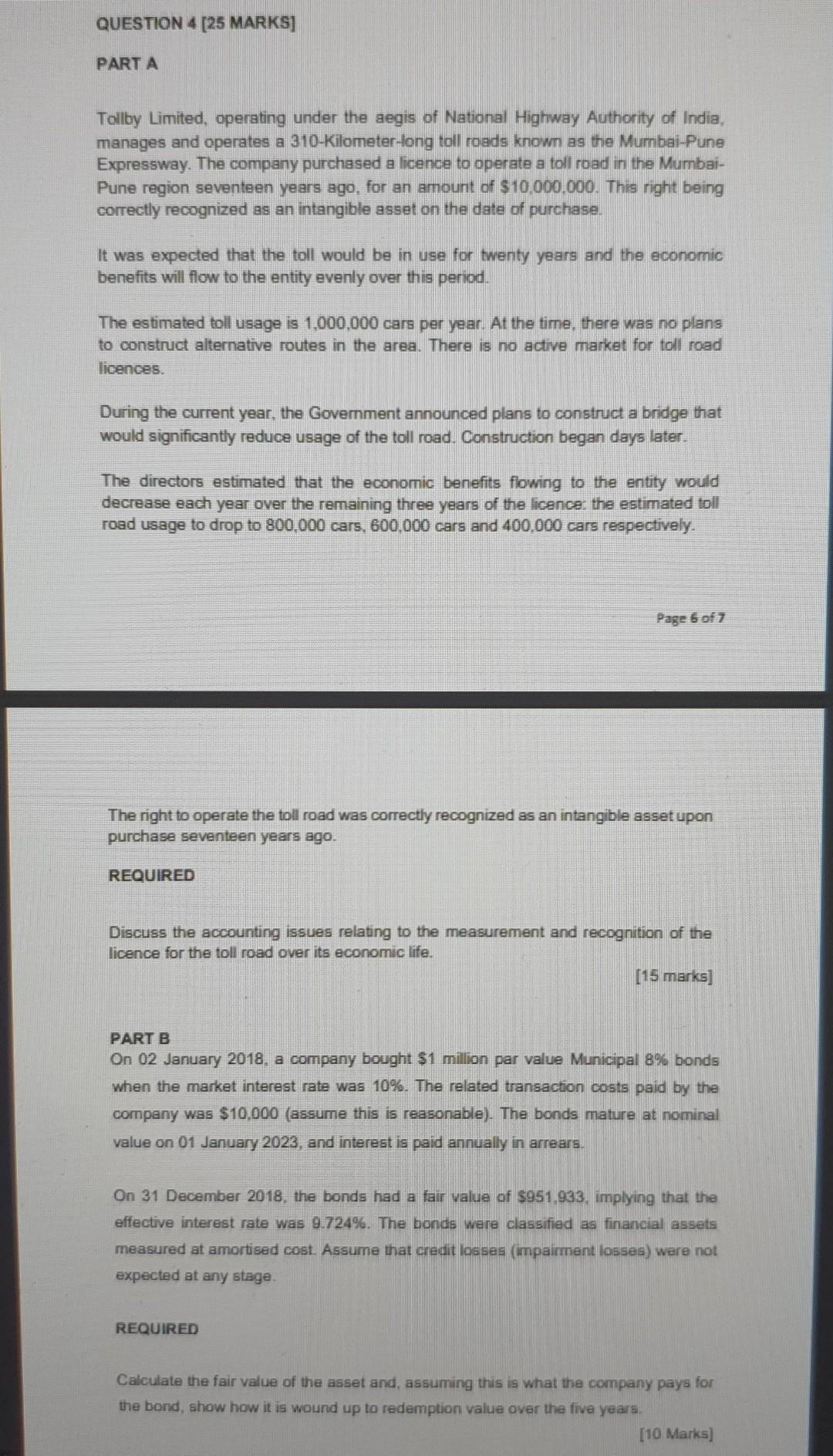

QUESTION 4 [25 MARKS] PART A Tollby Limited, operating under the aegis of National Highway Authority of India, manages and operates a 310 -Kilometer-tong toll

QUESTION 4 [25 MARKS] PART A Tollby Limited, operating under the aegis of National Highway Authority of India, manages and operates a 310 -Kilometer-tong toll roads known as the Mumbai-Pune Expressway. The company purchased a licence to operate a toll road in the MumbaiPune region seventeen years ago, for an amount of $10,000,000. This right being correctly recognized as an intangible asset on the date of purchase. It was expected that the toll would be in use for twenty years and the economic benefits will flow to the entity evenly over this period. The estimated toll usage is 1,000,000 cars per year. At the time, there was no plans to construct alternative routes in the area. There is no active market for toll road licences. During the current year, the Govemment announced plans to construct a bridge that would significantly reduce usage of the toll road. Construction began days later. The directors estimated that the economic benefits flowing to the entity would decrease each year over the remaining three years of the licence: the estimated toll road usage to drop to 800,000 cars, 600,000 cars and 400,000 cars respectively. Page 6 of 7 The right to operate the toll road was correctly recognized as an intangible asset upon purchase seventeen years ago. REQUIRED Discuss the accounting issues relating to the measurement and recognition of the licence for the toll road over its economic life. [15 marks] PART B On 02 January 2018, a company bought $1 million par value Municipal 8% bonds when the market interest rate was 10%. The related transaction costs paid by the company was $10,000 (assume this is reasonable). The bonds mature at nominal value on 01 January 2023, and interest is paid annually in arrears. On 31 December 2018, the bonds had a fair value of 5951,933 , implying that the effective interest rate was 9.724%. The bonds were classified as financial assets measured at amortised cost. Assume that credit losses (impairment losses) were not expected at any stage. REQUIRED Calculate the fair value of the asset and, assuming this is what the company pays for the bond, show how it is wound up to redemption value over the five years. [10 Marks]

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started