Answered step by step

Verified Expert Solution

Question

1 Approved Answer

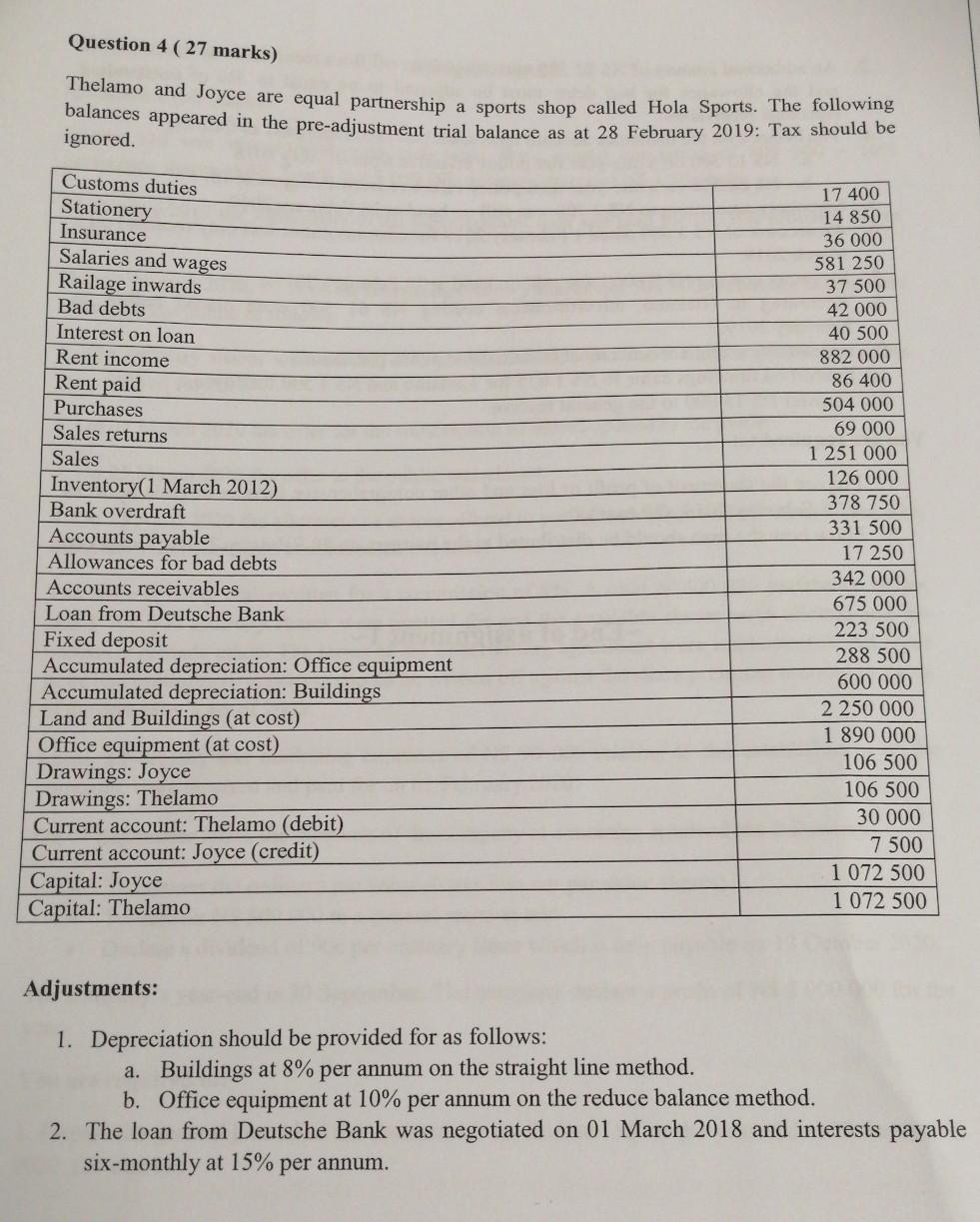

Question 4 ( 27 marks) Thelamo and Joyce are equal partnership a sports shop called Hola Sports. The following balances appeared in the pre-adjustment trial

