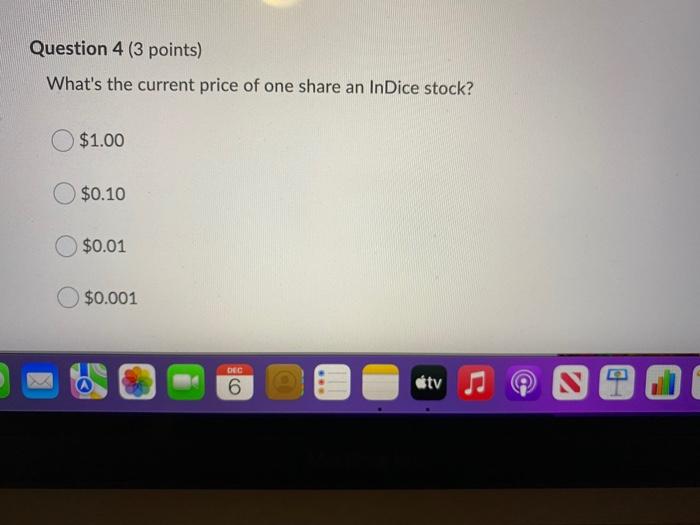

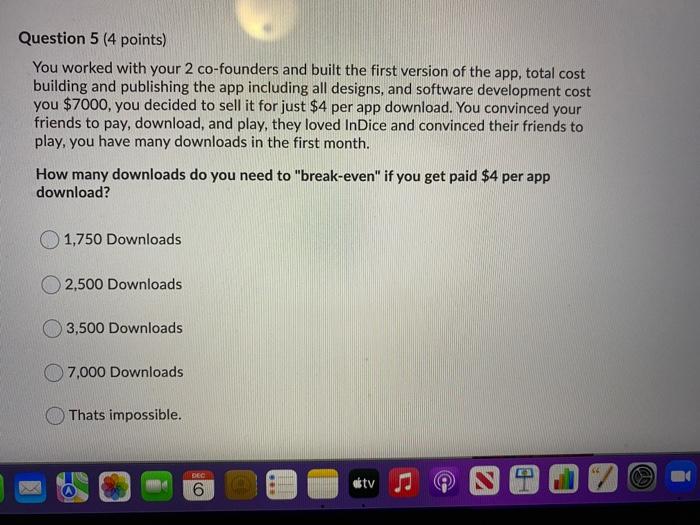

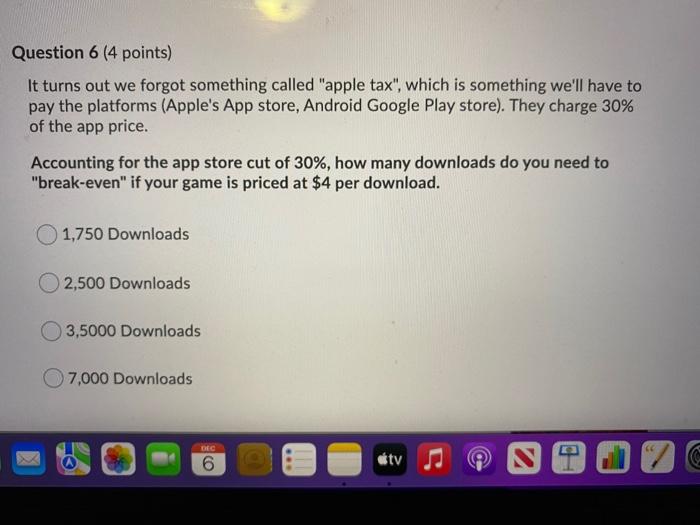

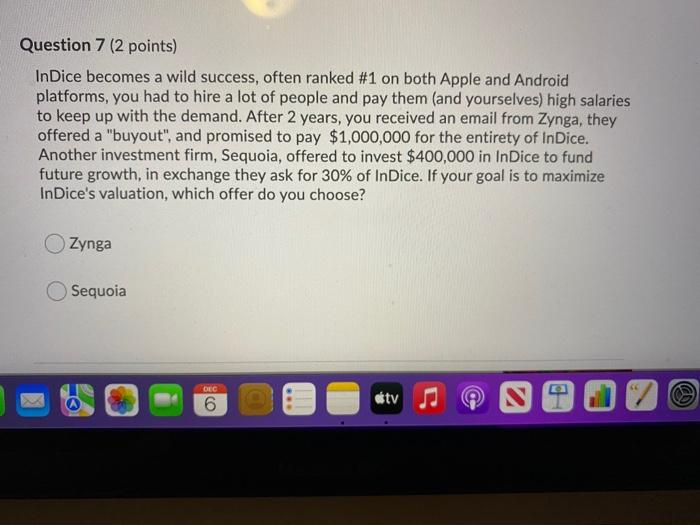

Question 4 (3 points) What's the current price of one share an In Dice stock? $1.00 $0.10 $0.01 $0.001 DEC 6 tv Question 5 (4 points) You worked with your 2 co-founders and built the first version of the app, total cost building and publishing the app including all designs, and software development cost you $7000, you decided to sell it for just $4 per app download. You convinced your friends to pay, download, and play, they loved InDice and convinced their friends to play, you have many downloads in the first month. How many downloads do you need to "break-even" if you get paid $4 per app download? 1,750 Downloads 2,500 Downloads 3,500 Downloads 7.000 Downloads Thats impossible. DEC 6 tv Question 6 (4 points) It turns out we forgot something called "apple tax", which is something we'll have to pay the platforms (Apple's App store, Android Google Play store). They charge 30% of the app price. Accounting for the app store cut of 30%, how many downloads do you need to "break-even" if your game is priced at $4 per download. 1,750 Downloads 2,500 Downloads 3,5000 Downloads 7,000 Downloads O DEC 6 sty Question 7 (2 points) InDice becomes a wild success, often ranked #1 on both Apple and Android platforms, you had to hire a lot of people and pay them (and yourselves) high salaries to keep up with the demand. After 2 years, you received an email from Zynga, they offered a "buyout", and promised to pay $1,000,000 for the entirety of InDice. Another investment firm, Sequoia, offered to invest $400,000 in In Dice to fund future growth, in exchange they ask for 30% of InDice. If your goal is to