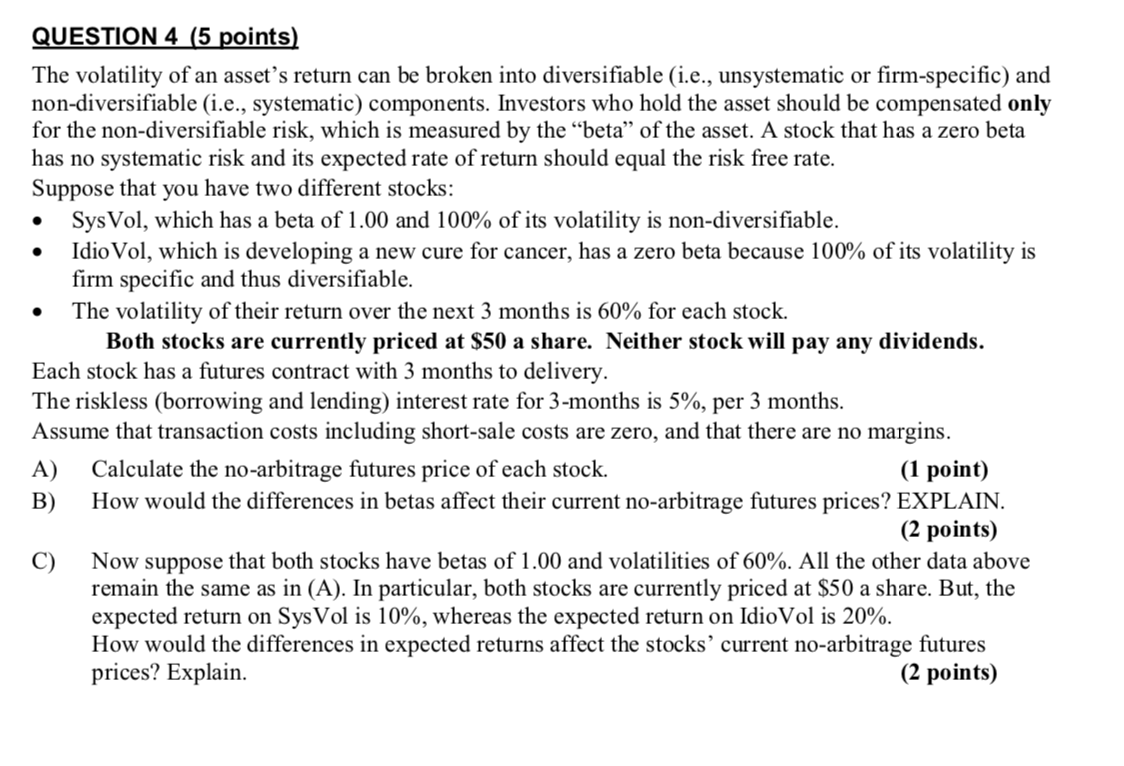

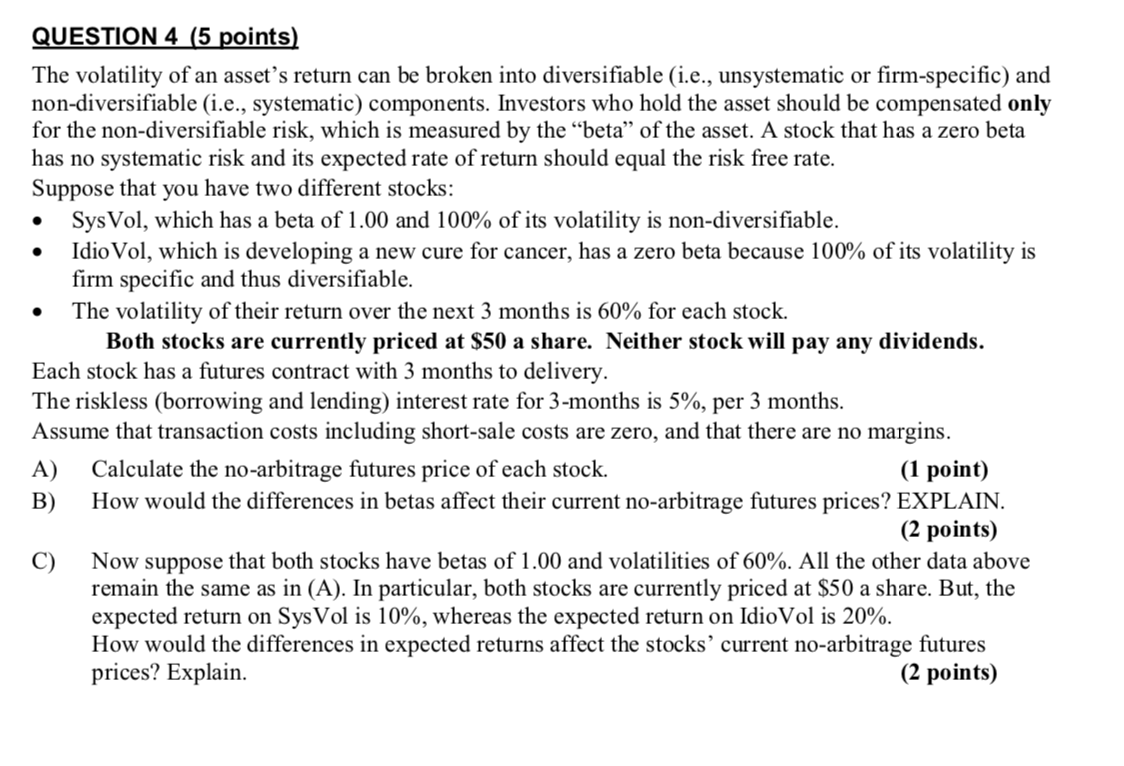

QUESTION 4. (5 points) The volatility of an asset's return can be broken into diversifiable (i.e., unsystematic or firm-specific) and non-diversifiable (i.e., systematic) components. Investors who hold the asset should be compensated only for the non-diversifiable risk, which is measured by the "beta" of the asset. A stock that has a zero beta has no systematic risk and its expected rate of return should equal the risk free rate. Suppose that you have two different stocks: Sys Vol, which has a beta of 1.00 and 100% of its volatility is non-diversifiable. Idio Vol, which is developing a new cure for cancer, has a zero beta because 100% of its volatility is firm specific and thus diversifiable. The volatility of their return over the next 3 months is 60% for each stock. Both stocks are currently priced at $50 a share. Neither stock will pay any dividends. Each stock has a futures contract with 3 months to delivery. The riskless (borrowing and lending) interest rate for 3-months is 5%, per 3 months. Assume that transaction costs including short-sale costs are zero, and that there are no margins. A) Calculate the no-arbitrage futures price of each stock. (1 point) B) How would the differences in betas affect their current no-arbitrage futures prices? EXPLAIN. (2 points) Now suppose that both stocks have betas of 1.00 and volatilities of 60%. All the other data above remain the same as in (A). In particular, both stocks are currently priced at $50 a share. But, the expected return on SysVol is 10%, whereas the expected return on IdioVol is 20%. How would the differences in expected returns affect the stocks' current no-arbitrage