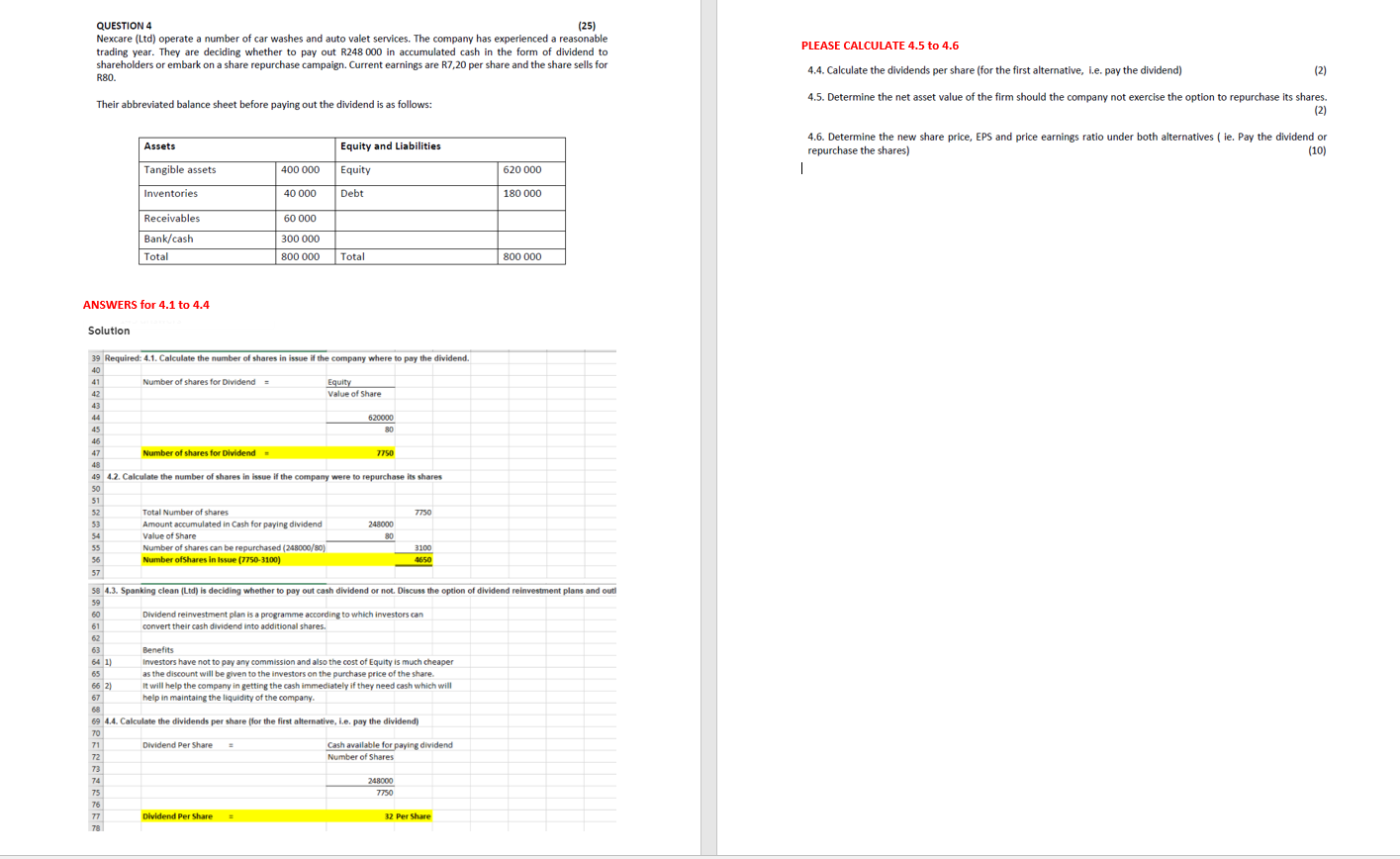

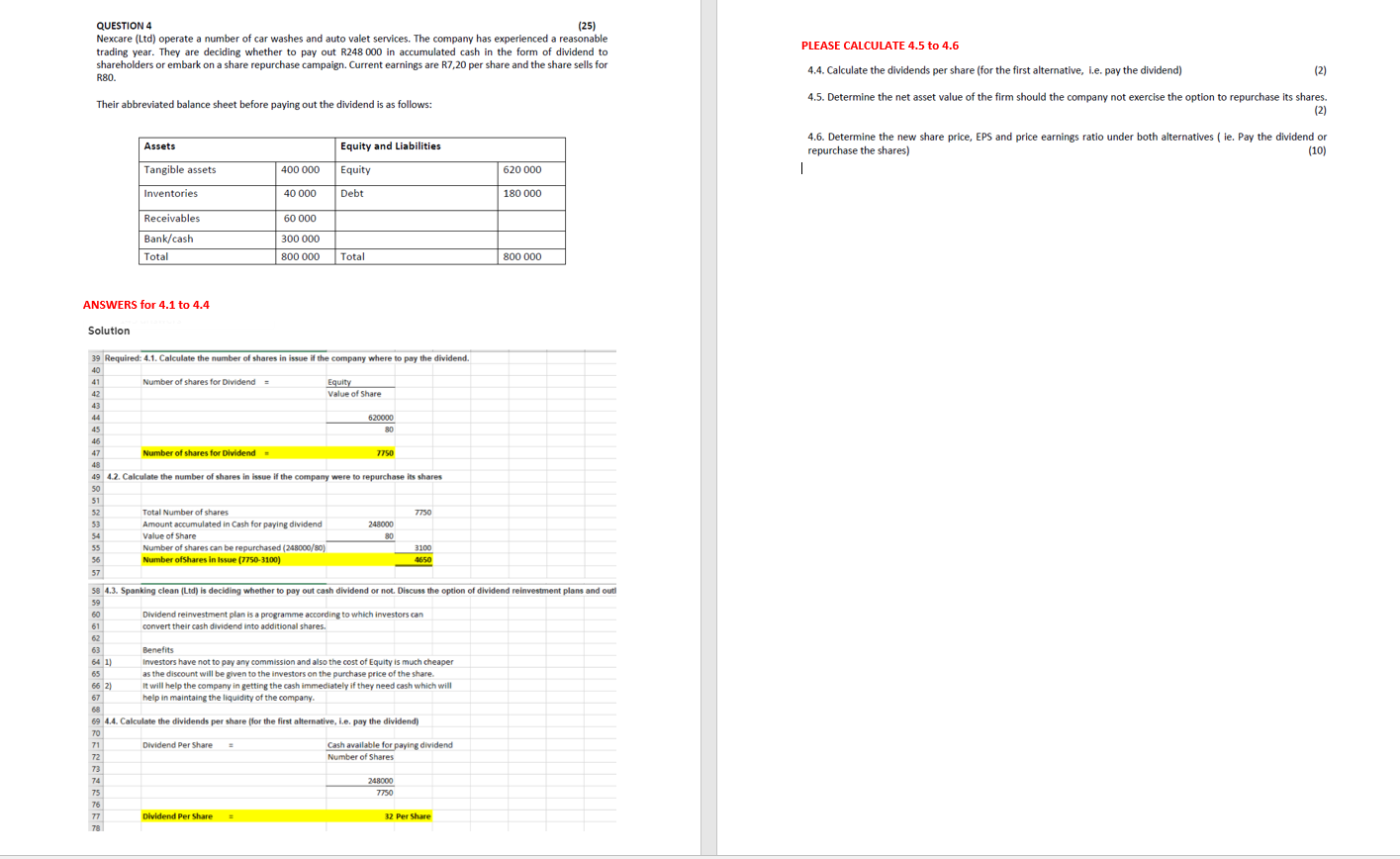

QUESTION 4 (25) Nexcare (Ltd) operate a number of car washes and auto valet services. The company has experienced a reasonable trading year. They are deciding whether to pay out R248 000 in accumulated cash in the form of dividend to shareholders or embark on a share repurchase campaign. Current earnings are R7,20 per share and the share sells for R80. PLEASE CALCULATE 4.5 to 4.6 4.4. Calculate the dividends per share (for the first alternative, i.e. pay the dividend) (2) Their abbreviated balance sheet before paying out the dividend is as follows: 4.5. Determine the net asset value of the firm should the company not exercise the option to repurchase its shares. (2) 4.6. Determine the new share price, EPS and price earnings ratio under both alternatives (ie. Pay the dividend or repurchase the shares) (10) Assets Equity and Liabilities Tangible assets Equity 620 000 | 400 000 40 000 Inventories Debt 180 000 Receivables 60 000 Bank/cash Total 300 000 800 000 Total 800 000 ANSWERS for 4.1 to 4.4 Solution 39 Required: 4.1. Calculate the number of shares in issue if the company where to pay the dividend. 40 41 Number of shares for Dividend Equity 42 Value of Share 620000 45 80 46 47 Number of shares for Dividend - 7750 48 49 4.2. Calculate the number of shares in issue if the company were to repurchase its shares 50 51 52 Total Number of shares 7750 53 Amount accumulated in Cash for paying dividend 248000 54 Value of Share 80 55 Number of shares can be repurchased (248000/80) 3100 56 Number of shares in Issue (7750-3100) 