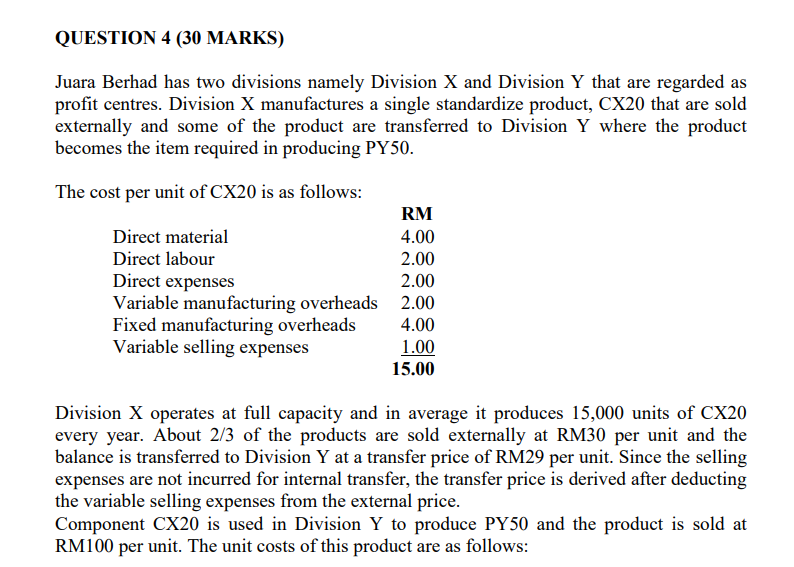

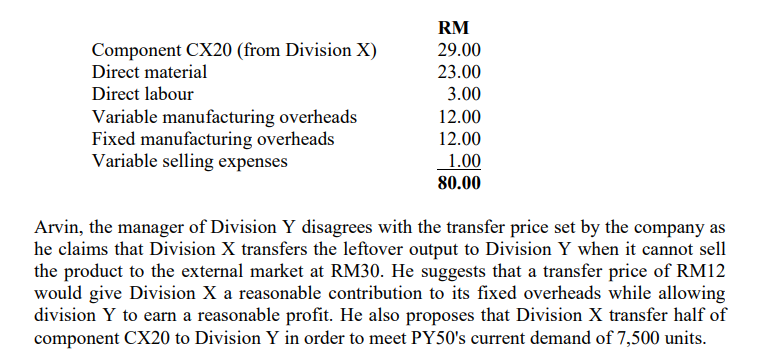

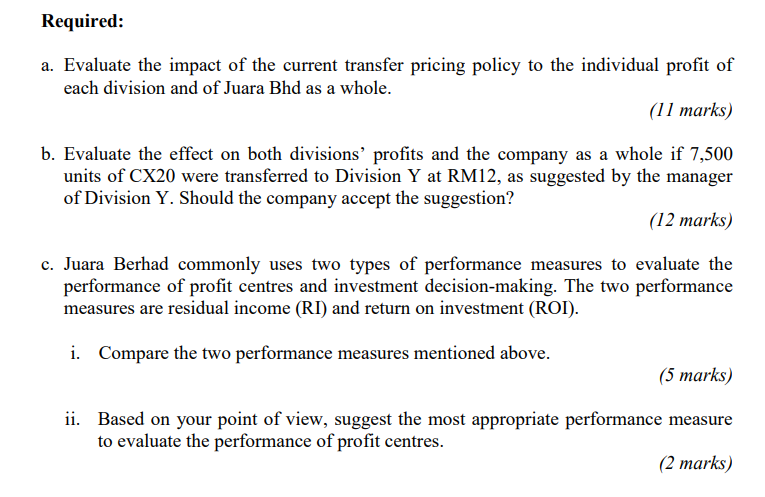

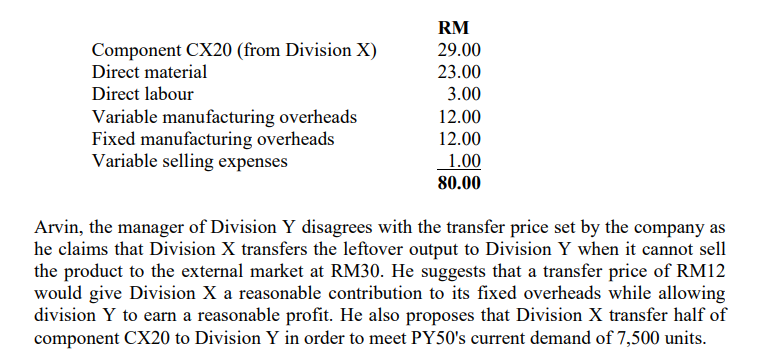

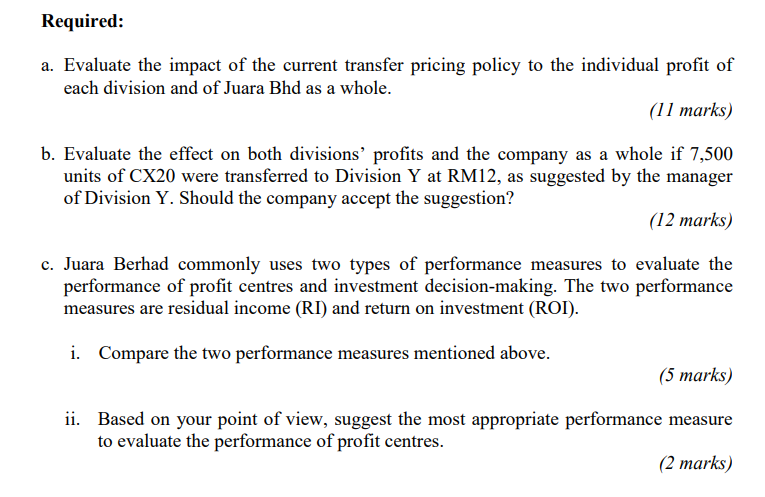

QUESTION 4 (30 MARKS) Juara Berhad has two divisions namely Division X and Division Y that are regarded as profit centres. Division X manufactures a single standardize product, CX20 that are sold externally and some of the product are transferred to Division Y where the product becomes the item required in producing PY50. The cost per unit of CX20 is as follows: RM Direct material 4.00 Direct labour 2.00 Direct expenses 2.00 Variable manufacturing overheads 2.00 Fixed manufacturing overheads 4.00 Variable selling expenses 1.00 15.00 Division X operates at full capacity and in average it produces 15,000 units of CX20 every year. About 2/3 of the products are sold externally at RM30 per unit and the balance is transferred to Division Y at a transfer price of RM29 per unit. Since the selling expenses are not incurred for internal transfer, the transfer price is derived after deducting the variable selling expenses from the external price. Component CX20 is used in Division Y to produce PY50 and the product is sold at RM100 per unit. The unit costs of this product are as follows: Component CX20 (from Division X) Direct material Direct labour Variable manufacturing overheads Fixed manufacturing overheads Variable selling expenses RM 29.00 23.00 3.00 12.00 12.00 1.00 80.00 Arvin, the manager of Division Y disagrees with the transfer price set by the company as he claims that Division X transfers the leftover output to Division Y when it cannot sell the product to the external market at RM30. He suggests that a transfer price of RM12 would give Division X a reasonable contribution to its fixed overheads while allowing division Y to earn a reasonable profit. He also proposes that Division X transfer half of component CX20 to Division Y in order to meet PY50's current demand of 7,500 units. Required: a. Evaluate the impact of the current transfer pricing policy to the individual profit of each division and of Juara Bhd as a whole. (11 marks) b. Evaluate the effect on both divisions' profits and the company as a whole if 7,500 units of CX20 were transferred to Division Y at RM12, as suggested by the manager of Division Y. Should the company accept the suggestion? (12 marks) c. Juara Berhad commonly uses two types of performance measures to evaluate the performance of profit centres and investment decision-making. The two performance measures are residual income (RI) and return on investment (ROI). i. Compare the two performance measures mentioned above. (5 marks) ii. Based on your point of view, suggest the most appropriate performance measure to evaluate the performance of profit centres. (2 marks)