Answered step by step

Verified Expert Solution

Question

1 Approved Answer

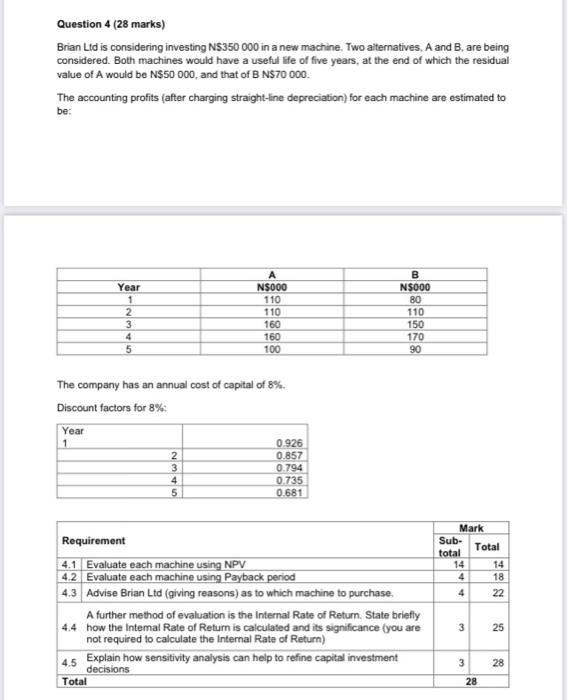

Question 4 (28 marks) Brian Ltd is considering investing N$350 000 in a new machine. Two alternatives, A and B, are being considered. Both machines

Question 4 (28 marks) Brian Ltd is considering investing N$350 000 in a new machine. Two alternatives, A and B, are being considered. Both machines would have a useful life of five years, at the end of which the residual value of A would be N$50 000, and that of B N$70 000. The accounting profits (after charging straight-line depreciation) for each machine are estimated to be: Year 1 Year 1 2 3 4 5 The company has an annual cost of capital of 8%. Discount factors for 8%: 4.5 Total A N$000 110 110 160 160 100 2345 0.926 0.857 0.794 0.735 0.681 Requirement 4.1 Evaluate each machine using NPV 4.2 Evaluate each machine using Payback period 4.3 Advise Brian Ltd (giving reasons) as to which machine to purchase. B N$000 80 110 150 170 90 A further method of evaluation is the Internal Rate of Return. State briefly 4.4 how the Internal Rate of Return is calculated and its significance (you are not required to calculate the Internal Rate of Return) Explain how sensitivity analysis can help to refine capital investment decisions Mark Sub- total 14 4 4 3 3 Total 28 14 18 22 25 28

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started