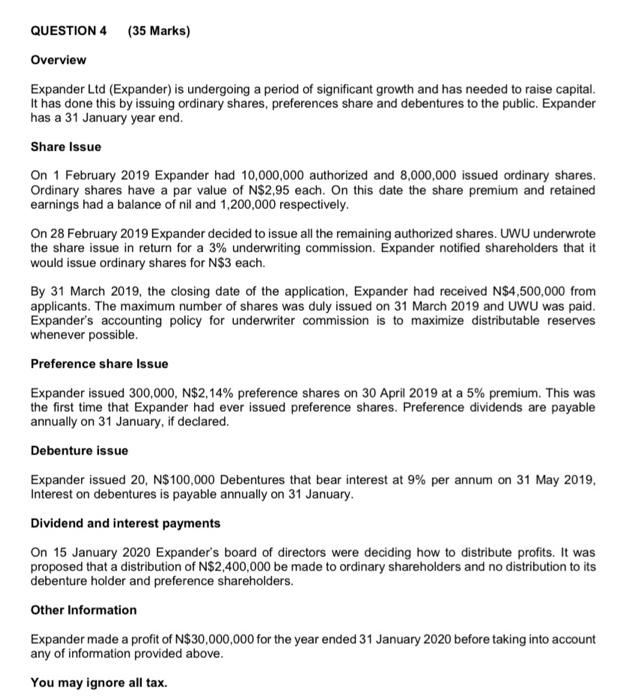

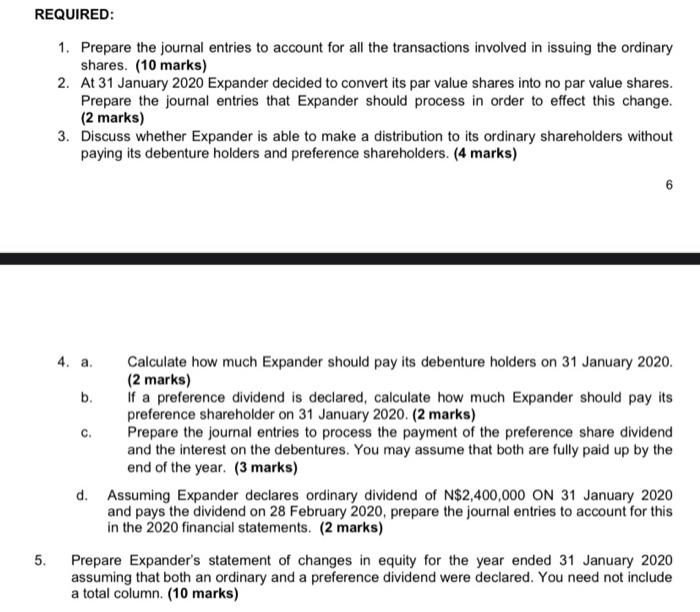

QUESTION 4 (35 Marks) Overview Expander Ltd (Expander) is undergoing a period of significant growth and has needed to raise capital. It has done this by issuing ordinary shares, preferences share and debentures to the public. Expander has a 31 January year end. Share Issue On 1 February 2019 Expander had 10,000,000 authorized and 8,000,000 issued ordinary shares. Ordinary shares have a par value of N$2,95 each. On this date the share premium and retained earnings had a balance of nil and 1,200,000 respectively. On 28 February 2019 Expander decided to issue all the remaining authorized shares. UWU underwrote the share issue in return for a 3% underwriting commission. Expander notified shareholders that it would issue ordinary shares for N$3 each. By 31 March 2019, the closing date of the application, Expander had received N$4,500,000 from applicants. The maximum number of shares was duly issued on 31 March 2019 and UWU was paid. Expander's accounting policy for underwriter commission is to maximize distributable reserves whenever possible. Preference share Issue Expander issued 300,000, N$2,14% preference shares on 30 April 2019 at a 5% premium. This was the first time that Expander had ever issued preference shares. Preference dividends are payable annually on 31 January, if declared. Debenture issue Expander issued 20, N$100,000 Debentures that bear interest at 9% per annum on 31 May 2019, Interest on debentures is payable annually on 31 January. Dividend and interest payments On 15 January 2020 Expander's board of directors were deciding how to distribute profits. It was proposed that a distribution of N$2,400,000 be made to ordinary shareholders and no distribution to its debenture holder and preference shareholders. Other Information Expander made a profit of N$30,000,000 for the year ended 31 January 2020 before taking into account any of information provided above. You may ignore all tax. REQUIRED: 1. Prepare the journal entries to account for all the transactions involved in issuing the ordinary shares. (10 marks) 2. At 31 January 2020 Expander decided to convert its par value shares into no par value shares. Prepare the journal entries that Expander should process in order to effect this change. (2 marks) 3. Discuss whether Expander is able to make a distribution to its ordinary shareholders without paying its debenture holders and preference shareholders. (4 marks) 6 4. a. Calculate how much Expander should pay its debenture holders on 31 January 2020. (2 marks) b. If a preference dividend is declared, calculate how much Expander should pay its preference shareholder on 31 January 2020. (2 marks) C. Prepare the journal entries to process the payment of the preference share dividend and the interest on the debentures. You may assume that both are fully paid up by the end of the year. (3 marks) d. Assuming Expander declares ordinary dividend of N$2,400,000 ON 31 January 2020 and pays the dividend on 28 February 2020, prepare the journal entries to account for this in the 2020 financial statements. (2 marks) 5. Prepare Expander's statement of changes in equity for the year ended 31 January 2020 assuming that both an ordinary and a preference dividend were declared. You need not include a total column. (10 marks)