Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 5 pts For the most recent fiscal year, book value of long-term debt at Schlumberger was $19532 million. The market value of

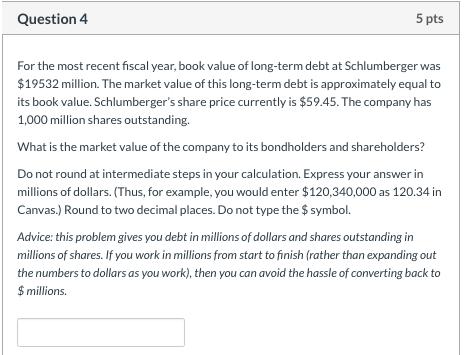

Question 4 5 pts For the most recent fiscal year, book value of long-term debt at Schlumberger was $19532 million. The market value of this long-term debt is approximately equal to its book value. Schlumberger's share price currently is $59.45. The company has 1,000 million shares outstanding. What is the market value of the company to its bondholders and shareholders? Do not round at intermediate steps in your calculation. Express your answer in millions of dollars. (Thus, for example, you would enter $120,340,000 as 120.34 in Canvas.) Round to two decimal places. Do not type the $ symbol. Advice: this problem gives you debt in millions of dollars and shares outstanding in millions of shares. If you work in millions from start to finish (rather than expanding out the numbers to dollars as you work), then you can avoid the hassle of converting back to $ millions.

Step by Step Solution

★★★★★

3.41 Rating (148 Votes )

There are 3 Steps involved in it

Step: 1

Question To find the market value of the company to its bondholders we need to consider ...

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started