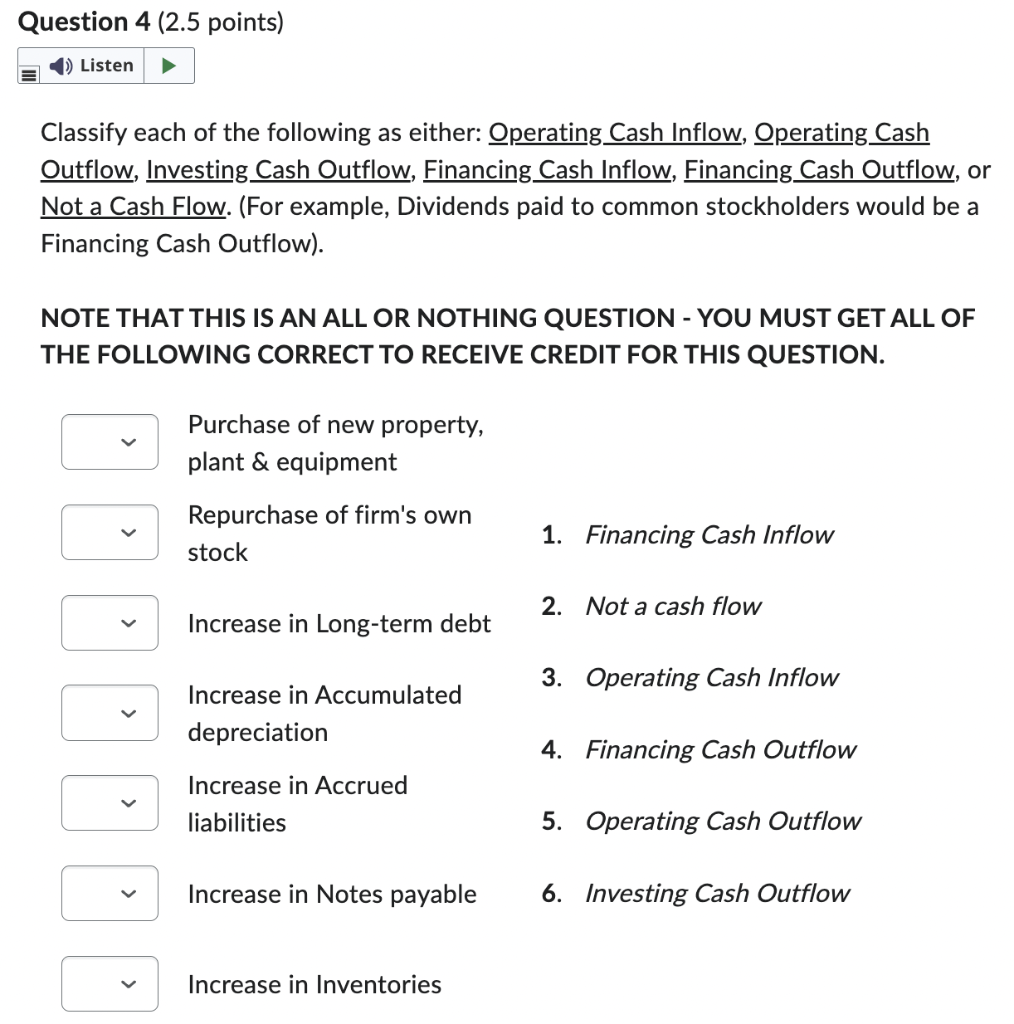

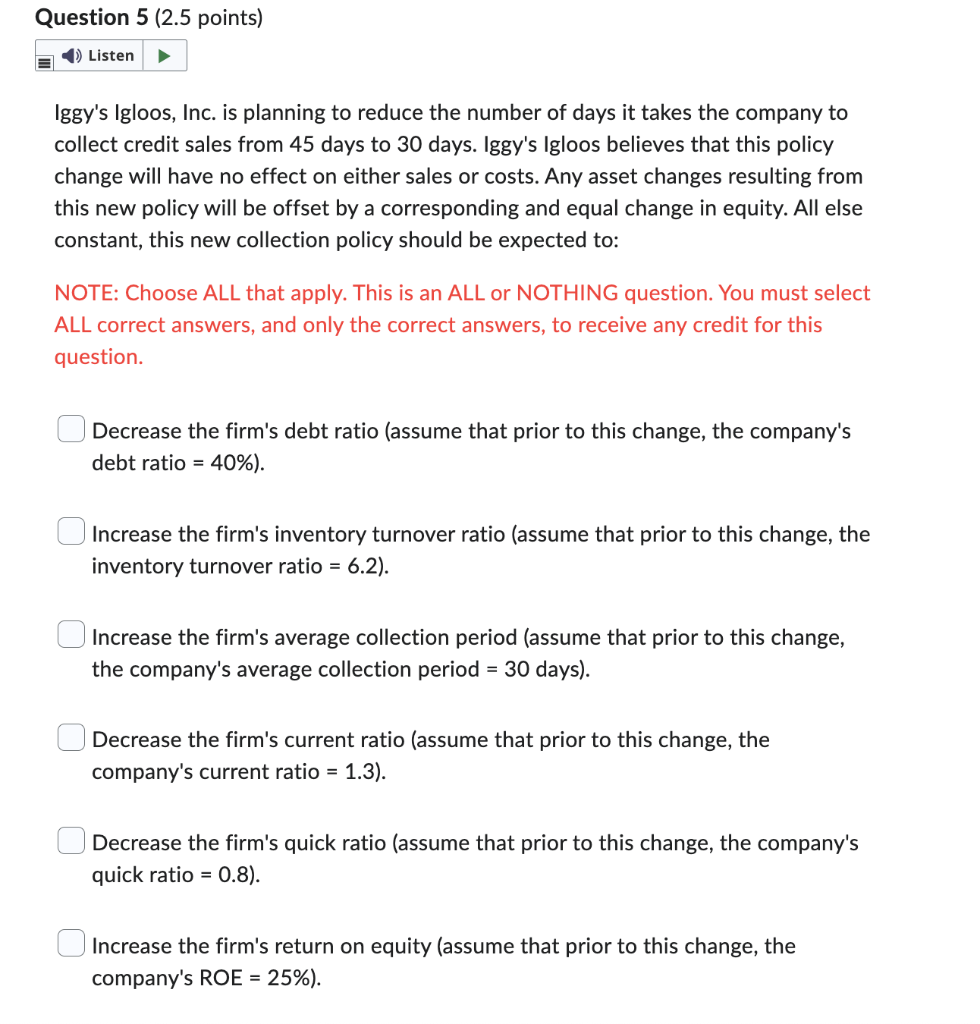

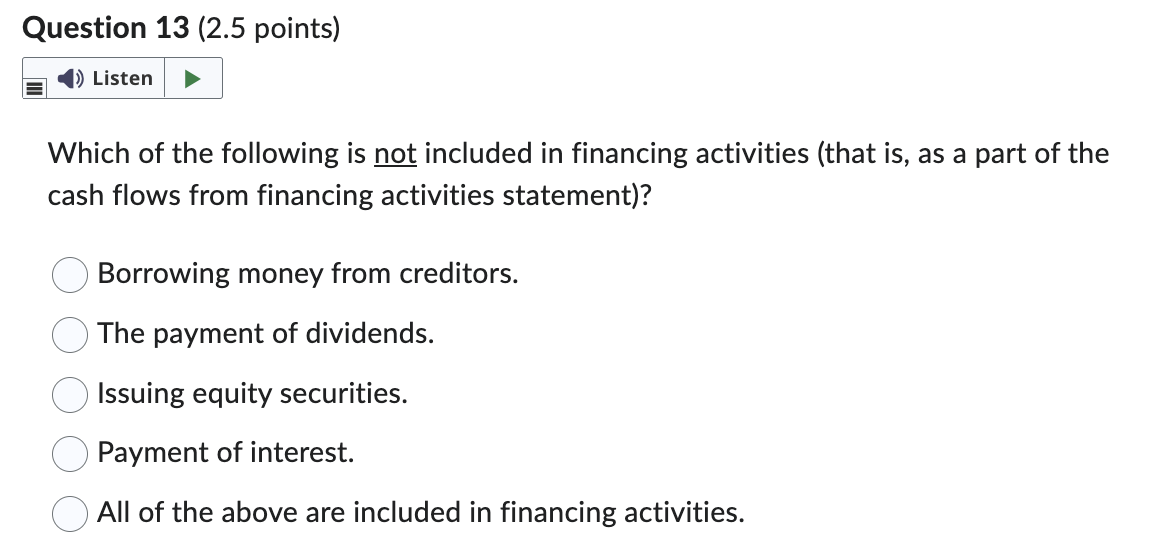

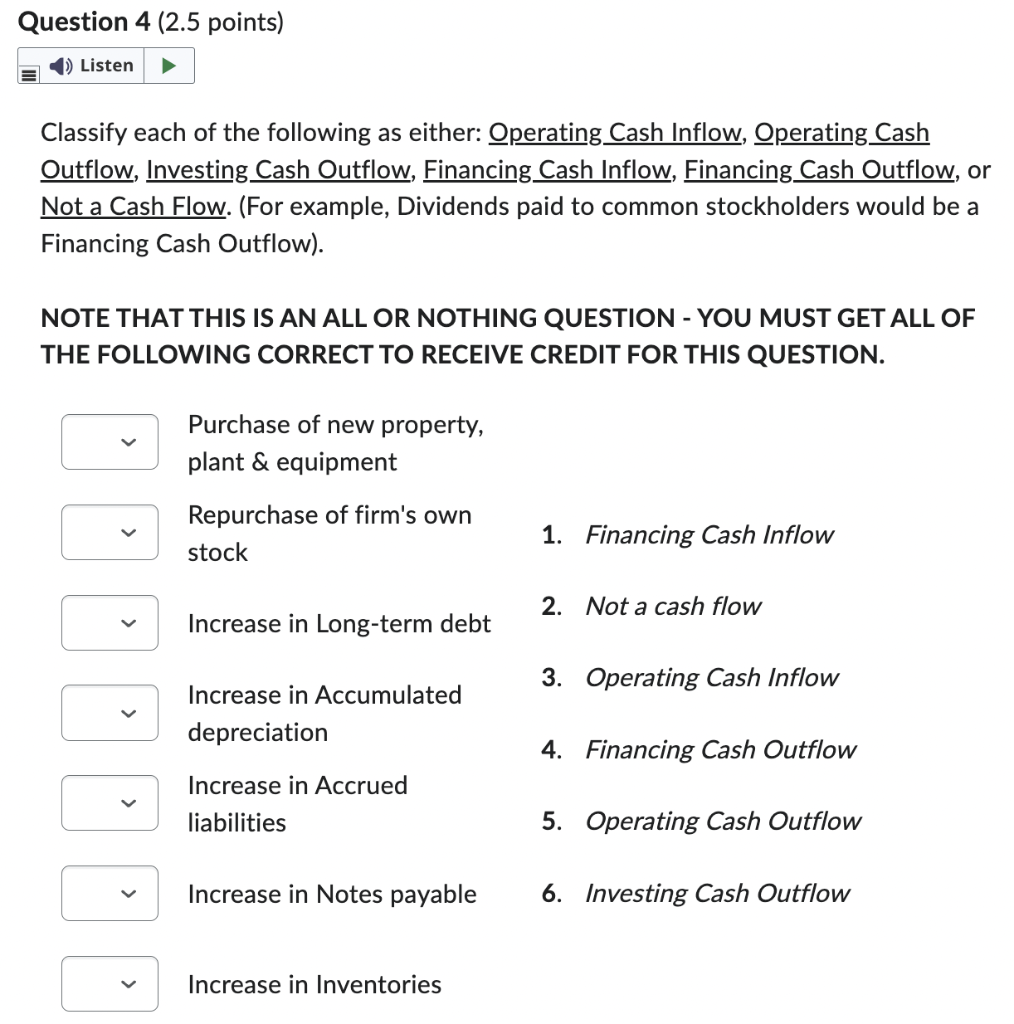

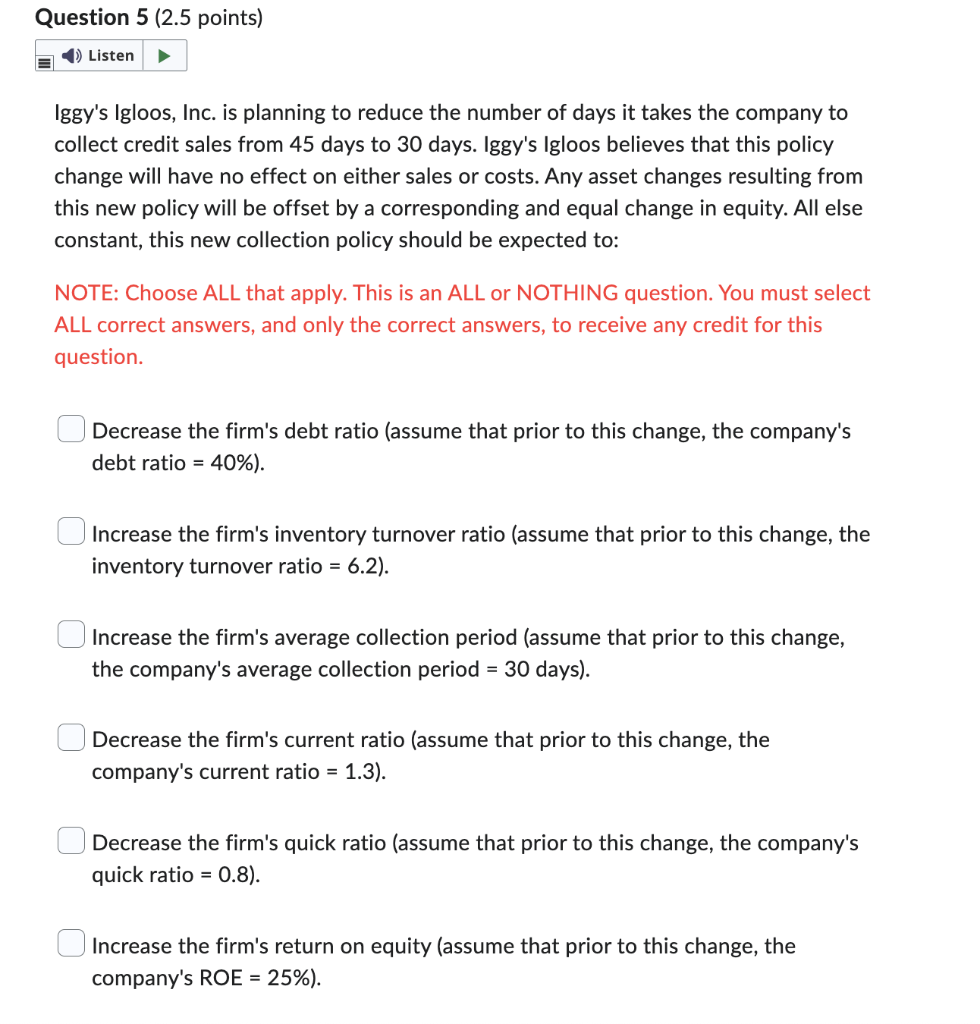

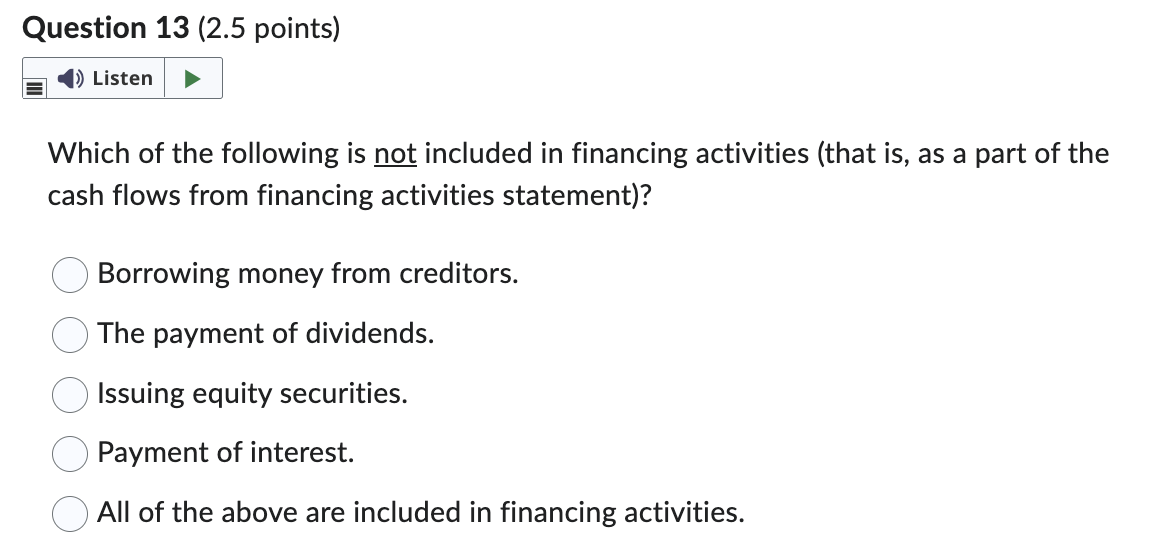

Question 4 (2.5 points) ) Listen Classify each of the following as either: Operating Cash Inflow, Operating Cash Outflow, Investing Cash Outflow, Financing Cash Inflow, Financing Cash Outflow, or Not a Cash Flow. (For example, Dividends paid to common stockholders would be a