futures prices? Explain. (2 points) C) QUESTION 4. (5 points) The volatility of an asset's return can be broken into diversifiable (i.e., unsystematic or firm-specific) and non-diversifiable (i.e., systematic) components. Investors who hold the asset should be compensated only for the non-diversifiable risk, which is measured by the "beta" of the asset. A stock that has a zero beta has no systematic risk and its expected rate of return should equal the risk free rate. Suppose that you have two different stocks: Sys Vol, which has a beta of 1.00 and 100% of its volatility is non-diversifiable. Idio Vol, which is developing a new cure for cancer, has a zero beta because 100% of its volatility is firm specific and thus diversifiable. The volatility of their return over the next 3 months is 60% for each stock. Both stocks are currently priced at $50 a share. Neither stock will pay any dividends. Each stock has a futures contract with 3 months to delivery. The riskless (borrowing and lending) interest rate for 3-months is 5%, per 3 months. Assume that transaction costs including short-sale costs are zero, and that there are no margins. A) Calculate the no-arbitrage futures price of each stock. (1 point) B) How would the differences in betas affect their current no-arbitrage futures prices? EXPLAIN. (2 points) Now suppose that both stocks have betas of 1.00 and volatilities of 60%. All the other data above remain the same as in (A). In particular, both stocks are currently priced at $50 a share. But, the expected return on SysVol is 10%, whereas the expected return on IdioVol is 20%. How would the differences in expected returns affect the stocks' current no-arbitrage futures prices? Explain. (2 points) C)