Answered step by step

Verified Expert Solution

Question

1 Approved Answer

Question 4 (7 x marks) Define operational risk as it applies to Mr Sigcau and elaborate on the two external factors (excluding the sea levels

Question 4 (7 x marks)

Define operational risk as it applies to Mr Sigcau and elaborate on the two external factors (excluding the sea levels and electricity outages) that could negatively influence the well-being of the caravan park. Recommend potential control measures for each exposure.

Question 5 (10 x marks)

Calculate the potential annual gross income and profit/loss for Mr Sigcau based on the available information in the case study. Indicate if the business is feasible based on all the information provided.

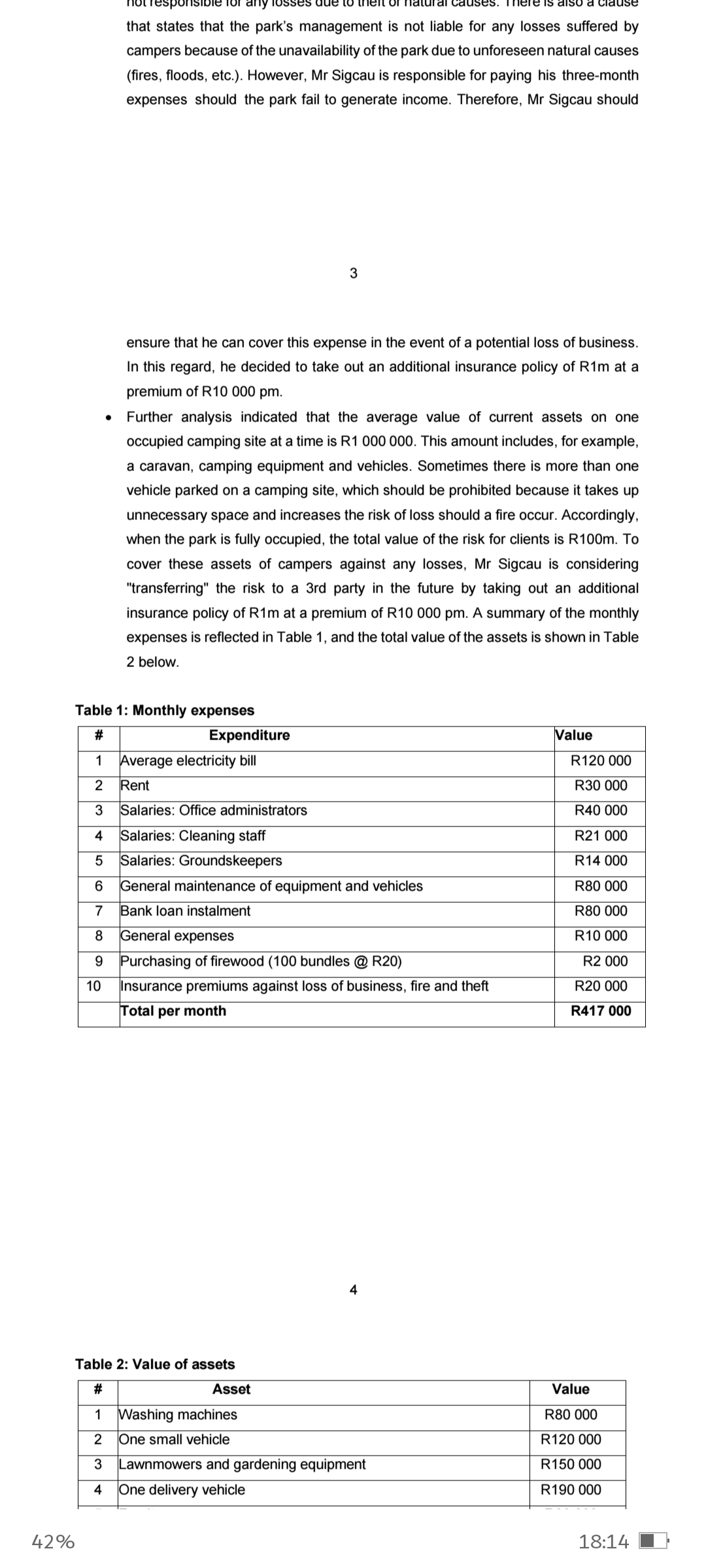

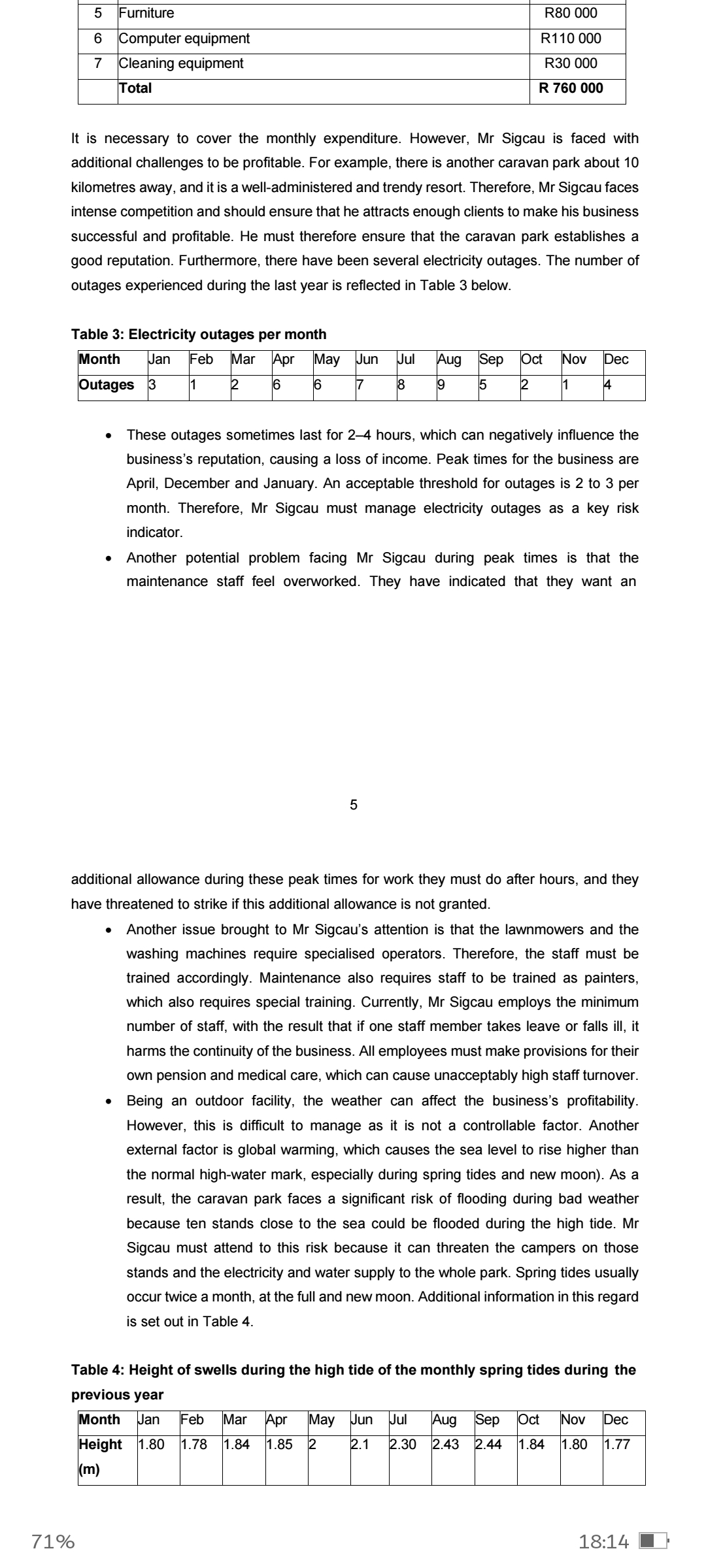

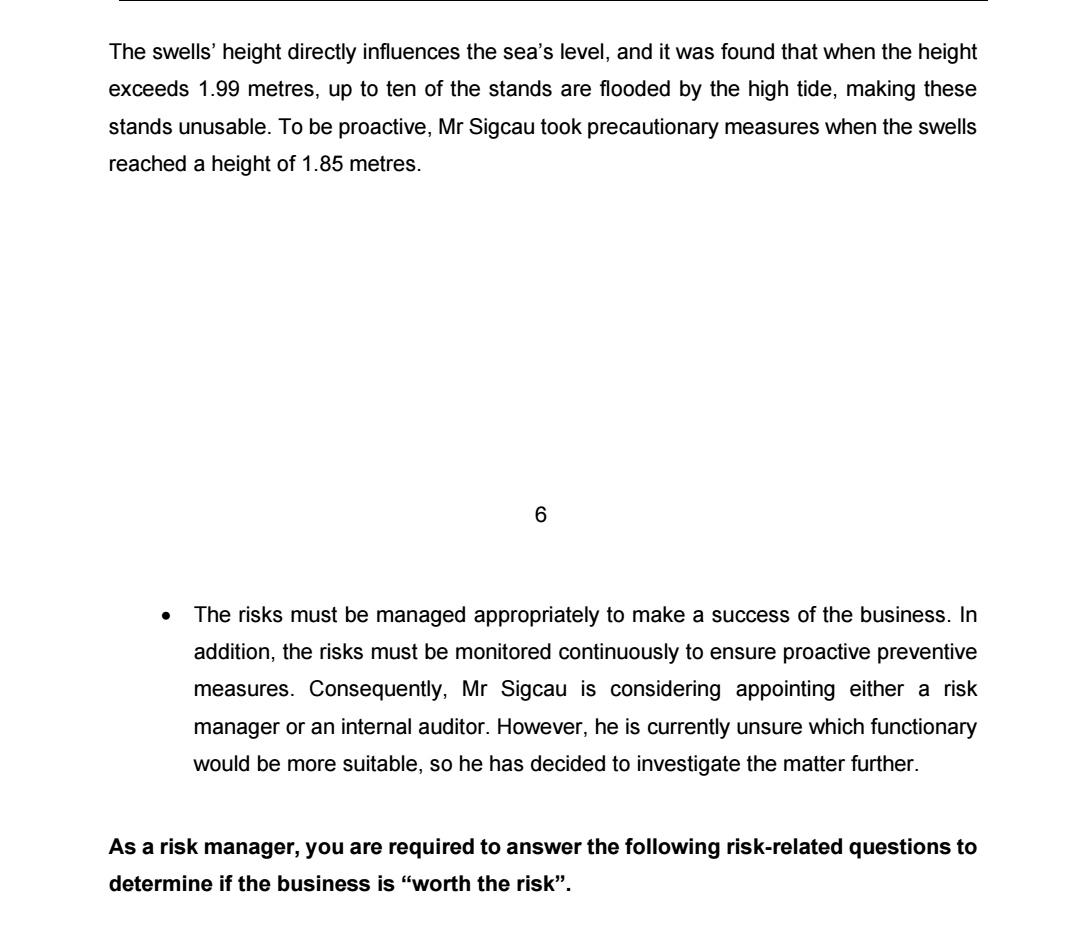

CASE STUDY Cape Agulhas is a small coastal town situated at the southern tip of Africa. It is a popular holiday area with several holiday homes and beach houses. The camping/caravan park, situated close to the sea (about 20 metres from the high-water mark), belongs to the local municipality. It has been neglected and failed to attract holidaymakers, so it is currently not a successful business enterprise. Mr Sigcau, a local entrepreneur, negotiated with the municipality to hire the camping/caravan park so that he could upgrade the facilities and manage them as a profitable business. The municipality agreed to rent the park to Mr Sigcau for R30 000 per month. This amount includes the supply of fresh water but excludes electricity usage. An analysis of the business revealed the following: - The camping ground is divided into 100 stands, with a water tap and an electrical box on each stand. - One ablution block is suitable for 100 people at a time (50 males and 50 females). - One laundry area has ten heavy-duty washing machines and ten wash basins with washing lines. - There is one access gate. The fencing around the park is not secure, and it allows easy access to the park without using the main entrance gate. - Mr Sigcau employed the following staff: - Four administrative workers at a salary of R480 000 per annum (R10 000 2 per staff member per month). They are responsible for the following tasks: - coordinating reservations - ensuring the collection of payments and regular depositing of monies received - dealing with enquiries - managing and coordinating the park's mini-shop, which sells firewood for campfires - coordinating the maintenance staff for the maintenance of the ablution block