Financing Cash Outflow). NOTE THAT THIS IS AN ALL OR NOTHING QUESTION - YOU MUST GET ALL OF THE FOLLOWING CORRECT TO RECEIVE CREDIT FOR THIS QUESTION. > > Purchase of new property, plant & equipment Repurchase of firm's own stock Increase in Long-term debt Increase in Accumulated depreciation Increase in Accrued liabilities Increase in Notes payable Increase in Inventories 1. Financing Cash Inflow 2. Not a cash flow 3. Operating Cash Inflow 4. Financing Cash Outflow 5. Operating Cash Outflow 6. Investing Cash Outflow Question 5 (2.5 points) Listen E Iggy's Igloos, Inc. is planning to reduce the number of days it takes the company to collect credit sales from 45 days to 30 days. Iggy's Igloos believes that this policy change will have no effect on either sales or costs. Any asset changes resulting from this new policy will be offset by a corresponding and equal change in equity. All else constant, this new collection policy should be expected to: NOTE: Choose ALL that apply. This is an ALL or NOTHING question. You must select ALL correct answers, and only the correct answers, to receive any credit for this question. Decrease the firm's debt ratio (assume that prior to this change, the company's debt ratio = 40%). Increase the firm's inventory turnover ratio (assume that prior to this change, the inventory turnover ratio = 6.2). Increase the firm's average collection period (assume that prior to this change, the company's average collection period = 30 days). Decrease the firm's current ratio (assume that prior to this change, the company's current ratio = 1.3). Decrease the firm's quick ratio (assume that prior to this change, the company's quick ratio = 0.8 Increase the firm's return on equity (assume that prior to this change, the company's ROE = 25%). Question 13 (2.5 points) Listen Which of the following is not included in financing activities (that is, as a part of the cash flows from financing activities statement)? Borrowing money from creditors. The payment of dividends. Issuing equity securities. Payment of interest. All of the above are included in financing activities