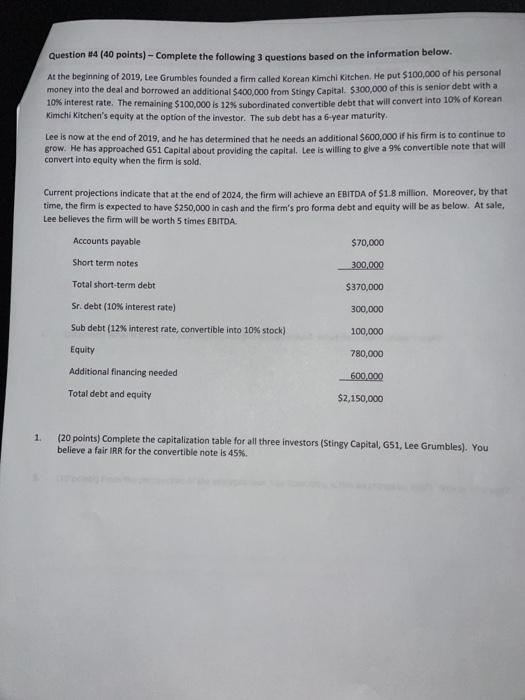

Question #4 (40 points) - Complete the following 3 questions based on the information below. At the beginning of 2019, Lee Grumbles founded a firm called Korean Kimchi Kitchen, He put $100,000 of his personal money into the deal and borrowed an additional $400,000 from Stingy Capital: $300,000 of this is senior debt with a 10% interest rate. The remaining $100,000 is 12% subordinated convertible debt that will convert into 10% of Korean Kimchi Kitchen's equity at the option of the investor. The sub debt has a 6-year maturity Lee is now at the end of 2019, and he has determined that he needs an additional $600,000 if his firm is to continue to grow. He has approached G51 Capital about providing the capital. Lee is willing to give a 9% convertible note that will convertinto equity when the firm is sold. Current projections indicate that at the end of 2024, the firm will achieve an EBITDA of $1.8 million. Moreover, by that time, the firm is expected to have $250,000 in cash and the firm's pro forma debt and equity will be as below. At sale. Lee believes the firm will be worth 5 times EBITDA. Accounts payable $70,000 Short term notes 300,000 Total short-term debt $370,000 Sr. debt (10% interest rate) 300,000 Sub debt (12% Interest rate, convertible into 10% stock) 100,000 780,000 Equity Additional financing needed Total debt and equity 600.000 $2,150,000 1 (20 points) Complete the capitalization table for all three investors (Stingy Capital, G51, Lee Grumbles). You believe a fair IRR for the convertible note is 45% Question #4 (40 points) - Complete the following 3 questions based on the information below. At the beginning of 2019, Lee Grumbles founded a firm called Korean Kimchi Kitchen, He put $100,000 of his personal money into the deal and borrowed an additional $400,000 from Stingy Capital: $300,000 of this is senior debt with a 10% interest rate. The remaining $100,000 is 12% subordinated convertible debt that will convert into 10% of Korean Kimchi Kitchen's equity at the option of the investor. The sub debt has a 6-year maturity Lee is now at the end of 2019, and he has determined that he needs an additional $600,000 if his firm is to continue to grow. He has approached G51 Capital about providing the capital. Lee is willing to give a 9% convertible note that will convertinto equity when the firm is sold. Current projections indicate that at the end of 2024, the firm will achieve an EBITDA of $1.8 million. Moreover, by that time, the firm is expected to have $250,000 in cash and the firm's pro forma debt and equity will be as below. At sale. Lee believes the firm will be worth 5 times EBITDA. Accounts payable $70,000 Short term notes 300,000 Total short-term debt $370,000 Sr. debt (10% interest rate) 300,000 Sub debt (12% Interest rate, convertible into 10% stock) 100,000 780,000 Equity Additional financing needed Total debt and equity 600.000 $2,150,000 1 (20 points) Complete the capitalization table for all three investors (Stingy Capital, G51, Lee Grumbles). You believe a fair IRR for the convertible note is 45%