and the camping grounds - five maintenance staff, employed at R7 000 per staff member per month, comprising three cleaners and two groundskeepers - A small function hall can be rented out for functions/workshops and can host about 100 delegates at a time. Currently, the hall is used for about 30 weekends per year. It is rented out for R1 000 per weekend. The park has the potential to be fully occupied during thirty weekends (60 days) and the school holidays in March/April (20 days), and the summer holidays in December/January (30 days). - Each stand is rented out for R500 per day. During off-peak seasons, the stands are 10% booked for an average of 200 days in the year at a rate of R300 per day. Each year, Mr Sigcau purchases 1200 bundles of firewood at R20 a bundle and sells each bundle to the campers for R50. - A major concern for Mr Sigcau is the threat of fire. Being a coastal town, the wind speed can reach up to 50 knots, regarded as a gale force that could cause an uncontrollable fire. Consequently, Mr Sigcau has insured the park against fire for R1m, at a monthly premium of R10 000 . Another problem is the vulnerability of campers/caravaners to theft. Owing to the location of the camping ground, there is an increasing incidence of theft and burglary. However, a clause in the camp rules, which must be signed by each client/visitor, states that the park's management is not responsible for any losses due to theft or natural causes. There is also a clause that states that the park's management is not liable for any losses suffered by 28% 18:13 that states that the park's management is not liable for any losses suffered by campers because of the unavailability of the park due to unforeseen natural causes (fires, floods, etc.). However, Mr Sigcau is responsible for paying his three-month expenses should the park fail to generate income. Therefore, Mr Sigcau should 3 ensure that he can cover this expense in the event of a potential loss of business. In this regard, he decided to take out an additional insurance policy of R1m at a premium of R10 000pm. - Further analysis indicated that the average value of current assets on one occupied camping site at a time is R1 000000 . This amount includes, for example, a caravan, camping equipment and vehicles. Sometimes there is more than one vehicle parked on a camping site, which should be prohibited because it takes up unnecessary space and increases the risk of loss should a fire occur. Accordingly, when the park is fully occupied, the total value of the risk for clients is R100m. To cover these