Answered step by step

Verified Expert Solution

Question

1 Approved Answer

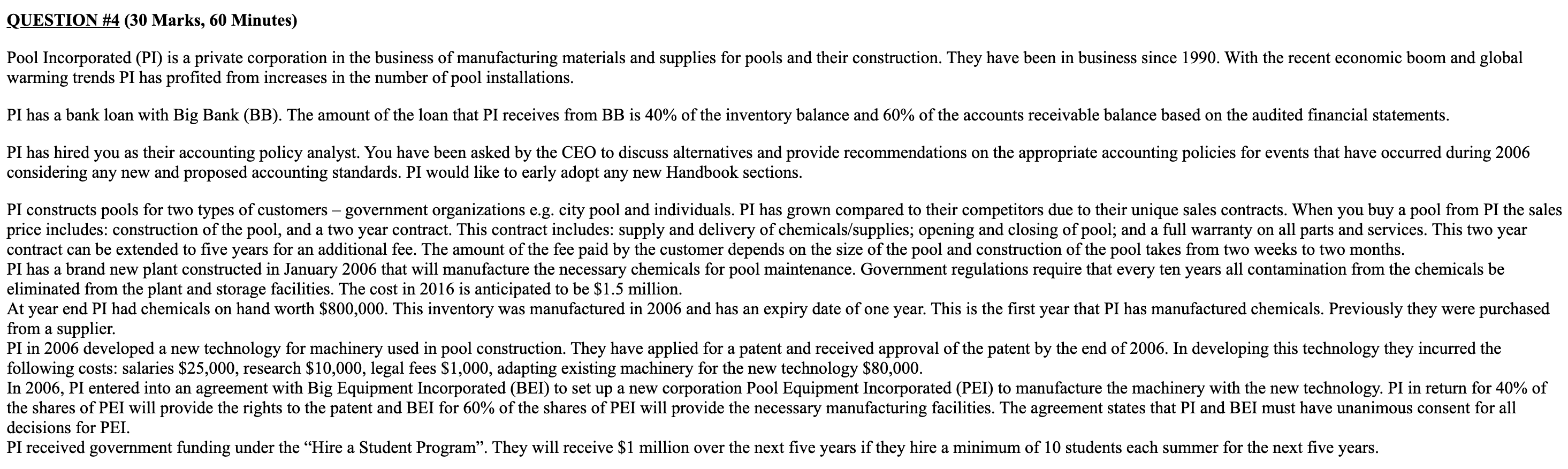

QUESTION # 4 ( 3 0 Marks, 6 0 Minutes ) Pool Incorporated ( PI ) is a private corporation in the business of manufacturing

QUESTION # Marks, Minutes

Pool Incorporated PI is a private corporation in the business of manufacturing materials and supplies for pools and their construction. They have been in business since With the recent economic boom and global

warming trends PI has profited from increases in the number of pool installations.

PI has a bank loan with Big Bank BB The amount of the loan that PI receives from BB is of the inventory balance and of the accounts receivable balance based on the audited financial statements.

PI has hired you as their accounting policy analyst. You have been asked by the CEO to discuss alternatives and provide recommendations on the appropriate accounting policies for events that have occurred during

considering any new and proposed accounting standards. PI would like to early adopt any new Handbook sections.

PI constructs pools for two types of customers government organizations eg city pool and individuals. PI has grown compared to their competitors due to their unique sales contracts. When you buy a pool from PI the sales

price includes: construction of the pool, and a two year contract. This contract includes: supply and delivery of chemicalssupplies; opening and closing of pool; and a full warranty on all parts and services. This two year

contract can be extended to five years for an additional fee. The amount of the fee paid by the customer depends on the size of the pool and construction of the pool takes from two weeks to two months.

PI has a brand new plant constructed in January that will manufacture the necessary chemicals for pool maintenance. Government regulations require that every ten years all contamination from the chemicals be

eliminated from the plant and storage facilities. The cost in is anticipated to be $ million.

At year end PI had chemicals on hand worth $ This inventory was manufactured in and has an expiry date of one year. This is the first year that PI has manufactured chemicals. Previously they were purchased

from a supplier.

PI in developed a new technology for machinery used in pool construction. They have applied for a patent and received approval of the patent by the end of In developing this technology they incurred the

following costs: salaries $ research $ legal fees $ adapting existing machinery for the new technology $

In PI entered into an agreement with Big Equipment Incorporated BEI to set up a new corporation Pool Equipment Incorporated PEI to manufacture the machinery with the new technology. PI in return for of

the shares of PEI will provide the rights to the patent and BEI for of the shares of PEI will provide the necessary manufacturing facilities. The agreement states that PI and BEI must have unanimous consent for all

decisions for PEI.

PI received government funding under the "Hire a Student Program". They will receive $ million over the next five years if they hire a minimum of students each summer for the next five years.

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started