maximize InDice's valuation, which offer do you choose? Zynga Sequoia DEC E ty 6 (co 2 Question 4 (3 points) What's the current price of one share an In Dice stock? $1.00 $0.10 $0.01 $0.001 DEC 6 tv Question 5 (4 points) You worked with your 2 co-founders and built the first version of the app, total cost building and publishing the app including all designs, and software development cost you $7000, you decided to sell it for just $4 per app download. You convinced your friends to pay, download, and play, they loved InDice and convinced their friends to play, you have many downloads in the first month. How many downloads do you need to "break-even" if you get paid $4 per app download? 1,750 Downloads 2,500 Downloads 3,500 Downloads 7.000 Downloads Thats impossible. DEC 6 tv Question 6 (4 points) It turns out we forgot something called "apple tax", which is something we'll have to pay the platforms (Apple's App store, Android Google Play store). They charge 30% of the app price. Accounting for the app store cut of 30%, how many downloads do you need to "break-even" if your game is priced at $4 per download. 1,750 Downloads 2,500 Downloads 3,5000 Downloads 7,000 Downloads O DEC 6 sty Question 7 (2 points) InDice becomes a wild success, often ranked #1 on both Apple and Android platforms, you had to hire a lot of people and pay them (and yourselves) high salaries to keep up with the demand. After 2 years, you received an email from Zynga, they offered a "buyout", and promised to pay $1,000,000 for the entirety of InDice. Another investment firm, Sequoia, offered to invest $400,000 in In Dice to fund future growth, in exchange they ask for 30% of InDice. If your goal is to maximize InDice's valuation, which offer do you choose? Zynga Sequoia DEC E ty 6 (co 2