assets of campers against any losses, Mr Sigcau is considering "transferring" the risk to a 3rd party in the future by taking out an additional insurance policy of R1m at a premium of R10 000pm. A summary of the monthly expenses is reflected in Table 1, and the total value of the assets is shown in Table 2 below. Table 1: Monthly expenses \begin{tabular}{|c|l|c|} \hline# & \multicolumn{1}{|c|}{ Expenditure } & Value \\ \hline 1 & Average electricity bill & R120 000 \\ \hline 2 & Rent & R30 000 \\ \hline 3 & Salaries: Office administrators & R40 000 \\ \hline 4 & Salaries: Cleaning staff & R21 000 \\ \hline 5 & Salaries: Groundskeepers & R14 000 \\ \hline 6 & General maintenance of equipment and vehicles & R80 000 \\ \hline 7 & Bank loan instalment & R80 000 \\ \hline 8 & General expenses & R10 000 \\ \hline 9 & Purchasing of firewood (100 bundles @ R20) & R20 000 \\ \hline 10 & Insurance premiums against loss of business, fire and theft & R417 000 \\ \hline & Total per month & \\ \hline \end{tabular} 4 Table 2: Value of assets \begin{tabular}{|c|l|c|} \hline# & \multicolumn{1}{|c|}{ Asset } & Value \\ \hline 1 & Washing machines & R80 000 \\ \hline 2 & One small vehicle & R120 000 \\ \hline 3 & Lawnmowers and gardening equipment & R150 000 \\ \hline 4 & One delivery vehicle & R190000 \\ \hline \end{tabular} 42% 18:14 It is necessary to cover the monthly expenditure. However, Mr Sigcau is faced with additional challenges to be profitable. For example, there is another caravan park about 10 kilometres away, and it is a well-administered and trendy resort. Therefore, Mr Sigcau faces intense competition and should ensure that he attracts enough clients to make his business successful and profitable. He must therefore ensure that the caravan park establishes a good reputation. Furthermore, there have been several electricity outages. The number of outages experienced during the last year is reflected in Table 3 below. - These outages sometimes last for 2-4 hours, which can negatively influence the business's reputation, causing a loss of income. Peak times for the business are April, December and January. An acceptable threshold for outages is 2 to 3 per month. Therefore, Mr Sigcau must manage electricity outages as a key risk indicator. - Another potential problem facing Mr Sigcau during peak times is that the maintenance staff feel overworked. They have indicated that they want an 5 additional allowance during these peak times for work they must do after hours, and they have threatened to strike if this additional allowance is not granted. - Another