Answered step by step

Verified Expert Solution

Question

1 Approved Answer

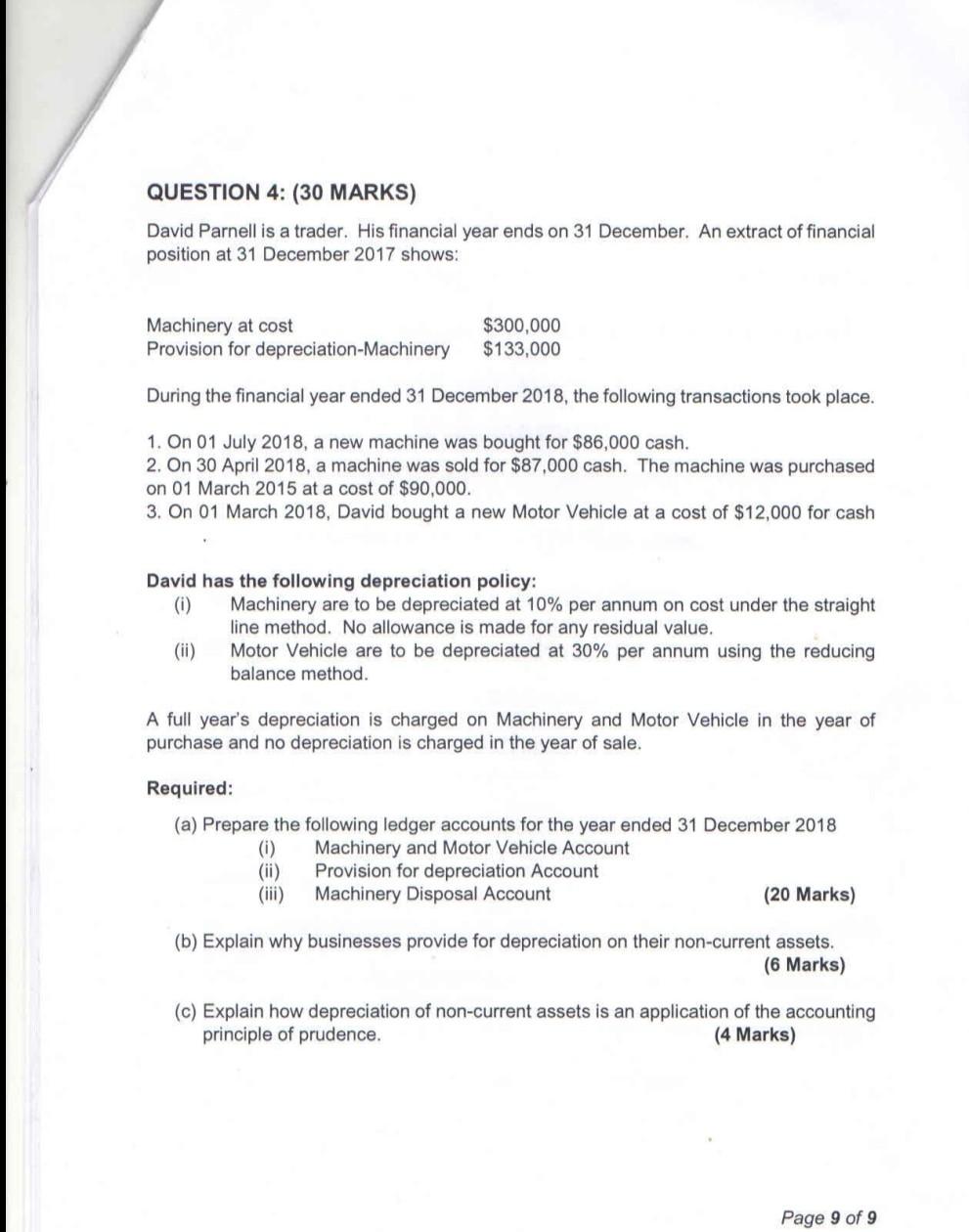

QUESTION 4: (30 MARKS) David Parnell is a trader. His financial year ends on 31 December. An extract of financial position at 31 December 2017

QUESTION 4: (30 MARKS) David Parnell is a trader. His financial year ends on 31 December. An extract of financial position at 31 December 2017 shows: Machinery at cost Provision for depreciation-Machinery $300,000 $133,000 During the financial year ended 31 December 2018, the following transactions took place. 1. On 01 July 2018, a new machine was bought for $86,000 cash. 2. On 30 April 2018, a machine was sold for $87,000 cash. The machine was purchased on 01 March 2015 at a cost of $90,000 3. On 01 March 2018, David bought a new Motor Vehicle at a cost of $12,000 for cash David has the following depreciation policy: (i) Machinery are to be depreciated at 10% per annum on cost under the straight line method. No allowance is made for any residual value. (ii) Motor Vehicle are to be depreciated at 30% per annum using the reducing balance method. A full year's depreciation is charged on Machinery and Motor Vehicle in the year of purchase and no depreciation is charged in the year of sale. Required: (a) Prepare the following ledger accounts for the year ended 31 December 2018 (i) Machinery and Motor Vehicle Account Provision for depreciation Account Machinery Disposal Account (20 Marks) (b) Explain why businesses provide for depreciation on their non-current assets. (6 Marks) (c) Explain how depreciation of non-current assets is an application of the accounting principle of prudence. (4 Marks) Page 9 of 9 QUESTION 4: (30 MARKS) David Parnell is a trader. His financial year ends on 31 December. An extract of financial position at 31 December 2017 shows: Machinery at cost Provision for depreciation-Machinery $300,000 $133,000 During the financial year ended 31 December 2018, the following transactions took place. 1. On 01 July 2018, a new machine was bought for $86,000 cash. 2. On 30 April 2018, a machine was sold for $87,000 cash. The machine was purchased on 01 March 2015 at a cost of $90,000 3. On 01 March 2018, David bought a new Motor Vehicle at a cost of $12,000 for cash David has the following depreciation policy: (i) Machinery are to be depreciated at 10% per annum on cost under the straight line method. No allowance is made for any residual value. (ii) Motor Vehicle are to be depreciated at 30% per annum using the reducing balance method. A full year's depreciation is charged on Machinery and Motor Vehicle in the year of purchase and no depreciation is charged in the year of sale. Required: (a) Prepare the following ledger accounts for the year ended 31 December 2018 (i) Machinery and Motor Vehicle Account Provision for depreciation Account Machinery Disposal Account (20 Marks) (b) Explain why businesses provide for depreciation on their non-current assets. (6 Marks) (c) Explain how depreciation of non-current assets is an application of the accounting principle of prudence. (4 Marks) Page 9 of 9

Step by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started