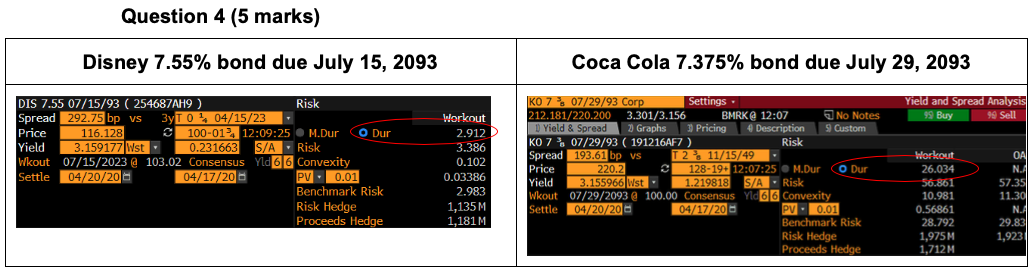

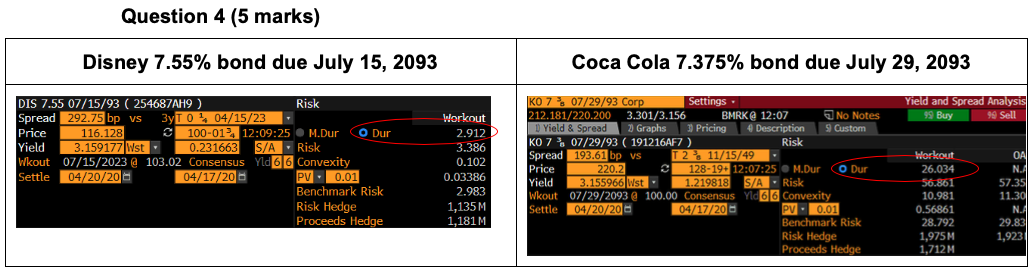

Question 4 (5 marks) Disney 7.55% bond due July 15, 2093 Coca Cola 7.375% bond due July 29, 2093 Yield and Spread Analysis 99 Buy 99 Sell DIS 7.55 07/15/93 ( 254687AH9 ) Risk Spread 292.75 bp vs 3yT 04. 04/15/23 Price 116.128 3 100-0124 12:09:25 M.Dur O Dur Yield 3.159177 Wst 0.231663 S/A. Risk Wkout 07/15/2023 @ 103.02 Consensus Yld 66 Convexity Settle 04/20/20 04/17/20 0.01 Benchmark Risk Risk Hedge Proceeds Hedge Workout 2.912 3.386 0.102 0.03386 2.983 1,135M 1,181M PV. K0 7 07/29/93 Corp Settings 212.181/220.200 3.301/3.156 BMRK @ 12:07 No Notes D Yield & Spread 2 Graphs Pricing Description Custom KO 7 * 07/29/93 (191216AF7 ) Risk Spread 193.61 bp vs T 211/15/49 Price 220.2 128-1912:07:25 M.Dur Dur Yield 3.155966 Wst. 1.219818 S/A - Risk Wkout 07/29/2093 @ 100.00 Consensus Yld 66 Convexity Settle 04/20/20 04/17/20 PV: 0.01 Benchmark Risk Risk Hedge Proceeds Hedge Workout 26.034 56.861 10.981 0.56861 28.792 1,975M 1,712M OA NA 57.35 11.301 N.A 29.83 1,9231 In the table above, you are given two issues of 100 year bonds: DIS 7.55% due 07/15/93 (from Case 3) and KO 7.375% due 07/29/93. By way of background, Coca Cola also issued a 100 year bond based on the success of the Disney offering back in 1993. However, the transactions were structured differently. Please explain in words (no calculations required) why the duration of the Disney bond is much lower than the duration of the Coca Cola bond. Frame your response with regard to investor expectations for each of these bonds. Hint: read Case 3 and focus on the documentation associated with the Disney bonds Question 4 (5 marks) Disney 7.55% bond due July 15, 2093 Coca Cola 7.375% bond due July 29, 2093 Yield and Spread Analysis 99 Buy 99 Sell DIS 7.55 07/15/93 ( 254687AH9 ) Risk Spread 292.75 bp vs 3yT 04. 04/15/23 Price 116.128 3 100-0124 12:09:25 M.Dur O Dur Yield 3.159177 Wst 0.231663 S/A. Risk Wkout 07/15/2023 @ 103.02 Consensus Yld 66 Convexity Settle 04/20/20 04/17/20 0.01 Benchmark Risk Risk Hedge Proceeds Hedge Workout 2.912 3.386 0.102 0.03386 2.983 1,135M 1,181M PV. K0 7 07/29/93 Corp Settings 212.181/220.200 3.301/3.156 BMRK @ 12:07 No Notes D Yield & Spread 2 Graphs Pricing Description Custom KO 7 * 07/29/93 (191216AF7 ) Risk Spread 193.61 bp vs T 211/15/49 Price 220.2 128-1912:07:25 M.Dur Dur Yield 3.155966 Wst. 1.219818 S/A - Risk Wkout 07/29/2093 @ 100.00 Consensus Yld 66 Convexity Settle 04/20/20 04/17/20 PV: 0.01 Benchmark Risk Risk Hedge Proceeds Hedge Workout 26.034 56.861 10.981 0.56861 28.792 1,975M 1,712M OA NA 57.35 11.301 N.A 29.83 1,9231 In the table above, you are given two issues of 100 year bonds: DIS 7.55% due 07/15/93 (from Case 3) and KO 7.375% due 07/29/93. By way of background, Coca Cola also issued a 100 year bond based on the success of the Disney offering back in 1993. However, the transactions were structured differently. Please explain in words (no calculations required) why the duration of the Disney bond is much lower than the duration of the Coca Cola bond. Frame your response with regard to investor expectations for each of these bonds. Hint: read Case 3 and focus on the documentation associated with the Disney bonds