issue brought to Mr Sigcau's attention is that the lawnmowers and the washing machines require specialised operators. Therefore, the staff must be trained accordingly. Maintenance also requires staff to be trained as painters, which also requires special training. Currently, Mr Sigcau employs the minimum number of staff, with the result that if one staff member takes leave or falls ill, it harms the continuity of the business. All employees must make provisions for their own pension and medical care, which can cause unacceptably high staff turnover. - Being an outdoor facility, the weather can affect the business's profitability. However, this is difficult to manage as it is not a controllable factor. Another external factor is global warming, which causes the sea level to rise higher than the normal high-water mark, especially during spring tides and new moon). As a result, the caravan park faces a significant risk of flooding during bad weather because ten stands close to the sea could be flooded during the high tide. Mr Sigcau must attend to this risk because it can threaten the campers on those stands and the electricity and water supply to the whole park. Spring tides usually occur twice a month, at the full and new moon. Additional information in this regard is set out in Table 4. Table 4: Height of swells during the high tide of the monthly spring tides during the previous year The swells' height directly influences the sea's level, and it was found that when the height exceeds 1.99 metres, up to ten of the stands are flooded by the high tide, making these stands unusable. To be proactive, Mr Sigcau took precautionary measures when the swells reached a height of 1.85 metres. 6 - The risks must be managed appropriately to make a success of the business. In addition, the risks must be monitored continuously to ensure proactive preventive measures. Consequently, Mr Sigcau is considering appointing either a risk manager or an internal auditor. However, he is currently unsure which functionary would be more suitable, so he has decided to investigate the matter further. As a risk manager, you are required to answer the following risk-related questions to determine if the business is "worth the riskStep by Step Solution

There are 3 Steps involved in it

Step: 1

Get Instant Access to Expert-Tailored Solutions

See step-by-step solutions with expert insights and AI powered tools for academic success

Step: 2

Step: 3

Ace Your Homework with AI

Get the answers you need in no time with our AI-driven, step-by-step assistance

Get Started