4650 57 58 4.3. Spanking clean (Ltd) is deciding whether to pay out cash dividend or not. Discuss the option of dividend reinvestment plans and out 59 60 Dividend reinvestment plan is a programme according to which investors can 61 convert their cash dividend into additional shares. 63 Benefits 64 1) Investors have not to pay any commission and also the cost of Equity is much cheaper 65 as the discount will be given to the investors on the purchase price of the share. 66 21 It will help the company in getting the cash immediately if they need cash which will 67 help in maintaing the liquidity of the company. 68 69 4.4. Calculate the dividends per share for the first alternative, i.e. pay the dividend) 70 71 Dividend Per Share Cash available for paying dividend 72 Number of Shares 73 74 248000 75 7750 76 77 Dividend Per Share 32 Per Share 78 QUESTION 4 (25) Nexcare (Ltd) operate a number of car washes and auto valet services. The company has experienced a reasonable trading year. They are deciding whether to pay out R248 000 in accumulated cash in the form of dividend to shareholders or embark on a share repurchase campaign. Current earnings are R7,20 per share and the share sells for R80. PLEASE CALCULATE 4.5 to 4.6 4.4. Calculate the dividends per share (for the first alternative, i.e. pay the dividend) (2) Their abbreviated balance sheet before paying out the dividend is as follows: 4.5. Determine the net asset value of the firm should the company not exercise the option to repurchase its shares. (2) 4.6. Determine the new share price, EPS and price earnings ratio under both alternatives (ie. Pay