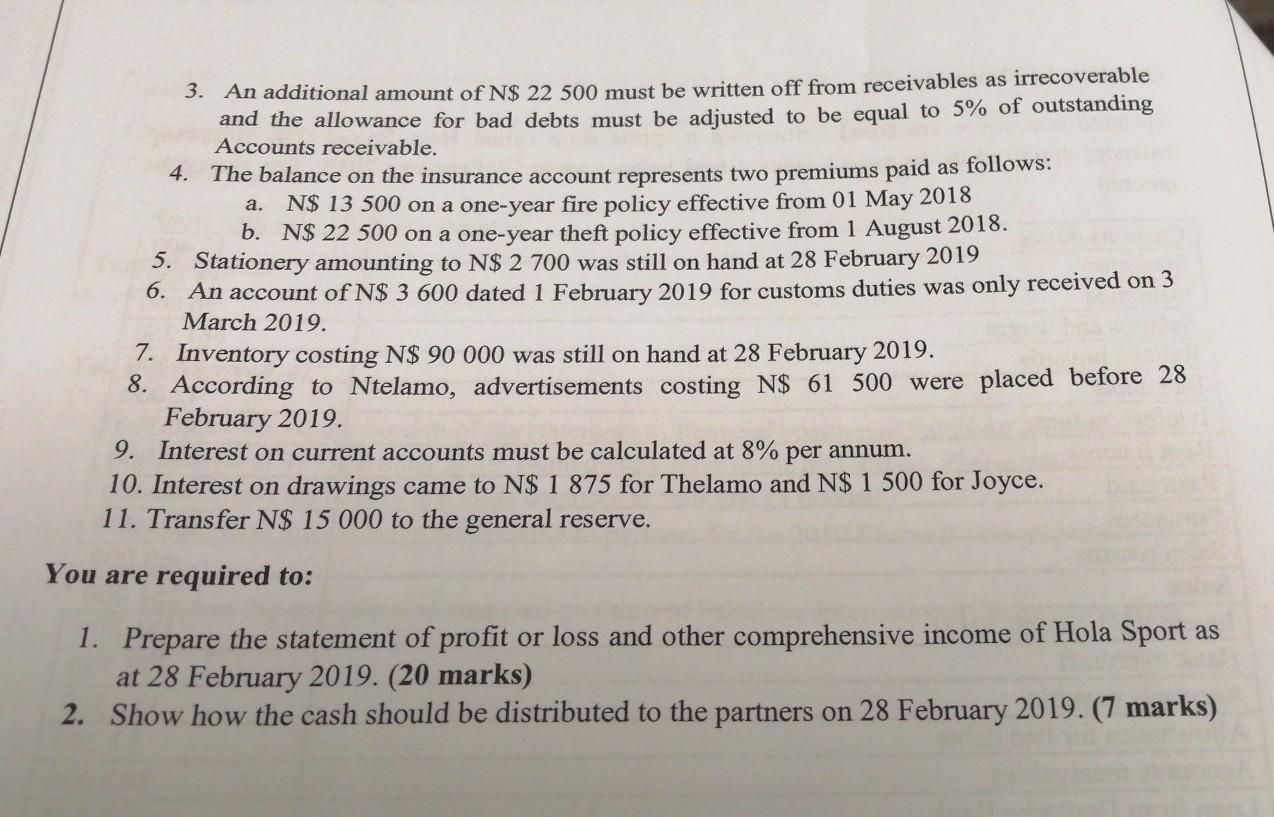

Question 4 ( 27 marks) Thelamo and Joyce are equal partnership a sports shop called Hola Sports. The following balances appeared in the pre-adjustment trial balance as at 28 February 2019: Tax should be ignored. Customs duties Stationery Insurance Salaries and wages Railage inwards Bad debts Interest on loan Rent income Rent paid Purchases Sales returns Sales Inventory(1 March 2012) Bank overdraft Accounts payable Allowances for bad debts Accounts receivables Loan from Deutsche Bank Fixed deposit Accumulated depreciation: Office equipment Accumulated depreciation: Buildings Land and Buildings (at cost) Office equipment (at cost) Drawings: Joyce Drawings: Thelamo Current account: Thelamo (debit) Current account: Joyce (credit) Capital: Joyce Capital: Thelamo 17 400 14 850 36 000 581 250 37 500 42 000 40 500 882 000 86 400 504 000 69 000 1 251 000 126 000 378 750 331 500 17 250 342 000 675 000 223 500 288 500 600 000 2 250 000 1 890 000 106 500 106 500 30 000 7 500 1 072 500 1 072 500 Adjustments: 1. Depreciation should be provided for as follows: a. Buildings at 8% per annum on the straight line method. b. Office equipment at 10% per annum on the reduce balance method. 2. The loan from Deutsche Bank was negotiated on 01 March 2018 and interests payable six-monthly at 15% per annum. 3. An additional amount of N$ 22 500 must be written off from receivables as irrecoverable and the allowance for bad debts must be adjusted to be equal to 5% of outstanding Accounts receivable. 4. The balance on the insurance account represents two premiums paid as follows: a. N$ 13 500 on a one-year fire policy effective from 01 May 2018 b. N$ 22 500 on a one-year theft policy effective from 1 August 2018. 5. Stationery amounting to N$ 2 700 was still on hand at 28 February 2019 6. An account of N$ 3 600 dated 1 February 2019 for customs duties was only received on 3 March 2019. 7. Inventory costing N$ 90 000 was still on hand at 28 February 2019. 8. According to Ntelamo, advertisements costing N$ 61 500 were placed before 28 February 2019. 9. Interest on current accounts must be calculated at 8% per annum. 10. Interest on drawings came to N$ 1 875 for Thelamo and N$ 1 500 for Joyce. 11. Transfer N$ 15 000 to the general reserve. You are required to: 1. Prepare the statement of profit or loss and other comprehensive income of Hola Sport as at 28 February 2019. (20 marks) 2. Show how the cash should be distributed to the partners on 28 February 2019. (7 marks)

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started