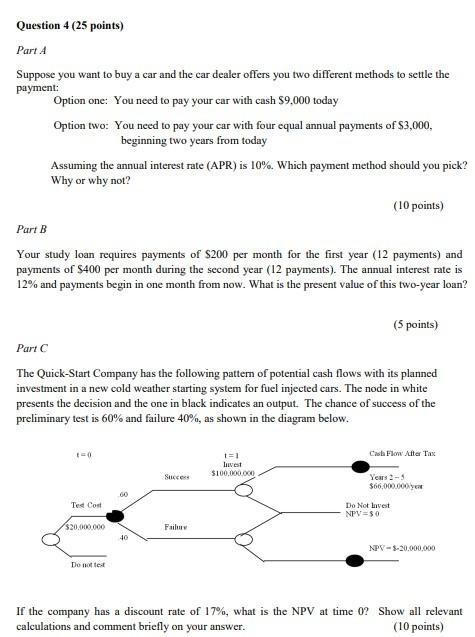

Question 4 (25 points) Part 1 Suppose you want to buy a car and the car dealer offers you two different methods to settle the payment: Option one: You need to pay your car with cash $9,000 today Option two: You need to pay your car with four equal annual payments of $3,000, beginning two years from today Assuming the annual interest rate (APR) is 10%. Which payment method should you pick? Why or why not? (10 points) Part 8 Your study loan requires payments of $200 per month for the first year (12 payments) and payments of $400 per month during the second year (12 payments). The annual interest rate is 12% and payments begin in one month from now. What is the present value of this two-year loan? (5 points) Part The Quick Start Company has the following pattern of potential cash flows with its planned investment in a new cold weather starting system for fuel injected cars. The node in white presents the decision and the one in black indicates an output. The chance of success of the preliminary test is 60% and failure 40%, as shown in the diagram below. Cash Flow Alter Tax 1 = 1 Invest $100,000.000 Succes Years 1-5 $66.000.000 year Ted Cost Do Not Invest NPV=30 $20.000.000 Faibu 40 NPV = -20.000.000 Do not test If the company has a discount rate of 17%, what is the NPV at time 0? Show all relevant calculations and comment briefly on your answer. (10 points) Question 4 (25 points) Part 1 Suppose you want to buy a car and the car dealer offers you two different methods to settle the payment: Option one: You need to pay your car with cash $9,000 today Option two: You need to pay your car with four equal annual payments of $3,000, beginning two years from today Assuming the annual interest rate (APR) is 10%. Which payment method should you pick? Why or why not? (10 points) Part 8 Your study loan requires payments of $200 per month for the first year (12 payments) and payments of $400 per month during the second year (12 payments). The annual interest rate is 12% and payments begin in one month from now. What is the present value of this two-year loan? (5 points) Part The Quick Start Company has the following pattern of potential cash flows with its planned investment in a new cold weather starting system for fuel injected cars. The node in white presents the decision and the one in black indicates an output. The chance of success of the preliminary test is 60% and failure 40%, as shown in the diagram below. Cash Flow Alter Tax 1 = 1 Invest $100,000.000 Succes Years 1-5 $66.000.000 year Ted Cost Do Not Invest NPV=30 $20.000.000 Faibu 40 NPV = -20.000.000 Do not test If the company has a discount rate of 17%, what is the NPV at time 0? Show all relevant calculations and comment briefly on your answer. (10 points)