the dividend or repurchase the shares) (10) Assets Equity and Liabilities Tangible assets Equity 620 000 | 400 000 40 000 Inventories Debt 180 000 Receivables 60 000 Bank/cash Total 300 000 800 000 Total 800 000 ANSWERS for 4.1 to 4.4 Solution 39 Required: 4.1. Calculate the number of shares in issue if the company where to pay the dividend. 40 41 Number of shares for Dividend Equity 42 Value of Share 620000 45 80 46 47 Number of shares for Dividend - 7750 48 49 4.2. Calculate the number of shares in issue if the company were to repurchase its shares 50 51 52 Total Number of shares 7750 53 Amount accumulated in Cash for paying dividend 248000 54 Value of Share 80 55 Number of shares can be repurchased (248000/80) 3100 56 Number of shares in Issue (7750-3100) 4650 57 58 4.3. Spanking clean (Ltd) is deciding whether to pay out cash dividend or not. Discuss the option of dividend reinvestment plans and out 59 60 Dividend reinvestment plan is a programme according to which investors can 61 convert their cash dividend into additional shares. 63 Benefits 64 1) Investors have not to pay any commission and also the cost of Equity is much cheaper 65 as the discount will be given to the investors on the purchase price of the share. 66 21 It will help the company in getting the cash immediately if they need cash which will 67 help in maintaing the liquidity of the company. 68 69 4.4. Calculate the dividends per share for the first alternative, i.e. pay the dividend) 70 71 Dividend Per Share Cash available for paying dividend 72 Number of Shares 73 74 248000 75 7750 76 77 Dividend Per Share 32 Per Share 78